A quality stock with stable margins / growth vs a cyclical stock with volatile cycles have both over time earned same returns but with different paths

Gold and nifty (proxy to growth and cash profits) returns are same since 2000 (nifty was at 23 times)

Nifty has outperformed Gold hugely in last ten years since its lower PE start point

At extremes, timing matters and valuations also

Nifty has outperformed Gold hugely in last ten years since its lower PE start point

At extremes, timing matters and valuations also

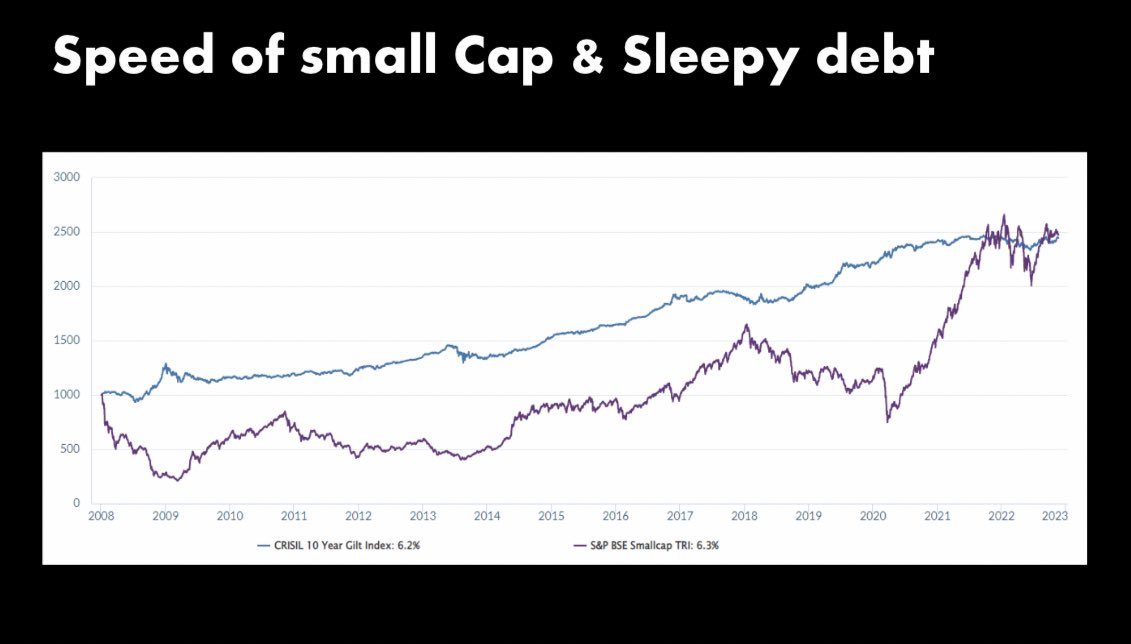

Small cap index went up 15 times since 2003 to 2007 but next 15 years could not even beat sovereign bonds

Opposite of speed (small caps) can be slow and sleepy debt (again at market extremes, timing matters)

Opposite of speed (small caps) can be slow and sleepy debt (again at market extremes, timing matters)

Opposite of active is passive - two years back an active fund did 12% alpha. Today 9% lesser than Index. Mean reversion keeps happening. Opposite of passive - active is good at times and vice versa

Opposite of quality is said to be value & vice versa ! 2 years back a quality style fund did 21% better than value style fund - and the same has reversed today

(I like both the funds - their styles - their managers)

Mean reversion happens

(I like both the funds - their styles - their managers)

Mean reversion happens

Opposite of india growth story is global investing & opposite of global diversification is home country (best country) thinking

2000-2010 : india shined

2010-2020 : USA (innovation) made money

Opposite to each other but yet money can be made by blending the two

Diversify

2000-2010 : india shined

2010-2020 : USA (innovation) made money

Opposite to each other but yet money can be made by blending the two

Diversify

The rich say sips are for poor. Opposite of Lumpsum is SIP. From expensive markets, sip s do better. From cheap markets, Lumpsum does better

Both are good depending on context

Both are good depending on context

Concentration is conviction - diversification is for ignorant.Yet globally diversified indices beat active managers

research says that only 4% cos made more money than debt returns. Hence concentrate in these 4%

Here, skills matter. Concentration can earn more yet can kill too

research says that only 4% cos made more money than debt returns. Hence concentrate in these 4%

Here, skills matter. Concentration can earn more yet can kill too

So what now

Don’t be binary always

Investing has dualities and many dimensions and nuances

Don’t get trapped in zero or one

Respect context - & then decide

Takeaways 👇👇

Don’t be binary always

Investing has dualities and many dimensions and nuances

Don’t get trapped in zero or one

Respect context - & then decide

Takeaways 👇👇

• • •

Missing some Tweet in this thread? You can try to

force a refresh