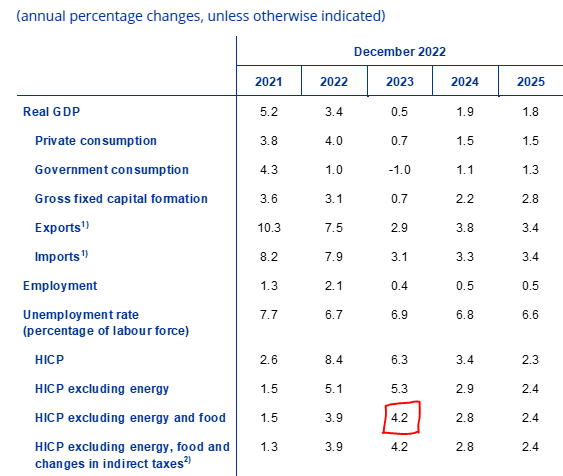

Very interesting inflation numbers today.

Let's have a look into the report.

A short thread.

1/

Let's have a look into the report.

A short thread.

1/

Inflation surprised on the downside: both headline and core CPI came in weaker than expected.

Actually only 2 (!) of the 67 economists surveyed by Bloomberg expected a 0.2% or lower MoM core CPI print.

What caused the surprise?

2/

Actually only 2 (!) of the 67 economists surveyed by Bloomberg expected a 0.2% or lower MoM core CPI print.

What caused the surprise?

2/

This excellent visualization from Bloomberg says a lot.

Energy and related services dropped - it was expected, but not as much.

Most importantly, the deflation in core goods (top right corner) picked up pace: for instance, used cars are now in outright deflation.

3/

Energy and related services dropped - it was expected, but not as much.

Most importantly, the deflation in core goods (top right corner) picked up pace: for instance, used cars are now in outright deflation.

3/

In his recent speech, Powell divided inflation in 3 main categories:

- Core goods: he expects them to be in a disinflationary trend

- Housing-related: he knows it's going to take a while because of calcs methodologies

- Ex-housing core services: this really matters to him

4/

- Core goods: he expects them to be in a disinflationary trend

- Housing-related: he knows it's going to take a while because of calcs methodologies

- Ex-housing core services: this really matters to him

4/

This is because ex-housing core services prices are the least distorted measure of the really sticky inflationary pressures in the US - in other words, the type of inflation the Fed wants to go away.

Here is the annualized 3m change in this series:

5/

Here is the annualized 3m change in this series:

5/

It seems like the massive tightening of financial conditions is starting to work its way through the core of the economy and dent inflation.

The other important thing for the Fed is the breadth of CPI - that's also declining.

The share of CPI components running at...

6/

The other important thing for the Fed is the breadth of CPI - that's also declining.

The share of CPI components running at...

6/

...4% annualized pace has dropped from 75% to 60% pretty rapidly.

While the absolute level of inflation is high, these 3 conditions seem to be unfolding:

- Sticky ex-shelter core services CPI moderating

- Breadth of inflation receding

- Overall inflation momentum declining

7/

While the absolute level of inflation is high, these 3 conditions seem to be unfolding:

- Sticky ex-shelter core services CPI moderating

- Breadth of inflation receding

- Overall inflation momentum declining

7/

This is good news for the Fed, but Powell will want to prevent a massive rally in stock and bond markets.

The only mistake he wants to avoid is to prematurely let the inflation fight go - in the '70s, that was an expensive mistake.

Now, the issue is..

8/

The only mistake he wants to avoid is to prematurely let the inflation fight go - in the '70s, that was an expensive mistake.

Now, the issue is..

8/

...that keeping animal spirits at bay isn't going to be easy this time as the evidence of a slowdown in inflation becomes more prominent.

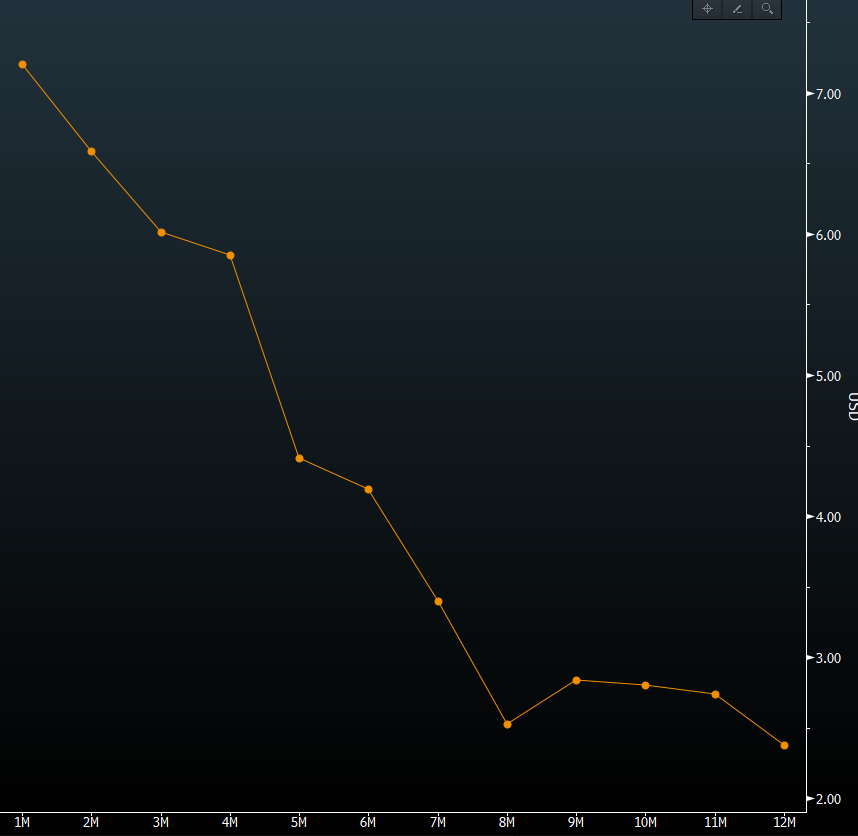

Also, inflation swap traders are pricing this path for CPI ahead - have a look.

YoY CPI priced at 2.5% in only 8 months from now!

9/

Also, inflation swap traders are pricing this path for CPI ahead - have a look.

YoY CPI priced at 2.5% in only 8 months from now!

9/

As the market cements its expectations for sharply lower CPI ahead and a subsequent Fed pivot, stocks and bonds are putting in a rally that will challenge Powell tomorrow.

How is he going to handle that?

10/

How is he going to handle that?

10/

I will be releasing a piece on TheMacroCompass.substack.com immediately after the Fed meeting to cover its implications for markets also in the light of this CPI report.

Consider subscribing so you receive it directly in your inbox - it's free!

11/11

Consider subscribing so you receive it directly in your inbox - it's free!

11/11

• • •

Missing some Tweet in this thread? You can try to

force a refresh