An introduction to Fair Value Gaps.

What is it? How do you identify it? How do you use it?

Let's dive in.

What is it? How do you identify it? How do you use it?

Let's dive in.

What is a Fair Value Gap?

1️⃣ It is an imbalance in price.

2️⃣ It indicates aggressiveness - created when price leaves an range quickly.

3️⃣ Price will seek to return to the FVG to rebalance and pick up unfilled orders.

1️⃣ It is an imbalance in price.

2️⃣ It indicates aggressiveness - created when price leaves an range quickly.

3️⃣ Price will seek to return to the FVG to rebalance and pick up unfilled orders.

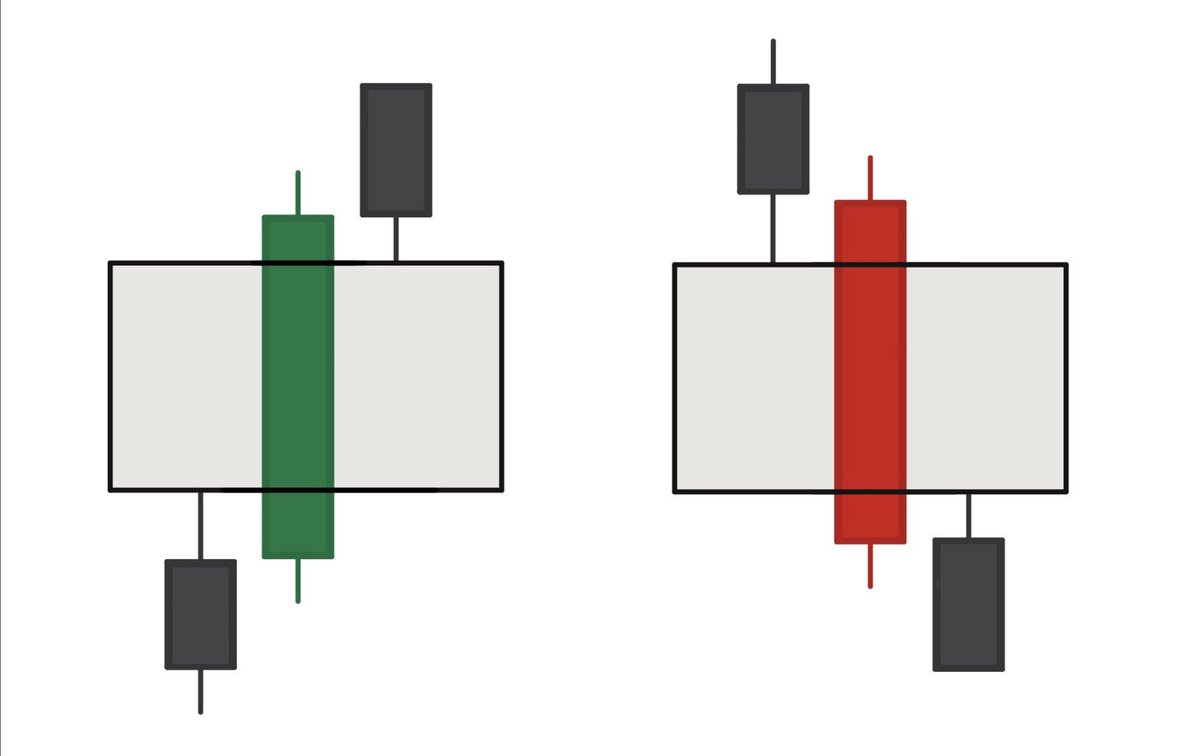

How do you identify a Fair Value Gap?

1️⃣ It is a 3 candle pattern.

2️⃣ It is identified as the area where the wicks of the first and third candle DON'T overlap.

3️⃣ It can be found on any timeframe.

1️⃣ It is a 3 candle pattern.

2️⃣ It is identified as the area where the wicks of the first and third candle DON'T overlap.

3️⃣ It can be found on any timeframe.

How do you use a Fair Value Gap?

1. If the higher time frame is bullish, they are expected to hold as support - an entry to go long.

2. If the higher time frame is bearish, they are expected to act as resistance - an entry to go short.

1. If the higher time frame is bullish, they are expected to hold as support - an entry to go long.

2. If the higher time frame is bearish, they are expected to act as resistance - an entry to go short.

I highly suggest you spend some time back testing Fair Value Gaps before using them in your own trading.

If you found this helpful -

• Bookmark it

• Share it with others

• Retweet it with your biggest takeaway

Jump back to the top here:

If you found this helpful -

• Bookmark it

• Share it with others

• Retweet it with your biggest takeaway

Jump back to the top here:

https://twitter.com/WealthBrah/status/1593295173869445126?s=20&t=l4FpR3KGeShgk7_CW7Lmrw

• • •

Missing some Tweet in this thread? You can try to

force a refresh