Agreed. And this is precisely why @norbertjmichel and I published a new paper calling for both the Federal Reserve and the Treasury to be prohibited from issuing a central bank digital currency, or CBDC.

The paper is here: cato.org/sites/cato.org…

But I'll break it down below.🧵

The paper is here: cato.org/sites/cato.org…

But I'll break it down below.🧵

https://twitter.com/justinamash/status/1592919434112700416

Proponents claim a CBDC would promote financial inclusion, spur faster payments, protect the dollar's status, and improve monetary policy---all worthy goals.

Yet all four arguments fail to stand up to scrutiny.

Yet all four arguments fail to stand up to scrutiny.

Financial inclusion?

Considering privacy and distrust for banks are the two of the top three reasons for being unbanked, it's hard to imagine how a CBDC would remedy the issue when trust in the government is at historic lows.

Considering privacy and distrust for banks are the two of the top three reasons for being unbanked, it's hard to imagine how a CBDC would remedy the issue when trust in the government is at historic lows.

Faster Payments?

The Fed already interrupted @TCHtweets's development of the real-time payments network with FedNow (expected in 2023).

Launching a CBDC would only repeat history by interrupting the development of stablecoins and the RTP network.

See: cato.org/blog/stablecoi…

The Fed already interrupted @TCHtweets's development of the real-time payments network with FedNow (expected in 2023).

Launching a CBDC would only repeat history by interrupting the development of stablecoins and the RTP network.

See: cato.org/blog/stablecoi…

World Reserve Currency?

The dollar's status is owed to the strength of the American economy and its legal protections.

If Congress wants to make real improvements, it can do so today by improving those characteristics.

cato.org/briefing-paper…

The dollar's status is owed to the strength of the American economy and its legal protections.

If Congress wants to make real improvements, it can do so today by improving those characteristics.

cato.org/briefing-paper…

Monetary Policy?

One common suggestion is that negative interest rate policies could be the tool the Fed has been missing all this time.

Yet what isn't always said as loudly is that negative interest policy largely requires cash to be eliminated. Even then, results are unclear

One common suggestion is that negative interest rate policies could be the tool the Fed has been missing all this time.

Yet what isn't always said as loudly is that negative interest policy largely requires cash to be eliminated. Even then, results are unclear

So if these purported benefits fail to stand up to scrutiny? What of the costs?

As @justinamash's tweet made clear, Americans already recognize that CBDCs pose a threat to financial privacy, financial freedom, and the very foundation of the banking system.

As @justinamash's tweet made clear, Americans already recognize that CBDCs pose a threat to financial privacy, financial freedom, and the very foundation of the banking system.

Put simply, a CBDC would most likely be the single largest assault on financial privacy since the creation of the Bank Secrecy Act and the establishment of the third-party doctrine.

With so much data in hand, a CBDC would provide countless opportunities for the government to control citizens’ financial transactions through:

-prohibiting and limiting purchases

-spurring and curbing purchases

-freezing and seizing funds.

-prohibiting and limiting purchases

-spurring and curbing purchases

-freezing and seizing funds.

There is also a risk that a CBDC could undermine both the foundation and the future of financial markets.

Not only would it risk disintermediating the banking system, but countries around the world have shown that they want a CBDC specifically to hold their monopoly over money.

Not only would it risk disintermediating the banking system, but countries around the world have shown that they want a CBDC specifically to hold their monopoly over money.

Finally, centralizing all of this data and power will make the Fed a prime target for cyber attacks.

Yes. The private sector is not immune from hacks, but centralizing data and power is one of the worst things that can be done for data security.

Yes. The private sector is not immune from hacks, but centralizing data and power is one of the worst things that can be done for data security.

These risks only scratch the surface, but they should already make it clear that there is no reason for the U.S. government to issue a CBDC when the costs are so high and the benefits are so low.

And this scrutiny is not just coming from @norbertjmichel and me.

@btcpolicyorg, @bankpolicy, @CUNA, @ddisparte, @WilliamJLuther, @RebelEconProf, @MartaBelcher, @gladstein, @TheCrowdFundLaw, @RepTomEmmer, @WarrenDavidson, and countless others have all spoken out against CBDCs.

@btcpolicyorg, @bankpolicy, @CUNA, @ddisparte, @WilliamJLuther, @RebelEconProf, @MartaBelcher, @gladstein, @TheCrowdFundLaw, @RepTomEmmer, @WarrenDavidson, and countless others have all spoken out against CBDCs.

But if you're still not convinced, check out our full @CatoInstitute paper below to see why Congress should prohibit both the Fed and the Treasury from going forward on a CBDC.

#CatoEcon

cato.org/working-paper/…

#CatoEcon

cato.org/working-paper/…

• • •

Missing some Tweet in this thread? You can try to

force a refresh

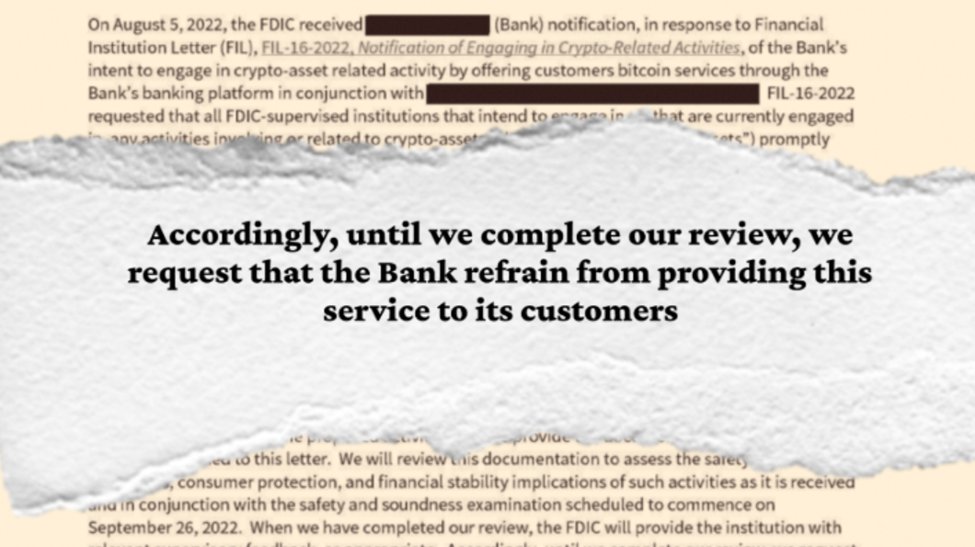

![Approximately 2,800 [redacted] customers can purchase, sell, and store Bitcoin using an application from [redacted] through the bank’s online and mobile banking platform… The FDIC has a number of questions… Until that review is completed, [redacted] should not expand the service to additional customers. (April 5, 2022)](https://pbs.twimg.com/media/GgnYDZ8WEAAWi8S.jpg)

![[Redacted] should not proceed with any crypto-asset activity until such time that the FDIC has determined [redacted] ability to implement the activity in a safe and sound manner. (May 5, 2023)](https://pbs.twimg.com/media/GgnYhoHXAAAcWkm.jpg)