@I_Am_The_ICT PD arrays I use.

You don't need all of them.

In reality, you need only 1 or 2 to be profitable.

$ES is used for the example.

A Thread 🧵🧵

You don't need all of them.

In reality, you need only 1 or 2 to be profitable.

$ES is used for the example.

A Thread 🧵🧵

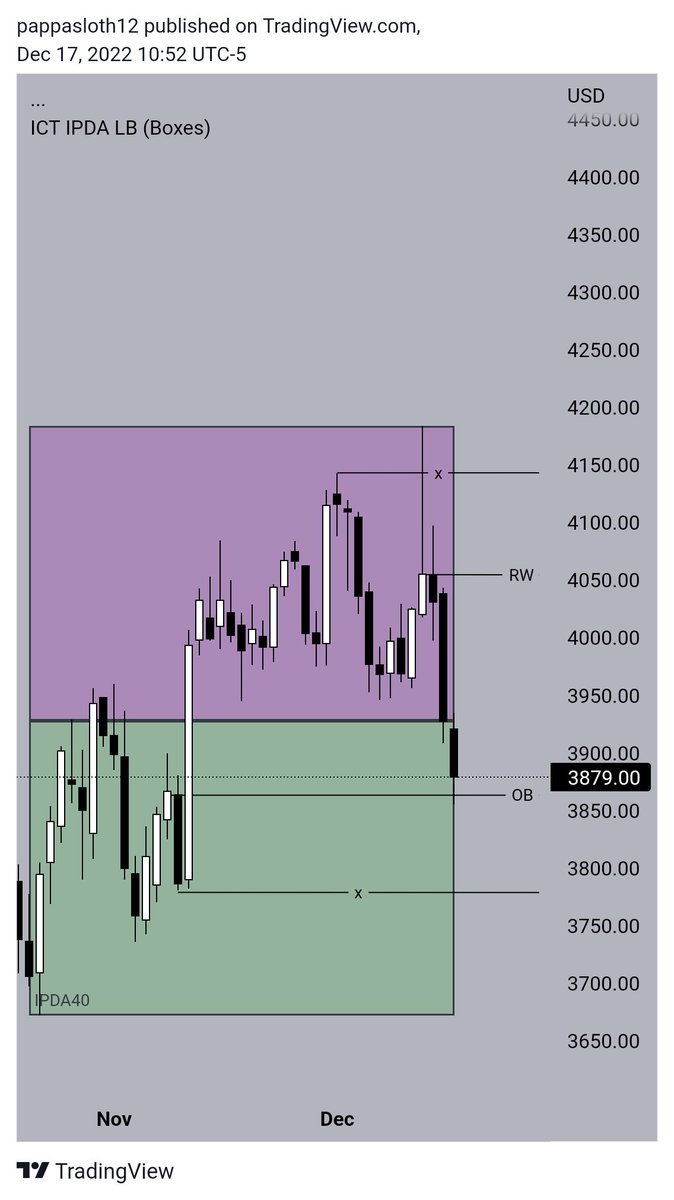

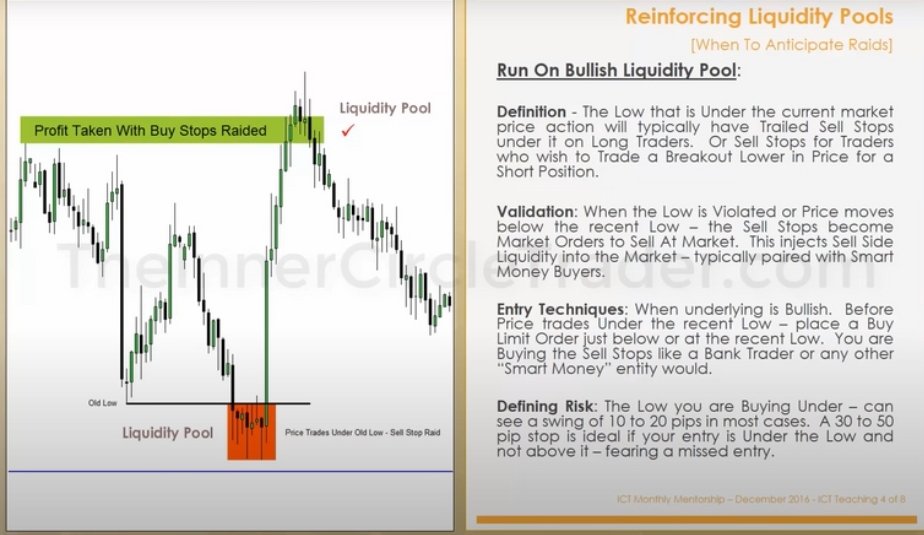

ICT Liquidity pool/Stop runs.

Above old highs and lows resides a lot of orders in the form of stop losses and orders for break-out traders.

Stops losses get paired with opposing contacts. Buy stop paired with sell orders and vice versa.

Above old highs and lows resides a lot of orders in the form of stop losses and orders for break-out traders.

Stops losses get paired with opposing contacts. Buy stop paired with sell orders and vice versa.

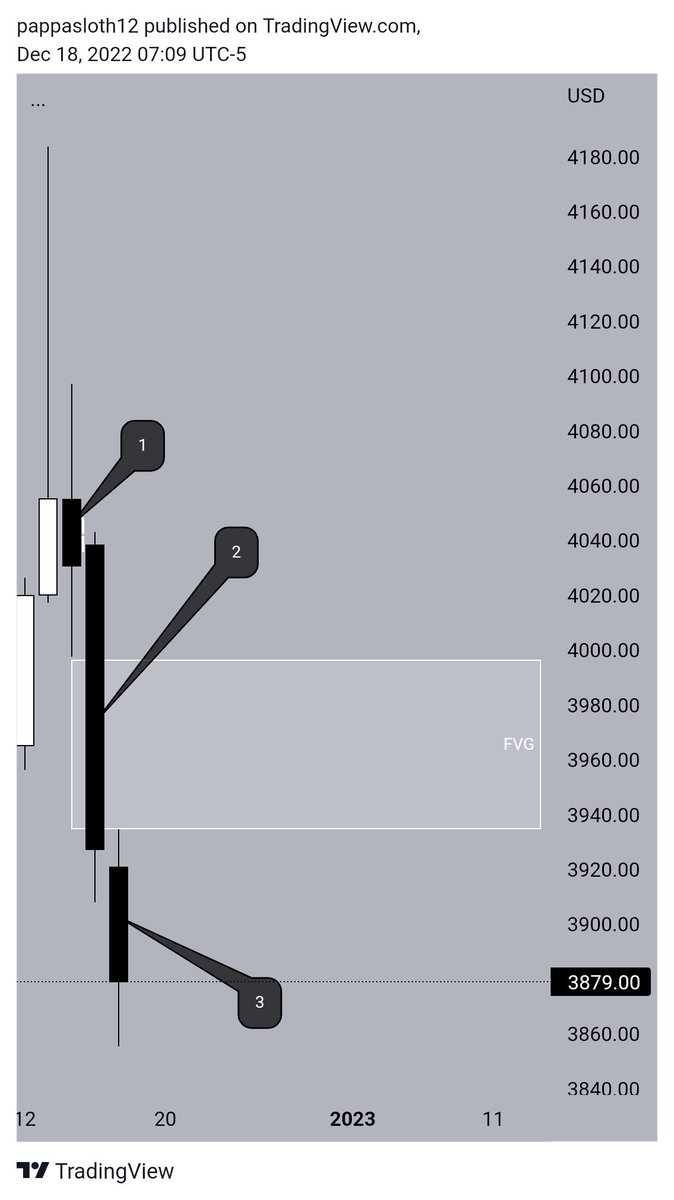

ICT fair value gap.

This a 3 candle formation.

In this example, the FVG is formed by candle 2 leaving nothing offered to buyers between the low of candle 1 and the high of candle 3 causing an imbalance in the market.

The market will want to be rebalanced at some point.

This a 3 candle formation.

In this example, the FVG is formed by candle 2 leaving nothing offered to buyers between the low of candle 1 and the high of candle 3 causing an imbalance in the market.

The market will want to be rebalanced at some point.

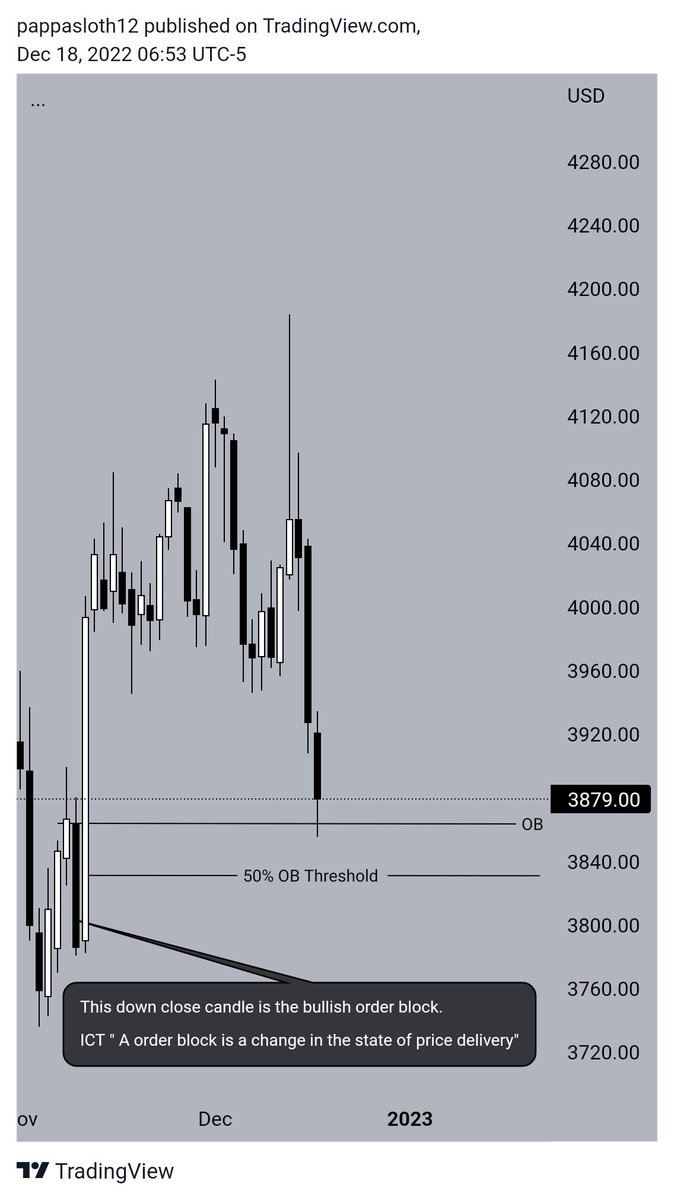

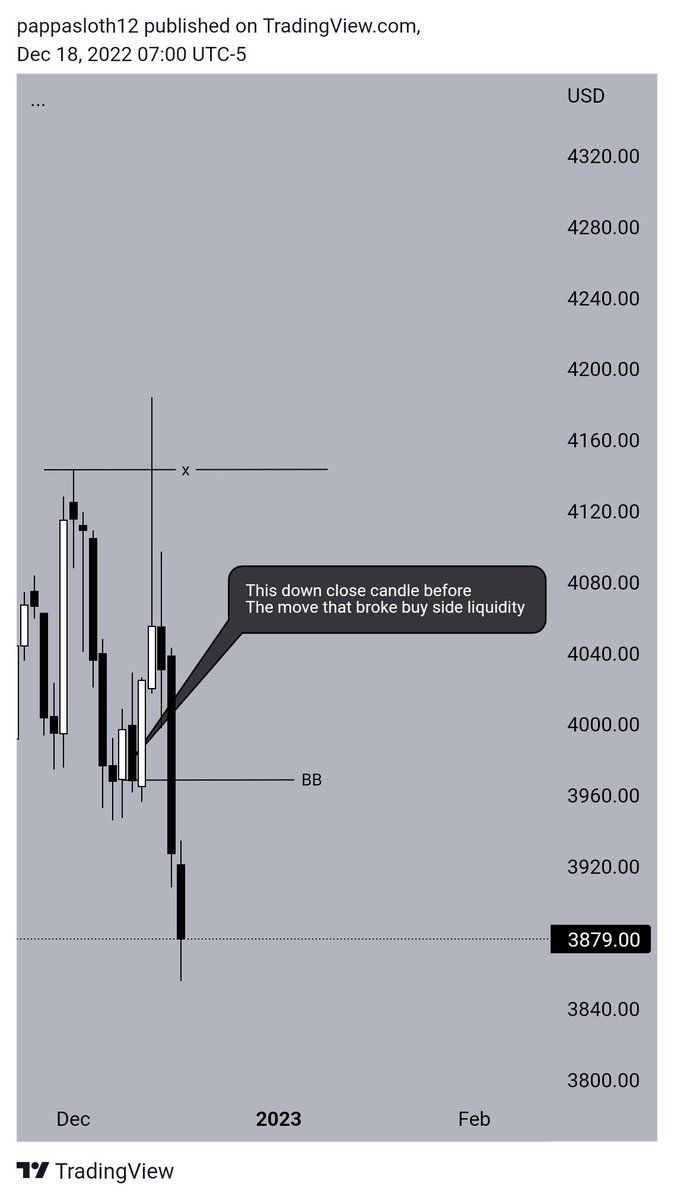

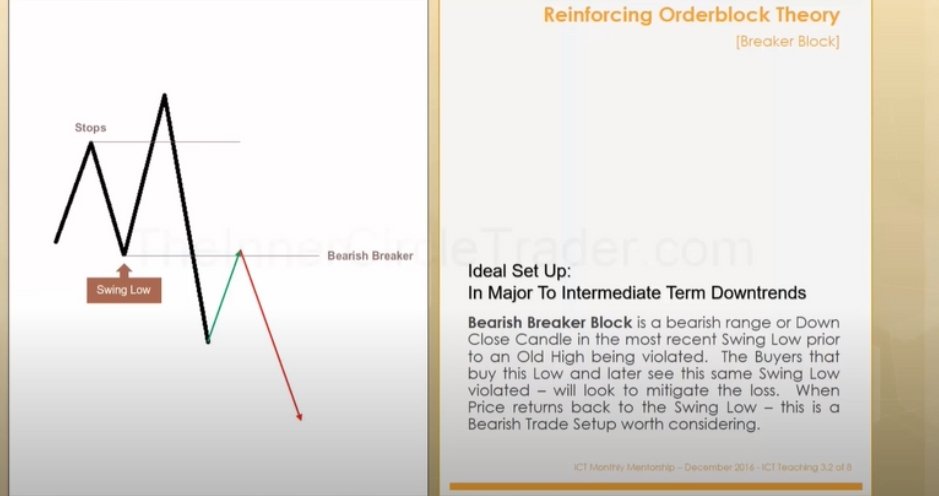

Following all of this.

I trade the YouTube mentorship.

I just replace the FVG entry with either OB or BB depending on what the market offers me.

I DO NOT NEED THEM ALL TO MAKE ME TAKE A TRADE.

I trade the YouTube mentorship.

I just replace the FVG entry with either OB or BB depending on what the market offers me.

I DO NOT NEED THEM ALL TO MAKE ME TAKE A TRADE.

• • •

Missing some Tweet in this thread? You can try to

force a refresh