$IBCX aims to represent the fundamental values of the Cosmos ecosystem.

Optimizing the portfolio allocation and dynamically maintaining the weight balances are crucial to achieving that goal.

We propose an execution plan for getting the Cosmos index token.

🧵 Threads 🧵

Optimizing the portfolio allocation and dynamically maintaining the weight balances are crucial to achieving that goal.

We propose an execution plan for getting the Cosmos index token.

🧵 Threads 🧵

2/9

To pick the first batch of tokens that'll form the beginning of $IBCX, we propose relying on market capitalization/liquidity (a tried-and-true valuation method) and IBC connectivity (one of Cosmos's prized characteristics).

Details are in our Medium post.

To pick the first batch of tokens that'll form the beginning of $IBCX, we propose relying on market capitalization/liquidity (a tried-and-true valuation method) and IBC connectivity (one of Cosmos's prized characteristics).

Details are in our Medium post.

3/9

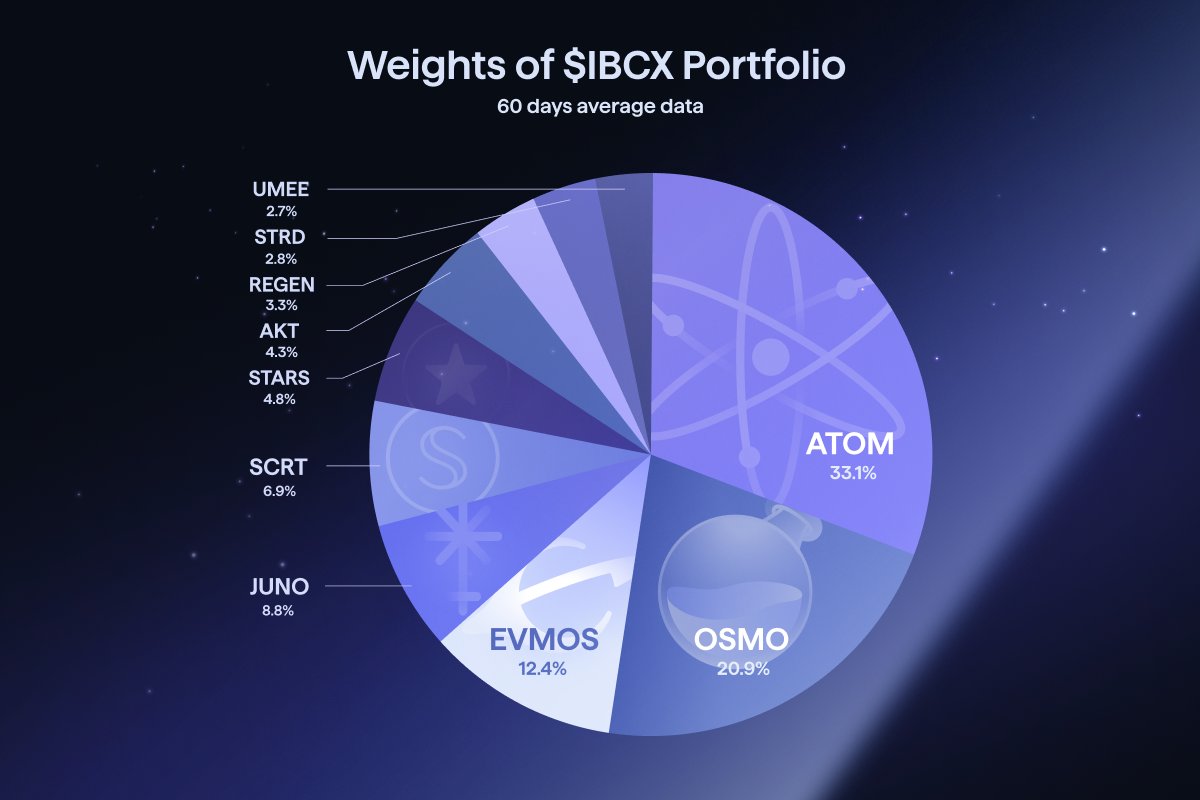

After selecting the tokens to be included in the $IBCX basket, we need to figure out how many of each of these tokens a unit of $IBCX will hold.

We propose to use the formulas below to calculate the initial portfolio weight %s:

After selecting the tokens to be included in the $IBCX basket, we need to figure out how many of each of these tokens a unit of $IBCX will hold.

We propose to use the formulas below to calculate the initial portfolio weight %s:

4/9

We calculate each token's market share % combined market capitalization and DEX liquidity.

To achieve the most accurate representation, we plan to use trailing performance. Also, to minimize the excessive influence of a single large token, the square root is applied.

We calculate each token's market share % combined market capitalization and DEX liquidity.

To achieve the most accurate representation, we plan to use trailing performance. Also, to minimize the excessive influence of a single large token, the square root is applied.

5/9

We'd like to emphasize that these weights represent share %s of the dollar value of tokens.

To maintain the fungibility of $IBCX, we'll fix the token quantities as a constant and let the variable, or the prices, drive the implied weight %s

We'd like to emphasize that these weights represent share %s of the dollar value of tokens.

To maintain the fungibility of $IBCX, we'll fix the token quantities as a constant and let the variable, or the prices, drive the implied weight %s

6/9

#𝗥𝗲𝗯𝗮𝗹𝗮𝗻𝗰𝗶𝗻𝗴

The initial composition proposed above should and will change accordingly, and we'll call this process portfolio rebalancing.

ION DAO will be responsible for this process after $IBCX launches.

#𝗥𝗲𝗯𝗮𝗹𝗮𝗻𝗰𝗶𝗻𝗴

The initial composition proposed above should and will change accordingly, and we'll call this process portfolio rebalancing.

ION DAO will be responsible for this process after $IBCX launches.

7/9

#𝗚𝗼𝘃𝗲𝗿𝗻𝗮𝗻𝗰𝗲

ION DAO proposals on $IBCX rebalancing will change the quantities, whether adding, reducing, or removing.

After passing the proposal, the rebalancing logic will perform swaps of the portfolio tokens on Osmosis to match the newly decided weight %s.

#𝗚𝗼𝘃𝗲𝗿𝗻𝗮𝗻𝗰𝗲

ION DAO proposals on $IBCX rebalancing will change the quantities, whether adding, reducing, or removing.

After passing the proposal, the rebalancing logic will perform swaps of the portfolio tokens on Osmosis to match the newly decided weight %s.

8/9

$ION #value_accrual

A $IBCX smart contract will incur this fee on every block and allocate 30% for the operation costs and the rest (70%) to the ION Treasury.

$ION #value_accrual

A $IBCX smart contract will incur this fee on every block and allocate 30% for the operation costs and the rest (70%) to the ION Treasury.

9/9

𝗖𝗼𝗻𝗰𝗹𝘂𝘀𝗶𝗼𝗻

While coming up with the methodology explained in this article, we considered neutrality and safety as core values of $IBCX. As always, we welcome all feedback from the community to improve our ideas.

Details:

👇👇👇

medium.com/@IBCindex/ibcx…

𝗖𝗼𝗻𝗰𝗹𝘂𝘀𝗶𝗼𝗻

While coming up with the methodology explained in this article, we considered neutrality and safety as core values of $IBCX. As always, we welcome all feedback from the community to improve our ideas.

Details:

👇👇👇

medium.com/@IBCindex/ibcx…

• • •

Missing some Tweet in this thread? You can try to

force a refresh