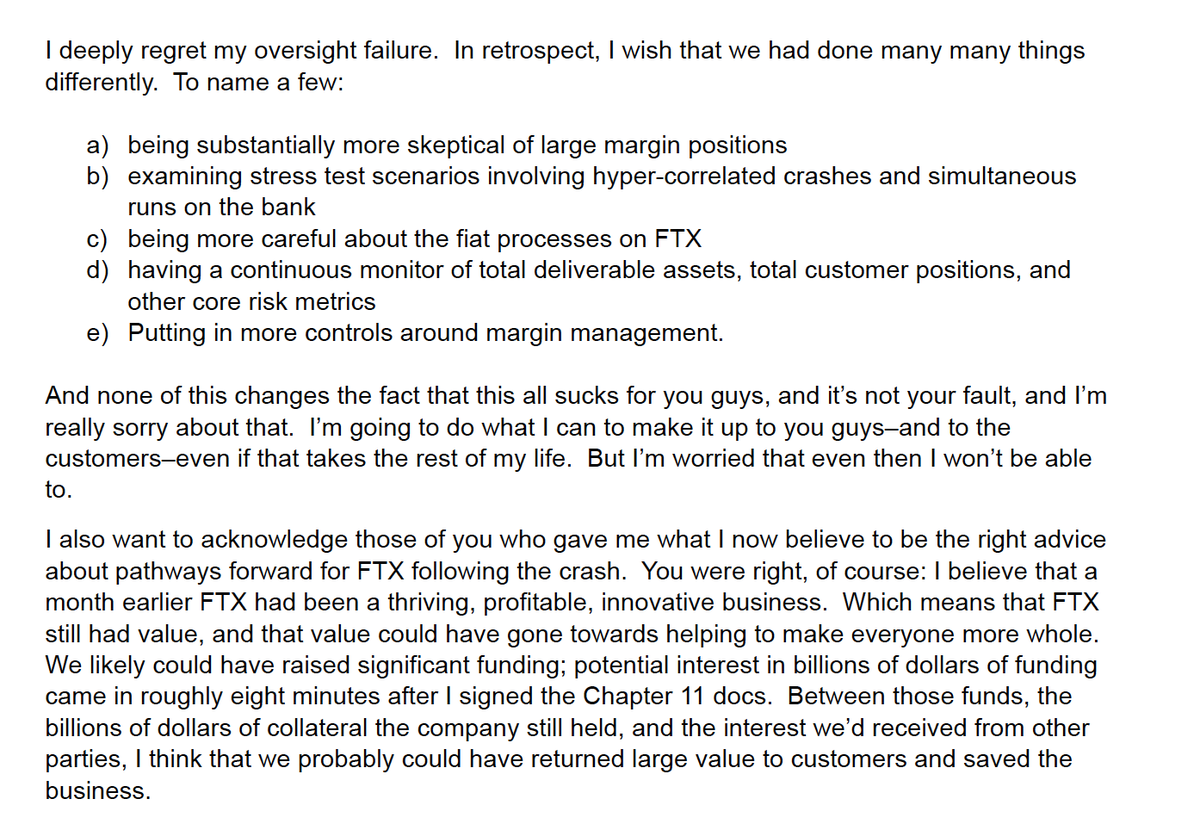

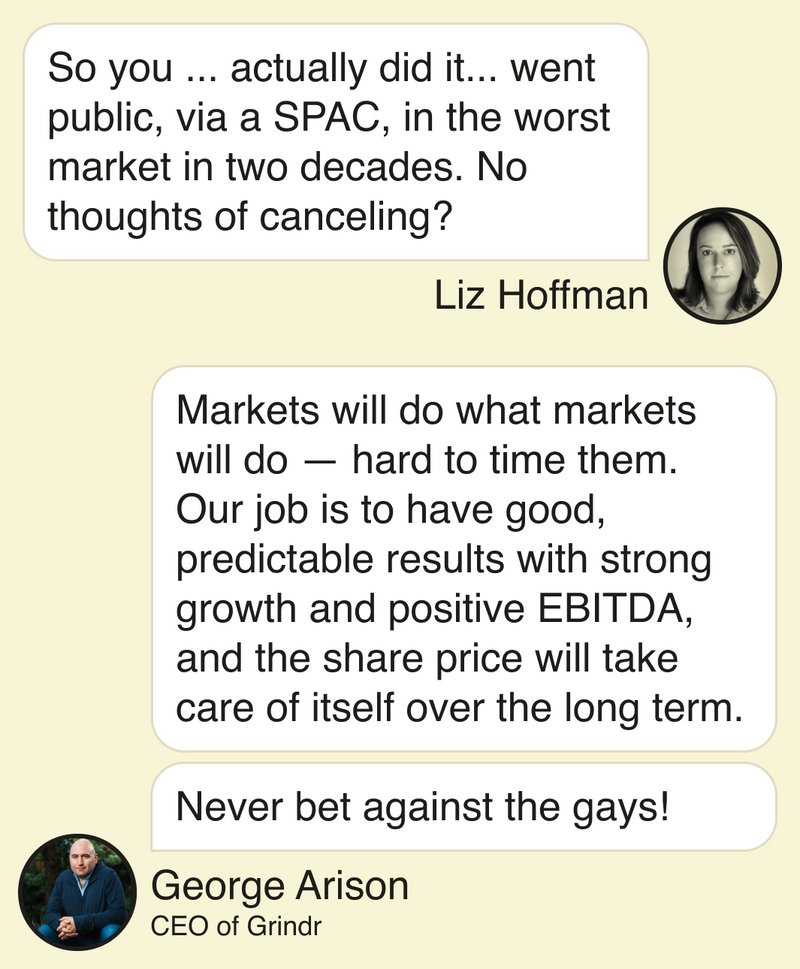

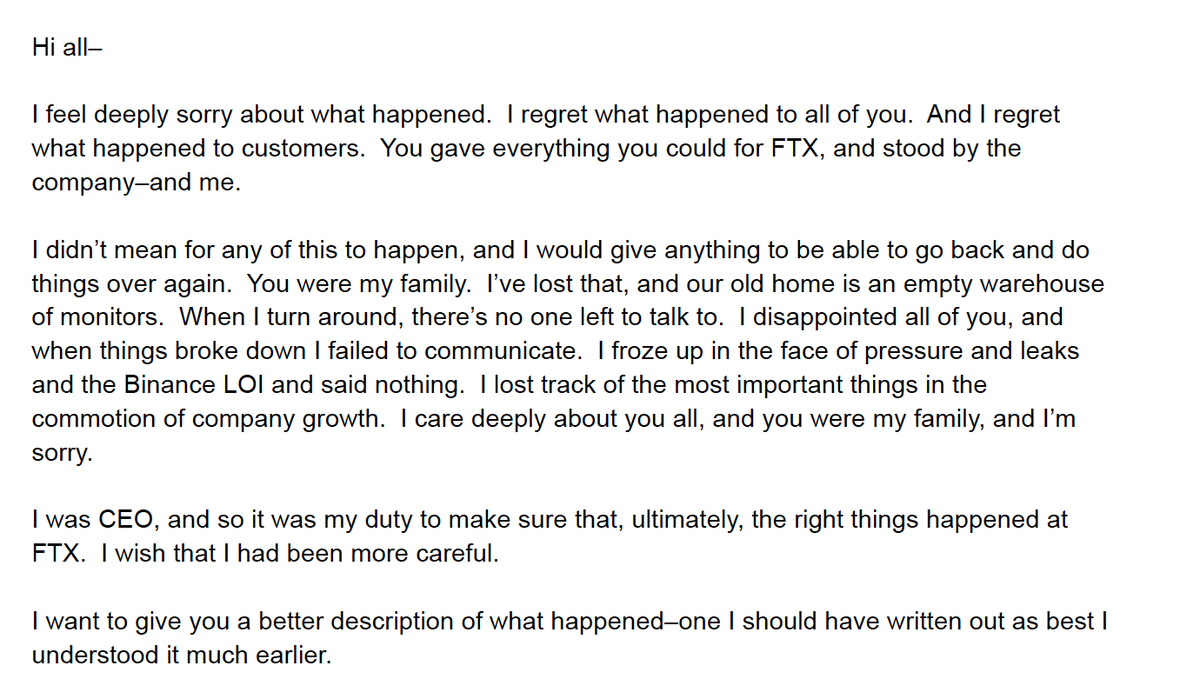

Letter SBF sent today to FTX employees h/t @CoinDesk

This mostly makes sense to me. FTX had a lot of collateral ($60bn) against not that many liabilities ($2bn). The problem is that collateral was monopoly money and the liabilities were ... real money. Just real basic banking stuff.

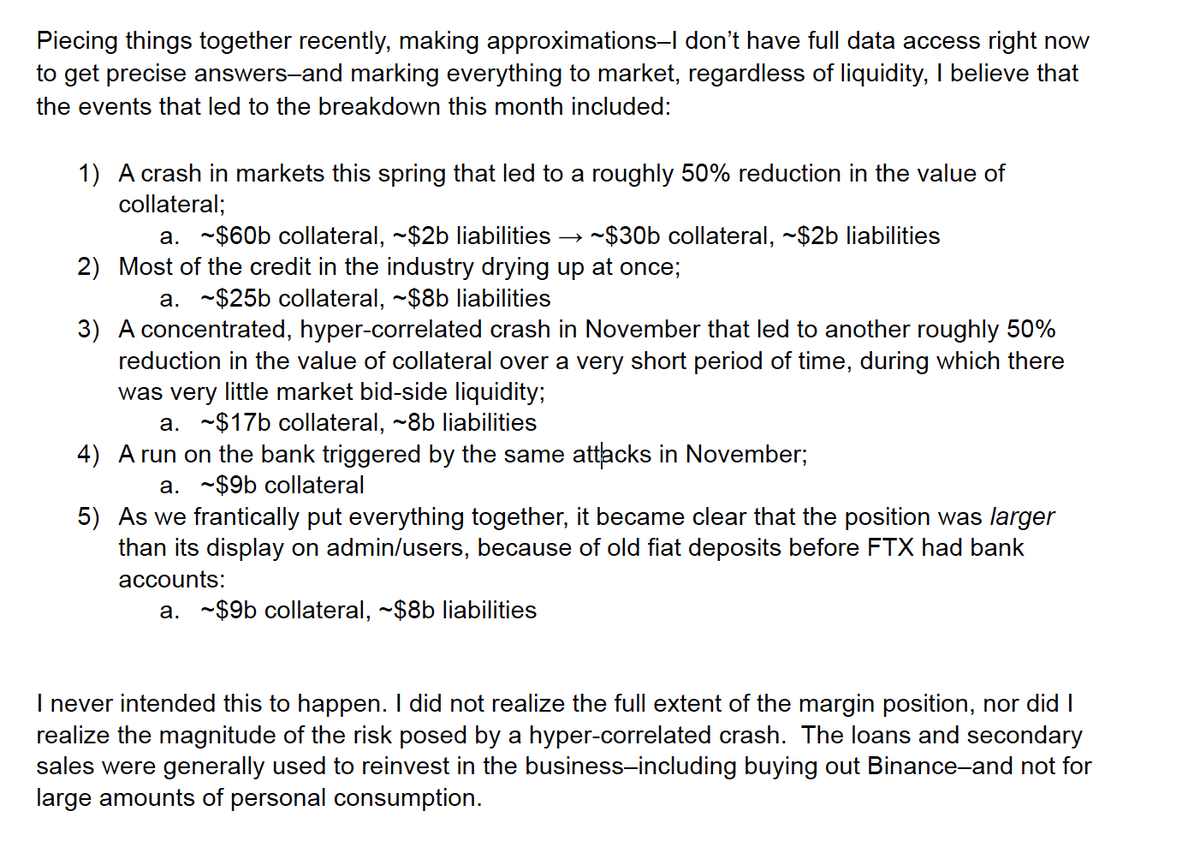

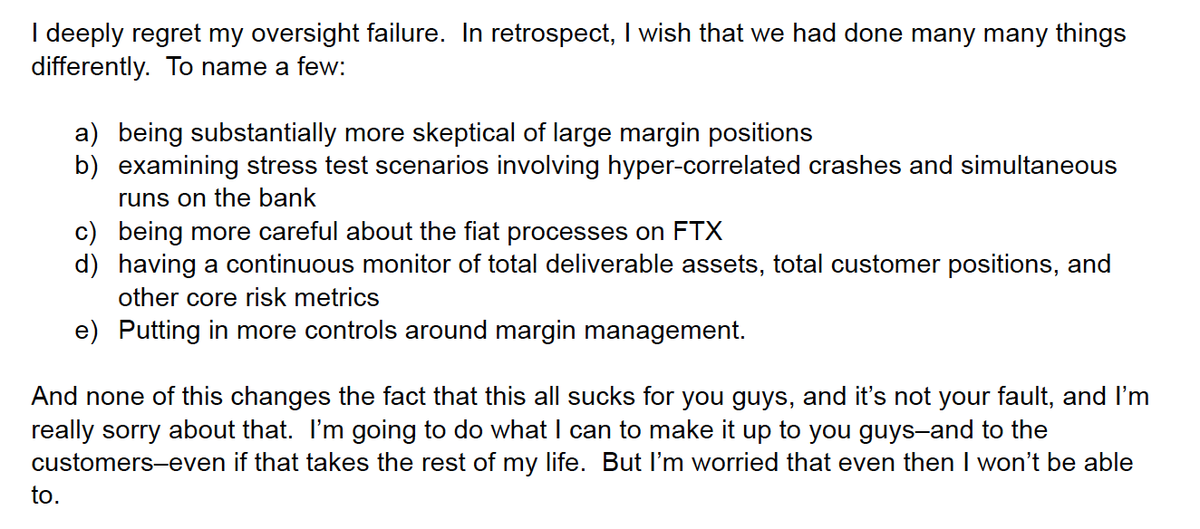

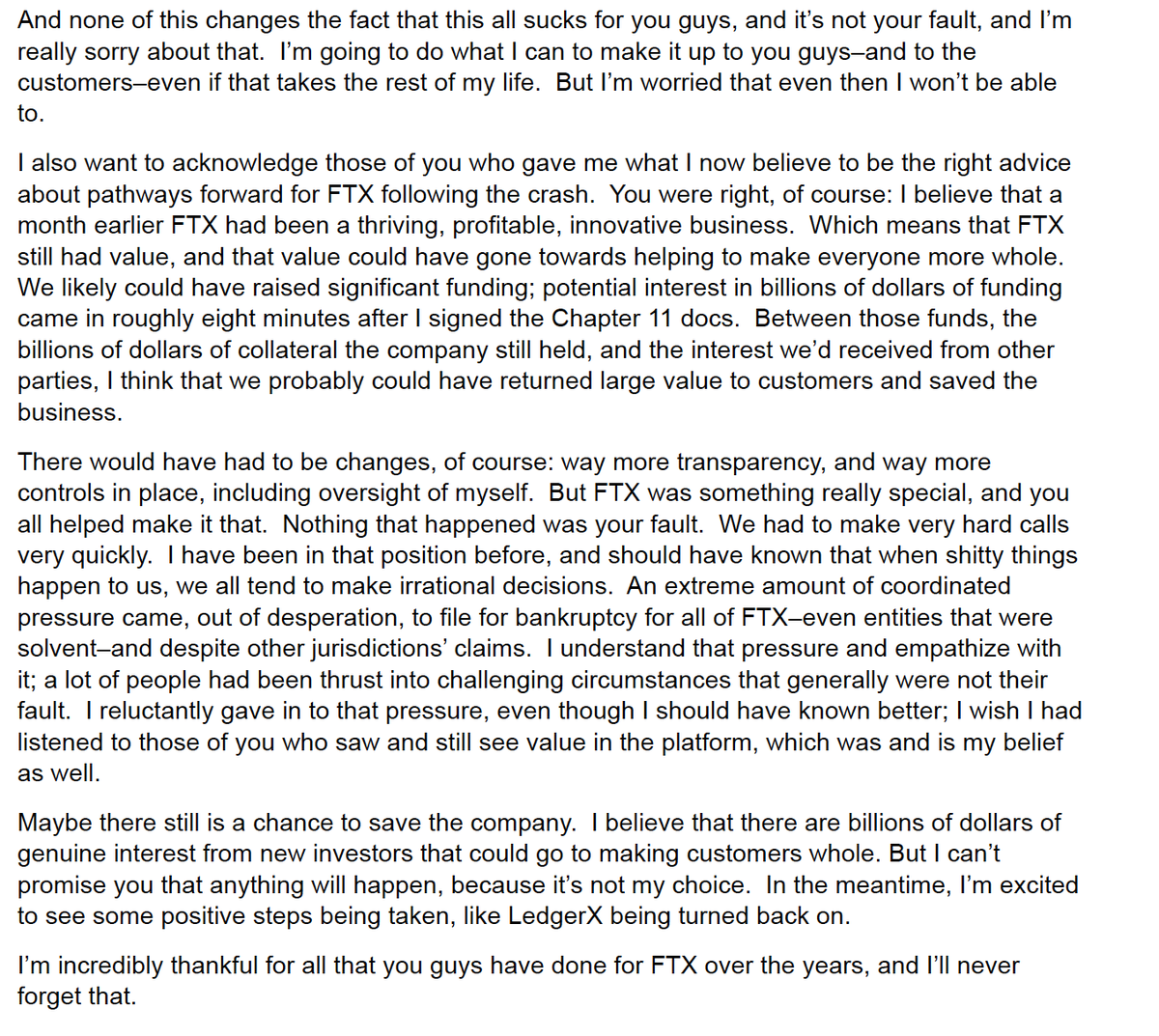

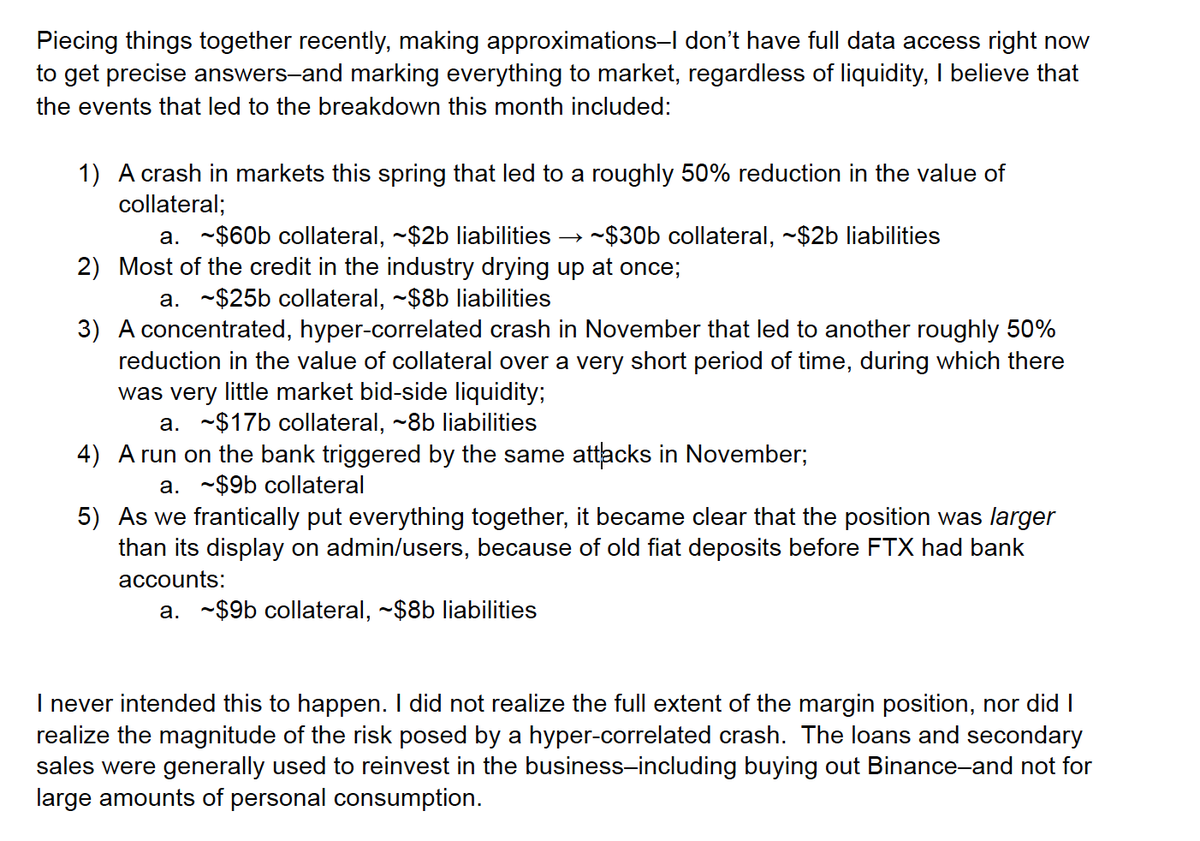

See here (SBF's words not mine, a bankruptcy trustee will sort it out, etc): Collateral - mostly crypto - went from being "worth" $60bn to $9bn *fast*

Even a "conservative" balance sheet goes upside-down very fast when the assets are garbage and the debts are real. See: Lehman

Even a "conservative" balance sheet goes upside-down very fast when the assets are garbage and the debts are real. See: Lehman

Setting aside whether there was fraud or not - a question for DOJ - this appears to just be a run on the bank. Crypto tokens are objectively riskier/stupider collateral than mortgage bonds, but neither are cash! Same basic gravitational forces at work here.

Sure yes you can further inflate your assets by doing pump-and-dumps or drain then by stealing customers’ money but neither is a prerequisite for what seems to have happened here

• • •

Missing some Tweet in this thread? You can try to

force a refresh