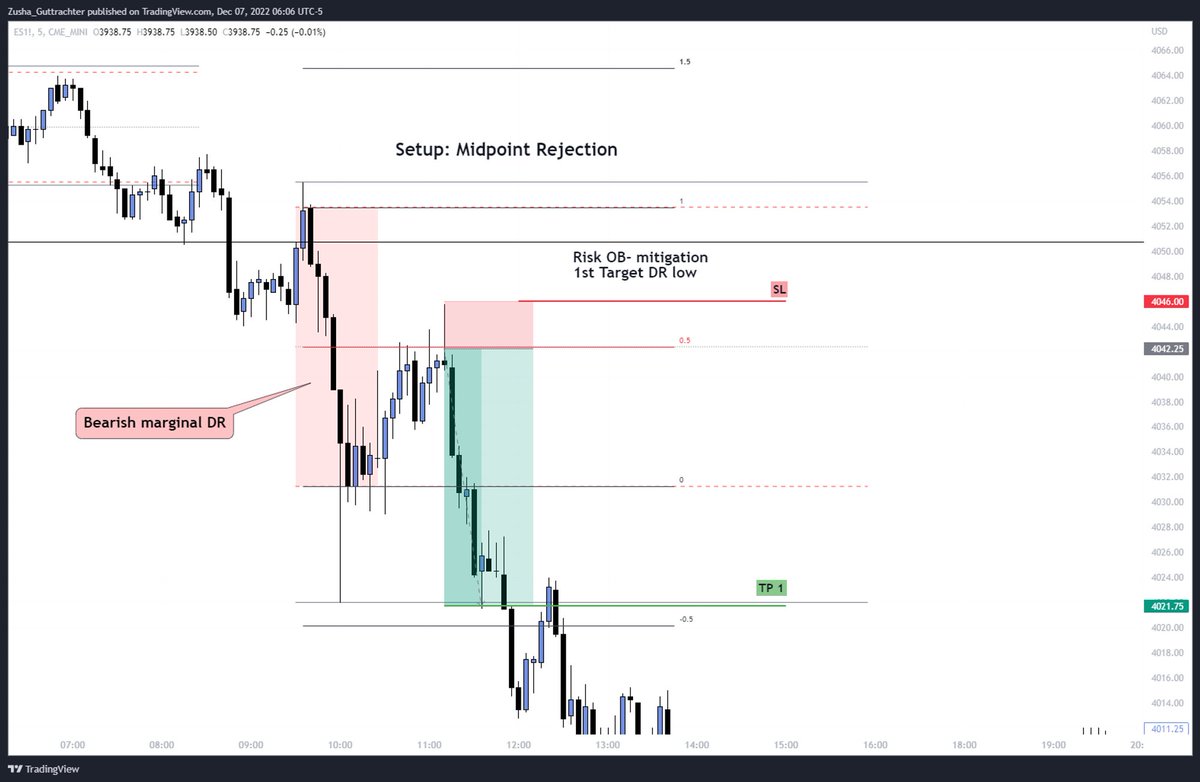

3 basic types of @IamMas7er #IDR setups.

Use with CONFLUANCE:

- Bias & Narrative

- Market Structure

- ICT PD arrays

Use with CONFLUANCE:

- Bias & Narrative

- Market Structure

- ICT PD arrays

These 3 types have deferent thought process. Basically when one failed the other one could manifest itself.

Note that the External rejection could be from the DR or IDR, and the Internal rejection could be from the 0.5 or deeply from 0.79.

Note that the External rejection could be from the DR or IDR, and the Internal rejection could be from the 0.5 or deeply from 0.79.

That is why you need CONFLUANCE.

PLEASE do not get me wrong -

We do not trade patterns or schemes, we trade algo logic.

We analyze liquidity, We asses time, We calculate risk and only then seize the opportunity.

PLEASE do not get me wrong -

We do not trade patterns or schemes, we trade algo logic.

We analyze liquidity, We asses time, We calculate risk and only then seize the opportunity.

PLEASE backtest.

See how the algo reacts to DR/IDR/STD levels. Which model is more probable and when.

This IDR is very new to most of us and I'm sure that many jems are to come.

See how the algo reacts to DR/IDR/STD levels. Which model is more probable and when.

This IDR is very new to most of us and I'm sure that many jems are to come.

Lastly... I wrote the previous thread for my trading plan and then decided to share to help other fellows get it faster.

I'm amazed by all the responses I received,

It demonstrate how eager the IDR community-family is to learn and develop.

I'm sure that we will RISE TOGETHER

I'm amazed by all the responses I received,

It demonstrate how eager the IDR community-family is to learn and develop.

I'm sure that we will RISE TOGETHER

And until we will come together, I would love for you to retweet the thread so that the contents will help as many brothers and sisters as possible.

Peace!

Peace!

*Internal

A basic misspell :)

A basic misspell :)

• • •

Missing some Tweet in this thread? You can try to

force a refresh