Welltower Inc. $WELL is a healthcare REIT with a $32 billion market cap that is the largest owner of senior housing facilities in the U.S., with investments in 1,568 properties.

(2/x)

(2/x)

Until last month, $WELL's largest tenant was a health system in the Midwest called ProMedica, which accounted for 12% of the company's 2021 NOI.

ProMedica faced severe distress and began breaching bond covenants in early 2022, threatening Welltower’s investment.

ProMedica faced severe distress and began breaching bond covenants in early 2022, threatening Welltower’s investment.

Given its size as $WELL's largest operator, Welltower has stressed the importance of ProMedica’s financial health as a key risk factor.

On Nov. 7th, 2022, $WELL announced a solution: it would transfer the operation of 147 skilled nursing facilities out of ProMedica and into a new joint venture with a health care operator called Integra Health.

The deal helped fuel a 9% rise in Welltower’s stock.

The deal helped fuel a 9% rise in Welltower’s stock.

$WELL's CEO said that Integra provided a “well-capitalized strategic partner” that would result in Welltower being paid 4% more in cash rent under the new JV, coming out ahead despite the distressed situation.

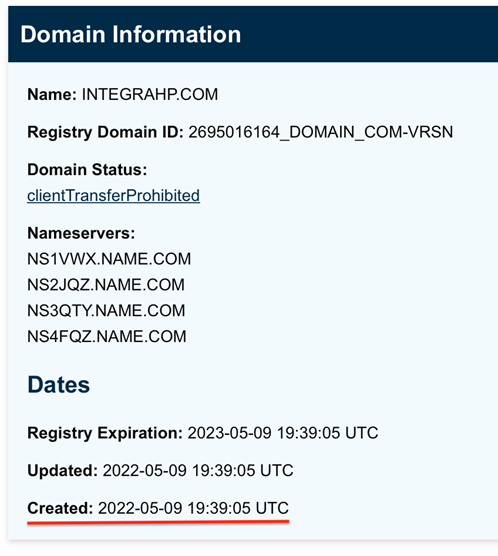

Despite the high praise from $WELL management and claims of being a well-experienced operator, Integra seems to barely exist.

The entity was registered 6 months ago, with its corporate website registered the same day.

The entity was registered 6 months ago, with its corporate website registered the same day.

Integra’s CEO, 29 y/o David Gefner, has no apparent background in the skilled nursing space. A former $WELL exec to told us he'd never heard of Gefner.

Integra has 0 employees on LinkedIn except for Gefner, who claims to have worked at the 6 month old entity for 11 months.

Integra has 0 employees on LinkedIn except for Gefner, who claims to have worked at the 6 month old entity for 11 months.

“As far as we know, there is none”: A senior ProMedica employee told us Integra had no operating experience and came in after $WELL couldn’t find genuine operators.

They are set to take over a master lease for 147 nursing facilities.

They are set to take over a master lease for 147 nursing facilities.

Evidence indicates that another of $WELL's distressed deals, a 2021 restructuring with troubled Genesis Healthcare, mirrored the latest ‘miracle’ deal.

$WELL appears to have quietly disposed of 21 of its most deeply distressed Genesis assets to a Gefner-affiliated firm, once again handing skilled nursing facilities over to an inexperienced operator and clearing its books of the mess.

Gefner previously worked at the investment firm that owned Genesis, according to contact database records.

Gefner’s PE firm, Perigrove, at one point shared an office address w/an affiliate of the owner of Genesis.

Gefner’s PE firm, Perigrove, at one point shared an office address w/an affiliate of the owner of Genesis.

The undisclosed relationship raises questions of overt conflicts of interest in the Gefner/Welltower/Genesis dealings. $WELL

Gefner also claims to be CEO of “prolific” PE firm "Perigrove", which claimed to have raised $3B.

We found no Form ADVs or Ds for Gefner or Perigrove.

We found no association w/ a broker/dealer, indicating Perigrove may have lied about its raises or raised capital illegally.

We found no Form ADVs or Ds for Gefner or Perigrove.

We found no association w/ a broker/dealer, indicating Perigrove may have lied about its raises or raised capital illegally.

Perigrove claimed on its website to have run 12 past real estate projects.

Real estate records show all were actually led by other developers.

Real estate records show all were actually led by other developers.

Perigrove had a documented role in only 1 project we could find through its website; an attempted launch of a $30 million crypto token to raise funds for a property once dubbed by Crain's Business as the "city's worst illegal hotel".

The token offering looks to have failed.

The token offering looks to have failed.

Perigrove’s website claims it operates out of a prestigious office building in Manhattan.

We visited and found the company has no presence at its claimed address.

We visited and found the company has no presence at its claimed address.

Instead, we found Perigrove’s office on the outskirts of New York City, in a strip mall sharing an address with an auto parts store.

On the front door of the building, Perigrove's name was spelled wrong, as "Perigove", with stickers.

On the front door of the building, Perigrove's name was spelled wrong, as "Perigove", with stickers.

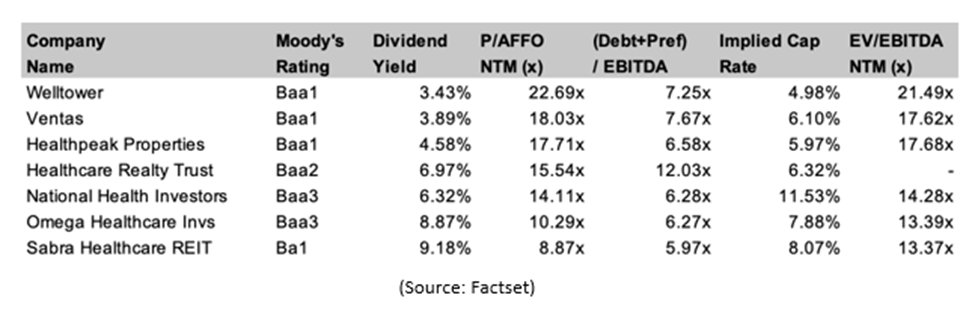

$WELL trades at a premium to competitors, with its price/estimated NTM AFFO at 22.69x, 22% higher than the average multiple of comparably-rated Ventas and Healthpeak.

It has the lowest dividend yield of its peers, indicating that the market views it as a safe asset.

It has the lowest dividend yield of its peers, indicating that the market views it as a safe asset.

This comes despite an industry in turmoil: a 2022 report said 50% of long term / post-acute home health facilities had defaulted in the last 12 mos.

The report surveyed 100 healthcare CFOs & found 25% who had not yet defaulted were concerned they would default on loans in '22.

The report surveyed 100 healthcare CFOs & found 25% who had not yet defaulted were concerned they would default on loans in '22.

$WELL also faces significantly larger maturities moving past 2023, with 2024 and 2025 debt totaling over $3.7 billion in a rising interest rate environment.

The company has been aggressively diluting, raising ~$4.5 billion in equity through ATM offerings in the past 2 years.

The company has been aggressively diluting, raising ~$4.5 billion in equity through ATM offerings in the past 2 years.

Overall, we think Welltower is an overpriced-to-perfection REIT obfuscating its distressed assets, raising questions about both its portfolio and the credibility of management as it attempts to raise capital from investors.

$WELL hindenburgresearch.com/welltower/

$WELL hindenburgresearch.com/welltower/

• • •

Missing some Tweet in this thread? You can try to

force a refresh