1/X

robert.p.balan Moderator Leader Owner

Nov 16, 2022 8:36 AM

NOVEMBER 16, 2022

LATE ASIAN SESSION BRIEF:

THE 10YR YIELD HAS GONE BACK TO 3.84 PCT -- TIME TO BAIL FROM COUNTERTEEND SHORT TRADES, WAIT FOR OPPORTUNITIES TO GET LONG AGAIN LATER DURING THE NY SESSION

robert.p.balan Moderator Leader Owner

Nov 16, 2022 8:36 AM

NOVEMBER 16, 2022

LATE ASIAN SESSION BRIEF:

THE 10YR YIELD HAS GONE BACK TO 3.84 PCT -- TIME TO BAIL FROM COUNTERTEEND SHORT TRADES, WAIT FOR OPPORTUNITIES TO GET LONG AGAIN LATER DURING THE NY SESSION

2/X

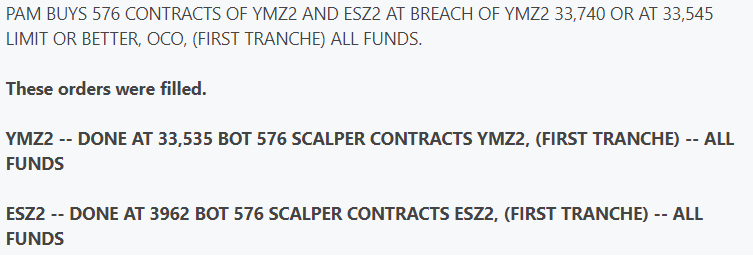

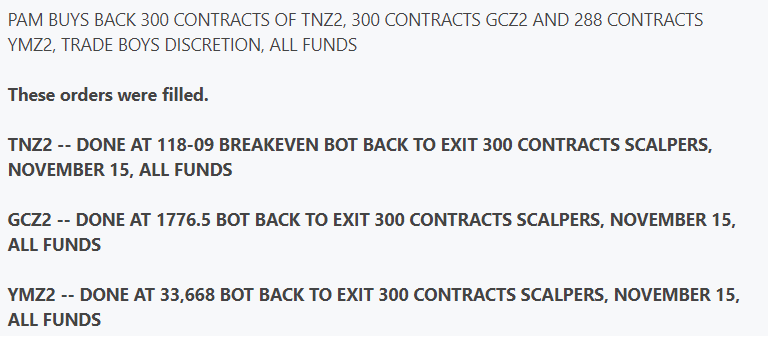

We are buying back short trades initiated yesterday, which were unfortunately steam-rollered by the supposed Russian missile strike in Poland, hammering yields lower (as well as equities). We are exiting the short trades with practically no damage.

We are buying back short trades initiated yesterday, which were unfortunately steam-rollered by the supposed Russian missile strike in Poland, hammering yields lower (as well as equities). We are exiting the short trades with practically no damage.

3/X

robert.p.balan Moderator Leader Owner

Nov 16, 2022 9:58 AM

NOVEMBER 16, 2022

EUROPEAN OPEN BRIEF:

MODELS STILL CALLING FOR A DOWN DAY TODAY FOR EQUITIES, TN AND GOLD FUTURES, AND UP DAY FOR THE 10YR YIELD

robert.p.balan Moderator Leader Owner

Nov 16, 2022 9:58 AM

NOVEMBER 16, 2022

EUROPEAN OPEN BRIEF:

MODELS STILL CALLING FOR A DOWN DAY TODAY FOR EQUITIES, TN AND GOLD FUTURES, AND UP DAY FOR THE 10YR YIELD

4/X

robert.p.balan Moderator Leader Owner

Nov 16, 2022 10:01 AM

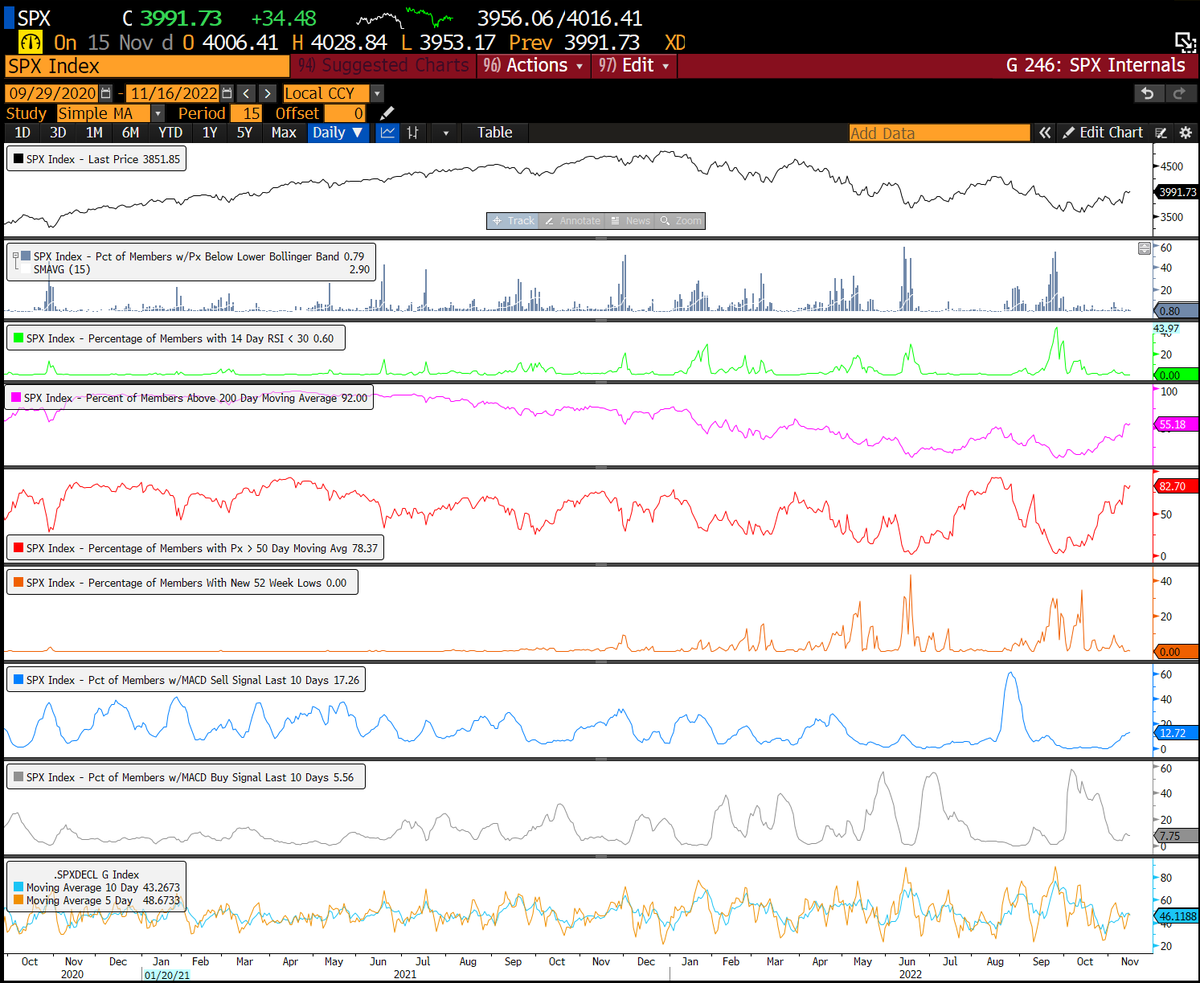

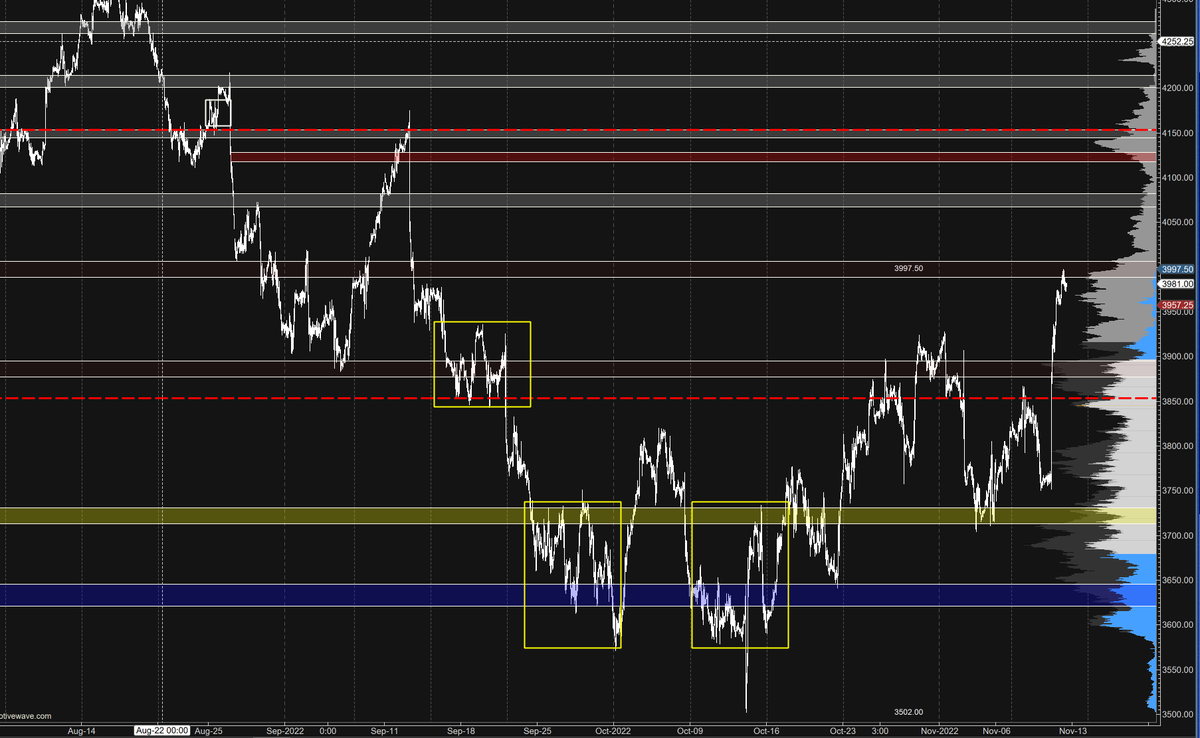

This is how the models are looking like today.

The Mod CCorr Coeff calls for sideways to lower NY close today, after which SPX rallies until Nov 23/24 at least (limit of the forecasting horizon of model).

robert.p.balan Moderator Leader Owner

Nov 16, 2022 10:01 AM

This is how the models are looking like today.

The Mod CCorr Coeff calls for sideways to lower NY close today, after which SPX rallies until Nov 23/24 at least (limit of the forecasting horizon of model).

5/X

robert.p.balan Moderator Leader Owner

Nov 16, 2022 10:07 AM

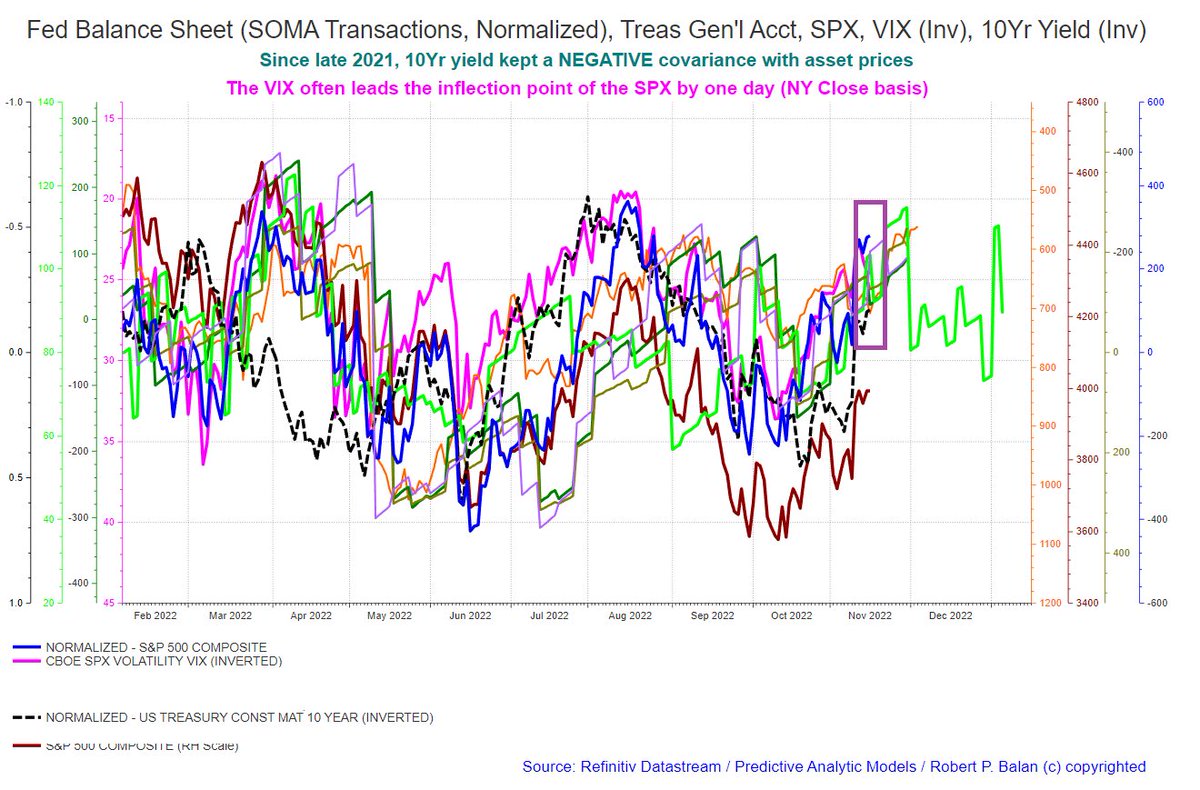

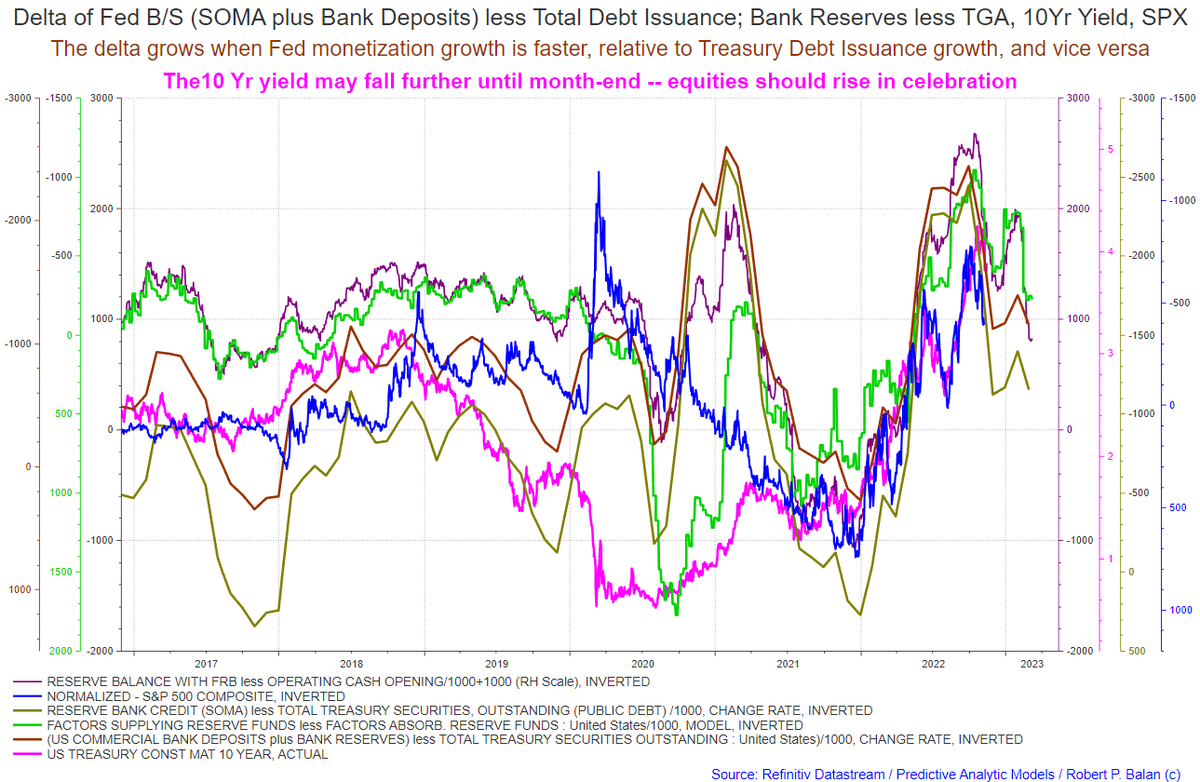

The SOMA models also call for one more dip today (NY close basis), then the index futures rally until end of the month.

robert.p.balan Moderator Leader Owner

Nov 16, 2022 10:07 AM

The SOMA models also call for one more dip today (NY close basis), then the index futures rally until end of the month.

6/X

robert.p.balan Moderator Leader Owner

Nov 16, 2022 10:11 AM

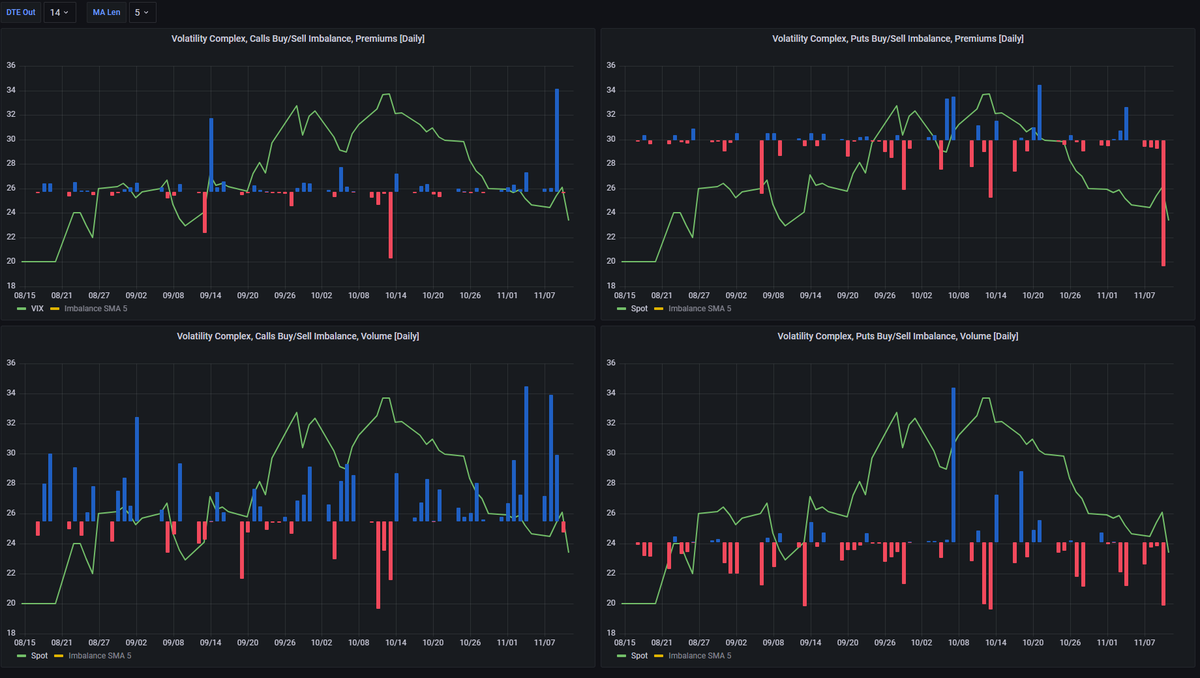

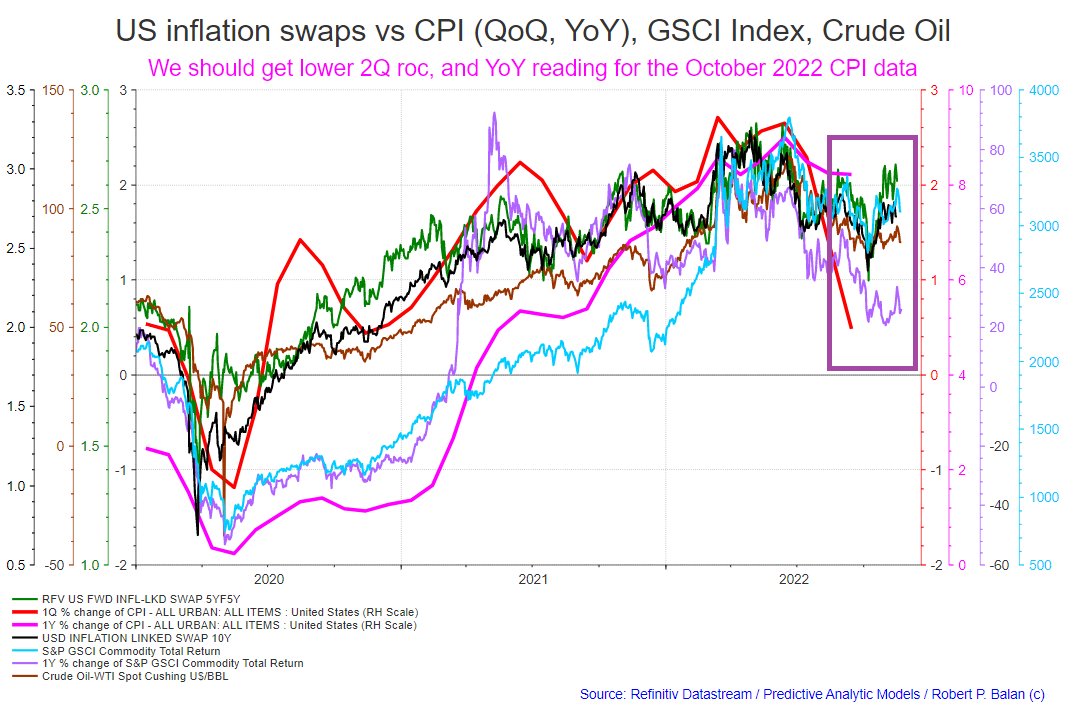

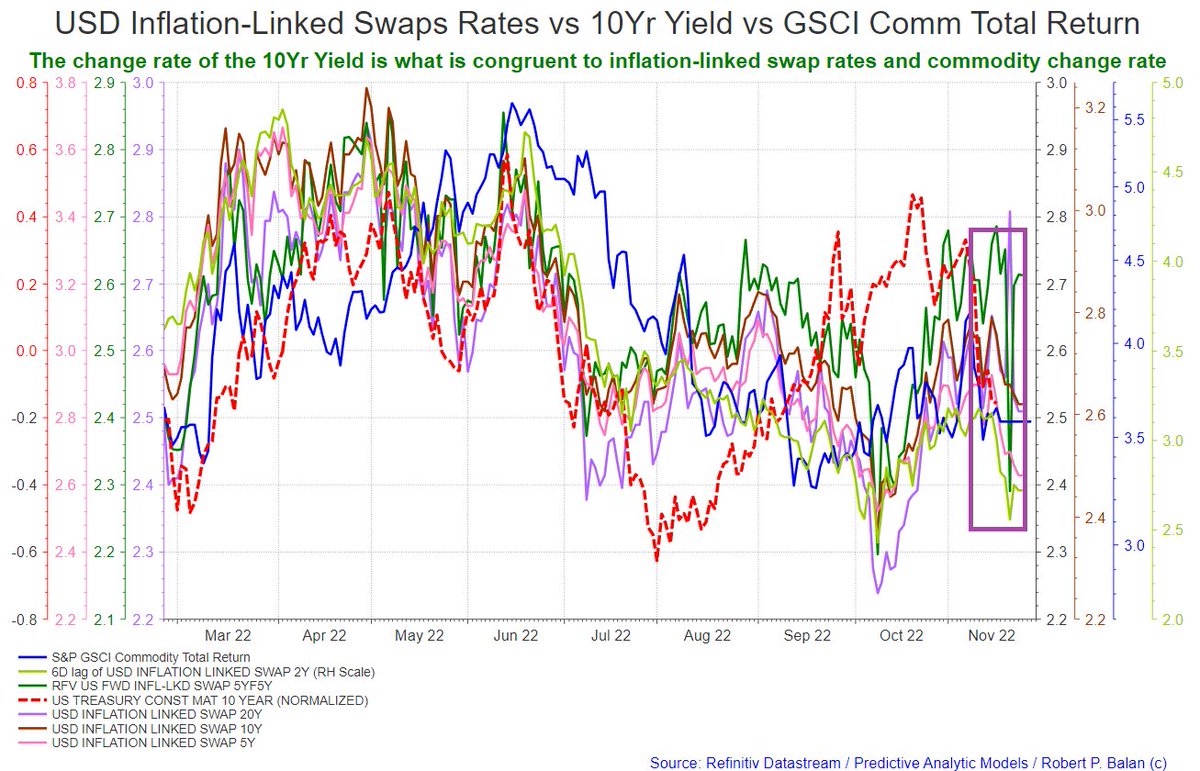

Inflation-Linked Swap Rate models also suggest an uptick in the 10Yr Yield today, followed by lower yields until at least Nov 21 (limit of models' forecast horizons).

robert.p.balan Moderator Leader Owner

Nov 16, 2022 10:11 AM

Inflation-Linked Swap Rate models also suggest an uptick in the 10Yr Yield today, followed by lower yields until at least Nov 21 (limit of models' forecast horizons).

7/X

robert.p.balan Moderator Leader Owner

Nov 15, 2022 12:59 PM

On longer horizon, our Delta Model suggests that 10Y Yield could be lower until end of Nov - early Dec. This model is not granular. but it is what we use for ETF trades.

Equities should rise, celebrating this fall.

robert.p.balan Moderator Leader Owner

Nov 15, 2022 12:59 PM

On longer horizon, our Delta Model suggests that 10Y Yield could be lower until end of Nov - early Dec. This model is not granular. but it is what we use for ETF trades.

Equities should rise, celebrating this fall.

8/X

robert.p.balan Moderator Leader Owner

Nov 16, 2022 10:18 AM

I was asked why PAM bought back shorts in pre Europe open. I asked the Trade Boys to give me a call if the 10Yr yield rises back to 3.84 pct overnight. Which they did. I looked at . . .

robert.p.balan Moderator Leader Owner

Nov 16, 2022 10:18 AM

I was asked why PAM bought back shorts in pre Europe open. I asked the Trade Boys to give me a call if the 10Yr yield rises back to 3.84 pct overnight. Which they did. I looked at . . .

9/X . . . the real time analysis and concluded that the yield rally from NY close was pretty much done. I did not want the trades to go back underwater --- so I had the Boys close out at breakeven or close to.

Later, deeper analysis showed we may have another sell-off later . .

Later, deeper analysis showed we may have another sell-off later . .

10/X . . . today. But that's enough countertrend trading for me.

So looking for lower index futures (higher 10Yr Yield) seen relative to yesterday. However, we won't be selling the dip, but instead will be looking for lower levels to initiate long equity, TN and Gold positions.

So looking for lower index futures (higher 10Yr Yield) seen relative to yesterday. However, we won't be selling the dip, but instead will be looking for lower levels to initiate long equity, TN and Gold positions.

11/X

van.g7

Nov 16, 2022 1:15 PM

it is good if we can see NQ future at 11730 11750 to exit short

robert.p.balan

Nov 16, 2022 1:19 PM

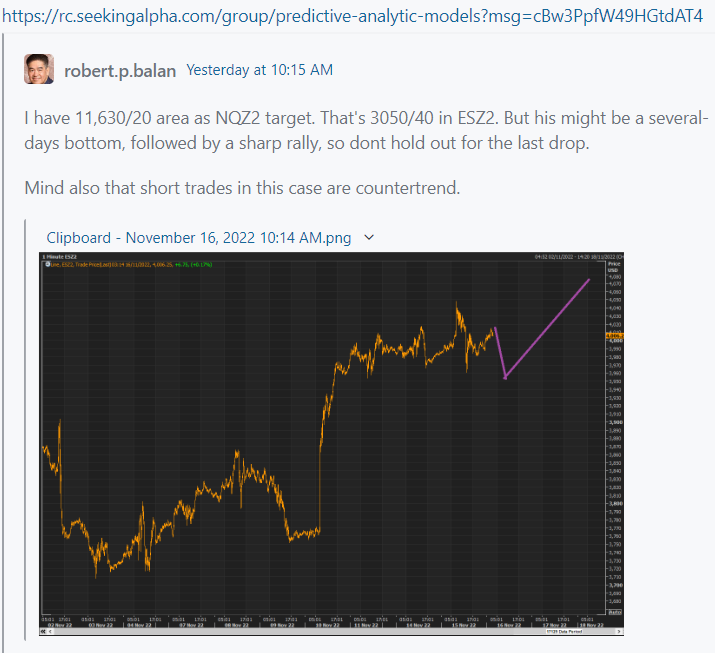

I have 11,630/20 area as NQ target. But his might be a several-days bottom, followed by a sharp rally, so dont hold out for the last drop.

van.g7

Nov 16, 2022 1:15 PM

it is good if we can see NQ future at 11730 11750 to exit short

robert.p.balan

Nov 16, 2022 1:19 PM

I have 11,630/20 area as NQ target. But his might be a several-days bottom, followed by a sharp rally, so dont hold out for the last drop.

12/X

robert.p.balan

Nov 16, 2022 10:15 AM

I have 11,630/20 area as NQZ2 target. That's 3050/40 in ESZ2. But his might be a several-days bottom, followed by a sharp rally, so dont hold out for the last drop.

Mind that short trades in this case are countertrend.

robert.p.balan

Nov 16, 2022 10:15 AM

I have 11,630/20 area as NQZ2 target. That's 3050/40 in ESZ2. But his might be a several-days bottom, followed by a sharp rally, so dont hold out for the last drop.

Mind that short trades in this case are countertrend.

13/X

Retail Sales not bad at all.

No wonder why the 10Yr Yield is rising hard, and equities tanking.

Retail Sales not bad at all.

No wonder why the 10Yr Yield is rising hard, and equities tanking.

14/X

bosshax

Nov 16, 2022 2:31 PM

Definitely a change in market reaction to what historically was a positive news beat (retail sales 1.3 v 1%)

In recent months hotter spending = more sustained inflation + tighter labour market. I'd argue hotter spending should mark down

bosshax

Nov 16, 2022 2:31 PM

Definitely a change in market reaction to what historically was a positive news beat (retail sales 1.3 v 1%)

In recent months hotter spending = more sustained inflation + tighter labour market. I'd argue hotter spending should mark down

15/X

Waiting for this dip in equities to play out -- and then we release the Krachen!

Watch for the alerts with the hour.

Waiting for this dip in equities to play out -- and then we release the Krachen!

Watch for the alerts with the hour.

16/X

sirlong

Nov 16, 2022 5:51 PM

RB are we looking for a dip in yield too to open some long bonds with equities

robert.p.balan Moderator Leader Owner

Nov 16, 2022 5:55 PM

sirlong --I don't currently have a good handle on the Yield outlook. Yesterday and today are supposed . . .

sirlong

Nov 16, 2022 5:51 PM

RB are we looking for a dip in yield too to open some long bonds with equities

robert.p.balan Moderator Leader Owner

Nov 16, 2022 5:55 PM

sirlong --I don't currently have a good handle on the Yield outlook. Yesterday and today are supposed . . .

17/X . . . to be up days (NY close basis). Not doing a TN trade until I understand why the Yield-equity covariance has turned positive. Anyway, we have two weeks to go with a long bond position. Another day of delay may actually improve our re-entry point.

18/X

robert.p.balan

Nov 16, 2022 9:54 PM

This remains our sweet spot for NQ - 11,630/20. But we're not buying NQ -- we buy YM and ES

Equity market firmer than expected (due to falling yields). So we may buy initial long trades without the NQ market reaching that "sweet spot".

robert.p.balan

Nov 16, 2022 9:54 PM

This remains our sweet spot for NQ - 11,630/20. But we're not buying NQ -- we buy YM and ES

Equity market firmer than expected (due to falling yields). So we may buy initial long trades without the NQ market reaching that "sweet spot".

19/19

robert.p.balan Moderator Leader Owner

Nov 16, 2022 10:28 PM

Then we complete our long purchases when we see that sweet spot.

OK -- I will see you during Asian trade. GN and GL.

robert.p.balan Moderator Leader Owner

Nov 16, 2022 10:28 PM

Then we complete our long purchases when we see that sweet spot.

OK -- I will see you during Asian trade. GN and GL.

• • •

Missing some Tweet in this thread? You can try to

force a refresh