2022✅ - Wow.

What a year of ups and downs, what may look like a very difficult period in the markets, in hindsight will actually prove to be one of the best learning experiences for anyone who is aiming to make it in trading

Performance YTD +97.78% vs:

$SPY -19%

$QQQ -34%

1/15

What a year of ups and downs, what may look like a very difficult period in the markets, in hindsight will actually prove to be one of the best learning experiences for anyone who is aiming to make it in trading

Performance YTD +97.78% vs:

$SPY -19%

$QQQ -34%

1/15

Was slightly slower than I would have liked in identifying the clear shift to the downside and so my equity curve suffered in the beginning.

Once I identified the clear bear market action circled below it was a matter of adjusting strategies and blocking out all the noise.

2/15

Once I identified the clear bear market action circled below it was a matter of adjusting strategies and blocking out all the noise.

2/15

A key part of my performance this year was knowing myself - ie. knowing my psychology and just as importantly my trading stats.

I opted for a shorter-term approach and was quicker to take profits when I had them.

Knowing I was uncomfortable holding O/N helped me adjust...

3/15

I opted for a shorter-term approach and was quicker to take profits when I had them.

Knowing I was uncomfortable holding O/N helped me adjust...

3/15

The overnight r/r was not appealing with such high risk of gaps. Vs previous years, I barely held positions over night, and if I did it was typically after already taking partial profits.

It is essential to know the kind of environment - what is working and what is not:

4/15

It is essential to know the kind of environment - what is working and what is not:

4/15

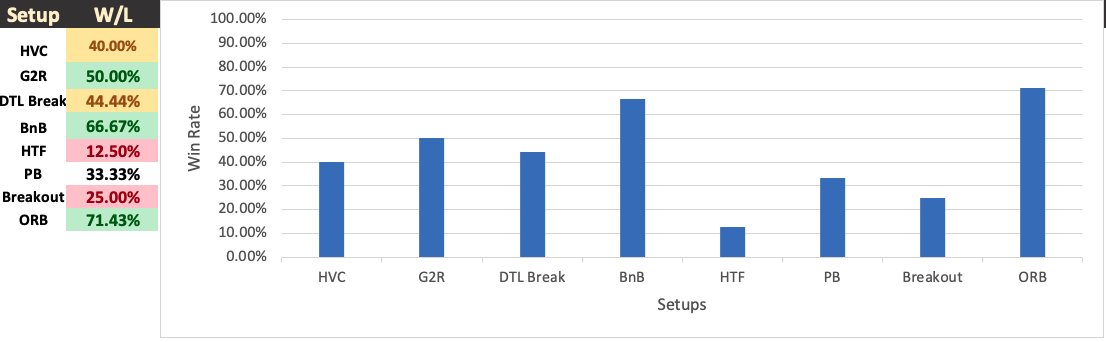

Tracking performance by setup quickly let me know what to focus on and what to stay away from. Not surprisingly my main sources of income (accumulated) were short setups as those are the ones that set up most frequently in this bear market

I also traded several #DTL setups

5/15

I also traded several #DTL setups

5/15

Despite the success on the short side of things, one of my best trades of the year did come on the long side in $AKRO after a +136% gap-up followed by tight consolidation:

6/15

6/15

The one area of my process that helped me identify weaknesses and improve, is 100% post-trade analysis - the single best way to improve your trading IMO

The above piechart screenshots are from a v helpful @PrimeTrading_ excel journal I suggest trying

7/15

stockbsessed.substack.com/p/post-trade-a…

The above piechart screenshots are from a v helpful @PrimeTrading_ excel journal I suggest trying

7/15

stockbsessed.substack.com/p/post-trade-a…

Aside from my personal trading, this year was really great in connecting with some truly awesome people

Me last year would never have thought that I'd start a @SubstackInc newsletter and get to interview market wizard @basso_tom!

Big plans for 2023!

8/15

stockbsessed.substack.com/p/11-questions…

Me last year would never have thought that I'd start a @SubstackInc newsletter and get to interview market wizard @basso_tom!

Big plans for 2023!

8/15

stockbsessed.substack.com/p/11-questions…

As helpful as twitter may be it is V IMP to not let opinions cloud your judgement.

People are still hungover from the crazy 2020 market and listening to advice about buying the dip would have only destroyed your equity curve

As @markminervini says - block out the audibles.

9/15

People are still hungover from the crazy 2020 market and listening to advice about buying the dip would have only destroyed your equity curve

As @markminervini says - block out the audibles.

9/15

My advice to everyone is that the good thing is we get to start fresh next week.

Whatever happened in 2022, leave it behind - don't dwell on the past. But the lessons you learned are invaluable and should never be forgotten, it is how we improve every day and year!

10/15

Whatever happened in 2022, leave it behind - don't dwell on the past. But the lessons you learned are invaluable and should never be forgotten, it is how we improve every day and year!

10/15

The best thing you can do for yourself is fuel your burning desire to succeed by learning every single day!

If you put in the work the opportunities are endless.

In order to take your trading to the next level and shorten your learning curve I highly suggest:

11/15

If you put in the work the opportunities are endless.

In order to take your trading to the next level and shorten your learning curve I highly suggest:

11/15

- Subscribing to very helpful and informative trading blogs such as:

Prime trading: @PrimeTrading_

Thoughts from Enjoy the Ride: @basso_tom

Market Diary & Playbook: @jeffsuntrading

Caruso Insights: @Trader_mcaruso

Trading Engineered: @RichardMoglen

12/15

Prime trading: @PrimeTrading_

Thoughts from Enjoy the Ride: @basso_tom

Market Diary & Playbook: @jeffsuntrading

Caruso Insights: @Trader_mcaruso

Trading Engineered: @RichardMoglen

12/15

- Reading all the books listed here several times over, if studied well, these are more than enough to help you succeed:

14/15

linktr.ee/stockbsessed

14/15

linktr.ee/stockbsessed

I wish you all the very best year possible and I cannot wait for what 2023 has in store for us! 🥳🥳🥳

15/15

15/15

• • •

Missing some Tweet in this thread? You can try to

force a refresh