What is happening now with private REITs is more important to markets than the FTX blow up. More impactful and just as interesting, although without the Tom Brady storyline. Let's unpack it.

1/

1/

Private REITs, or non-traded REITs are plain old boring REITs that are unburdened by pesky transparency and price discovery.

2/

2/

The price discovery issue is the key feature - or the key bug depending on how you look at things. NAV is set by periodic appraisal, which means lower volatility and smoother returns. But of course, that’s a mirage.

3/

3/

And since the appraisal schedule is typically annual, when there is an economic turn, the appraisal based NAVs are going to be slow to catch up to the new environment.

4/

https://twitter.com/philbak1/status/1595183831908519937?s=20&t=t0vIzQgAwpMyfUpfmoEYYA

4/

Blackstone launched BREIT, a private fund of nontraded REITs, in 2017. It has dominated fund flows.

5/

5/

Per the amazing @Chvolk "During 2021 the private REIT reportedly raised about 70% of all the equity capital raised by private REIT companies. Since its 2017 inception, the company has raised a staggering $59.9 billion, repurchasing approximately $7.3 billion of this amount..."

6/

6/

"... through its stockholder liquidity program. As of June 30, the NAV was reported to be $68.3 billion... if BREIT were a public company, its reported value would have the company ranked fifth amongst all equity REITs in terms of equity market capitalization."

7/

7/

Sidebar, but here is where we get into the Crowding Effect. We see this all the time when a strategy is working and everyone piles in. We saw this a couple years ago when Blackrock tried to steer all of their Aladdin models into “low vol” strategies...

8/

8/

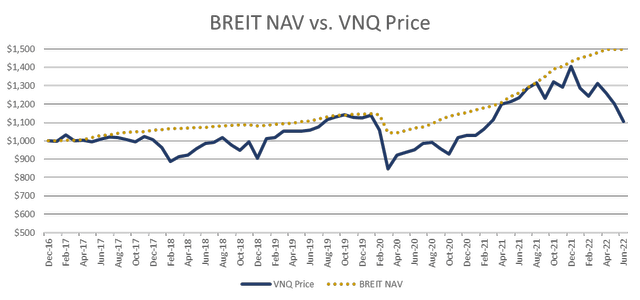

Ok, so performance is great with lower vol than public REITs, everyone crowds in, and suddenly the divergence between public and private REITs hits laughably unsustainable levels

12/

12/

And as long as the NAVs were being marked up no one seemed to care about the fees.

Shall we talk about the fees? Hope you are sitting down.

13/

Shall we talk about the fees? Hope you are sitting down.

13/

Selling fee: 9.06% spread out over 7 years

Management fee: 1.25% annually (and based on possibly inflated NAVs)

Performance fee: 12.5% of the net after 5% hurdle.

Ouch.

14/

Management fee: 1.25% annually (and based on possibly inflated NAVs)

Performance fee: 12.5% of the net after 5% hurdle.

Ouch.

14/

Based on historical annual performance levels, that comes out to a whopping 3.62% per year

15/

15/

Why is this fund so material to $BX ? Well, 3.62% of 68 Billion dollars is 2.46 Billion dollars in fees. Every year.

16/

16/

Our HAUS ETF charges 60 bp for managed access to residential REITs. If you don't mind malls and office building stinking up your fund you can buy VNQ for 12 bp, all-in.

17/

17/

Can Blackstone outperform VNQ by >350 bp every year, compounding indefinitely? Maybe. Possibly. That’s a pretty high bar. Maybe it works in a ZIRP environment?

18/

18/

But for that higher fee you probably think you are getting value. LOL, silly goose. Noooo, the multiples in private REITs are much, much higher. And the public REITs have been beaten down by the market while the privates are still clinging to old appraisal data.

19/

19/

Ok, let's talk liquidity.

Lets say investors get nervous and want to sell. Well, BREIT holds a bunch of MBS that are liquid, they can sell those. But what if there are more redemption requests? No problem, they can use the inflows to offset.

20/

Lets say investors get nervous and want to sell. Well, BREIT holds a bunch of MBS that are liquid, they can sell those. But what if there are more redemption requests? No problem, they can use the inflows to offset.

20/

And what if the inflows dry up? Then they can sell properties, no problem.

21/

commercialobserver.com/2022/12/blacks…

21/

commercialobserver.com/2022/12/blacks…

But what if, let's just say, what if the real estate market freezes up, inflows dry up, and redemption requests heat up. All at once.

22/

22/

What happens then is Blackstone gates the fund, investors are trapped, and $BX goes to work trying to sell properties.

And as you sit around waiting for your redemption request to fill, the line gets longer and longer.

23/

And as you sit around waiting for your redemption request to fill, the line gets longer and longer.

23/

And the fees are still being charged at the current appraisal-based NAVs.

But will Blackstone be able to sell properties at those appraised prices?

LOL

24/

But will Blackstone be able to sell properties at those appraised prices?

LOL

24/

There’s more here. Blackstone giving themselves preferential liquidity, dividends paid as dilutive shares, non gaap accounting, leverage... We have a lot of questions, and there is more to come.

And it's not just $BREIT. It's also $SREIT. And $BCRED. And more to come.

25/

And it's not just $BREIT. It's also $SREIT. And $BCRED. And more to come.

25/

26/

Let's pick this back up, shall we?

First, icymi, we took a look at who is vulnerable to this fund and why. It's actually very sad that it's primarily low risk investors. Retirees, widows & orphans, that kind of thing. You can read about that here: philbak.substack.com/p/blame-it-on-…

Let's pick this back up, shall we?

First, icymi, we took a look at who is vulnerable to this fund and why. It's actually very sad that it's primarily low risk investors. Retirees, widows & orphans, that kind of thing. You can read about that here: philbak.substack.com/p/blame-it-on-…

27/ Ok, with that out of the way we are going to get a little wonky now.

We know BREIT was expensive, especially as compared to public REITs. But how expensive?

We know BREIT was expensive, especially as compared to public REITs. But how expensive?

28/

All data through Q3 2022. All of this research will be sent in more detail from Armada ETFs to our clients.

We'll start with implied cap rate.

All data through Q3 2022. All of this research will be sent in more detail from Armada ETFs to our clients.

We'll start with implied cap rate.

Our proprietary NOI analysis shows BREIT implied cap at 3.8%

We created a public REIT equivalent portfolio, the details of which we'll share in our paper to our clients, which shows an implied cap of 5.5%

Drastic difference, but there's more.

We created a public REIT equivalent portfolio, the details of which we'll share in our paper to our clients, which shows an implied cap of 5.5%

Drastic difference, but there's more.

What truly matters is cash flow, so we analyzed AFFO.

Annualizing Q3 2022, BREIT had a 46.7x AFFO. Our public market equivalent was just 22x. This is a massive difference, obviously.

But, wait for it...

Annualizing Q3 2022, BREIT had a 46.7x AFFO. Our public market equivalent was just 22x. This is a massive difference, obviously.

But, wait for it...

The BREIT AFFO includes management fees and performance fees to Blackstone added back in.

Um, what?

So let's be prudent here, let's take those back out. Just for shits and giggles, just to see where we are at.

Um, what?

So let's be prudent here, let's take those back out. Just for shits and giggles, just to see where we are at.

Our adjusted AFFO for BREIT grows to ~400x

34/

(sorry, was so horrified by these results forgot the thread numbers. we are at 34 and barely scratching the surface)

When we look at Blackstone's 9% NAV increase through Q3 2022 it is explained by 13% NOI growth, 4.4% dist yield and 6% from interest rate hedges

(sorry, was so horrified by these results forgot the thread numbers. we are at 34 and barely scratching the surface)

When we look at Blackstone's 9% NAV increase through Q3 2022 it is explained by 13% NOI growth, 4.4% dist yield and 6% from interest rate hedges

35/

On the public equivalent side, NAVs (per sell-side analysts) have dropped ~8.3% YTD, and the public REITs are trading at a 9% discount to revised NAVs

On the public equivalent side, NAVs (per sell-side analysts) have dropped ~8.3% YTD, and the public REITs are trading at a 9% discount to revised NAVs

36/

This is a complete and total divergence of these two types of REITs that defies any reasonable explanation.

But what is the mechanism under which they'll converge? Without liquidity the market can stay irrational longer than blah blah solvent...

This is a complete and total divergence of these two types of REITs that defies any reasonable explanation.

But what is the mechanism under which they'll converge? Without liquidity the market can stay irrational longer than blah blah solvent...

37/

The answer is that redemptions are the mechanism that forces a convergence. Redemptions will force BX to sell properties for real money in the real world, just as the public REITs are selling for real prices in the real world.

The answer is that redemptions are the mechanism that forces a convergence. Redemptions will force BX to sell properties for real money in the real world, just as the public REITs are selling for real prices in the real world.

38/

Excellent point made by @JohnGuineeREIT on our Think Tank conversation today. If you are in BREIT and have been defaulted into the dividend reinvestment plan, your dividends are being reinvested at current (questionable) NAVs. Better to opt out and take the divs as cash.

Excellent point made by @JohnGuineeREIT on our Think Tank conversation today. If you are in BREIT and have been defaulted into the dividend reinvestment plan, your dividends are being reinvested at current (questionable) NAVs. Better to opt out and take the divs as cash.

• • •

Missing some Tweet in this thread? You can try to

force a refresh