Here's a peak at the stories (first-hand accounts) from the ghosts of SBF's past

The FTX/Alameda situation still has us shook!

SBF decimated the markets, let's take a look at the skeletons in his closet

🧵👇

The FTX/Alameda situation still has us shook!

SBF decimated the markets, let's take a look at the skeletons in his closet

🧵👇

An early trader for Alameda Research spoke about the evident mistakes made during their time at Alameda and how there was a clear lack of money coming in both ways:

https://twitter.com/hosseeb/status/1592029330485698562?s=20&t=oEKdZlLkIJUt1pE7v34Wlw

Another employee under SBF cited his tyrannical nature as the main reason for the overall collapse of the SBF empire:

https://twitter.com/211lp/status/1592073286007271424?s=20&t=zZhV9HCD_WlPvziBfK1lRA

An early FTX market maker tried to provide SBF with some friendly hygiene advice aiding him to look neater when representing FTX, it’s clear he ignored that:

https://twitter.com/mgnr_io/status/1591979688662274048?s=20&t=H8i3jzvGBKjqOrdOlBKYPA

FTX employees also have recorded accounts of a supposed back-door implementation to the exchange's codebase

This was reportedly led by...you guessed it, SBF in an attempt to swindle auditors and cover the exec's tracks:

This was reportedly led by...you guessed it, SBF in an attempt to swindle auditors and cover the exec's tracks:

https://twitter.com/vydamo_/status/1591969831523602432?s=20&t=bWWO4La9jylrqEgMLMYG0w

The contagion…unimaginable, however, an FTX insider hinted at more centralized exchanges being in major trouble:

https://twitter.com/MarioNawfal/status/1591907871826268160?s=20&t=JsZQPNydr0I1RFIdF2zGqg

Looking at the internal notes, we can see evidence of FTX hedging and exiting $USDT via multiple trades with no intention of holding assets:

https://twitter.com/0xstrobe/status/1591375924162957330?s=20&t=qdcxS1Ocn_FlWYlHZtQU9Q

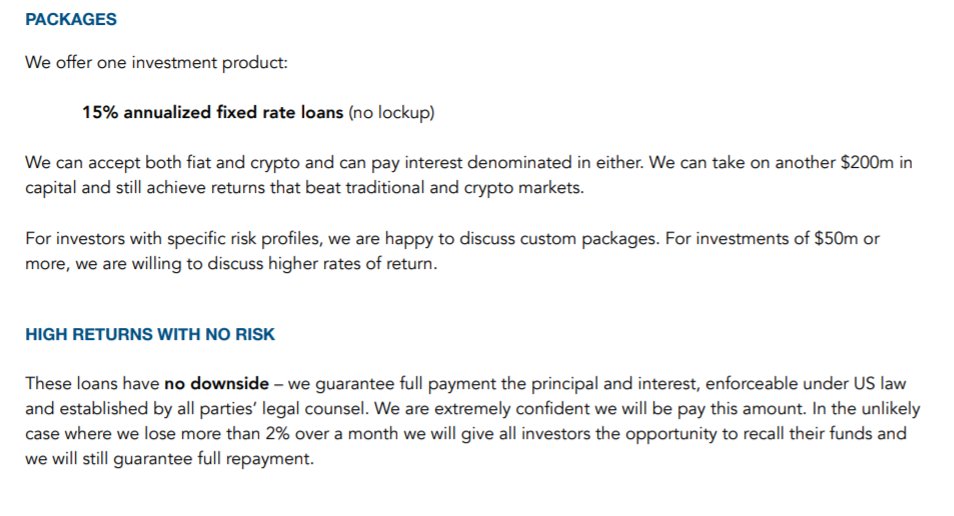

The return of Su Zhu's significance comes into play as tweets recirculated regarding his concerns about Alameda in 2019 and explains how their pamphlet said “High Returns, No Risk":

https://twitter.com/sumfattytuna/status/1591475020995624960?s=20&t=gYVOwiIuooiLHx6FE0Fttg

An anon account added on a forum that SBF was losing money on Japanese arbitrage trades, but this was just another barricade of lies from SBF as he claimed to be profiting:

https://twitter.com/AutismCapital/status/1592009944928489473?s=20&t=NtmEHjEKXJFcR29HK3Iqkg

Outside opinions provide different insights through speculation

@0xdoug suggests the scheme of Alameda’s exit plan:

@0xdoug suggests the scheme of Alameda’s exit plan:

https://twitter.com/0xdoug/status/1591161987547168768?s=20&t=fEgRju3Ekw9XFJl8_Hx20g

Subscribe to our newsletter if you want our weekly digest of the most important happenings in the Cryptoverse: 0xilluminati.com

We hope you've found this thread helpful.

Follow us @0x_illuminati for more.

Like/Retweet the first tweet below if you can:

Follow us @0x_illuminati for more.

Like/Retweet the first tweet below if you can:

https://twitter.com/0x_illuminati/status/1593288004533043200

Enjoyed this thread?

Follow @0x_illuminati, and subscribe to our newsletter: thecryptoilluminati.substack.com

Follow @0x_illuminati, and subscribe to our newsletter: thecryptoilluminati.substack.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh