1/ The FTX fallout has the potential to impact crypto for years to come.

Today, new information brings confusion, speculation and the potential for another bankruptcy.

Here is the short 20 tweet version of events, simplified with numbers & data visualization: 👇🧵

Today, new information brings confusion, speculation and the potential for another bankruptcy.

Here is the short 20 tweet version of events, simplified with numbers & data visualization: 👇🧵

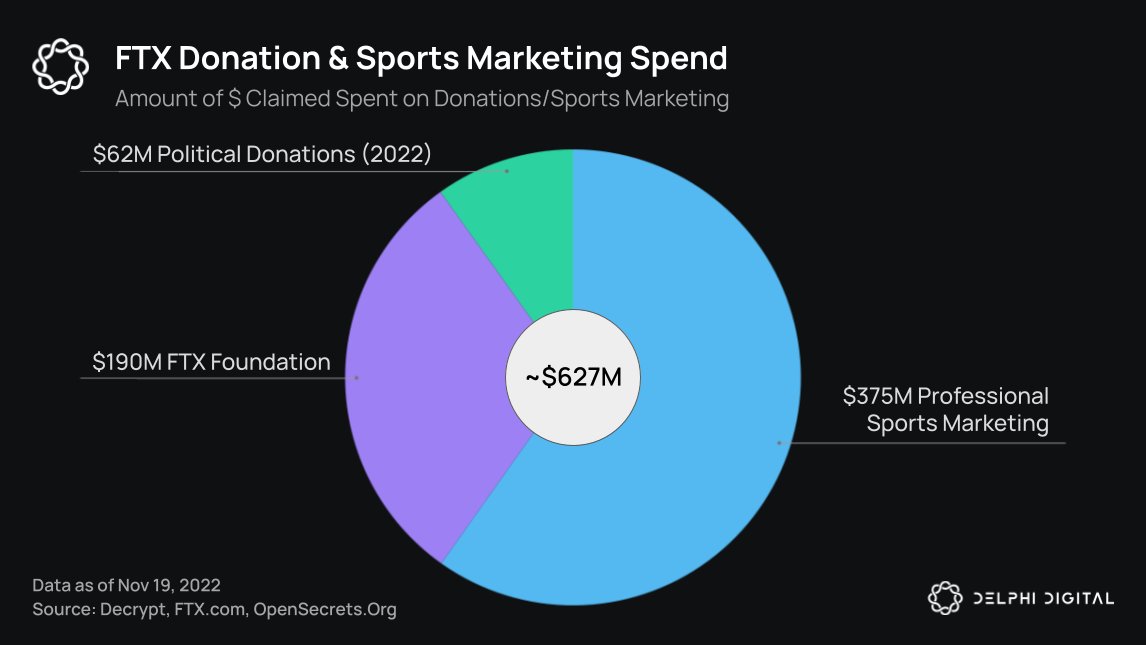

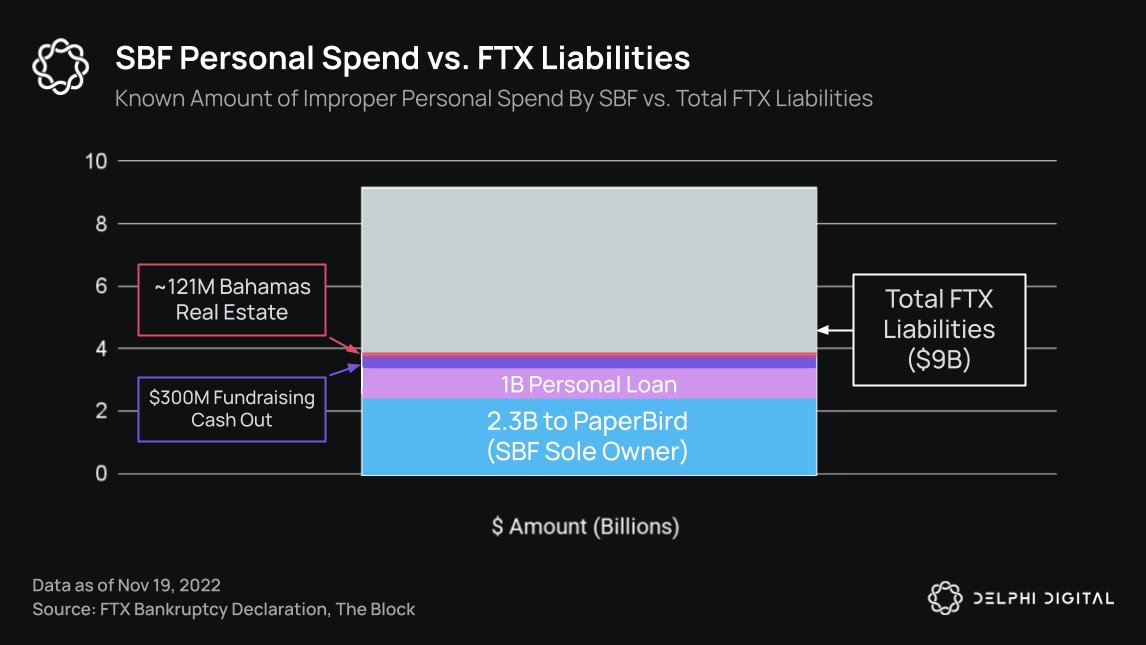

2/ The Fraud:

- $9B in liabilities

- $2.3B loan given to PaperBird (SBF sole owner)

- $1B loan given to SBF

- $300M cashout from recent FTX fundraising round

- $121M on bahamas real estate

- $9B in liabilities

- $2.3B loan given to PaperBird (SBF sole owner)

- $1B loan given to SBF

- $300M cashout from recent FTX fundraising round

- $121M on bahamas real estate

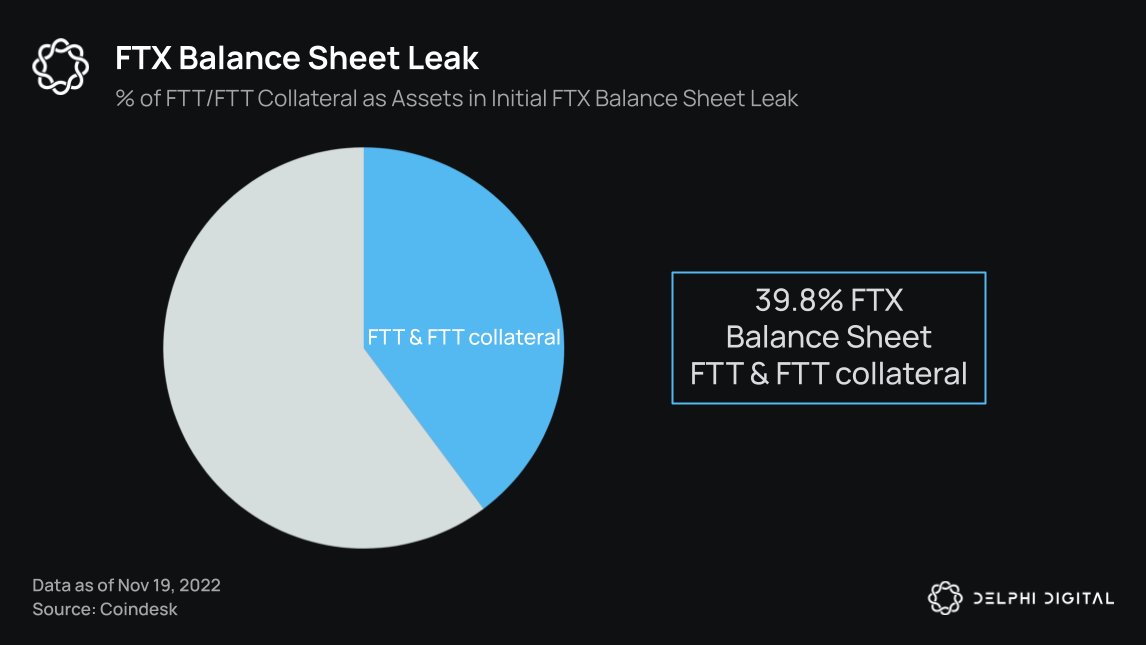

4/ The Leak:

On November 2nd, a @CoinDesk article written by @IanAllison123 claims CoinDesk has received a copy of FTX's balance sheet.

The leak reveals that nearly 40% of the asset side of FTX's balance sheet is FTT/FTT collateral.

On November 2nd, a @CoinDesk article written by @IanAllison123 claims CoinDesk has received a copy of FTX's balance sheet.

The leak reveals that nearly 40% of the asset side of FTX's balance sheet is FTT/FTT collateral.

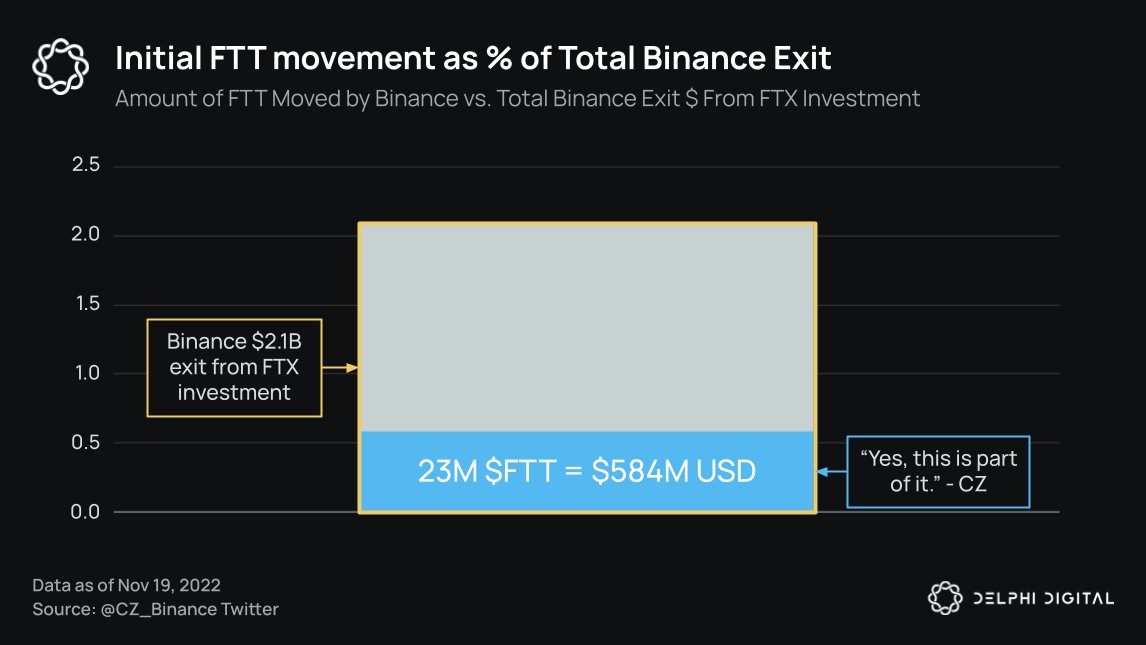

5/ The tweet:

Following the leak, Binance CEO @cz_binance announces Binance will be liquidating all of the FTT they had received from an FTX investment exit, over the course of a few months.

CZ then quote RTs a $584M FTT movement claiming this movement was "part of it”.

Following the leak, Binance CEO @cz_binance announces Binance will be liquidating all of the FTT they had received from an FTX investment exit, over the course of a few months.

CZ then quote RTs a $584M FTT movement claiming this movement was "part of it”.

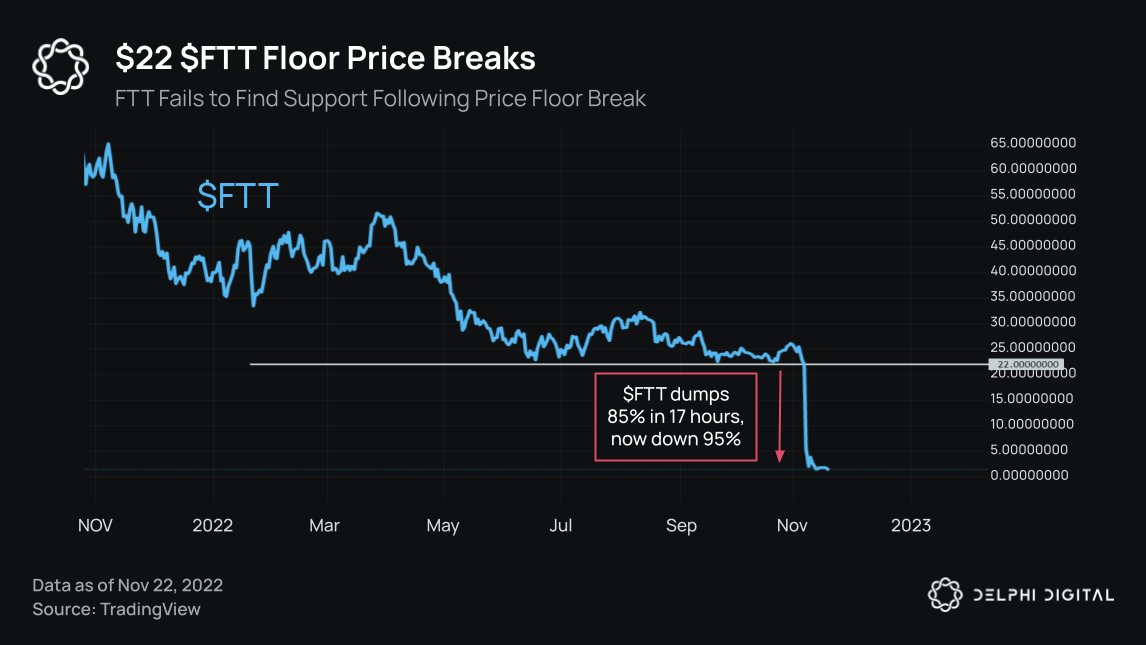

6/ The response:

Caroline Ellison, CEO of Alameda offers to buy all of the $FTT from Binance OTC at $22.

Caroline Ellison, CEO of Alameda offers to buy all of the $FTT from Binance OTC at $22.

7/ The sell-off:

Solana dumps 17% in 12 hours, losing ~$1.47B in marketcap as FTT holds its $22 floor price.

FTX was one of the largest holders of Solana and is presumably selling their $SOL holdings to generate liquidity to hold the $22 $FTT price floor.

Solana dumps 17% in 12 hours, losing ~$1.47B in marketcap as FTT holds its $22 floor price.

FTX was one of the largest holders of Solana and is presumably selling their $SOL holdings to generate liquidity to hold the $22 $FTT price floor.

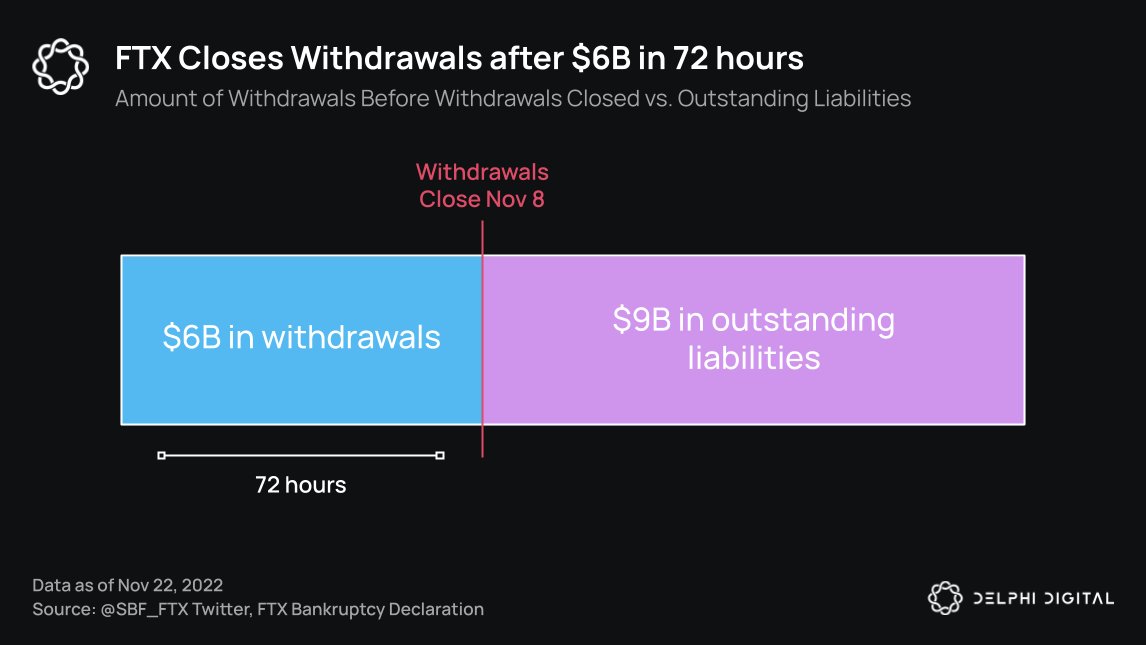

9/ The Bank Run:

FTX experiences $6B of net withdrawals in 72 hours leading up to withdrawals being paused.

FTX experiences $6B of net withdrawals in 72 hours leading up to withdrawals being paused.

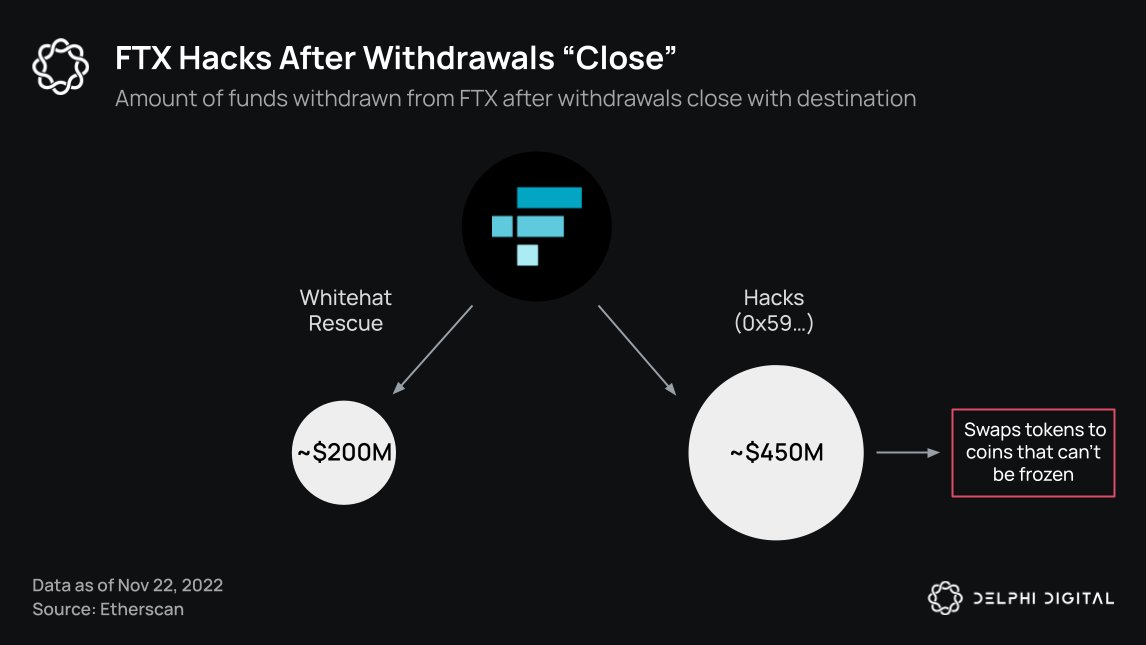

10/ The hack:

After withdrawals close, $450M is withdrawn to Ethereum address "0x59.."

0x59's on-chain activity meets the criteria of a blackhat hacker. Their identity remains unknown.

$200M is then withdrawn from FTX in an apparent employee whitehat rescue of remaining funds.

After withdrawals close, $450M is withdrawn to Ethereum address "0x59.."

0x59's on-chain activity meets the criteria of a blackhat hacker. Their identity remains unknown.

$200M is then withdrawn from FTX in an apparent employee whitehat rescue of remaining funds.

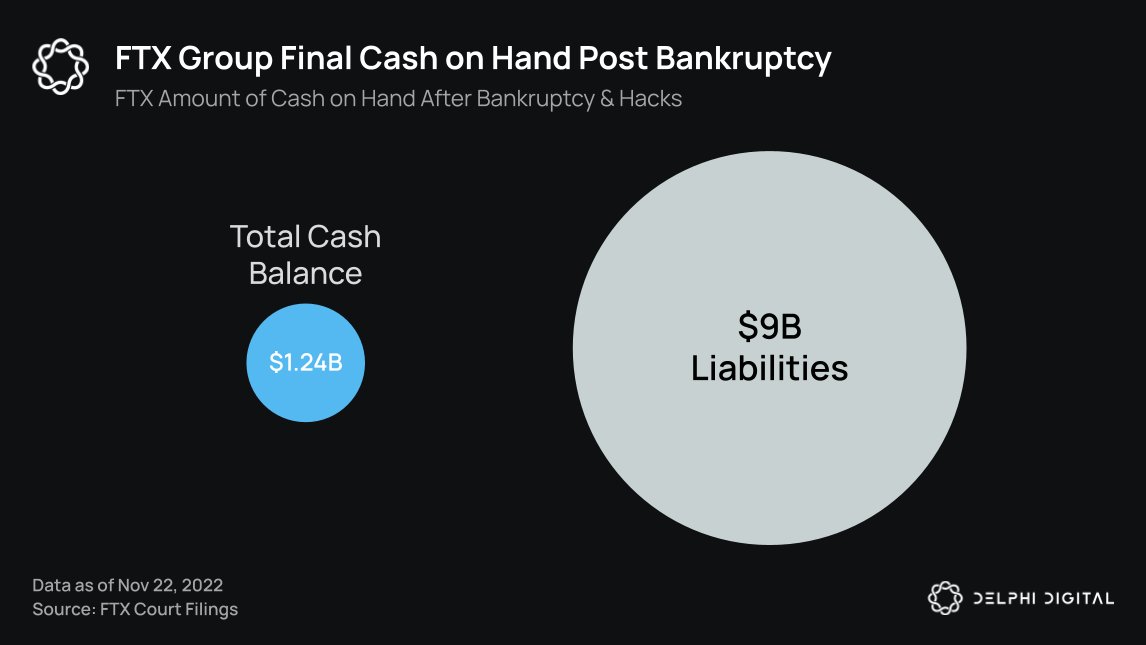

11/ The Dust Clears:

FTX files for chapter 11 bankruptcy.

FTX Group reports a total cash balance of $1.24B as of Sunday, November 20.

FTX files for chapter 11 bankruptcy.

FTX Group reports a total cash balance of $1.24B as of Sunday, November 20.

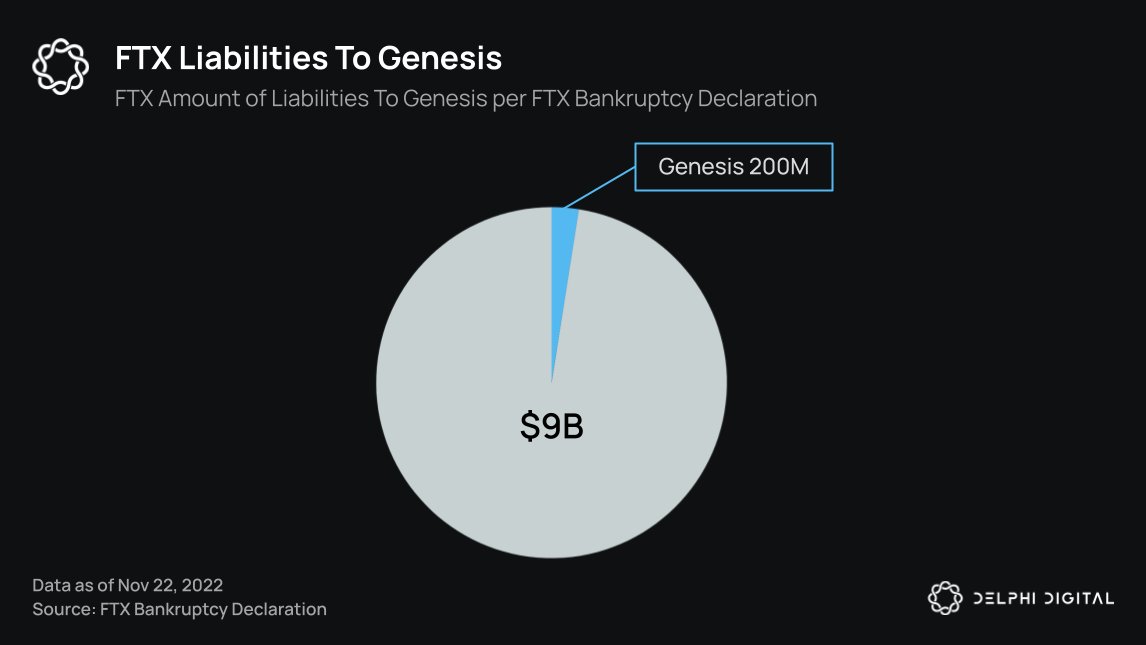

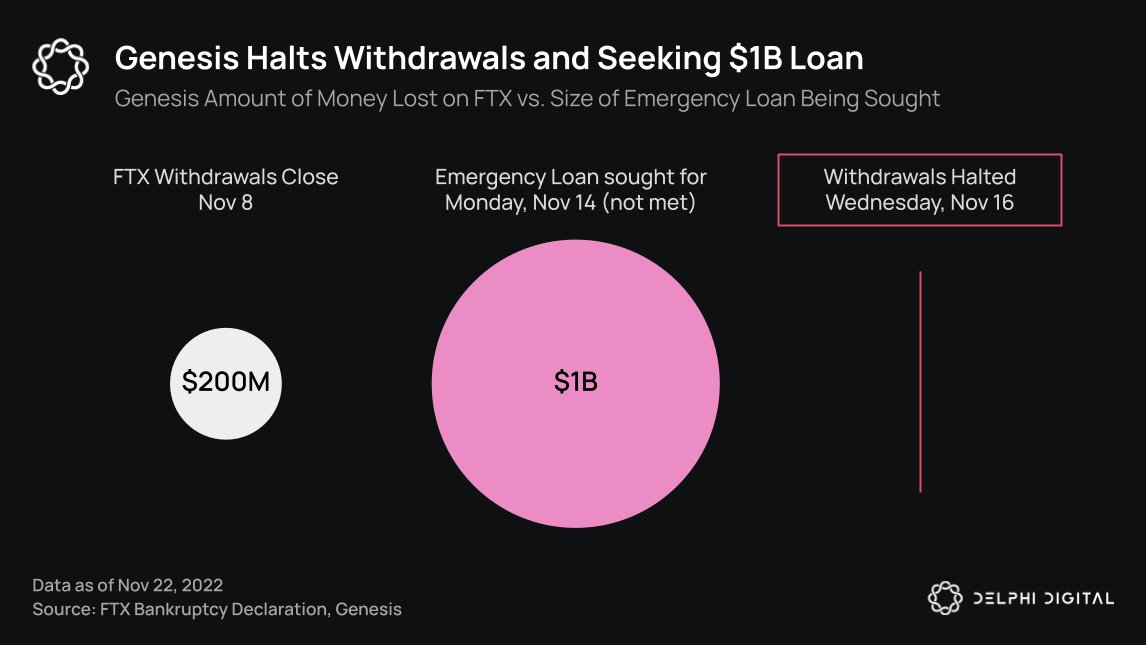

13/ With $200m lost in FTX, Genesis seeks an emergency $1B loan for Monday, Nov 14, which is not met.

The loan was likely in order to meet impending withdrawals as a result of contagion fears.

Genesis then closes withdrawals on Wednesday, Nov 16.

The loan was likely in order to meet impending withdrawals as a result of contagion fears.

Genesis then closes withdrawals on Wednesday, Nov 16.

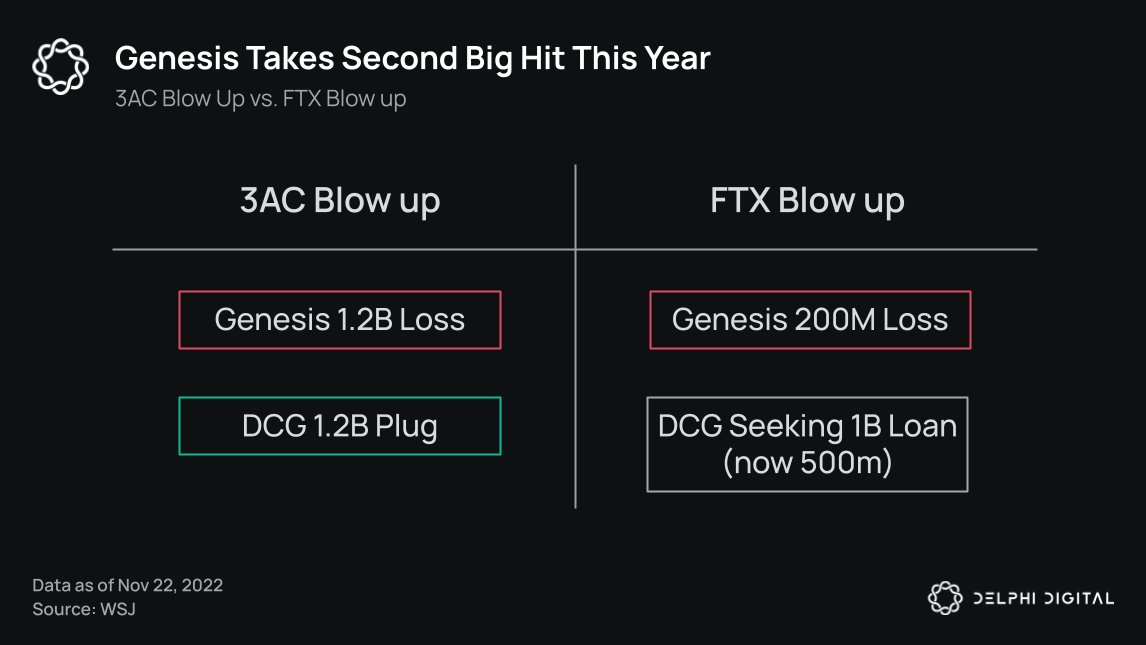

14/ The Repeat Offender:

Genesis lost $1.2B in bad loans to 3AC in May. This hole was plugged by DCG, Genesis' parent company.

Genesis now faces another hole and DCG is now seeking external fundraising in the form of a $500m loan (reduced from $1B from lack of demand).

Genesis lost $1.2B in bad loans to 3AC in May. This hole was plugged by DCG, Genesis' parent company.

Genesis now faces another hole and DCG is now seeking external fundraising in the form of a $500m loan (reduced from $1B from lack of demand).

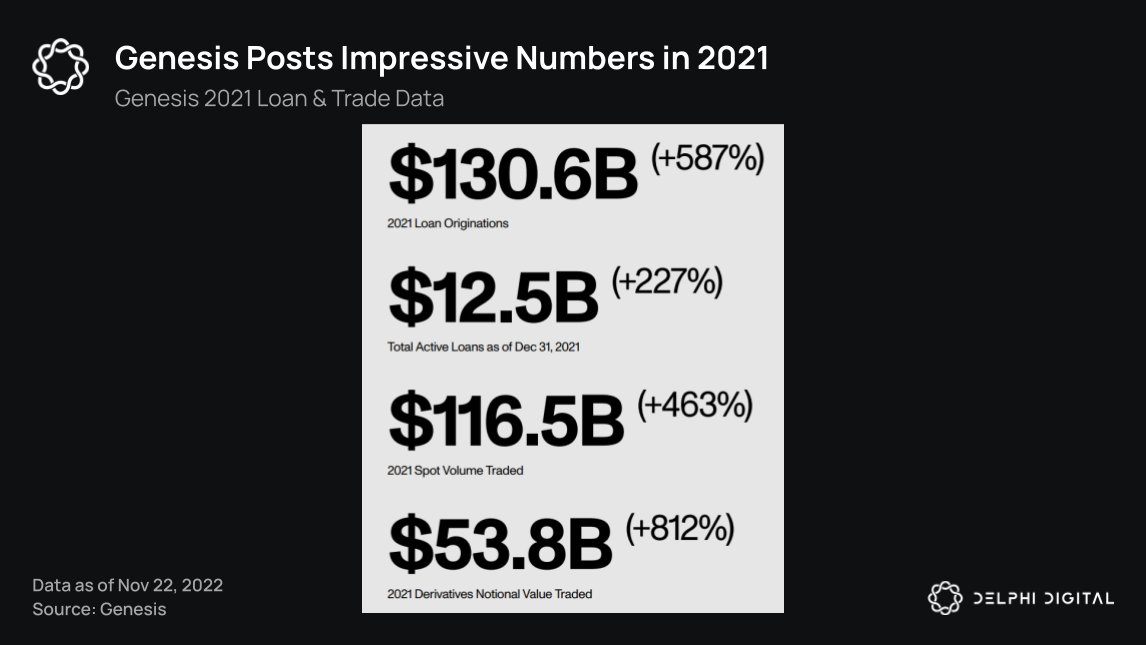

15/ The fear part 1:

Genesis is the largest institutional crypto lender, giving out over $130B in loans in 2021 alone.

The absence of Genesis would further constrain liquidity and leverage in crypto markets.

Genesis is the largest institutional crypto lender, giving out over $130B in loans in 2021 alone.

The absence of Genesis would further constrain liquidity and leverage in crypto markets.

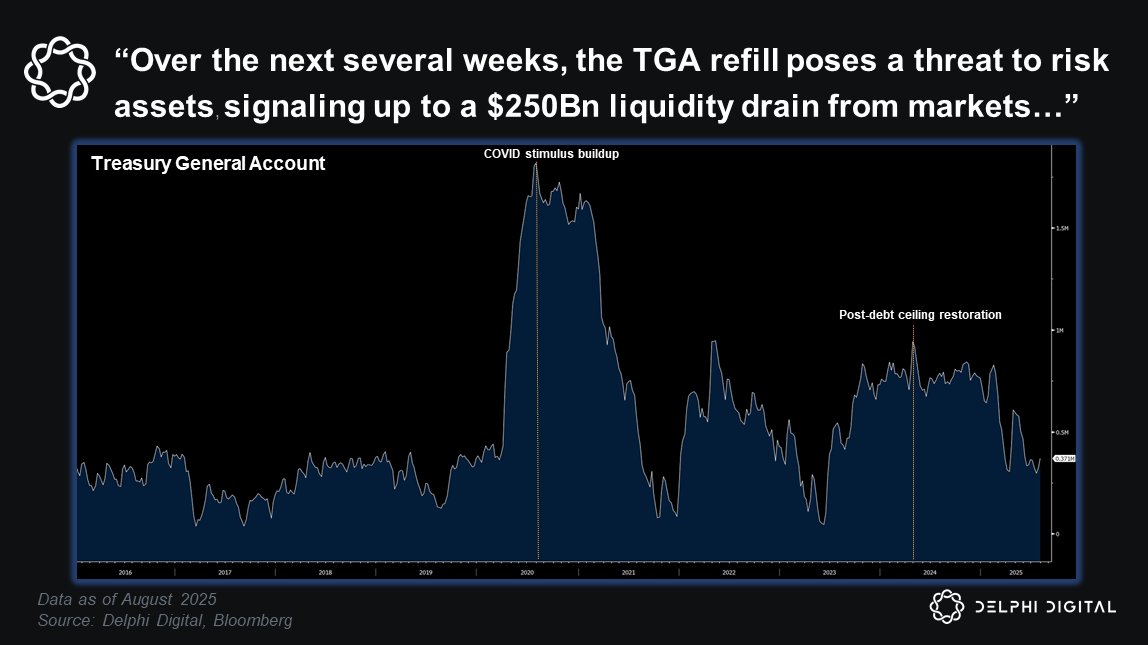

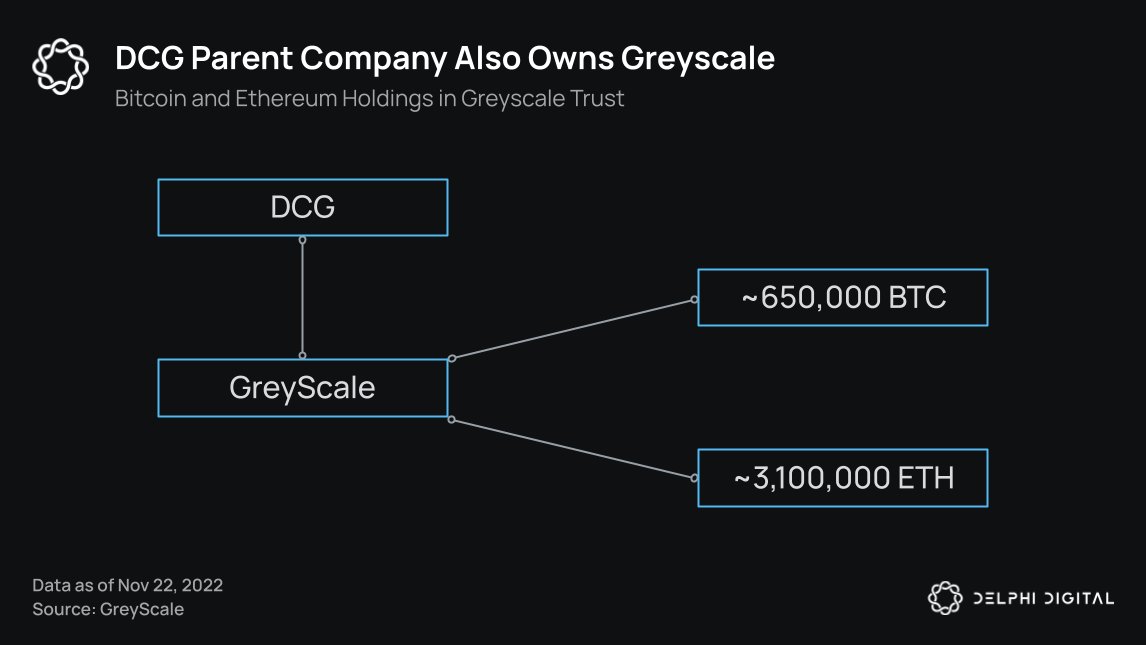

16/ The fear part 2:

DCG, Genesis’ parent company is also the parent company to Grayscale and the Grayscale trust.

The Grayscale trust currently holds 635K BTC & 3.1M ETH.

This past Friday, Grayscale announced they won't be providing proof of reserves for "security concerns".

DCG, Genesis’ parent company is also the parent company to Grayscale and the Grayscale trust.

The Grayscale trust currently holds 635K BTC & 3.1M ETH.

This past Friday, Grayscale announced they won't be providing proof of reserves for "security concerns".

17/ Reg M

DCG has the option to enact “Reg M” for the GreyScale Trust which enables trust holders to redeem shares (a power they don't currently have).

A significant portion of trust shares are owned by DCG, enabling them to meet Genesis’ liabilities by liquidating holdings.

DCG has the option to enact “Reg M” for the GreyScale Trust which enables trust holders to redeem shares (a power they don't currently have).

A significant portion of trust shares are owned by DCG, enabling them to meet Genesis’ liabilities by liquidating holdings.

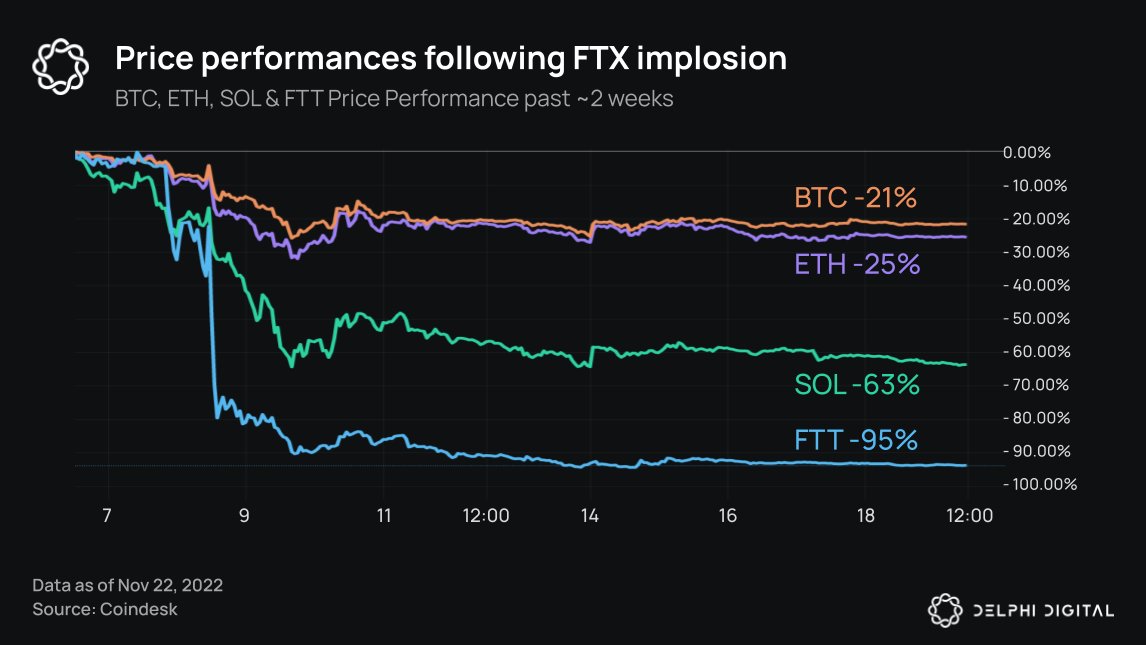

18/ The Market:

The implosion, contagion fears and potential GreyScale Trust liquidations has been reflected in the markets over the past 2 weeks:

Bitcoin -21%

Ethereum -25%

Solana -63%

FTT -95%

The implosion, contagion fears and potential GreyScale Trust liquidations has been reflected in the markets over the past 2 weeks:

Bitcoin -21%

Ethereum -25%

Solana -63%

FTT -95%

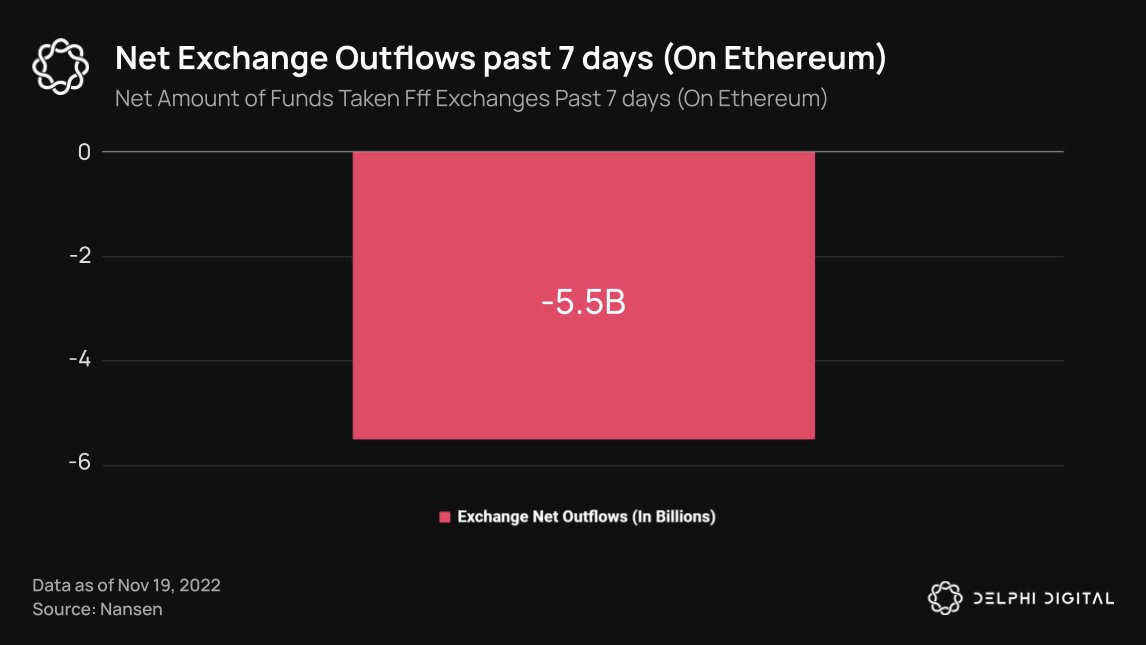

19/ CEX flows:

Centralized exchanges have experienced a net $5.5B outflow from exchanges over a 7-day period on Ethereum alone.

Centralized exchanges have experienced a net $5.5B outflow from exchanges over a 7-day period on Ethereum alone.

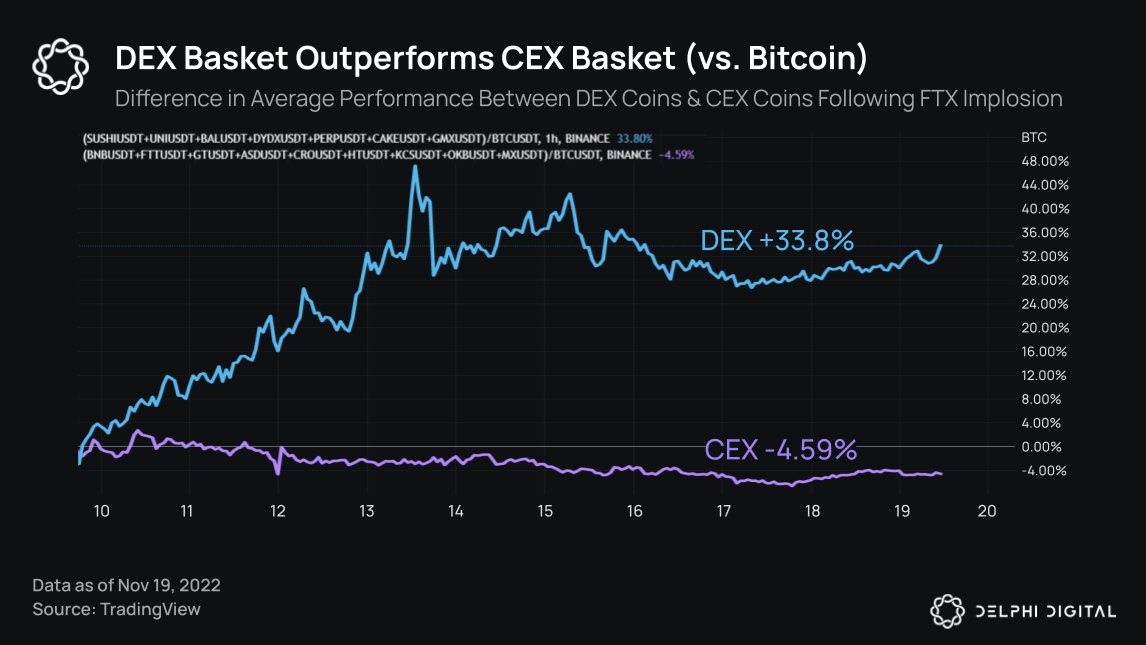

20/ DEX resilience:

In a 10-day period following FTX's blow up, our DEX basket went up 33.8% vs. BTC.

Our CEX basket went down 4.59% vs. BTC during the same period.

DeFi 📈

CeFi 📉

In a 10-day period following FTX's blow up, our DEX basket went up 33.8% vs. BTC.

Our CEX basket went down 4.59% vs. BTC during the same period.

DeFi 📈

CeFi 📉

The industry is experiencing a setback that will ultimately advance principles of decentralization & self-custody.

CeFi blew up, DeFi didn’t.

For more, follow us @Delphi_Digital and check out our black friday research sale below! Thanks for reading.

👉 members.delphidigital.io/checkout/4891

CeFi blew up, DeFi didn’t.

For more, follow us @Delphi_Digital and check out our black friday research sale below! Thanks for reading.

👉 members.delphidigital.io/checkout/4891

• • •

Missing some Tweet in this thread? You can try to

force a refresh