As many of you know, I've been following the #VoyagerBankruptcy quite closely and was a former director/CIO (resigned in Feb 2021)

I realize many don't have the full story of what happened in one place - a timeline of events

A thread on @investvoyager & @SBF_FTX 🧵 (1/n)

I realize many don't have the full story of what happened in one place - a timeline of events

A thread on @investvoyager & @SBF_FTX 🧵 (1/n)

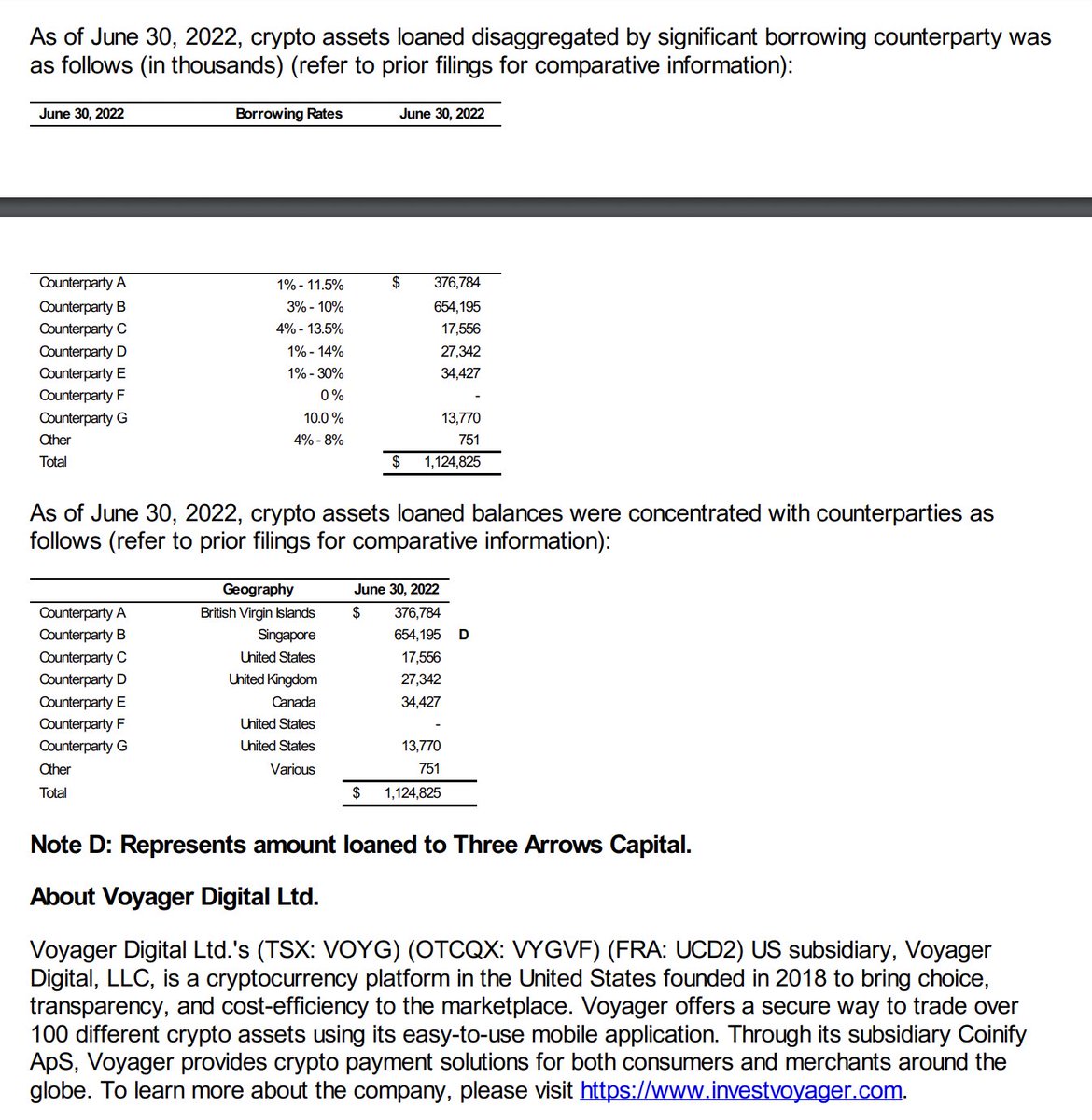

Voyager's lending business has always been rather opaque. Taken from their most recent interim financial statements (Sedar.com), the lenders were hidden forcing the community to speculate on how much risk/exposure there truly was

Voyager grew their lending book from $393M in June 2021 to over $2B in March 2022 - a over 400% increase in less than a year

This is despite the CEO assuring investors that there was "no contagion"

This is despite the CEO assuring investors that there was "no contagion"

In an earnings call in May, Steve Ehrlich (@Ehrls15), CEO of Voyager, was assuring analysts that there was "no contagion" with lenders and that they had "conversations with every single one of them"

Whether or not this is true, @zhusu & @KyleLDavies would go on to ghost Voyager

Whether or not this is true, @zhusu & @KyleLDavies would go on to ghost Voyager

It is also worth mentioning that there are some strange unexplained discrepancies between some of the reported numbers and "fair market value" that were caught by the community

https://twitter.com/ChelleDiVita/status/1593363658087727110

On May 24, 2022, In a press release only distributed to Canada (and specifically not intended to be distributed to US), Voyager adds 3AC to their $60MM private placement

On June 14th Voyager provided an update saying they had a "straightforward, low-risk approach to lending and asset management" with "extensive due diligence"

Also, no participation in "DeFi lending, algorithmic stablecoins, lending or derivatives" & no exposure to Celsius

Also, no participation in "DeFi lending, algorithmic stablecoins, lending or derivatives" & no exposure to Celsius

Worth noting that Kirkland & Ellis claim no conflict of interest between representing Celsius/Voyager

We do not know, however, whether Voyager withdrew assets from Celsius in advance of an impending bankruptcy

cases.stretto.com/public/x191/11…

We do not know, however, whether Voyager withdrew assets from Celsius in advance of an impending bankruptcy

cases.stretto.com/public/x191/11…

June 17, 2022 - "White Knight" @SBF_FTX comes in and offers $200M cash/USDC + 15,000 BTC revolving line of credit to Voyager on what appears to be very favorable terms

As Voyager is a public company, the loan agreement is public on Sedar.com (highly encourage people to look at the source docs - happy to help people parse them too)

The most important, overlooked term in the loan is that FTX becomes the "Preferred Lender"

The most important, overlooked term in the loan is that FTX becomes the "Preferred Lender"

Why is this important? This is my opinion.

The same reason that FTX wanted Voyager creditor assets. FTX needed more assets to strengthen their balance sheet and needed Voyager's assets to cover the hole.

As we now know, FTX is insolvent with liabilities greatly exceeding assets

The same reason that FTX wanted Voyager creditor assets. FTX needed more assets to strengthen their balance sheet and needed Voyager's assets to cover the hole.

As we now know, FTX is insolvent with liabilities greatly exceeding assets

Also June 17, 2022 - Alameda buys more shares of Voyager (pursuant to the prior private placement)

I believe at this point Alameda is now the largest individual shareholder in Voyager

I believe at this point Alameda is now the largest individual shareholder in Voyager

June 22, 2022 - Voyager provides a "market update" with their total exposure to 3AC

A few nights before, myself and some community members were trying to estimate 3AC exposure, but the amount lent blows all expectations out of the water in terms of size

$350M USDC & 15,250 BTC

A few nights before, myself and some community members were trying to estimate 3AC exposure, but the amount lent blows all expectations out of the water in terms of size

$350M USDC & 15,250 BTC

Assuming 3AC is the Singaporean lender, that means in the wake of the @terra_money collapse in May, Voyager had actually increased, rather than decreased, their exposure to 3AC between March 2022 and June 2022

Speculation, but could have been linked to 3AC investment in equity

Speculation, but could have been linked to 3AC investment in equity

June 27, 2022 - Voyager issues notice of default to 3AC

"The platform continues to operate and fulfill customer orders and withdrawals"

Voyager draws $75M of the line of credit (which will later make alameda the largest individual creditor in Voyager)

Voyager engages Moelis

"The platform continues to operate and fulfill customer orders and withdrawals"

Voyager draws $75M of the line of credit (which will later make alameda the largest individual creditor in Voyager)

Voyager engages Moelis

July 1 - Voyager suspends deposits/withdrawals

Voyager engages Moelis, Consello group & Kirkland and Ellis

We also get confirmation that the Singapore lender was 3AC (previously unknown information)

Voyager engages Moelis, Consello group & Kirkland and Ellis

We also get confirmation that the Singapore lender was 3AC (previously unknown information)

Furthermore, we get information that as of June 30, 2022 that over half of Voyager's total loan book was loaned to 3AC

But not to worry! We have Tom Brady from Consello on the case

Screenshot of consello.com taken Nov 29, 2022 in case it changes

Screenshot of consello.com taken Nov 29, 2022 in case it changes

August 17 - Voyager sells @coinify back to coinify management for $2M

This is after previously buying Coinify for $84M just one year prior in Aug 2021

finextra.com/pressarticle/8…

This is after previously buying Coinify for $84M just one year prior in Aug 2021

finextra.com/pressarticle/8…

Sept 26 - after a "highly competitive auction process" FTX was selected to acquire Voyager's assets

$111M of "incremental value" was offered (of which a significant chunk was the $50/account incentive FTX US was offering)

"Best alternative for Voyager stakeholders"

$111M of "incremental value" was offered (of which a significant chunk was the $50/account incentive FTX US was offering)

"Best alternative for Voyager stakeholders"

As part of the process, @VoyagerUCC had conducted an investigation. The result of the investigation were disclosed to creditors

3AC had provided minimal information and provided only a NAV statement

3AC had provided minimal information and provided only a NAV statement

https://twitter.com/shingolavine/status/1582157007343456260

Voyager CEO Steve Ehrlich claimed to have a net worth of $2.7M despite over $30M of stock being sold by SJE Consulting

https://twitter.com/shingolavine/status/1582861848545591297

Today, after months of waiting and a near miss with FTX, Voyager creditors sit in a worse spot than before with a restarted bankruptcy process and an unclear path forward

https://twitter.com/shingolavine/status/1591147153388605441

Voyager is now a part of 2022 crypto history!

https://twitter.com/shingolavine/status/1590155009941209088

Sources for this thread:

* Stretto

* Sedar.com

* Sedi.ca

* Bloomberg.com

* Consello.com

* My own pain and suffering

* Stretto

* Sedar.com

* Sedi.ca

* Bloomberg.com

* Consello.com

* My own pain and suffering

• • •

Missing some Tweet in this thread? You can try to

force a refresh