POWER OF COMPOUNDING IN OPTION SELLING

Compounding can turn 20 lakhs into 2449 crores!

And the best part is you don't have to make big Roi.

Find out how

Compounding can turn 20 lakhs into 2449 crores!

And the best part is you don't have to make big Roi.

Find out how

1: The first goal is to have a longer time view and also the long term mindset.

Because the real power of compounding is only felt in a longer time period as opposed to a shorter timeframe.

Because the real power of compounding is only felt in a longer time period as opposed to a shorter timeframe.

2: Target only 2% roi in a month.

This is something which most of the guys on twitter laugh at because it seems small but over a longer term , Just 2% roi compounded can do wonders.

I'll explain how.

This is something which most of the guys on twitter laugh at because it seems small but over a longer term , Just 2% roi compounded can do wonders.

I'll explain how.

3: Example : Let's say you start with 20 lakhs capital and only make 2% a month.

In 20 years, you will end with 23 cr if you keep on compounding it.

That's 100 times return in 20 years. But hedge funds would kill to make this much.

In 20 years, you will end with 23 cr if you keep on compounding it.

That's 100 times return in 20 years. But hedge funds would kill to make this much.

4: Even if we deduct taxes and brokerages, still we end up with a very handsome figure.

Making 2% a month in option selling consistently is very much possible. In fact, even if you trade only intraday it's possible. You don't even have to take overnight risk to make 2% a month.

Making 2% a month in option selling consistently is very much possible. In fact, even if you trade only intraday it's possible. You don't even have to take overnight risk to make 2% a month.

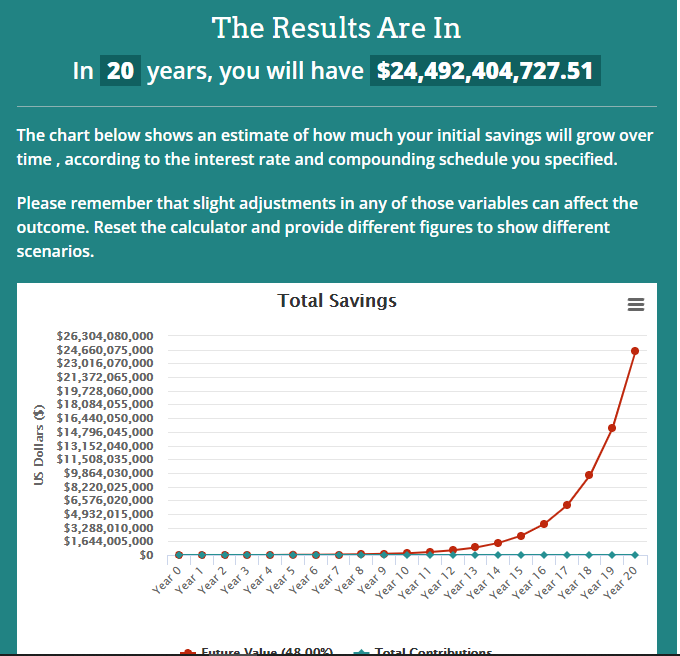

5: Now let's say after a few years your trading skills improve and you are able to make 4% a month consistently.

Starting capital is 20 lakhs.

In 20 years, the final amount will be more than 2449 crores.

Starting capital is 20 lakhs.

In 20 years, the final amount will be more than 2449 crores.

6: I might trigger some people after saying this, but of course after reaching a certain stage you can always withdraw some part of your capital.

You don't have to necessarily wait for that long. Even getting half or 1/4 of this is amazing.

You don't have to necessarily wait for that long. Even getting half or 1/4 of this is amazing.

7: To experience the full benefit of compounding, Avoid withdrawing your money your account in the early stages.

If you start to withdraw your profits , then compounding won't take place. Only withdraw as little as possible.

If you start to withdraw your profits , then compounding won't take place. Only withdraw as little as possible.

8: It won't be a cakewalk.

Even making 2% a month consistently will require hardwork and efforts in the longer run. This is not a get quick rich scheme because 20 years is also a long time.

But surely it's worth it and the way to grow your capital to a larger size.

Even making 2% a month consistently will require hardwork and efforts in the longer run. This is not a get quick rich scheme because 20 years is also a long time.

But surely it's worth it and the way to grow your capital to a larger size.

9: If you've liked this thread then do "RETWEET" and "FOLLOW ME" for more such threads.

You can also follow "Inner Circle" on instagram for more trading related content instagram.com/innercirclepro

You can also follow "Inner Circle" on instagram for more trading related content instagram.com/innercirclepro

For the naysayers, I will provide 15% discount to join Inner Circle and exprience the power of compounding themselves.

Use the code "COMPOUND15" to get 15% off. Valid only till tonight.

rigipay.com/g/CKKzgZr7QI

Use the code "COMPOUND15" to get 15% off. Valid only till tonight.

rigipay.com/g/CKKzgZr7QI

• • •

Missing some Tweet in this thread? You can try to

force a refresh