1/ BREAKING: As reported overnight in @thetimes there is a new consultation out later today

google.com/url?rct=j&sa=t…

A short 🧵 in some of the detail

TLDR: Some helpful bits, but too litttle, too late with NOTHING for AA/LTA

google.com/url?rct=j&sa=t…

A short 🧵 in some of the detail

TLDR: Some helpful bits, but too litttle, too late with NOTHING for AA/LTA

2/ The consultation is expected to be published later this morning

Heres a snapshot of what it covers (and what it doesnt)

Heres a snapshot of what it covers (and what it doesnt)

3/ The main areas cover 3 main areas

- Some pension flexibilities around retirement only

- Some changes (not enough) to deal with inflation

- minor access changes to PCNs

- Some pension flexibilities around retirement only

- Some changes (not enough) to deal with inflation

- minor access changes to PCNs

4/ (1)

Changes to pensionable retirement - i.e. retiring from 1995 pension and being re-employed in 2015 and still earning 2015 benefits (a big deal - weve been asking for this for years)

Changes to pensionable retirement - i.e. retiring from 1995 pension and being re-employed in 2015 and still earning 2015 benefits (a big deal - weve been asking for this for years)

5/ Previously if you worked beyond 60 you would burn 95 pension as there are no #lateretirementfactors

Now you can conintue to build 2015 pension whilst drawing some of all of your 1995 benefits (but reducing pensionable pay >10%)

Now you can conintue to build 2015 pension whilst drawing some of all of your 1995 benefits (but reducing pensionable pay >10%)

6/ This option doesnt of course take pension taxation away, but it does mean for example a member could partially retire if they reached (the now falling in real terms) LTA and continue saving 2015 pension (still subject to AA and LTA; but at least they crystalised some benefits)

7/ Partial retirement will allow drawing 100% of the benefits in 1995 - important so AA issues will only arise from the other scheme not the interaction of schemes.

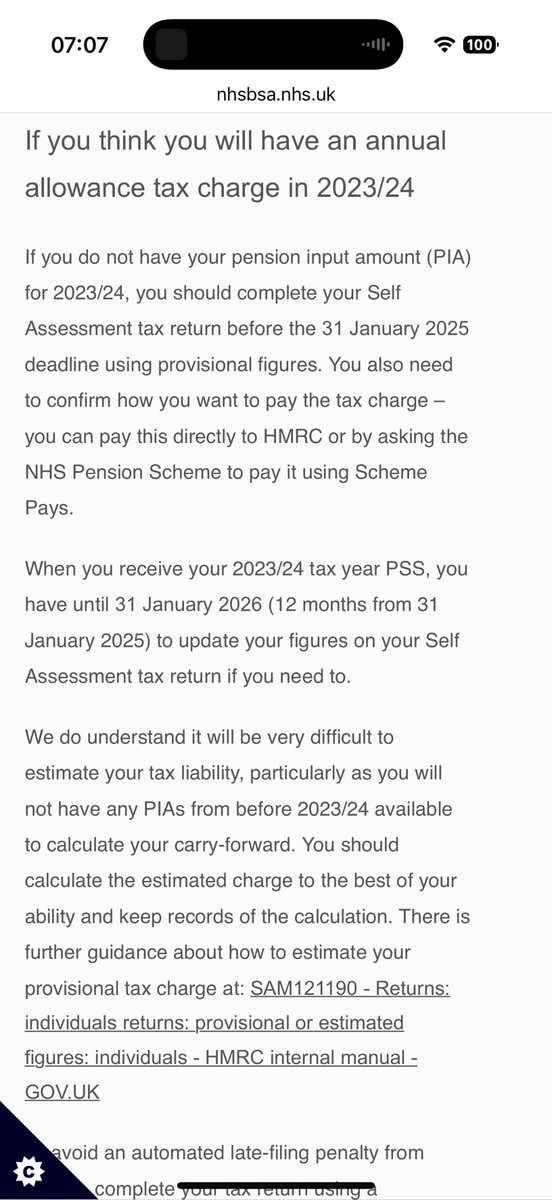

9/ (2) Next the bits about inflation - or rather fixing the bits they have already announced ignoring #NegativePIAs

As previusly announced this will be done by moving revaluation dates in 2015 / 1995 GP scheme to 6th April

As previusly announced this will be done by moving revaluation dates in 2015 / 1995 GP scheme to 6th April

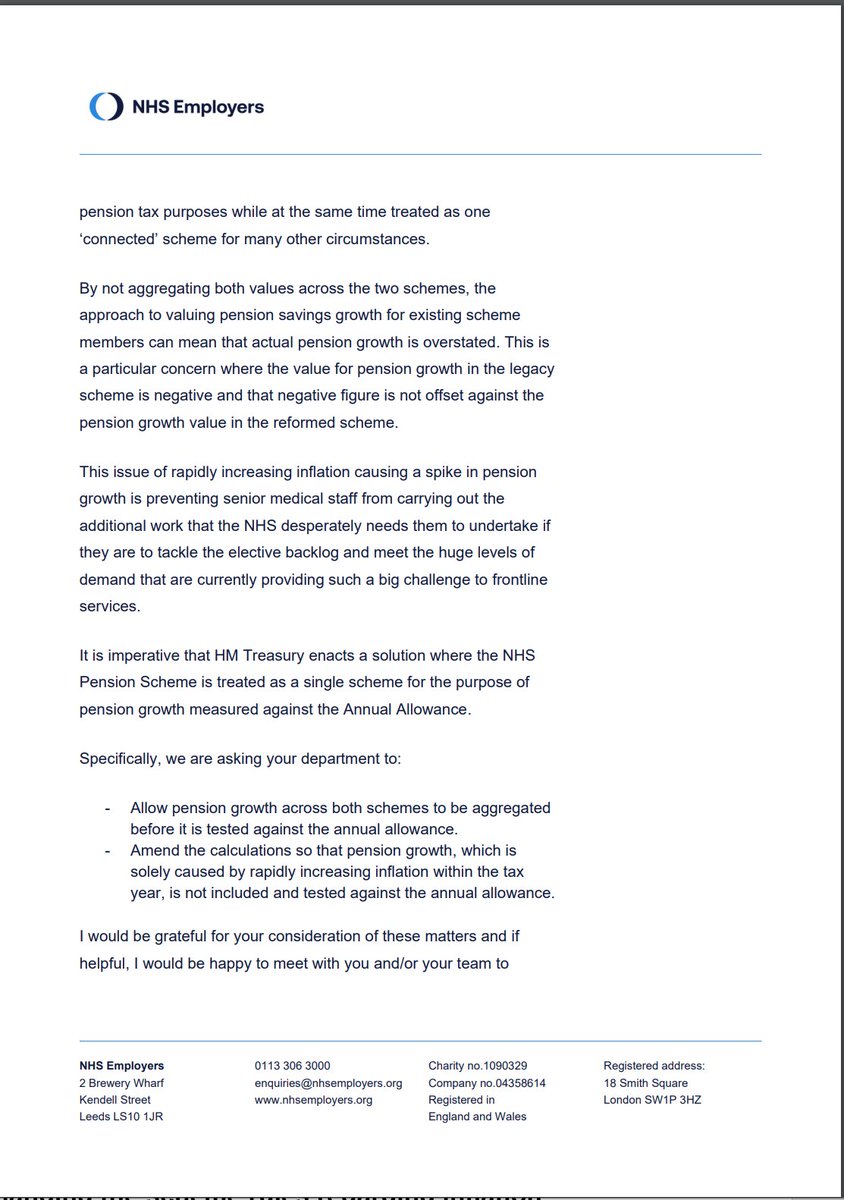

10/ This does help align revluation to the opening value for #CPIdisconnect, but IGNORES the massive problems with #fixnegativePIAs

Very dissapointing they didnt fix this - @thebma, @NHSEmployers & @AISMANewsline all asked @hmtreasury for this

Very dissapointing they didnt fix this - @thebma, @NHSEmployers & @AISMANewsline all asked @hmtreasury for this

11/ The failure to address this will leave members MASSIVLEY overpaying AA charges for non-existent growth in 2023/4 and 2024/5 - we will continue to lobby HM Treasury for this

12/ There will also be some small changes to scheme access to allow PCNs staff to acces the NHS pension scheme

13/ All in all there are some positives here - partial retirement & a fix of *some* of the problems relating to inflation #CPIdisconnect but IGNORING issues of inflation related negative PIAs (a *massive deal*).

14/ But crucially whilst this does help those who are peri-retirement, it does *nothing* for mid career doctors punished by unfair punitive AA and LTA taxes. They will continue to reduce activity / retire early to avoid these charges. Still need #taxunregistered #FixTheFinanceAct

15/ 15/ Read the @bma_pensions comment in the Times - "the proposed changes appear to be too little, too late...doctors will continue to receive sky high & completely unexpected tax bills by continuing to provide care for patients, care they desperately need"

18/ According to @willquince "senior staff will no longer feel forced to retire early, ultimately benefiting patients by ensuring their expertise remains in the NHS for longer so we can continue to deliver world-class healthcare."

19/ I disagree - unless & until @DHSCgovuk @hmtreasury recognise the driver of this is the general annual allowance & rapidly reducing lifetime allowance, I am afraid higher earning NHS staff will continue to reduce activity & retire earlier than they might have #TaxUnregistered

• • •

Missing some Tweet in this thread? You can try to

force a refresh