Joel Greenblatt compounded at 49% (!) from 1985 to 2005.

And the best thing, he taught a Columbia Class on how to do it.

Here are 7 Investing Gems from his Columbia Classnotes👇🏼

And the best thing, he taught a Columbia Class on how to do it.

Here are 7 Investing Gems from his Columbia Classnotes👇🏼

1. Don‘t do Portfolio Management

If you think like a portfolio manager, you cannot simultaneously behave like an owner.

But portfolio managers research stocks. Owners research businesses.

And that’s what we try to do. Research and buy businesses.

If you think like a portfolio manager, you cannot simultaneously behave like an owner.

But portfolio managers research stocks. Owners research businesses.

And that’s what we try to do. Research and buy businesses.

2. Management vs. Incentives

For 90% of investors, getting a genuine and honest picture of the management is impossible.

Instead, look at the incentive structure for the management.

Are they incentivized to add value to the company?

If so, they will. If not, they won’t…

For 90% of investors, getting a genuine and honest picture of the management is impossible.

Instead, look at the incentive structure for the management.

Are they incentivized to add value to the company?

If so, they will. If not, they won’t…

3. All about Valuation

In the end, it’s all about valuation.

Do good valuation work, and you’ll make good investments.

There’s lots of noise in finance and investing.

But that’s not what causes superior returns.

Find the context/story others cannot see, and you’ll do good.

In the end, it’s all about valuation.

Do good valuation work, and you’ll make good investments.

There’s lots of noise in finance and investing.

But that’s not what causes superior returns.

Find the context/story others cannot see, and you’ll do good.

4. Leverage & Patience

If you own a concentrated portfolio, leverage is far more dangerous.

It’ll wipe you out in downturns that ALWAYS occur sooner or later.

Have patience and trust in your decisions, and there’s no need for leverage.

If you own a concentrated portfolio, leverage is far more dangerous.

It’ll wipe you out in downturns that ALWAYS occur sooner or later.

Have patience and trust in your decisions, and there’s no need for leverage.

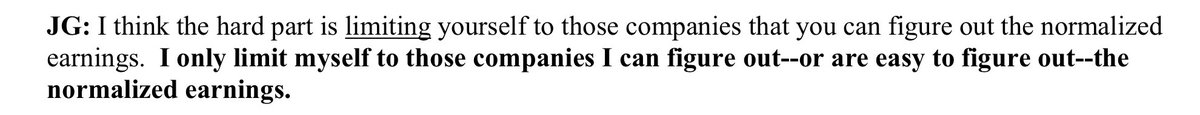

5. What’s your limit?

Most investors fail to see their boundaries.

There are so many names and “opportunities” thrown at you that it’s tempting to fall for them.

But what companies do you actually understand?

For most of us, that will be a very limited amount.

Most investors fail to see their boundaries.

There are so many names and “opportunities” thrown at you that it’s tempting to fall for them.

But what companies do you actually understand?

For most of us, that will be a very limited amount.

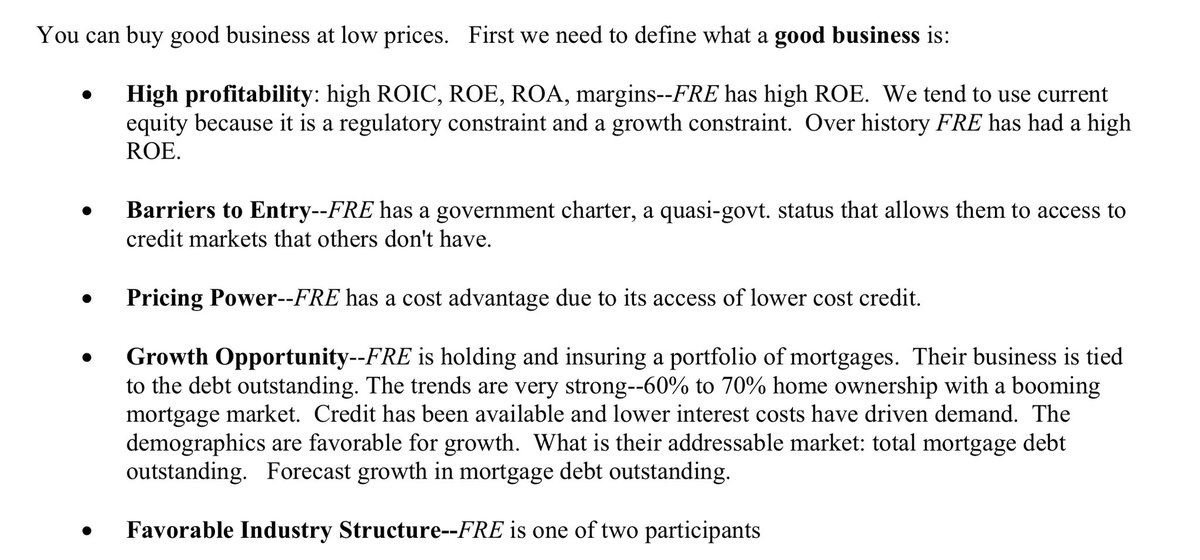

6. What’s a good Business

It’s always: “Buy a good business at a fair price.”

But what is a good business?

This is Greenblatt’s criteria:

It’s always: “Buy a good business at a fair price.”

But what is a good business?

This is Greenblatt’s criteria:

You can get the PDF of all Class Notes on my Substack Research Page (link below).

Before you go there, please Like and Retweet this Thread.

Thanks a lot.

Ohh and for more daily Tweets on Investing, follow me @MnkeDaniel 😁

Class Notes PDF:

danielmnke.substack.com/p/resources

Before you go there, please Like and Retweet this Thread.

Thanks a lot.

Ohh and for more daily Tweets on Investing, follow me @MnkeDaniel 😁

Class Notes PDF:

danielmnke.substack.com/p/resources

• • •

Missing some Tweet in this thread? You can try to

force a refresh