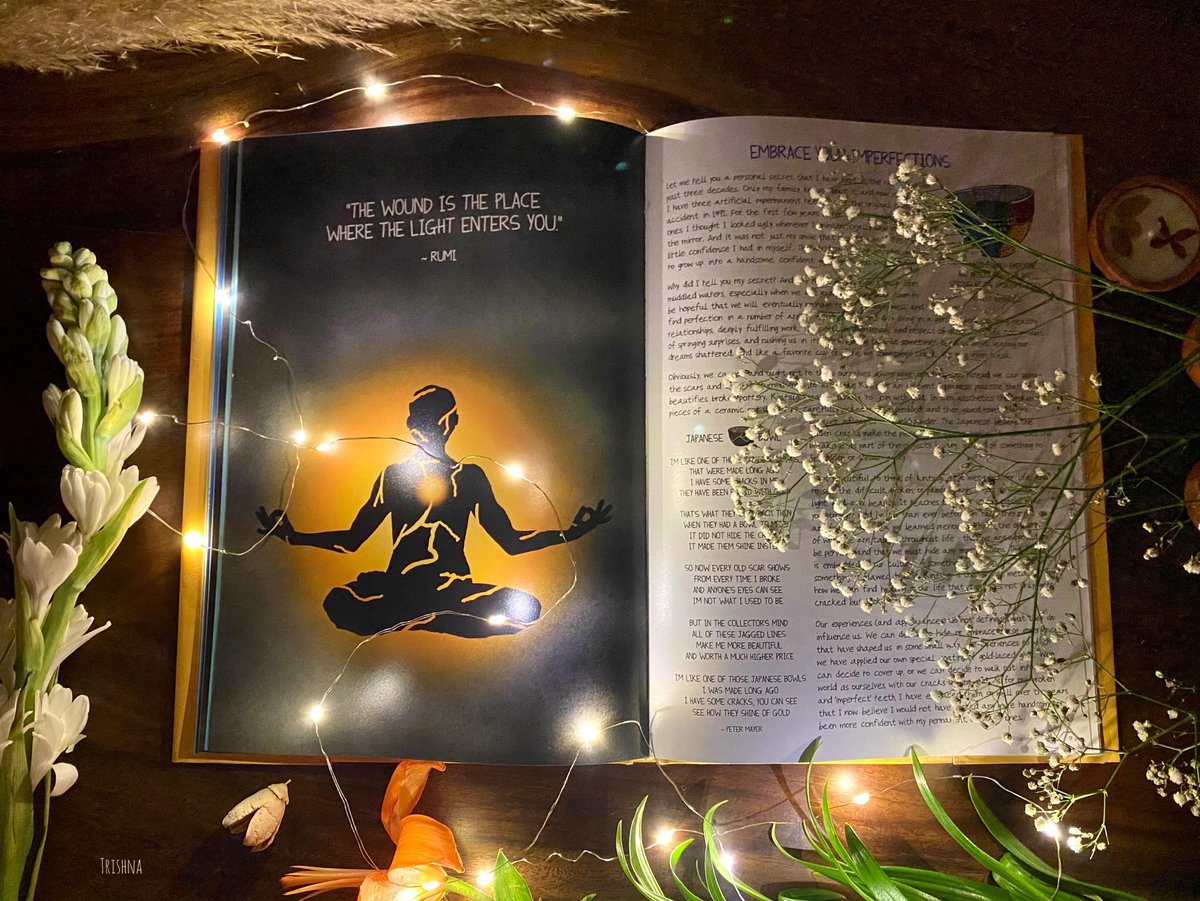

If you wish to end 2022 on a 'wise' note, I have an offer to make. :-)

Get your copy of #TheSketchbookofWisdom at a special price till 31st Dec. 2022.

Available here - book.safalniveshak.com

If you like(d) the book, please spread the word. Thank you.

Get your copy of #TheSketchbookofWisdom at a special price till 31st Dec. 2022.

Available here - book.safalniveshak.com

If you like(d) the book, please spread the word. Thank you.

• • •

Missing some Tweet in this thread? You can try to

force a refresh