1/ 95 Crypto Theses for 2023

(thread version)

(thread version)

1) This three tweet thread from 2021 is the "why" behind crypto. It remains the best thing I've ever written.

2) We're going back to "crypto" (native, organic, punk rock) vs. "Web3" (bad juju, consultant approved, weak) in 2023.

More Personal Wallets, Privacy, DeFi, DePIN.

Less exchanges, black box lenders, and ponzinomics.

More Personal Wallets, Privacy, DeFi, DePIN.

Less exchanges, black box lenders, and ponzinomics.

3) The core crypto thesis hasn't changed.

Crypto is inevitable because we're winning on talent and capital, we benefit from generation change to digital natives, and there have been dozens of high impact, open source innovations developed in the past year.

Crypto is inevitable because we're winning on talent and capital, we benefit from generation change to digital natives, and there have been dozens of high impact, open source innovations developed in the past year.

4) The biggest problems of this cycle (exchange & lender fraud and mismanagement, smart contract hacks, etc.) will be solved by entrepreneurs who want to build the next crypto unicorns.

Crypto problems tend to yield unicorn companies.

Crypto problems tend to yield unicorn companies.

5) Bitcoin is in a historic "buy" range in terms of MVRV - only seen three times in the past decade: Jan 2015, Dec 2018, and Mar 2020.

We're also 18 months out from the halving, and bitcoin is the only crypto considered an "outside money" candidate for USD reserve skeptics.

We're also 18 months out from the halving, and bitcoin is the only crypto considered an "outside money" candidate for USD reserve skeptics.

6) The Ethereum Merge was the greatest technical achievement in crypto in the past five years.

The EVM is now entrenched as the default crypto operating system, and ETH's economics make it a compelling, yield generating asset for a new crop of asset managers.

The EVM is now entrenched as the default crypto operating system, and ETH's economics make it a compelling, yield generating asset for a new crop of asset managers.

7) In PoS systems, your market cap is your security. Alt-L1s have much higher structural selling pressure next year (FTX and distressed funds, unlocks, high staking rewards) than Ethereum.

That will make it even harder for them to chip away at ETH's lead post-Merge.

That will make it even harder for them to chip away at ETH's lead post-Merge.

8) The entire DeFi market cap is $12.5 billion.

I'm betting it will outperform it's peer group in banking over the next 1, 3, and 5 years.

I'm betting it will outperform it's peer group in banking over the next 1, 3, and 5 years.

9) NFTs are an $8bn market cap asset class. Almost all of that is in PFP projects.

I hope you like the jpegs you own.

Median individual NFT resale value will continue to plummet, but the number of NFT projects will continue to explode. Bullish picks and shovels like OpenSea.

I hope you like the jpegs you own.

Median individual NFT resale value will continue to plummet, but the number of NFT projects will continue to explode. Bullish picks and shovels like OpenSea.

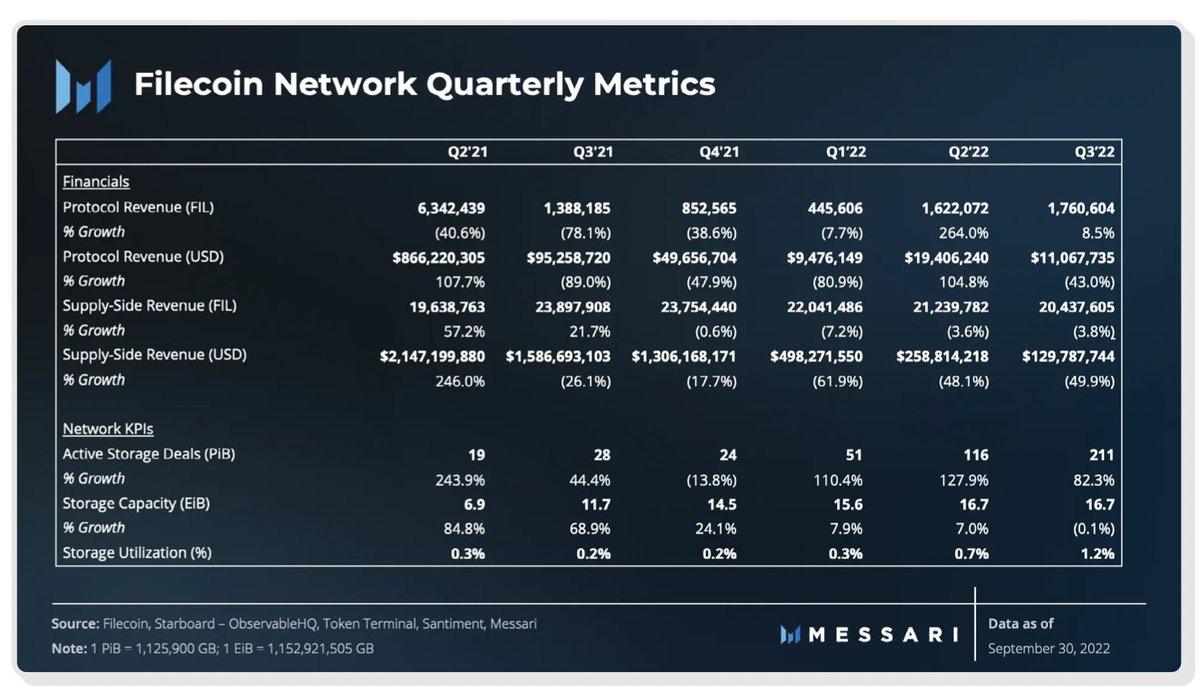

10) Decentralized physical infrastructure networks (DePIN) are the most important area of investment in crypto right now.

Censorship risks and platform risks are real.

DePIN like Filecoin, Arweave, Helium, Livepeer, etc. solve those problems.

Censorship risks and platform risks are real.

DePIN like Filecoin, Arweave, Helium, Livepeer, etc. solve those problems.

11) We'll see a flight to "fundamentals" with tokens that have actual users / customers surviving and everything else sucking serious wind.

You can measure fundamentals now:

You can measure fundamentals now:

12) VC funding has fallen off a cliff.

2021: $28.5bn

2022 (1H): $29.3bn

2022 (2H): $6.6bn

2022 was an "up year", but we're pacing for an 80% decline in funding YoY.

Entrepreneurs: MAKE IT LAST!

2021: $28.5bn

2022 (1H): $29.3bn

2022 (2H): $6.6bn

2022 was an "up year", but we're pacing for an 80% decline in funding YoY.

Entrepreneurs: MAKE IT LAST!

13) Last year we were talking about IPOs and SPACs. This year we're talking about distressed M&A and restructurings. Beneficiaries will be startups with big balance sheets and institutions that want to enter the market on the cheap.

14) Binance and Coinbase are the most important CeFi entities in crypto. All exchanges face regulatory threats, but the juggernauts will be SAFU and weather the storm.

In fact, they and the surviving exchanges will come out stronger on the other side of this cycle.

In fact, they and the surviving exchanges will come out stronger on the other side of this cycle.

15) Policy situation is this:

+ We prevented DCCPA from making it into law this year (good), but now comprehensive legislation is unlikely

+ We will hopefully get good stablecoin law

+ Two years of legal battles with the SEC (XRP et al), CFTC (Ooki et al), Treasury (privacy)

🤷♂️

+ We prevented DCCPA from making it into law this year (good), but now comprehensive legislation is unlikely

+ We will hopefully get good stablecoin law

+ Two years of legal battles with the SEC (XRP et al), CFTC (Ooki et al), Treasury (privacy)

🤷♂️

16) Contagion could end if DCG-Genesis-Gemini situation is resolved.

DCG will be significantly weakened by the crisis at Genesis at minimum. (Sell Luno? CoinDesk? Foundry?)

Gemini needs a resolution to avoid regulatory hell.

DCG will be significantly weakened by the crisis at Genesis at minimum. (Sell Luno? CoinDesk? Foundry?)

Gemini needs a resolution to avoid regulatory hell.

17) Silvergate *should* be fine based on how conservatively they ran the bank.

But Elizabeth Warren is on the warpath and parroting short-seller talking points to serve her ulterior motive of punishing a crypto friendly bank.

But Elizabeth Warren is on the warpath and parroting short-seller talking points to serve her ulterior motive of punishing a crypto friendly bank.

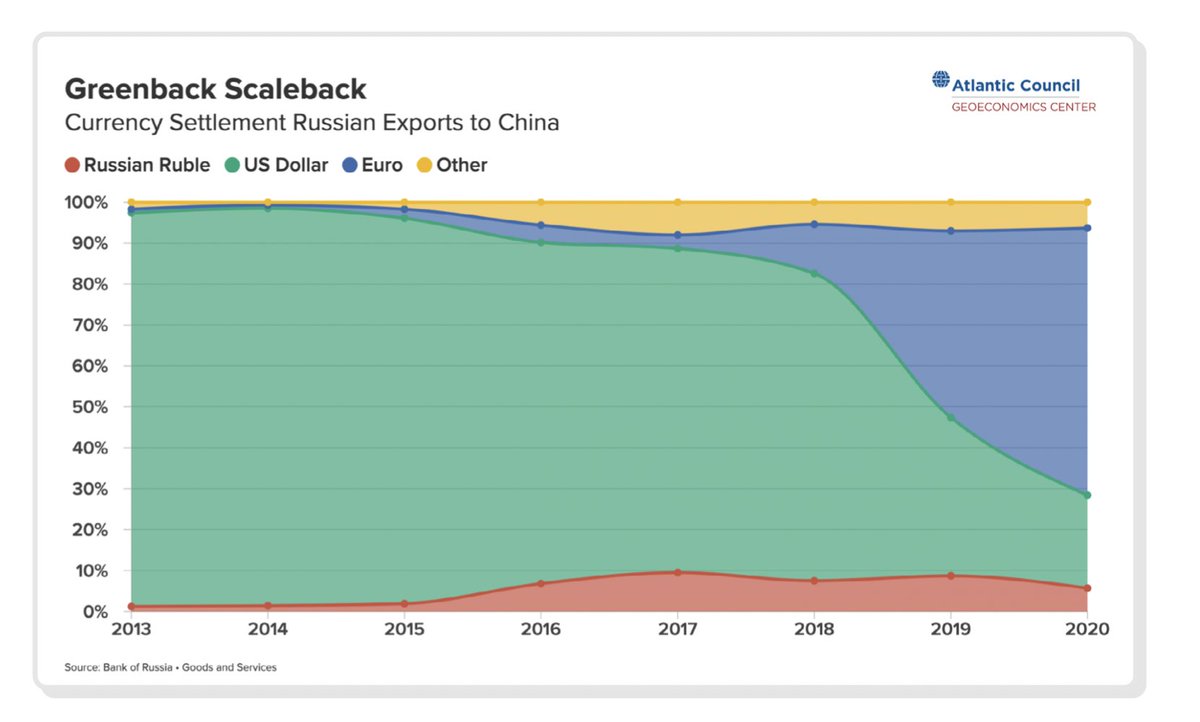

18) You can't just cancel countries.

More countries USD reserve ratios are going to start falling in the coming years. A competitive and private USD-denominated stablecoin could help soften the blow and keep dollars our leading export.

More countries USD reserve ratios are going to start falling in the coming years. A competitive and private USD-denominated stablecoin could help soften the blow and keep dollars our leading export.

19) Bitcoin mining is still majority "dirty." I'm no climate hawk, but I also think we shouldn't reopen coal plants to mine bitcoin if we don't need to.

Bullish public-private partnerships that lean on miners as a load balancing money battery. e.g. bullish flared gas mining.

Bullish public-private partnerships that lean on miners as a load balancing money battery. e.g. bullish flared gas mining.

20) Ethereum isn't private enough. Zcash isn't sufficiently adopted.

We need a Layer-1 with end to end privacy guarantees.

In the meantime, both ETH and ZEC will converge further towards each other.

We need a Layer-1 with end to end privacy guarantees.

In the meantime, both ETH and ZEC will converge further towards each other.

https://twitter.com/balajis/status/1573472350951145472

21) I spent a month with the Messari team writing The Theses. You can view if here, and fill in the rest of the Theses in the replies. My work here is done.

Happy holidays!

messari.io/crypto-theses-…

Happy holidays!

messari.io/crypto-theses-…

• • •

Missing some Tweet in this thread? You can try to

force a refresh