NEW: US-style deals that allow big companies to pay to avoid criminal prosecution have spread around the world — and so has a pattern of repeat corruption offenses, an ICIJ investigation has found. 🧵bit.ly/3uRmQik

Our analysis shows that over the last two decades, more and more countries have turned to American-inspired leniency deals to punish corporations for alleged bribery, corruption and other crimes. bit.ly/3uRmQik

Designed in the 1930s as a way to give juvenile offenders in Brooklyn a second chance, deferred prosecution and non prosecution agreements became a popular method for U.S. authorities to go after corporate crime in the 2000s. bit.ly/3uRmQik

Other nations followed suit, allowing them to grab a slice of surging financial settlements.

Over two decades, 30 countries used leniency deals to resolve corruption allegations against at least 265 companies, reaping $34.9 billion in payments, ICIJ found. bit.ly/3uRmQik

Over two decades, 30 countries used leniency deals to resolve corruption allegations against at least 265 companies, reaping $34.9 billion in payments, ICIJ found. bit.ly/3uRmQik

Corporate settlements are considered easier and less costly than trials and have been touted as success stories in combating global corruption.

But dozens of companies who settled bribery or fraud cases went on to become repeat offenders, ICIJ found. bit.ly/3uRmQik

But dozens of companies who settled bribery or fraud cases went on to become repeat offenders, ICIJ found. bit.ly/3uRmQik

Deutsche Bank, pharmaceutical giant Novartis and major oil company Eni are among firms that promised to clean up their act after escaping prosecution for bribery schemes only to again be accused of corruption and enter into new leniency deals. bit.ly/3uRmQik

And while price tags of corporate settlements have soared – from a high of $844,000 in 2000 to $2.5 billion in 2020 – critics argue that companies often view financial penalties incurred in leniency deals as a cost of doing business. bit.ly/3uRmQik

Companies frequently hire former prosecutors or politically connected insiders to negotiate the deals behind closed doors.

Few countries disclose details of these agreements, and those that do often don’t name the bribe-payers or bribe-takers. bit.ly/3uRmQik

Few countries disclose details of these agreements, and those that do often don’t name the bribe-payers or bribe-takers. bit.ly/3uRmQik

Corruption settlements don’t appear to stop misbehaving companies from winning government business either.

ICIJ found at least a dozen large firms profited from U.S. and European contracts after they paid to settle corruption-related allegations. bit.ly/3uRmQik

ICIJ found at least a dozen large firms profited from U.S. and European contracts after they paid to settle corruption-related allegations. bit.ly/3uRmQik

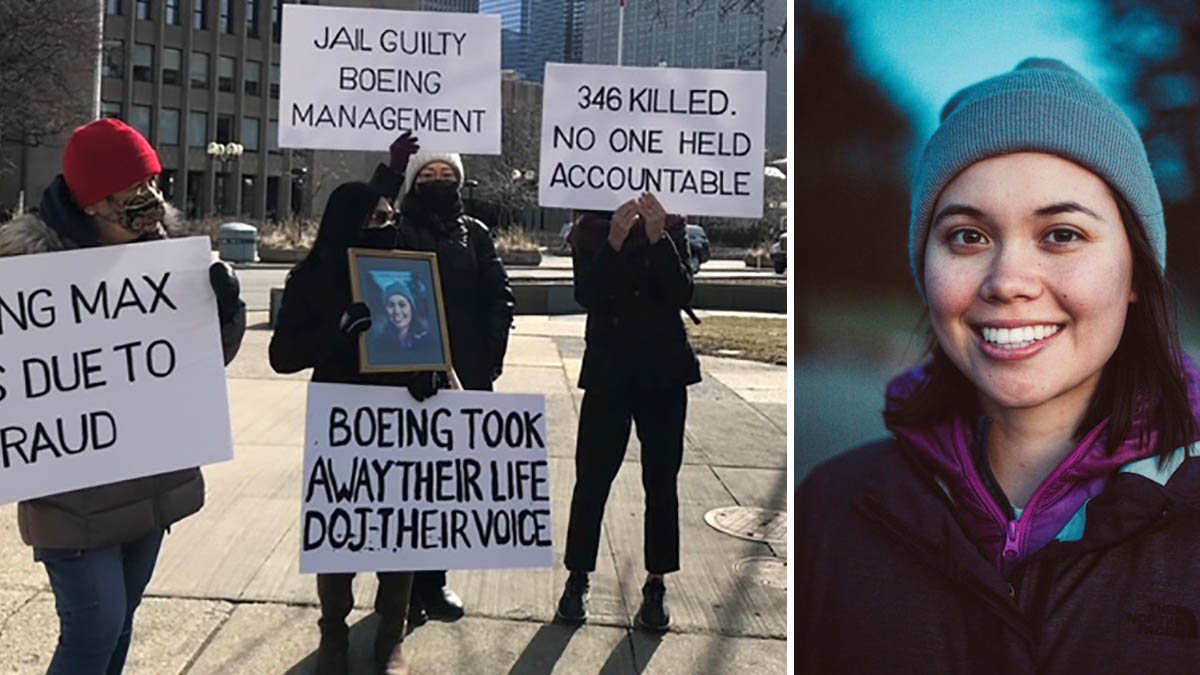

Victims of corporate crimes are also left in the dark.

Enraged families of those killed in a 2019 Boeing 737 MAX crash want the company’s $2.5 billion settlement thrown out and for high-ranking executives to be held accountable at a public trial. bit.ly/3uRmQik

Enraged families of those killed in a 2019 Boeing 737 MAX crash want the company’s $2.5 billion settlement thrown out and for high-ranking executives to be held accountable at a public trial. bit.ly/3uRmQik

Some argue that negotiated corruption settlements are better than no enforcement at all.

Many countries, including leading powers like China, Japan and India, conduct limited or no foreign bribery enforcement, according to a 2022 @anticorruption report. bit.ly/3uRmQik

Many countries, including leading powers like China, Japan and India, conduct limited or no foreign bribery enforcement, according to a 2022 @anticorruption report. bit.ly/3uRmQik

Criticisms that the U.S. model faces at home – that financial penalties have no real deterrent effect, individuals are not held to account, and that firms with deep pockets violate the law again and again – are also emerging abroad. bit.ly/3uRmQik

Earlier this year, ICIJ’s #EricssonList investigation on corrupt business practices in Iraq resulted in @TheJusticeDept telling the telecom giant that it had violated its $1 billion corruption settlement again, its second breach in less than six months. bit.ly/3FT18AT

It was this pattern of recidivism that prompted ICIJ’s review of corporate settlements worldwide.

Want us to investigate other global trends, secrets or scandals? Get in touch with your tips or leads! bit.ly/374vT6H

Want us to investigate other global trends, secrets or scandals? Get in touch with your tips or leads! bit.ly/374vT6H

Want to keep up with ICIJ’s world-spanning investigations on global inequities, cross-border crime, corruption, and accountability?

📧 Subscribe at: bit.ly/3bkNEOJ

🎁 And donate to support our work! Gifts are being *matched* through Dec. 31! bit.ly/3FS4sw3

📧 Subscribe at: bit.ly/3bkNEOJ

🎁 And donate to support our work! Gifts are being *matched* through Dec. 31! bit.ly/3FS4sw3

• • •

Missing some Tweet in this thread? You can try to

force a refresh