12 Images that contain Wisdom EVERY Investor needs to know!

1. Investing is without alternative, but the average investor is terrible at it.

Primarily, because of their behavioral biases. We will explore many of them in the following images.

1. Investing is without alternative, but the average investor is terrible at it.

Primarily, because of their behavioral biases. We will explore many of them in the following images.

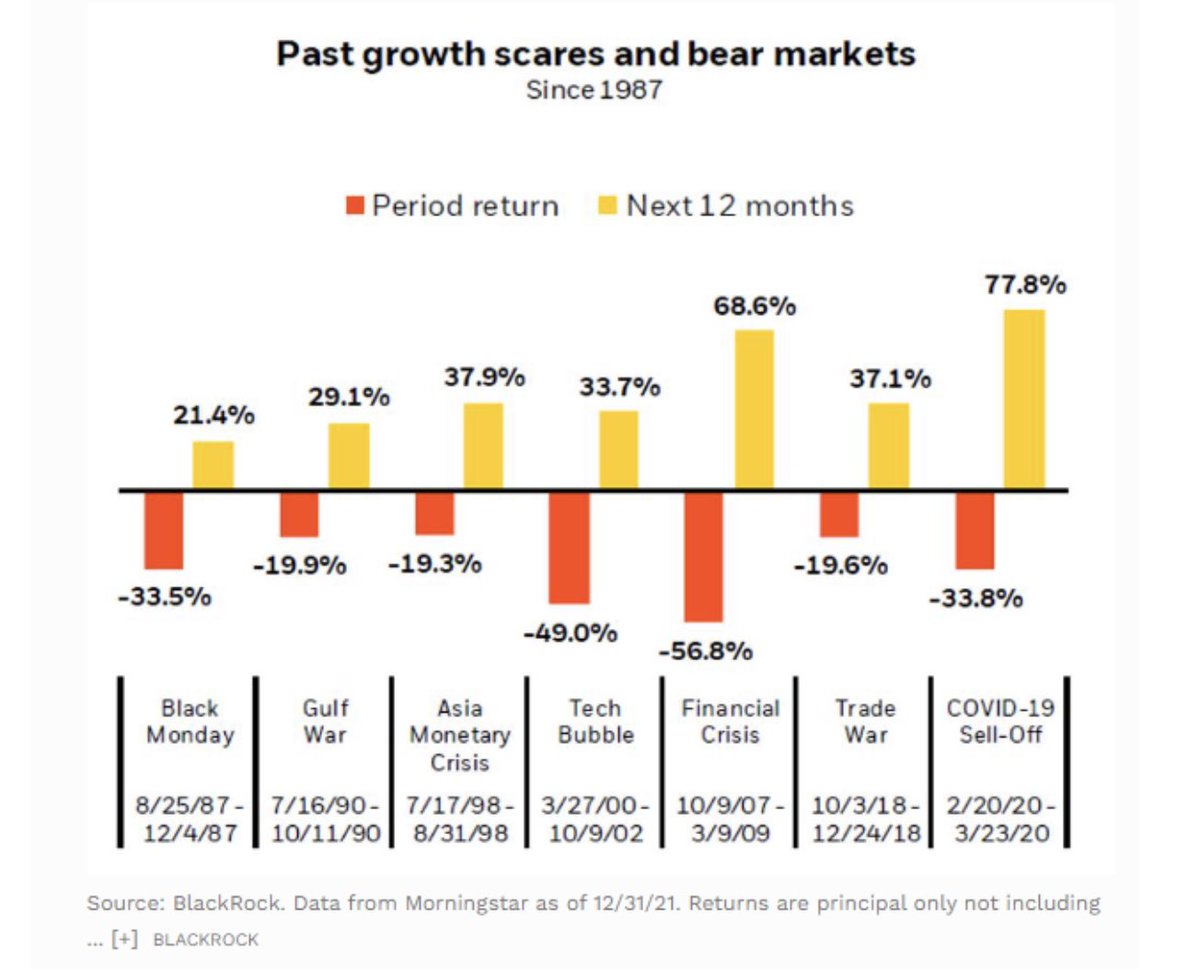

3. We have talked a lot about a recession lately.

For our portfolios, it’s too late already. The year before the actual recession is the worst for stocks.

The good news, if you hold onto your investments, you’ll perform pretty well pretty soon.

For our portfolios, it’s too late already. The year before the actual recession is the worst for stocks.

The good news, if you hold onto your investments, you’ll perform pretty well pretty soon.

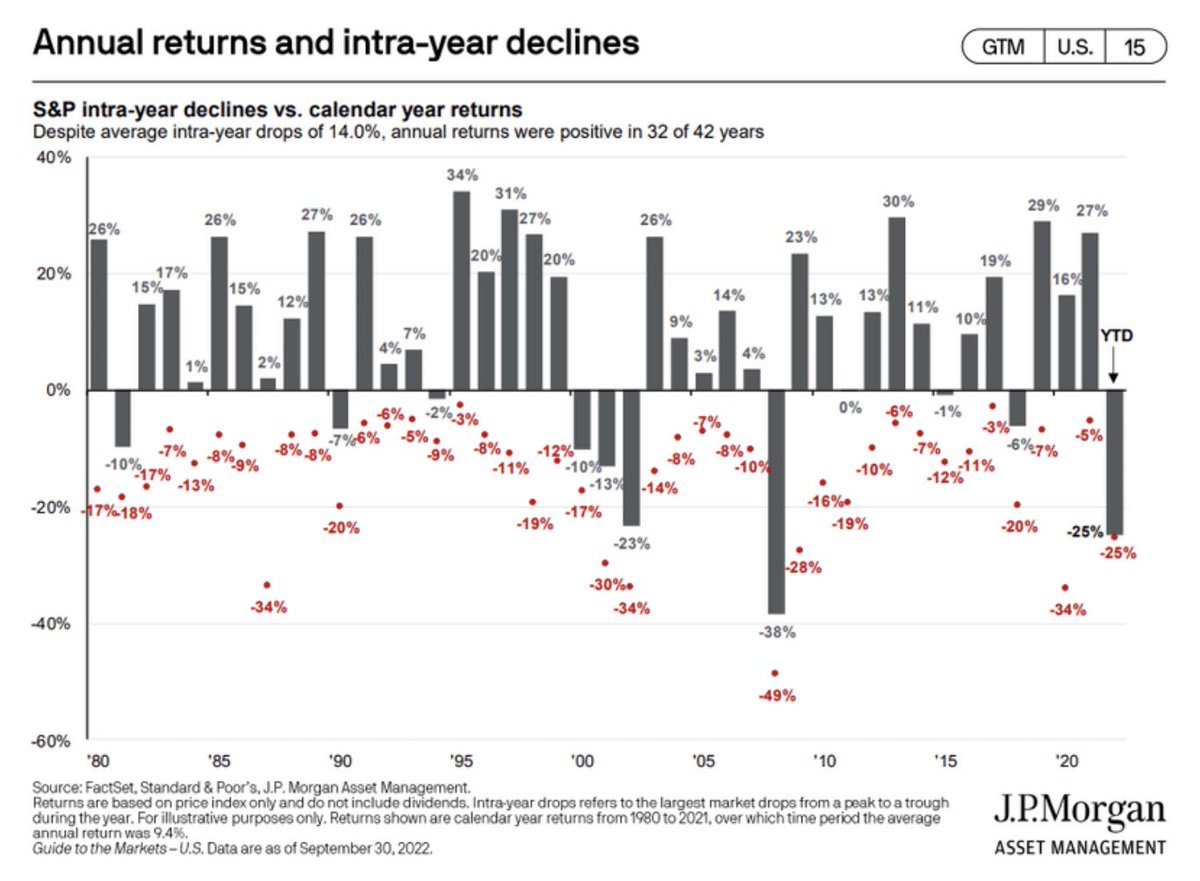

5. Declines are no reason to worry. It’s a part of the game an investor plays.

There are many opportunities in these declines for the rational investor.

There are many opportunities in these declines for the rational investor.

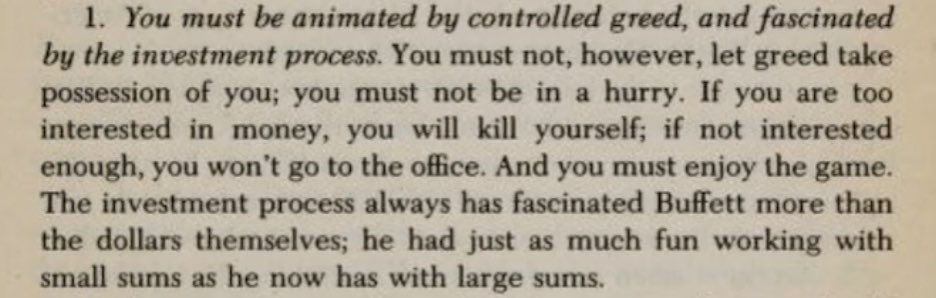

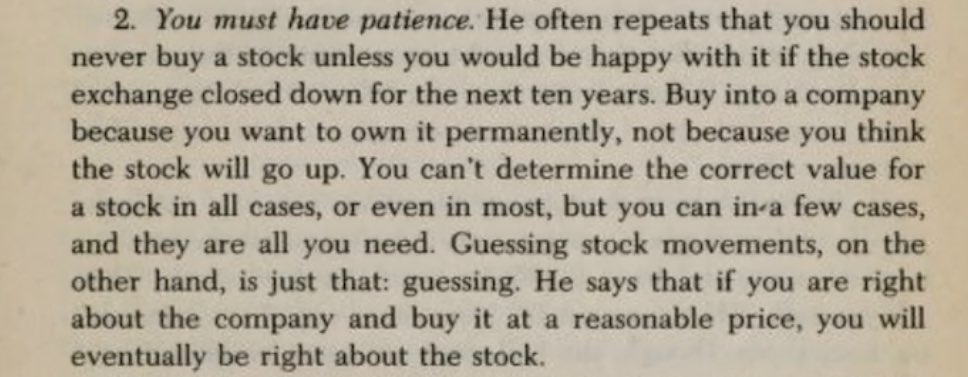

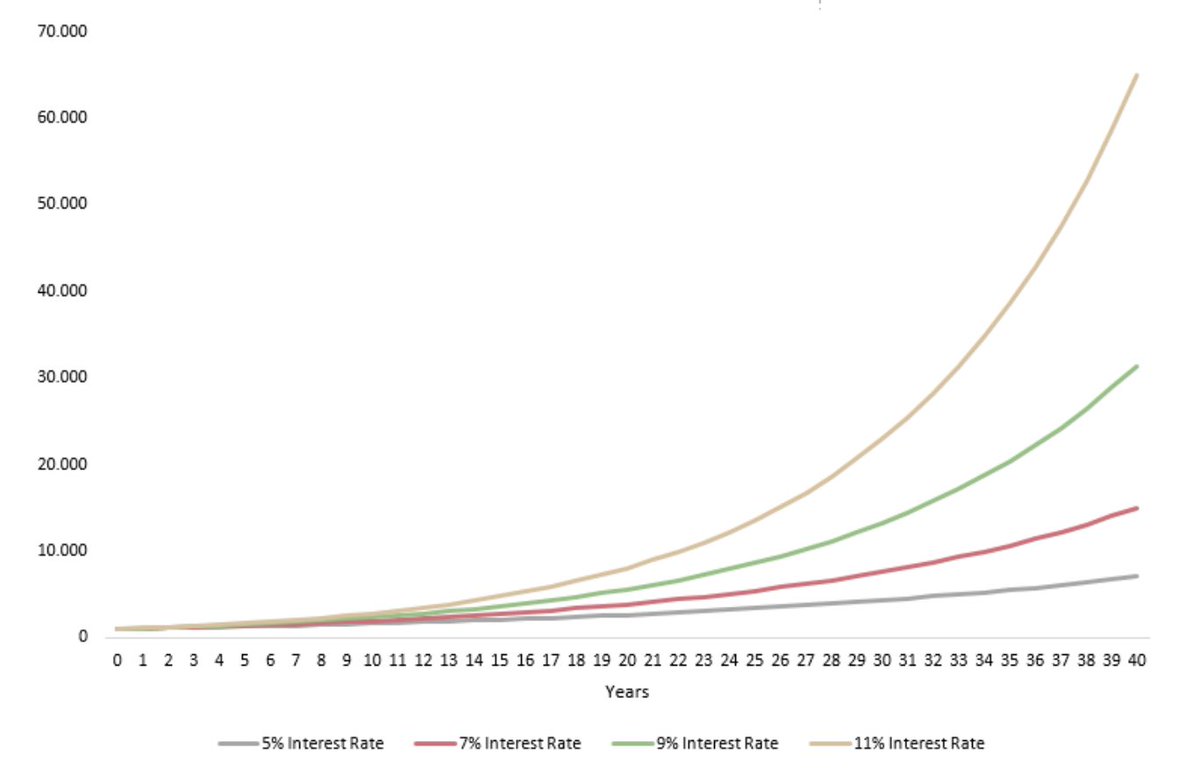

6. Do not chase the moonshots.

The difference of 1% or 2% may seem small, but a little above average is outstandingly better in the long run.

The difference of 1% or 2% may seem small, but a little above average is outstandingly better in the long run.

7. Chasing such moonshots often ends with a severe loss of capital.

And making up for that loss is extremely difficult.

And making up for that loss is extremely difficult.

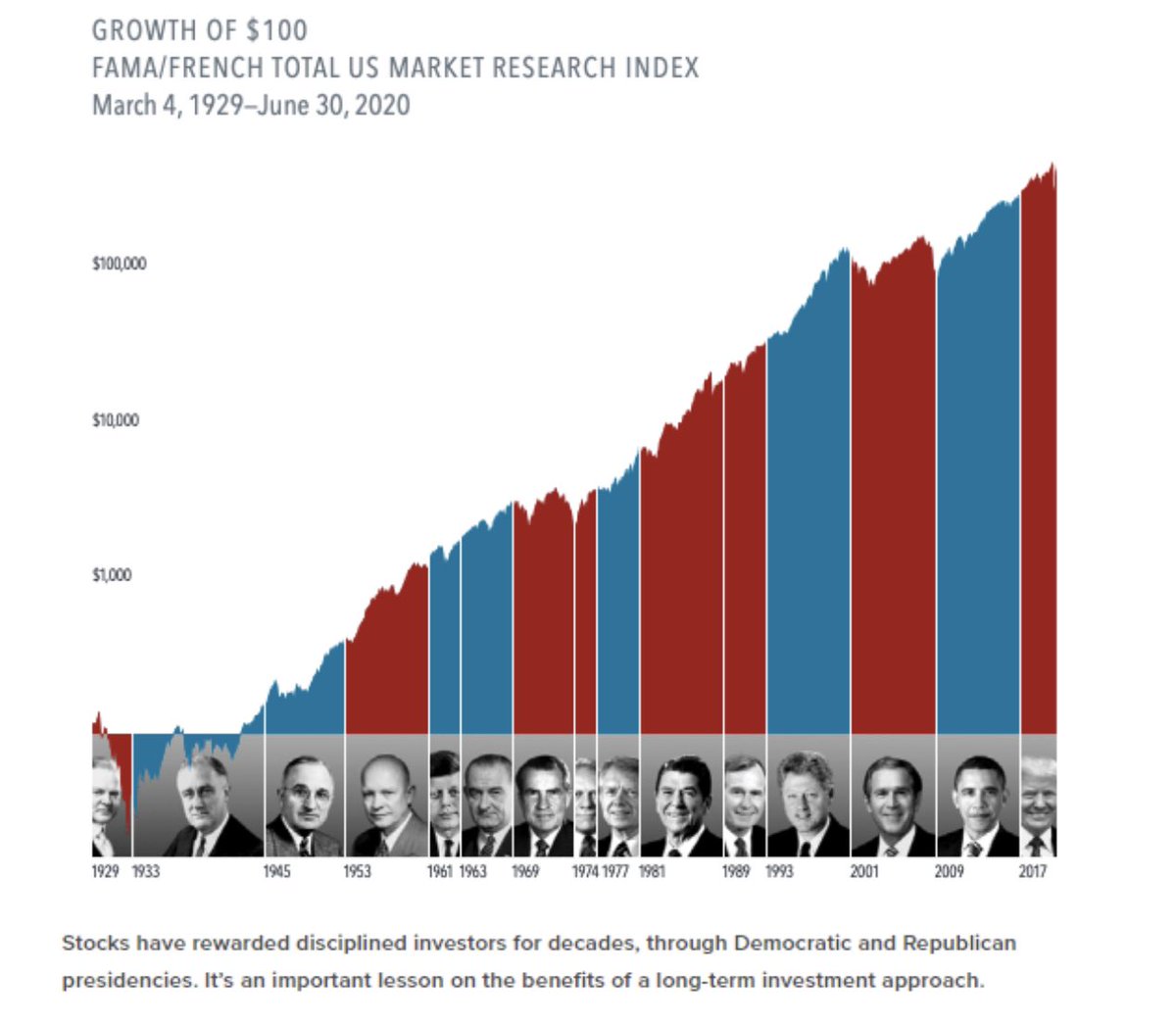

8. Interesting, especially in the current context of the Midterms.

The market doesn’t care too much about Democrats or Republicans.

The market doesn’t care too much about Democrats or Republicans.

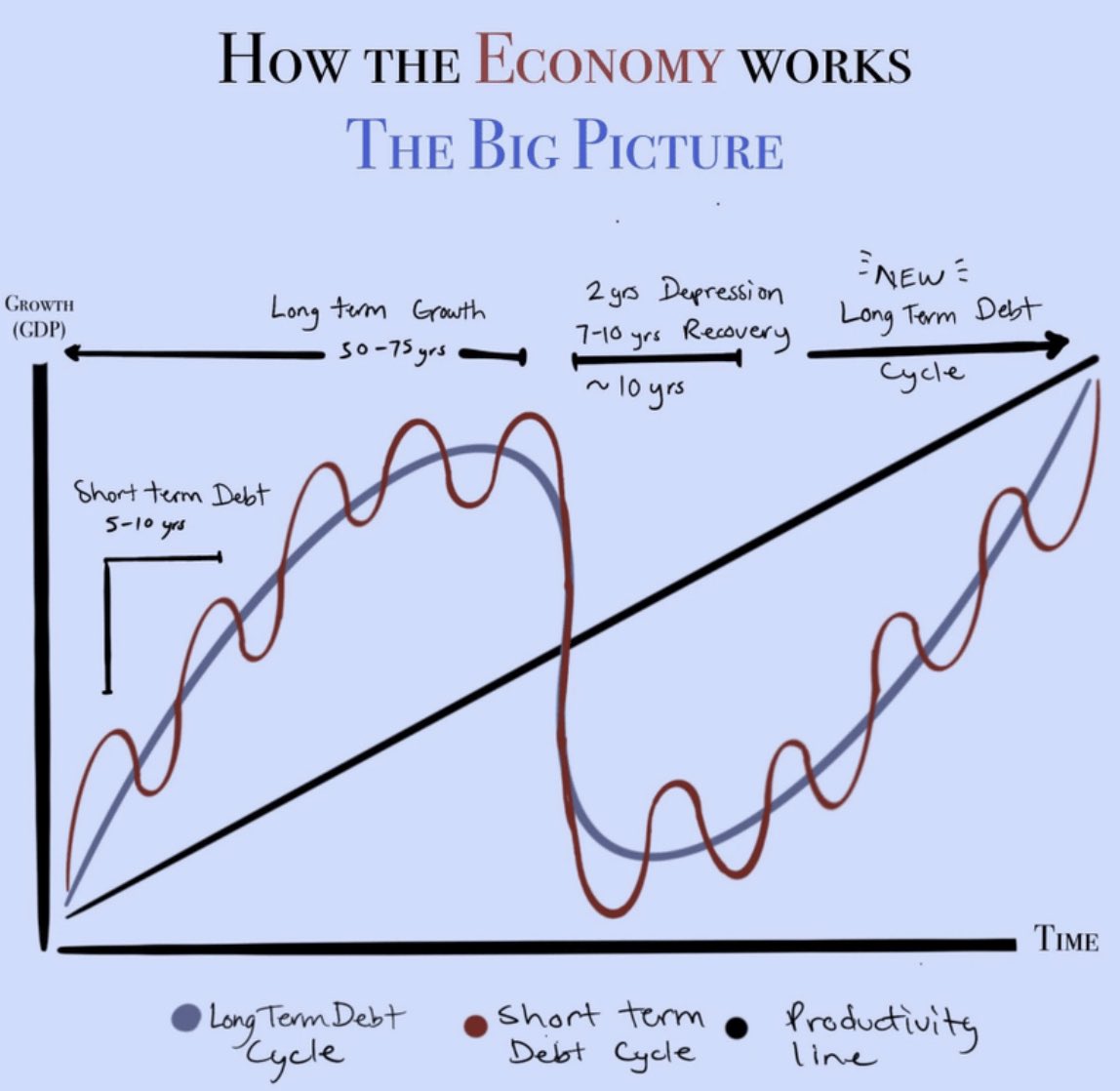

9. The market behaves like a pendulum.

It spends most time in the middle. But occasionally, it gets to the extremes.

That’s why we have cycles and volatility, no linear growth.

It spends most time in the middle. But occasionally, it gets to the extremes.

That’s why we have cycles and volatility, no linear growth.

12. Time in the market beats timing the market.

Missing only a few days in the market can cause you to be the average investor we saw in the first graph.

Even worse, the rallies are unpredictable and often in bear markets where many investors stand on the sideline.

Missing only a few days in the market can cause you to be the average investor we saw in the first graph.

Even worse, the rallies are unpredictable and often in bear markets where many investors stand on the sideline.

If you enjoyed this post, please Like and Retweet this Thread so more people get to see it.

Follow me @MnkeDaniel to learn more about Investing

Follow me @MnkeDaniel to learn more about Investing

https://twitter.com/mnkedaniel/status/1592865573440217093?s=61&t=EA0hoozDp031T8qO21c_2Q

Ohh, and in case you want to read more in-depth articles on Investing and markets, you should follow my free Substack.

danielmnke.substack.com

danielmnke.substack.com

Also, if you liked this thread, check out this one by @BrianFeroldi.

Phenomenal thread that inspired me to write this one.

Phenomenal thread that inspired me to write this one.

https://twitter.com/brianferoldi/status/1548637128518770690?s=61&t=EA0hoozDp031T8qO21c_2Q

• • •

Missing some Tweet in this thread? You can try to

force a refresh