The recent undercover work by @cbcmarketplace to expose mortgage fraud in Canada raised questions around how these bad actors were able to operate so brazenly. Now a new audit of @RECOhelps raises further doubts that self-governance is working. 1/ cbc.ca/news/marketpla…

Some takeaways from the incredibly scathing Auditor General's report:

auditor.on.ca/en/content/ann…

2/

auditor.on.ca/en/content/ann…

2/

Re spot audits:

"RECO has never performed a full

on-site inspection at 27% of registered brokerages, and

has not conducted a full on-site inspection at a further

35% of brokerages in more than five years."

3/

"RECO has never performed a full

on-site inspection at 27% of registered brokerages, and

has not conducted a full on-site inspection at a further

35% of brokerages in more than five years."

3/

Re the adequacy of fines as deterrents:

" we found that 67% of registrants were

fined a lower amount than the commission earned

in the related real estate transaction."

4/

" we found that 67% of registrants were

fined a lower amount than the commission earned

in the related real estate transaction."

4/

SO ANNOYING....lost the last 6 tweets on this thread. Will try to repost

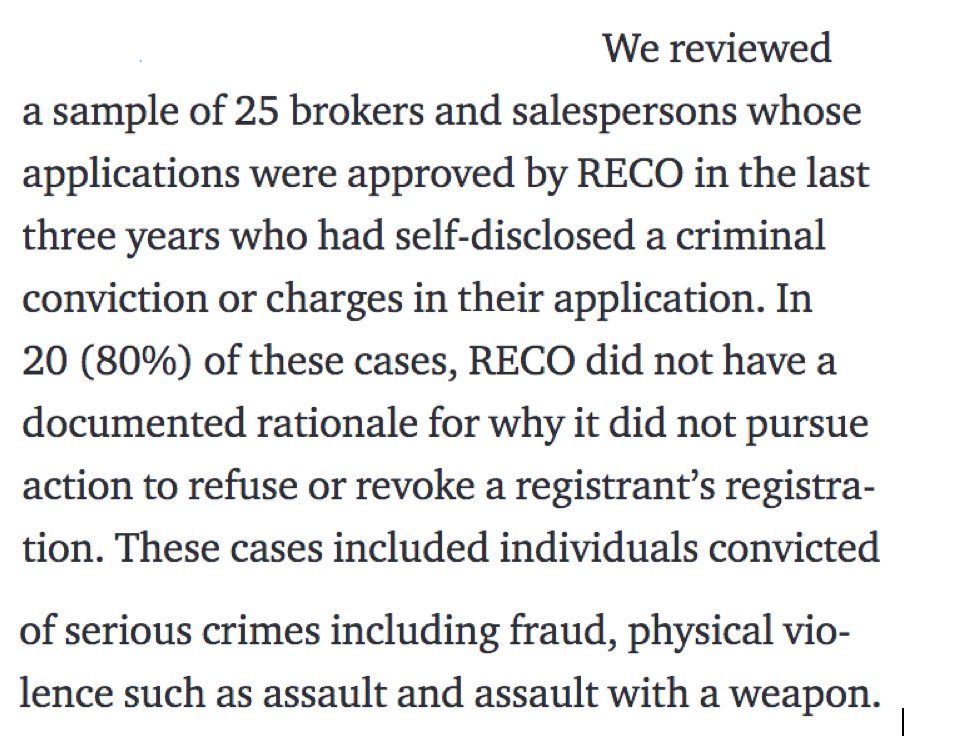

Re screening for criminals:

"RECO does not have a formal policy, guide-

lines or a consistent process to assess whether

to refuse to register applicants who have a

criminal history."

HO...LEE....SHITE!

5/

"RECO does not have a formal policy, guide-

lines or a consistent process to assess whether

to refuse to register applicants who have a

criminal history."

HO...LEE....SHITE!

5/

Re fraud/lack of controls in qualification exams:

"...major breach in the integrity of exams

offered...RECO has not

taken steps to independently verify whether the

issues that led to the breaches have been satisfactorily addressed."

6/

"...major breach in the integrity of exams

offered...RECO has not

taken steps to independently verify whether the

issues that led to the breaches have been satisfactorily addressed."

6/

Re inspection of brokerages

"RECO does not review and monitor whether

inspections of brokerages are carried out

consistently and effectively"

"proportion of inspections that identify instances of non-compliance...as high as 82%"

BUT... "rarely follows up"

7/

"RECO does not review and monitor whether

inspections of brokerages are carried out

consistently and effectively"

"proportion of inspections that identify instances of non-compliance...as high as 82%"

BUT... "rarely follows up"

7/

Re money laundering:

"FINTRAC received zero reports of large cash

transactions between the 2017/18 and 2020/21

fiscal years, and just 18 reports of large cash

transactions in 2021/22, from real estate brokers

and salespersons."

8/

"FINTRAC received zero reports of large cash

transactions between the 2017/18 and 2020/21

fiscal years, and just 18 reports of large cash

transactions in 2021/22, from real estate brokers

and salespersons."

8/

Re conflicts of interest

"Although RECO’s role is to protect consumers,

its Board is composed mainly of real estate

industry representatives. At the time of our

audit, only two of the 12 directors on RECO’s

Board were not registered members of the real

estate industry."

9/

"Although RECO’s role is to protect consumers,

its Board is composed mainly of real estate

industry representatives. At the time of our

audit, only two of the 12 directors on RECO’s

Board were not registered members of the real

estate industry."

9/

End there. Just a crazy report. Governance of the real estate industry is even worse than I thought.

Industry is in serious need of a real regulator.

Industry is in serious need of a real regulator.

• • •

Missing some Tweet in this thread? You can try to

force a refresh