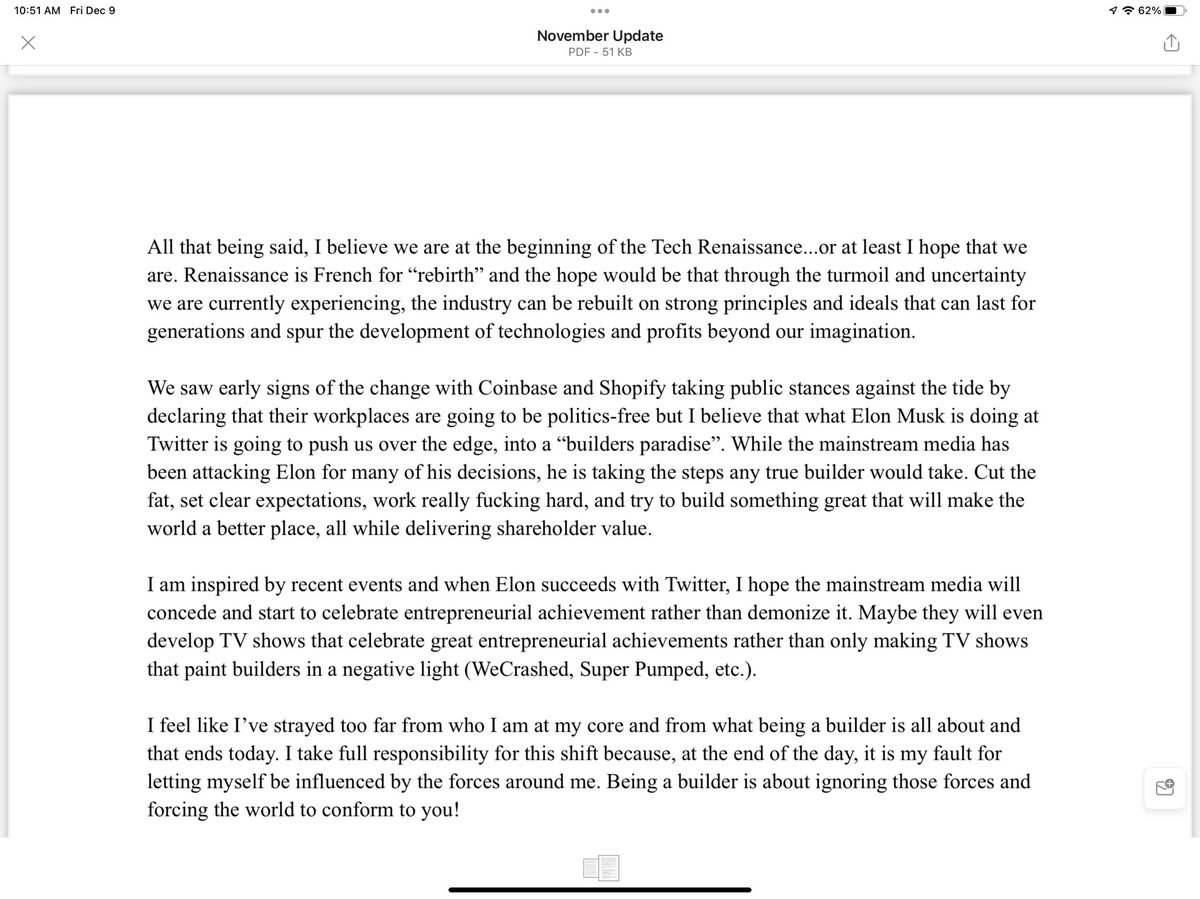

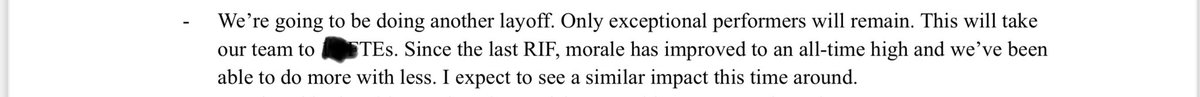

1) The fact that Twitter is running well with headcount down significantly really matters.

Whether they admit or not, everyone in SV admires Elon.

A lot of venture funded CEOs are sending emails like this; inspired by Elon and taking drastic action.

Margins are going up.

Whether they admit or not, everyone in SV admires Elon.

A lot of venture funded CEOs are sending emails like this; inspired by Elon and taking drastic action.

Margins are going up.

2) “Things are supposed to be hard.”

This mentality will impact most tech companies.

We will start to hear “lighter is faster” and references to small teams being superior to large teams.

A gift from God to VCs with rosters full of “Summer” CEOs because “Winter” is here.

This mentality will impact most tech companies.

We will start to hear “lighter is faster” and references to small teams being superior to large teams.

A gift from God to VCs with rosters full of “Summer” CEOs because “Winter” is here.

3) Strong CEOs cut early which increases the co’s odds of success. Burn is an area under the curve problem.

This is more compassionate as the laid off employees enter a stronger job market while also being better for remaining employees as the company is less likely to fail.

This is more compassionate as the laid off employees enter a stronger job market while also being better for remaining employees as the company is less likely to fail.

4) Weak CEOs cut late and thereby put everyone at risk.

They have to cut more because they are cutting later and the employees thereby enter a weaker job market. By trying to be compassionate they actually just hurt everyone involved.

CEOs are paid to make hard decisions.

They have to cut more because they are cutting later and the employees thereby enter a weaker job market. By trying to be compassionate they actually just hurt everyone involved.

CEOs are paid to make hard decisions.

5) And make no mistake - cutting costs is a really hard decision.

“Costs” are often just a euphemism for employees and these are real people with real lives. Not just numbers on a spreadsheet.

And yes for the reply people, I have made these points before.

“Costs” are often just a euphemism for employees and these are real people with real lives. Not just numbers on a spreadsheet.

And yes for the reply people, I have made these points before.

6) TLDR, capital scarcity is going to advantage strong, “Winter” CEOs who have generally been inspired by what Elon is doing at Twitter.

They are going to drive margins and do more with less.

Their companies will be more likely to succeed and their employees will do better.

They are going to drive margins and do more with less.

Their companies will be more likely to succeed and their employees will do better.

7) And to cover all bases, I had permission to share that email.

• • •

Missing some Tweet in this thread? You can try to

force a refresh