HUSTLER FUND FOOD FOR THOUGHT:

If all 50bn went to the 14-day loan at 8% p.a, the Fund would need to achieve a 99.7% repayment rate on each 14-day cycle to stay afloat.

If it only achieves 75% repayment rate, 90% of its money would be lost within 4 months.

Let’s dive in 🧵

1/

If all 50bn went to the 14-day loan at 8% p.a, the Fund would need to achieve a 99.7% repayment rate on each 14-day cycle to stay afloat.

If it only achieves 75% repayment rate, 90% of its money would be lost within 4 months.

Let’s dive in 🧵

1/

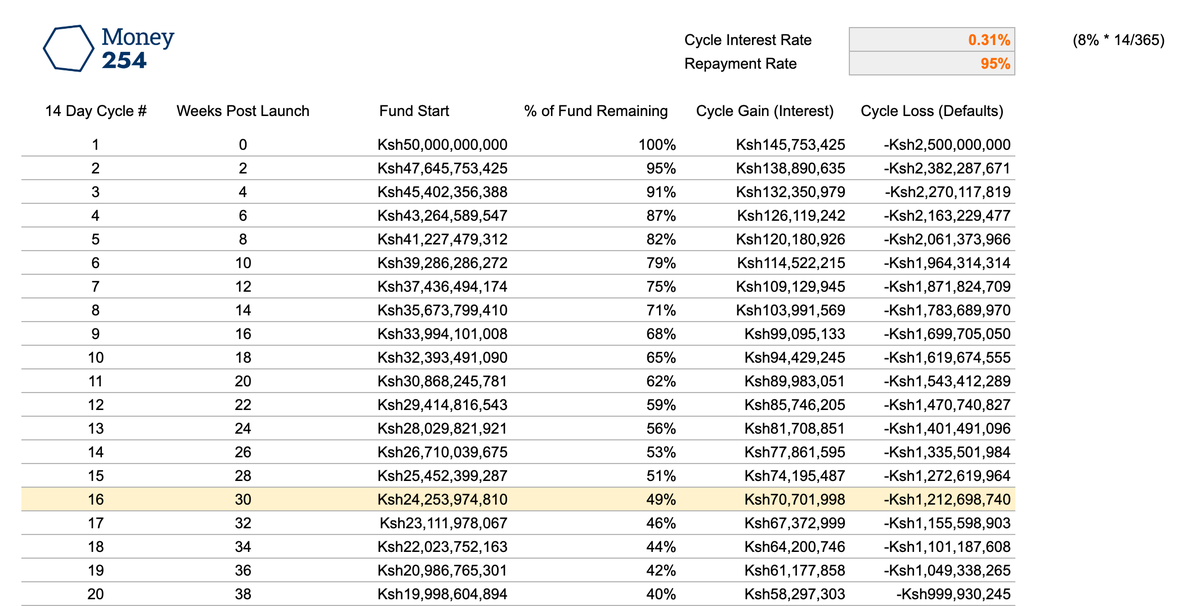

We’ve heard that the Hustler Fund plans a direct to consumer product that will be offered at 8% per annum at 14 days.

That means a 0.31% effective interest rate on each 14 day loan - the 14 day’s share of the 8% yearly interest rate.

#Money254

#HustlerFund

2/

That means a 0.31% effective interest rate on each 14 day loan - the 14 day’s share of the 8% yearly interest rate.

#Money254

#HustlerFund

2/

On this assumption, the fund will gain only 0.31% for each 14 day-loan repaid. The fund will loose all the money that is not repaid to it, or defaults.

If people default on more than 0.31% of the loans, the fund will loose money on each loan cycle.

#Money254

#HustlerFund

3/

If people default on more than 0.31% of the loans, the fund will loose money on each loan cycle.

#Money254

#HustlerFund

3/

Unsecured short term digital loans are not new - tech-only industry leaders generally achieve between 70% and 90% repayments on short-term digital loan products in Kenya.

#Money254

#HustlerFund

4/

#Money254

#HustlerFund

4/

With GoK transparently saying there will be no CRB listings for defaults, it can be expected that repayments may be significantly lower.

The GoK has tried unsecured short term lending before, with less than 50% of people repaying loans from the Women and Youth Fund.

5/

The GoK has tried unsecured short term lending before, with less than 50% of people repaying loans from the Women and Youth Fund.

5/

If GoK manages a conservatively optimistic 75% repayment rate on the Hustler Fund loans, the fund will have lost 90% of their money in 16 weeks.

99% of the money is gone by week 30.

#Money254

#HustlerFund

6/

99% of the money is gone by week 30.

#Money254

#HustlerFund

6/

If GoK pulls a miracle and manages 95% repayment rates, beating most of the highest venture capital backed digital lending startups in Kenya, 25bn is still lost within 30 weeks.

#Money254

#HustlerFund

7/

#Money254

#HustlerFund

7/

What does this mean? Three options:

Option 1 - The fund cannot allocate much money to this direct to consumer product and will lend to intermediaries, where it can guarantee better repayment rates.

#Money254

#HustlerFund

/8

Option 1 - The fund cannot allocate much money to this direct to consumer product and will lend to intermediaries, where it can guarantee better repayment rates.

#Money254

#HustlerFund

/8

Option 2 - The fund has to raise it’s interest rate to recoup losses on each 14-day product (8% per loan vs 8% per annum will be interesting to watch here)

Option 3 - The fund is about to loose a lot of money very quickly.

What do you think?

#Money254

#HustlerFund

/End

Option 3 - The fund is about to loose a lot of money very quickly.

What do you think?

#Money254

#HustlerFund

/End

FOLLOW UP TWEET!

Want to play fund manager and see what terms you’d need to set the Hustler Fund product to, to keep it afloat? Or just check our math on the scenarios?

Link here:>>

docs.google.com/spreadsheets/d…

Want to play fund manager and see what terms you’d need to set the Hustler Fund product to, to keep it afloat? Or just check our math on the scenarios?

Link here:>>

docs.google.com/spreadsheets/d…

Do you think the sustainability/longevity of the Hustler Fund, which on its launch is effectively the personal cheapest personal loan in Kenya, is something to worry about when the prevailing default rates are put in focus?

We complied the thread here>>

money254.co.ke/post/how-long-…

We complied the thread here>>

money254.co.ke/post/how-long-…

• • •

Missing some Tweet in this thread? You can try to

force a refresh