Few of my learnings as an investor in 2022. A thread. 🧵

1) Investing is simple but not easy. It is very hard to become a long-term investor. Sometimes, it can be a lonely road especially when your hypothesis gets tested again and again

cont..

cont..

2)Watching the screen and trying to assess daily moves can be hugely unproductive if you are a long-term investor. Lot of people sell great businesses looking at the screen

cont..

cont..

3)Don’t try to do all – multitasking does not work in stock markets. Focus on your personal strength. Either be a good fundamental or technical or algo trader but don’t try to be everything

cont...

cont...

4)You don’t buy a stock, but the stock buys you. Your choice of stocks depends on your personality traits. There is a reason that someone will like SBI or UBI or BOI in the same sector

cont...

cont...

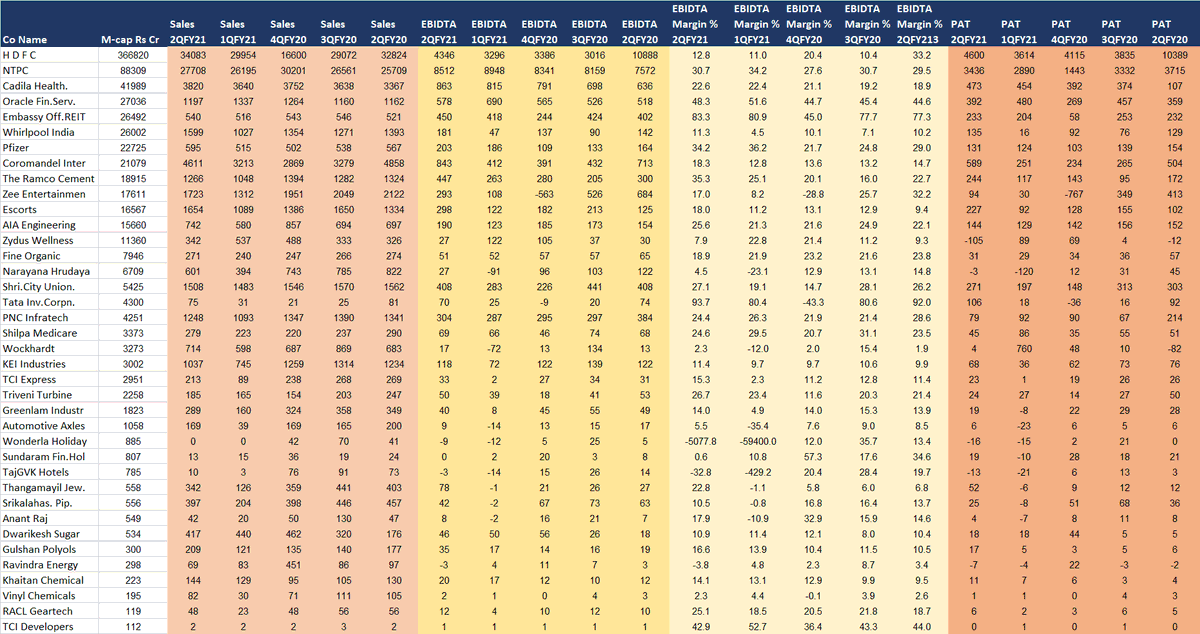

5)You will not own everything & will never be 100% correct. Prashant Jain invested in 465 stocks – and 1 in 4 resulted in loss. ONLY 55 stocks accounted for gain of 74,000 cr (85% of total). You will never be 100% correct – don’t beat yourself

cont...

cont...

6)Trading is fun but not for everyone – very few have discipline to take losses and cut positions. Speculation requires a human quality of accepting defeat & booking losses sooner than later

cont...

cont...

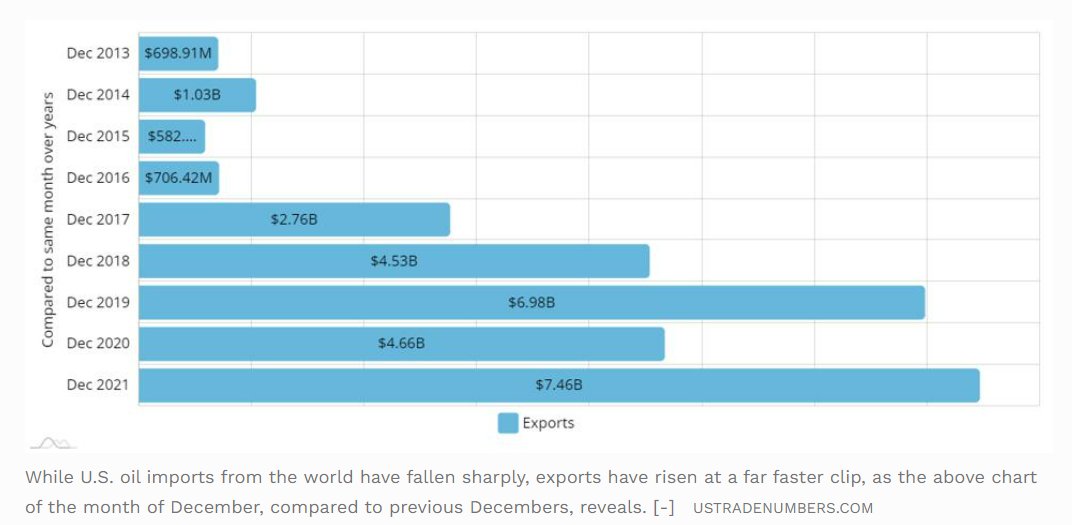

7)Beauty of LONG UPCYCLES that people forget rationality & beauty of LONG DOWNCYCLE is that people forget growth

cont..

cont..

8)Sometimes cheap can be very expensive

cont..

cont..

9)Risk management via right allocation is more important than picking the right stock, which is generally ignored by lot of retail investors

cont...

cont...

10)Only research & deep research can help anyone to hold great businesses in the long term. Maintaining discipline in the rising markets is the hardest thing

cont..

cont..

11)Boring is good for investment, may not give you adrenaline rush and quick money. NO one wants to become rich slowly

cont..

cont..

12) One can borrow stock ideas but not conviction. We always lose money is kachra or hearsay stocks with no research but noise - good businesses always make money. The agony & financial pain of a wrong investment can be far higher than the joy of a successful one

cont...

cont...

13) Your belief in the country’s growth should not change looking at SGX Nifty

END - Thanks for reading. Wishing you & your dear family a great 2023 and many more years to come.

END - Thanks for reading. Wishing you & your dear family a great 2023 and many more years to come.

• • •

Missing some Tweet in this thread? You can try to

force a refresh