A Quality of earnings for searchers can save you thousands💵➡️ Here’s a breakdown of the QofE process for self-funded and traditional searchers #ETA 🧵

The QofE has become productized in the middle market and beyond.

Step down to main street and LMM and you’ll find that most firms aren’t the right fit and have no interest in working with search funds or others that aren’t serial buyers or don’t have significant capital

Step down to main street and LMM and you’ll find that most firms aren’t the right fit and have no interest in working with search funds or others that aren’t serial buyers or don’t have significant capital

Result 🟰 self-funded and traditional searchers are underserved with a small selection of reliable QofE providers. Even better ➡️ scopes, deliverables, and price vary wildly!

1st off, do you need one? I'm biased, but hell yeah you do! You worked for the big boss for years and chose ETA as your big ticket to change your life. Whether raising search capital or self-funding, you’ve entered a new world.

You may not have experience in the industries you’re looking in, much less experience with unsophisticated finance & acct.

A QofE provider has experience from 100s of SMB deals. Cayne Crossing has done diligence on 1000+ deals, and we’ve seen just about every trick in the book

A QofE provider has experience from 100s of SMB deals. Cayne Crossing has done diligence on 1000+ deals, and we’ve seen just about every trick in the book

Searchers don’t need a GAAP expert, but you need a partner with an in depth understanding of how financial statements work. The most impactful QofE adjustments are often balance sheet related!

The puzzle usually works, you just have to figure out how to put it together

The puzzle usually works, you just have to figure out how to put it together

Scoping➡️ Maximizing value while being budget conscious. The QofE in the SMB world shouldn’t be productized. Goals must align.

Rather than differentiate between “QofE light” and “QofE”, we generally find the deliverable is driven mostly by searcher type⬇️

Rather than differentiate between “QofE light” and “QofE”, we generally find the deliverable is driven mostly by searcher type⬇️

Self-funded searchers➡️ You’re going the SBA route and have some non-institutional investors. QofE probably isnt “required”, but most SBA lenders prefer it.

Limit scope to digestible format focused on identifying key risk. Excel databook is sufficient. Ask for example reports!

Limit scope to digestible format focused on identifying key risk. Excel databook is sufficient. Ask for example reports!

At minimum, focus on:

1⃣ Proof of cash - validates cash inflows and outflows by tying out bank statements to financials.

Quick fraud check, but also an excellent activity to validate net operating cashflow

1⃣ Proof of cash - validates cash inflows and outflows by tying out bank statements to financials.

Quick fraud check, but also an excellent activity to validate net operating cashflow

2⃣ P&L and BS analysis - The CIM shows $10m of revenue and $1.5m SDE.

These are likely driving your valuation, so moving the needle at a 2-6x multiple can be meaningful!

Make sure to get monthly financials for this exercise to better understand accounting process

These are likely driving your valuation, so moving the needle at a 2-6x multiple can be meaningful!

Make sure to get monthly financials for this exercise to better understand accounting process

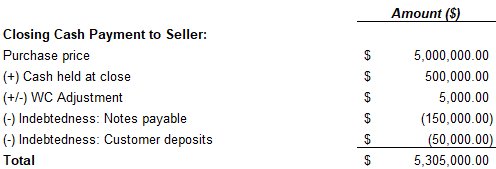

3⃣ Net working capital - Whether you’re using a traditional NWC peg approach, buying it separate, or the seller is retaining, the business needs a sufficient amount of NWC to operate. Figuring this out can make or break the deal.

4⃣ Reconcile payroll to payroll reports.

4⃣ Reconcile payroll to payroll reports.

How about traditional searchers? ⬇️

You have more sophisticated investors, maybe big-name search investors, and may be beyond the size of SBA lending. You’re told you need to get a QofE.

You have more sophisticated investors, maybe big-name search investors, and may be beyond the size of SBA lending. You’re told you need to get a QofE.

Output is generally a formalized report that is easily digestible and shareable for investors/lenders. Analysis still built in Excel, but this lives behind the report.

The scope grows beyond the SF scope to include more in-depth analysis, diligence on customer/vendor trends, etc

The scope grows beyond the SF scope to include more in-depth analysis, diligence on customer/vendor trends, etc

Phasing➡️Whether SF or traditional, phasing is key! You should be in the know asap on any potential issue or key item, and the work can be paused at any time. A fixed fee shouldn’t imply all or nothing.

Get preliminary points via oral or email points.

Get preliminary points via oral or email points.

Timing➡️ 3-4 week process that kicks off post-LOI. Key is getting the right data from seller. QuickBooks is great because we know we can get access and have a big chunk of data quickly. If not, this is a big variable.

Regardless, get the request list over to the seller asap

Regardless, get the request list over to the seller asap

Cost➡️Expectations are key. The typical self-funded deal is <~$5M, single US entity, couple bank accounts, and often QuickBooks based. Added complexity or inconsistent practices drives added fees.

We want to see CIM and raw financials at min. Our first impression and scoping are based on 1) # of entities/sets of books, 2) # and complexity of mgmt adjustments, 3) size of COA, 4) # of bank accounts, 5) industry focus - inventory, rev rec, etc

SF searchers - Huge price range in the market ($5k-$35k+). Key is what's in scope.

Budget middle of that range at min to avoid surprise. Every biz is different and every scope should be tailored for each deal. Work with the QofE provider to get to the right scope/fee for you

Budget middle of that range at min to avoid surprise. Every biz is different and every scope should be tailored for each deal. Work with the QofE provider to get to the right scope/fee for you

Traditional searchers - The scope and output are more in depth & formalized. Typical trad searcher deal is a step up in size/complexity, plus it generally requires a more robust output.

This brings a premium in pricing. Budget along the higher end of the range above

This brings a premium in pricing. Budget along the higher end of the range above

@Derek_CayneQofE and I are always happy to shoot around ideas pre/post-LOI!

Throw me a follow and a retweet if you enjoyed! Happy searching!

Thanks to @bentigg for the thread idea

Throw me a follow and a retweet if you enjoyed! Happy searching!

Thanks to @bentigg for the thread idea

• • •

Missing some Tweet in this thread? You can try to

force a refresh