Saw a post on how option buying, ITM, ATM and whether it is theta or delta that hurts or harms an option buyer. But instead of trolling, lets be constructive.. So here are some thoughts .. (contd)

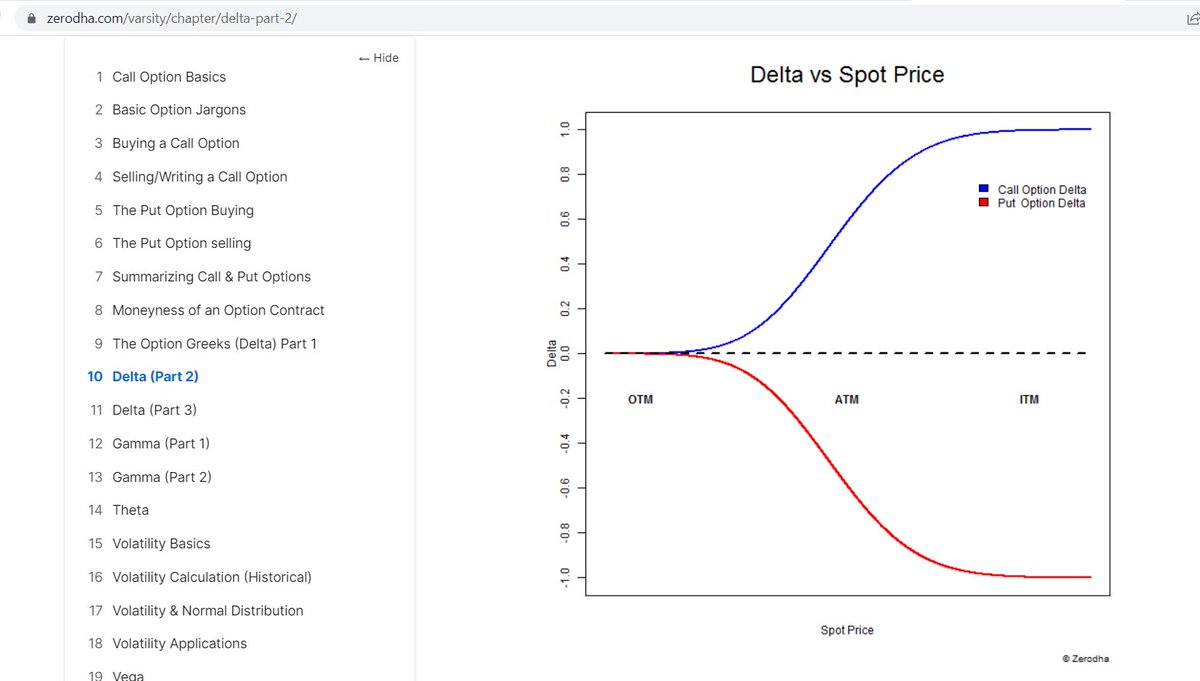

Now on a per lot basis, the Delta of an ITM option or an ATM option will of course be higher than OTM. You can see it in this graph provided by Zerodha Varsity.

But most of us arent restricted to a maximum number of lots. If we want the delta exposure, just buy a few more. As many as you want to give you the delta exposure you need. You want to be close to future (Delta 1) , but two ATMs.

Now there must be a trade off right? It isnt necessarily in terms of outlay. Lets take the below image.Bit distorted because its 1 DTE , but it provides an idea

Now if I want 1 delta overall, (one futures worth), I could buy two ATMs for Rs. 85.1 total, or 11 qty of 18900 CE for just Rs. 55.5 . Yay, far cheaper than even a single 0.95 D at a strike of 18400.... Lets GO!!!!

But the above image is a snapshot in time. Time is inevitable. Time wont pause. Time is the enemy of everyone. Everything changes, and so do your options.

This is where the second order greeks come in. Those headache inducing Vanna, Vomma, Charm, Veta, Vera and everyones favourite Gamma.

Those deltas we talked about, they dont stay constant. They change all the time.. with time. And that change is Charm. The second order greek of the change of Delta with time. And charm is anything but,....its actually kinda kinky....

(h/t saurabh.com/Site/Talks_fil… ... nice plots)

(h/t saurabh.com/Site/Talks_fil… ... nice plots)

One way of thinking about it is, to imagine the extrinsic value of an option as a "time value of the option"

Now we know that over time, that extrinsic portion is going to 0. No matter what option you have, whats left is what you are intrinsically.

Now we know that over time, that extrinsic portion is going to 0. No matter what option you have, whats left is what you are intrinsically.

This extrinsic value follows a curve that looks like a mountain peak. With the ATM being at the top of the mountain.

will continue this after market hours

Note the above plot on extrinsic values is mostly symmetrical. Lets ignore the slight skew in the symmetry (not option skew).

You can also see the extrinsic decrease with time. This is Theta Decay (keeping everything else constant)

You can also see the extrinsic decrease with time. This is Theta Decay (keeping everything else constant)

This tells us that the Theta decay on a long option, equidistant from the futures price should be the same whether the option is ITM or OTM. And its maximum ATM. Which makes sense, an ATM option has the maximum extrinsic value.

So lets buy ITM or OTM options to minimize Theta decay right? Leave those ATMs alone.... Well, Did you see that kinky little charm? If the stock doesnt move, those deltas are going to decay. So to have the same exposure, you are going to have to buy more.....

Ok, then lets go deep deep ITM or deep deep OTM. Charm and Theta are minimized..... Well, now for deep ITM you run into Delta risks for when it moves against you (you are practically just running a futures position), and for Deep OTM, if the stock doesnt move enough ....you get 0

So, should you not buy options at all? No...thats not what i want you to take away from this. What I want you to understand is that there are tradeoffs.... Each of those options purchases is a valid trade. Deep ITM, ATM, OTM.... all of them can work at the right moment.

Just dont go around thinking that there is one solution that fits everything. Understand the nuances of the position you are taking, what can go against you, and how the values will change with time....

There is no biggest enemy. There are only risks. You can transfer the risk from one place to the other. But that needs you to understand them.

• • •

Missing some Tweet in this thread? You can try to

force a refresh