1/ No, DCG and Genesis can't "dump" GBTC. That's part of their liquidity crisis, but also net good news for GBTC shareholders and FUD fighting.

Why?

In public markets there are rules! 👇

Why?

In public markets there are rules! 👇

2/ DCG bought nearly $800mm worth of GBTC shares since the premium flipped to a discount in early 2021.

DCG's board authorized up to $1.2bn of share purchases across Grayscale Trusts.

In light of the current liquidity issues, the remainder is likely on hold indefinitely.

DCG's board authorized up to $1.2bn of share purchases across Grayscale Trusts.

In light of the current liquidity issues, the remainder is likely on hold indefinitely.

3/ This is especially true since DCG/Genesis took possession of *35 million shares* or 5% of the GBTC trust as part of 3AC's liquidated collateral in Q2.

DCG and affiliates now own 10% of the trust shares, but these are highly illiquid.

DCG and affiliates now own 10% of the trust shares, but these are highly illiquid.

4/ Why?

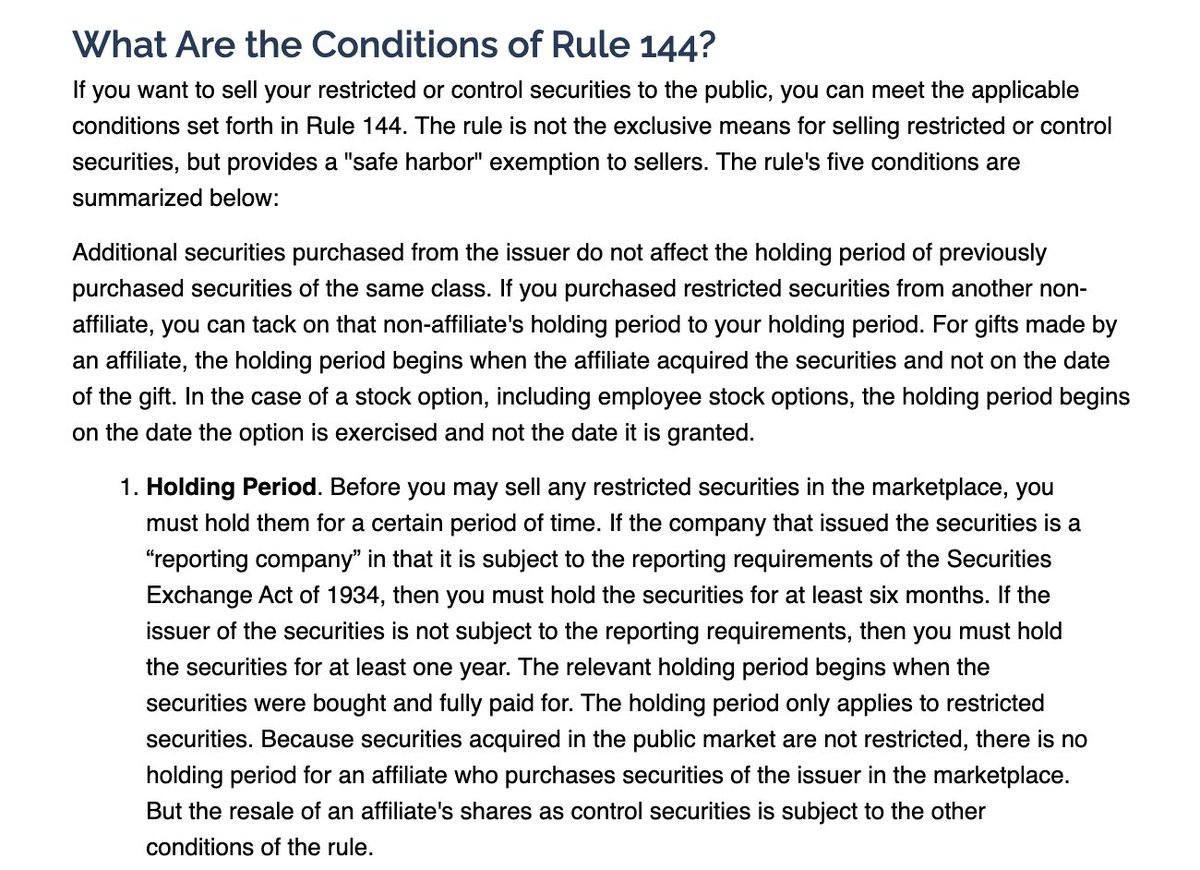

Grayscale is not a true "ETF" it's a publicly listed vehicle under something called Rule 144.

Two major affiliate selling restrictions under 144:

+ Notice of Proposed Sales (would spook the market)

+ Cap on sales of 1% of outstanding shares or weekly trading volume.

Grayscale is not a true "ETF" it's a publicly listed vehicle under something called Rule 144.

Two major affiliate selling restrictions under 144:

+ Notice of Proposed Sales (would spook the market)

+ Cap on sales of 1% of outstanding shares or weekly trading volume.

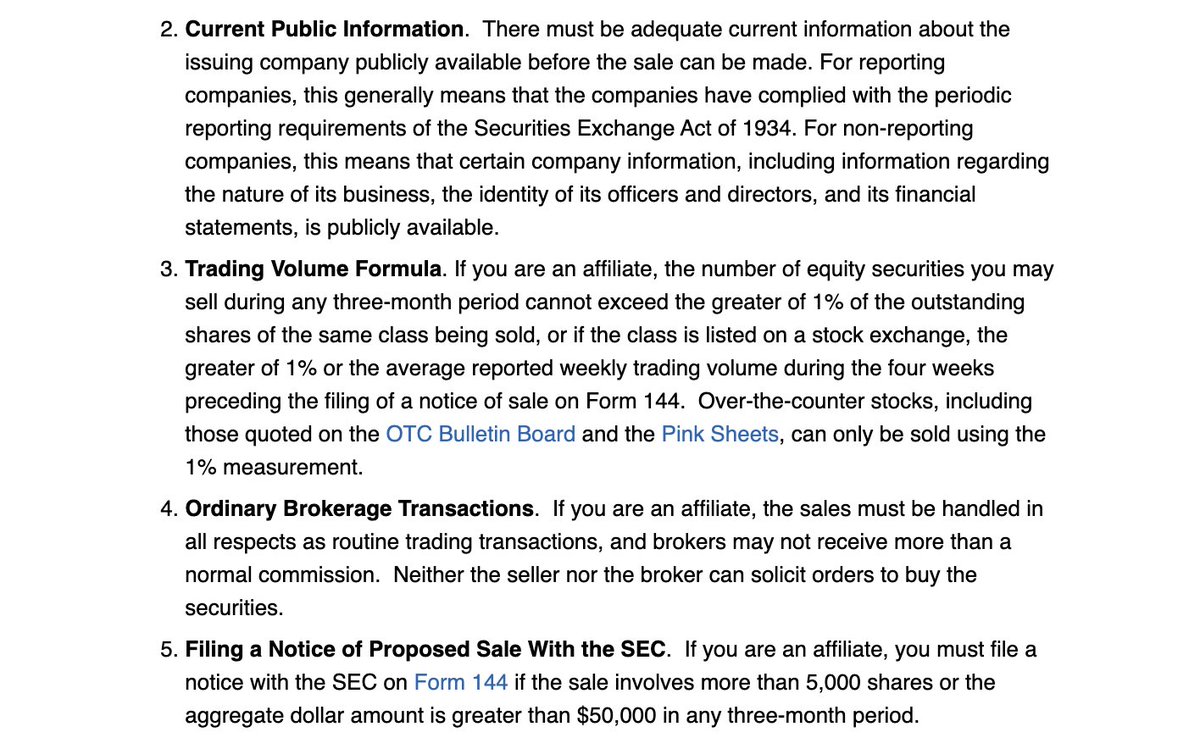

5/ Given GBTC has a daily volume of ~4.5mm shares that works out to quarterly cap on sales of 2.5mm shares ($23mm / quarter) under the trading test and 6.9mm shares ($62mm / quarter) under the asset test.

The 1% rule is the "greater of the two", BUT...

The 1% rule is the "greater of the two", BUT...

6/ Since max allowable sales under the 1% test would be 3% of daily volume dumped on the offer side of the book, forced selling by DCG-Genesis would further depress prices AND telegraph sales to the market.

It's *much* more likely DCG-Genesis refinance using GBTC as collateral.

It's *much* more likely DCG-Genesis refinance using GBTC as collateral.

• • •

Missing some Tweet in this thread? You can try to

force a refresh