Cash Flows matter most.

As an investor, you NEED to understand cash flow statements.

Let’s talk through how a Cash Flow Statement works👇🏼

As an investor, you NEED to understand cash flow statements.

Let’s talk through how a Cash Flow Statement works👇🏼

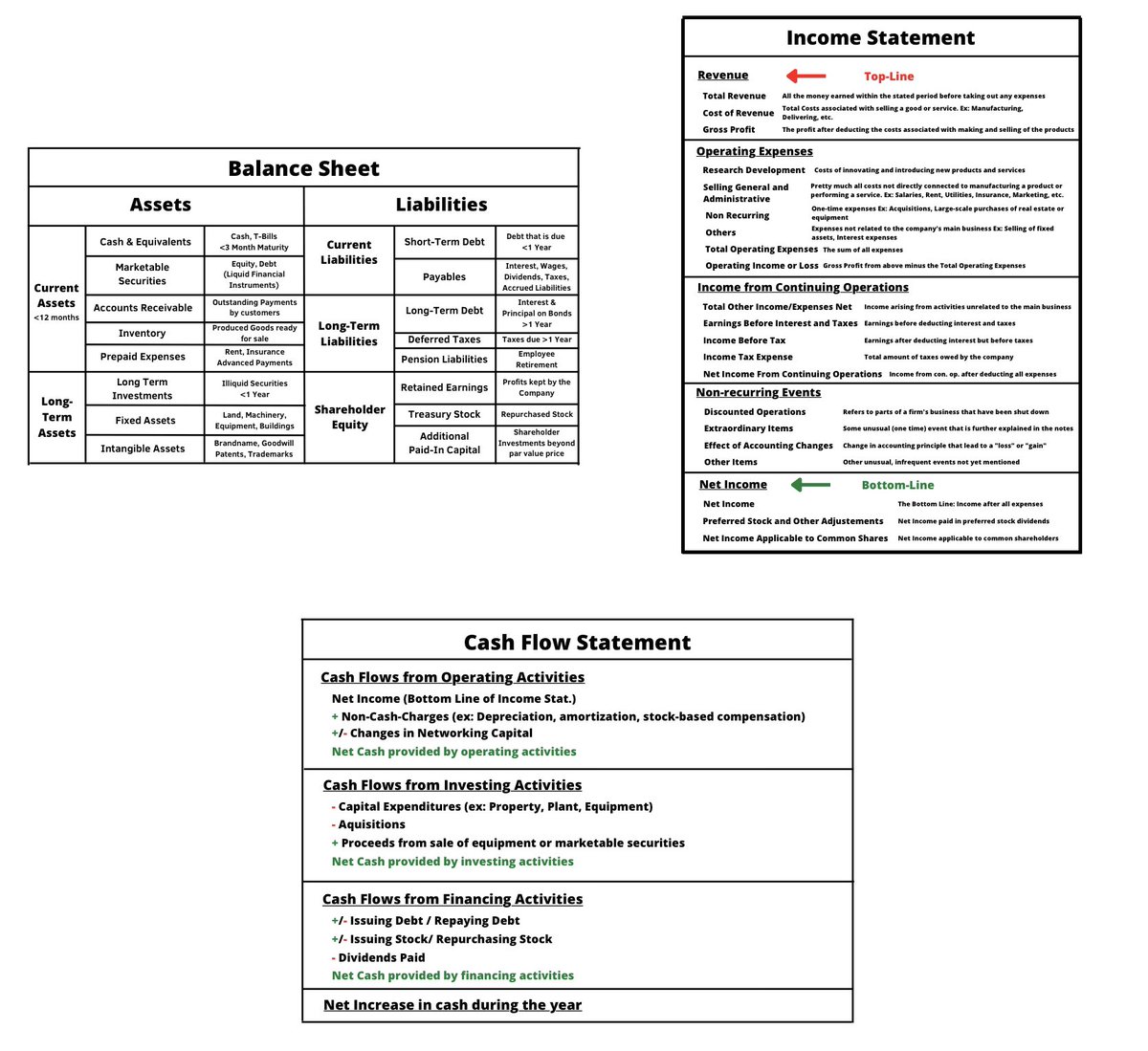

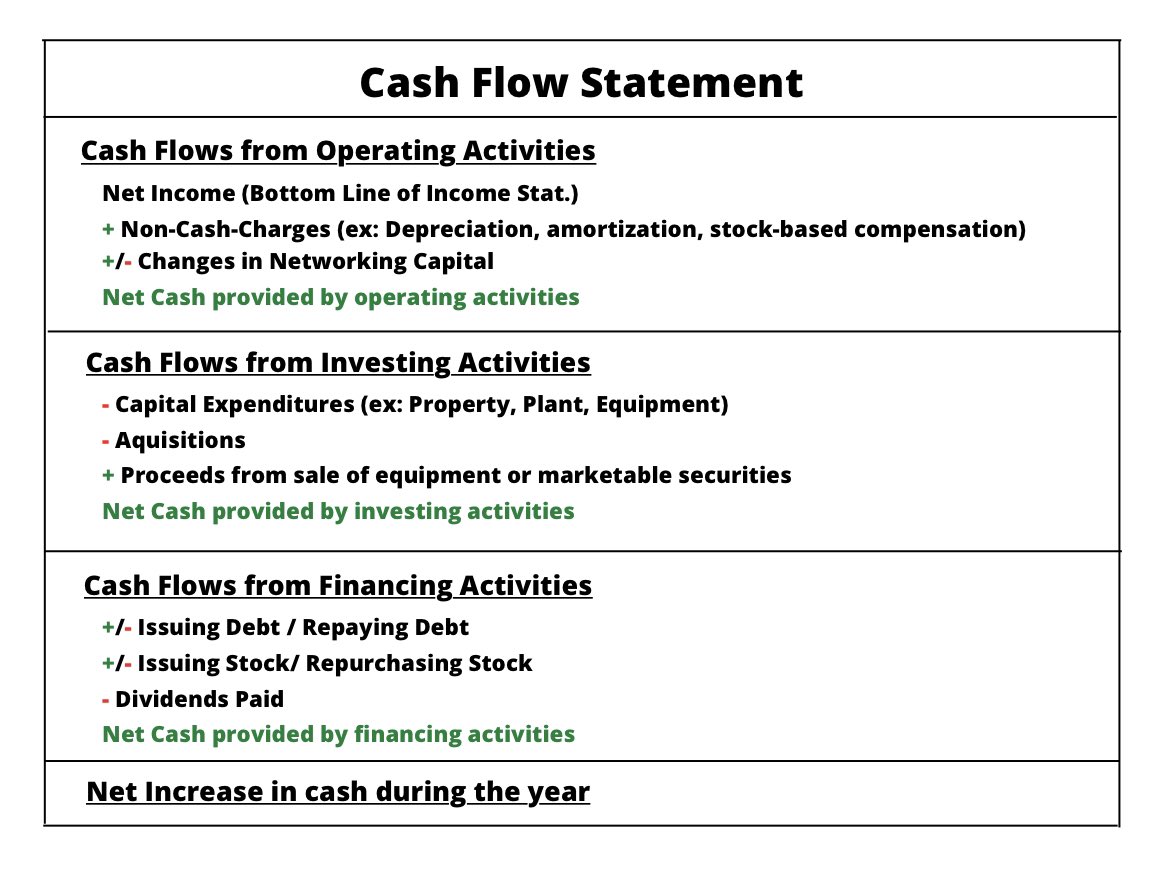

A Cash Flow Statement is divided into three parts:

1) CF from Operating Activities

2) CF from Investing Activities

3) CF from Financing Activities

1) CF from Operating Activities

2) CF from Investing Activities

3) CF from Financing Activities

1. CF from Operating Activities

a) We start with the net income from the income statement.

b) We then add back all non-cash charges.

Those are expenses for which no cash is actually paid at that moment.

c) After adding/subtracting NWC, we get net cash from op. Act.

a) We start with the net income from the income statement.

b) We then add back all non-cash charges.

Those are expenses for which no cash is actually paid at that moment.

c) After adding/subtracting NWC, we get net cash from op. Act.

2. CF from Investing Activities

This section shows the cash spent or generated by investments made.

a) Capital expenditures and acquisitions always represent expenses.

b) If the company sold equipment, securities, or other parts of the business, we add the generated cash here.

This section shows the cash spent or generated by investments made.

a) Capital expenditures and acquisitions always represent expenses.

b) If the company sold equipment, securities, or other parts of the business, we add the generated cash here.

3. CF from Financing Activities

This section shows the cash flows used to fund the company.

a) CFs are positive when the company issued debt, negative when repaying debt

b) Same goes for stock issuing or repurchasing

c) If the company pays a dividend that gets subtracted

This section shows the cash flows used to fund the company.

a) CFs are positive when the company issued debt, negative when repaying debt

b) Same goes for stock issuing or repurchasing

c) If the company pays a dividend that gets subtracted

We end up with the net increase/decrease in cash.

The results of the cash flow statements of companies are often volatile.

It‘s important to look for the reason for that volatility.

Let‘s take a look at an example.

The results of the cash flow statements of companies are often volatile.

It‘s important to look for the reason for that volatility.

Let‘s take a look at an example.

Those are the CF Statements of Apple.

Apple is one of the most profitable companies in the world.

Yet, CFs have been negative for the last three years.

Is Apple, in fact, an unprofitable business?

Apple is one of the most profitable companies in the world.

Yet, CFs have been negative for the last three years.

Is Apple, in fact, an unprofitable business?

As you can see, operating CFs are positive and growing, so the business model works.

Investing CFs are very volatile. The reason seems to be the Short Term Investments.

Let‘s see why.

Investing CFs are very volatile. The reason seems to be the Short Term Investments.

Let‘s see why.

The main differences between 2019 and 2020 were purchases of marketable securities.

So this is not directly related to the business model.

But generally, the negative CFs stem from the huge stock repurchase program of Apple.

Without them, Apple is highly CF positive.

So this is not directly related to the business model.

But generally, the negative CFs stem from the huge stock repurchase program of Apple.

Without them, Apple is highly CF positive.

That’s a wrap!

If you enjoyed this thread, please follow me @MnkeDaniel and retweet the Thread below:

If you enjoyed this thread, please follow me @MnkeDaniel and retweet the Thread below:

https://twitter.com/mnkedaniel/status/1595396912915562497?s=61&t=3YQoyi8wxD1SMkBcZGvMMQ

Ohh, and in case you want to read more in-depth articles on Investing and markets, you should follow my free Substack.

danielmnke.substack.com

danielmnke.substack.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh