There is a ONCE-IN-A-LIFETIME opportunity to disrupt the $1.5T auto lending market.

My insight as a 15-year industry insider (with a twist in the end): 🧵

My insight as a 15-year industry insider (with a twist in the end): 🧵

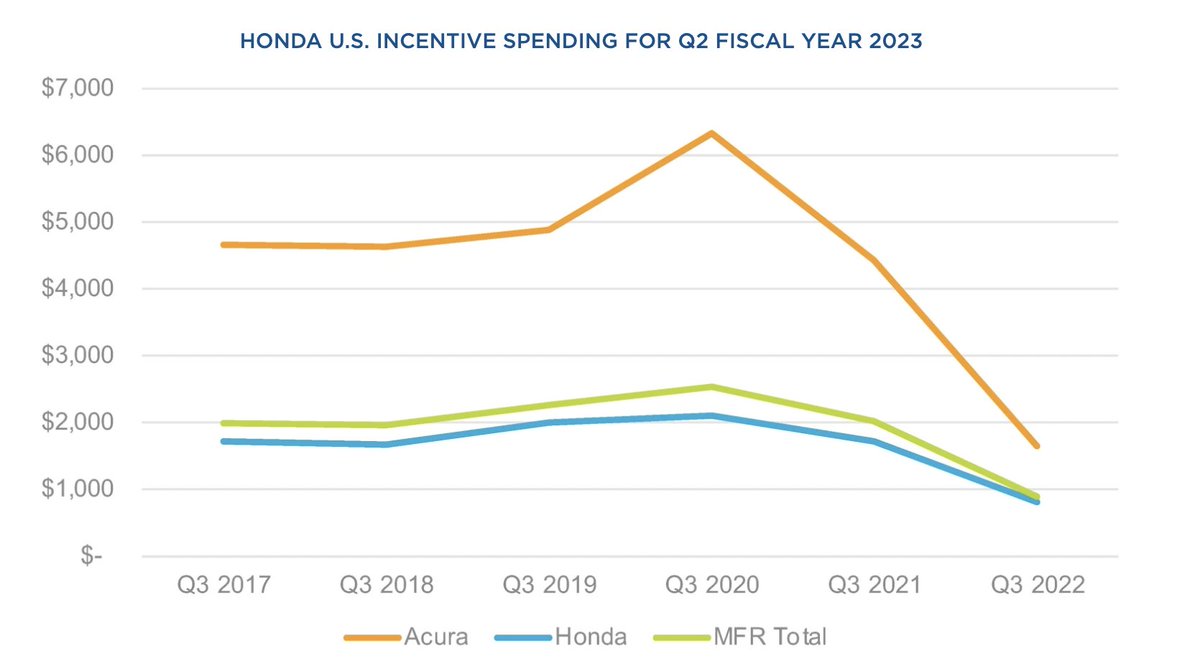

Legacy auto lenders went on a lending CRAZE over the past 2 years.

If we’re going to compare this to VC:

They all went “Tiger Global” on us.

But...

If we’re going to compare this to VC:

They all went “Tiger Global” on us.

But...

The party is now OVER.

Auto lenders are running for cover.

Lending guidelines are tightening (for the most part).

And dealers are losing access to lenders on a daily basis.

Here's the BIG problem with all of this (in 3 parts):

Auto lenders are running for cover.

Lending guidelines are tightening (for the most part).

And dealers are losing access to lenders on a daily basis.

Here's the BIG problem with all of this (in 3 parts):

1) Lenders are starting to SUFFER the consequences of their historical lending

2) Traditional auto lending is INEFFECTIVE in the current market environment

And 3) Lenders are becoming a lot more CONSERVATIVE

Let's quickly explain each point:

2) Traditional auto lending is INEFFECTIVE in the current market environment

And 3) Lenders are becoming a lot more CONSERVATIVE

Let's quickly explain each point:

1) Lenders are starting to SUFFER the consequences of their historical lending

Auto delinquencies and repossessions are INCREASING.

Repos are already up 3% since 2021.

But what's scary is that that number is rising rapidly.

The "free-money" era is over and people are hurting.

Auto delinquencies and repossessions are INCREASING.

Repos are already up 3% since 2021.

But what's scary is that that number is rising rapidly.

The "free-money" era is over and people are hurting.

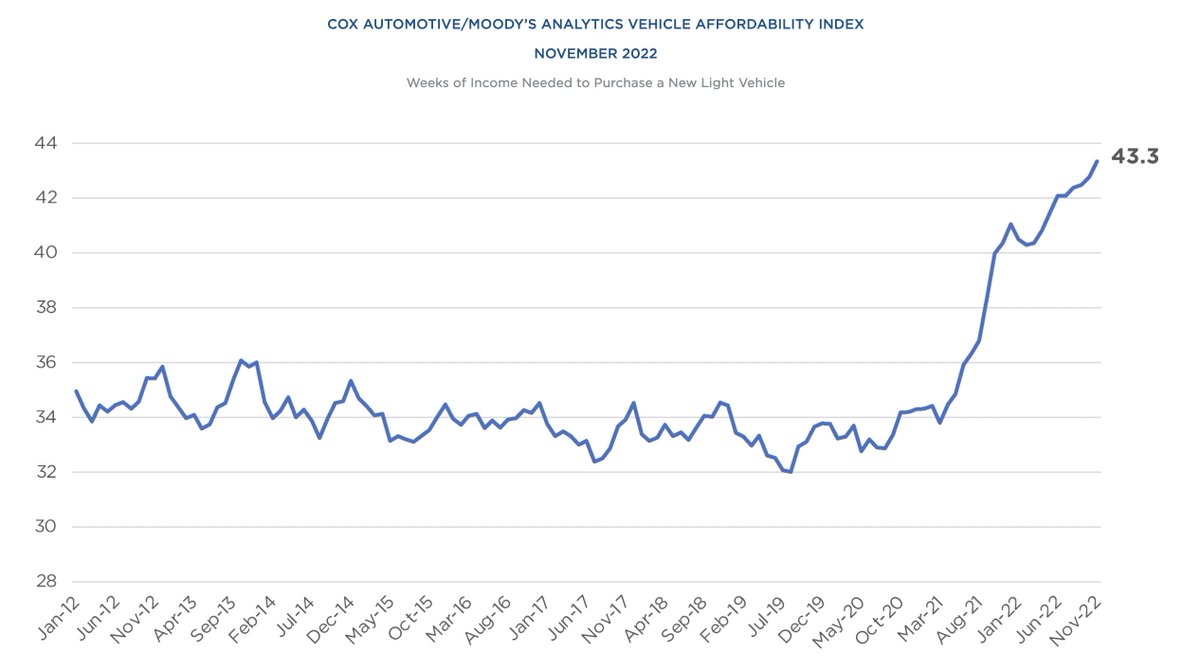

2) Record-high car prices and interest rates are making traditional auto lending INEFFECTIVE

New car affordability continues to DECLINE.

The median # of weeks of income needed to purchase the average new car has reached a NEW record: 43.3 weeks from 42.8 weeks (Nov vs Oct 22).

New car affordability continues to DECLINE.

The median # of weeks of income needed to purchase the average new car has reached a NEW record: 43.3 weeks from 42.8 weeks (Nov vs Oct 22).

And the cherry on top:

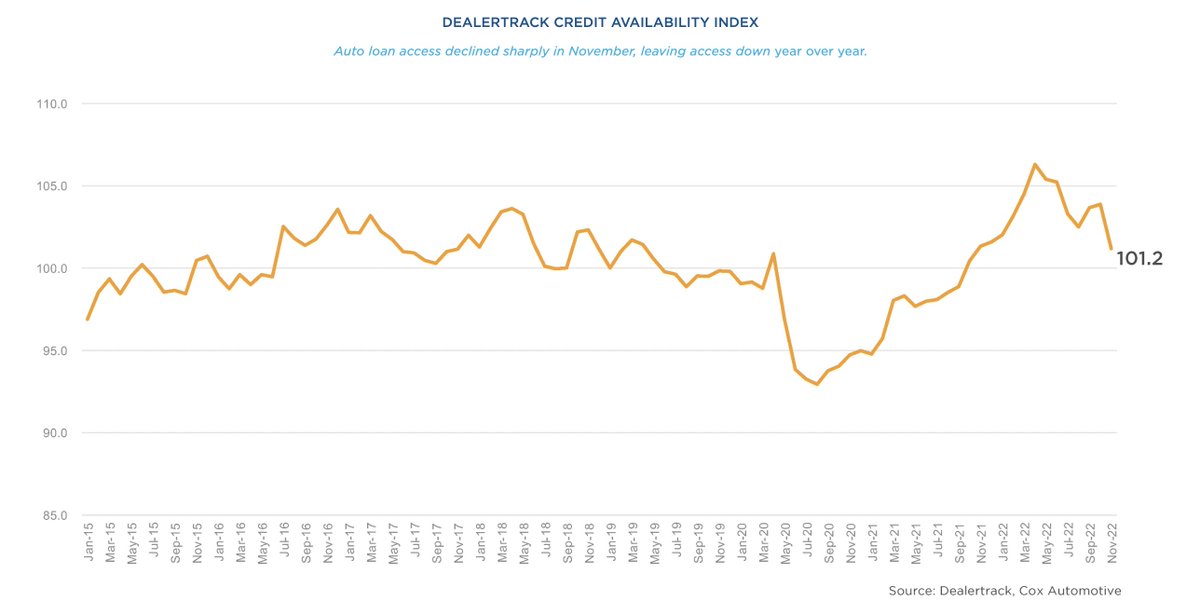

3) Lenders are NOT lending like before

Auto credit availability is QUICKLY falling.

And based on how things are pacing, it will continue FALLING.

Dealers and consumers are running out of options.

Yet... People still need to buy cars.

3) Lenders are NOT lending like before

Auto credit availability is QUICKLY falling.

And based on how things are pacing, it will continue FALLING.

Dealers and consumers are running out of options.

Yet... People still need to buy cars.

Bottom-line:

The current lending landscape is NEGATIVELY impacting THOUSANDS of car dealers and MILLIONS of consumers.

And that's exactly where the OPPORTUNITY lies.

Although there is ONE type of institution that has stepped up big time...

The current lending landscape is NEGATIVELY impacting THOUSANDS of car dealers and MILLIONS of consumers.

And that's exactly where the OPPORTUNITY lies.

Although there is ONE type of institution that has stepped up big time...

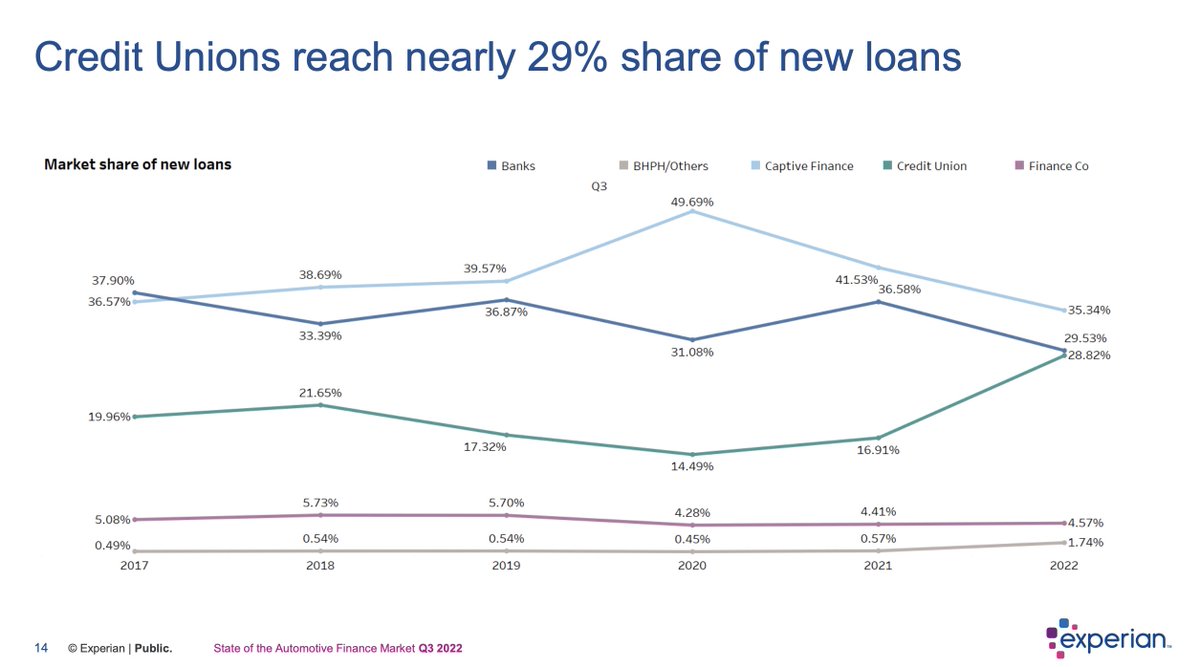

CREDIT UNIONS.

CUs now make up nearly 30% (!) of all new auto loans.

AN ALL-TIME RECORD.

YES — CUs have a structural cost advantage over traditional lenders.

But there's a big problem...

CUs now make up nearly 30% (!) of all new auto loans.

AN ALL-TIME RECORD.

YES — CUs have a structural cost advantage over traditional lenders.

But there's a big problem...

Credit unions SUCK at technology and have LIMITED liquidity.

They can't possibly replace traditional auto lenders.

Alas...

A PERFECT STORM brewing for disruption.

They can't possibly replace traditional auto lenders.

Alas...

A PERFECT STORM brewing for disruption.

- Legacy auto lenders are battening down the hatches

- Credit unions are stepping up with better terms

- But CUs also have SHIT technology and LIMITED liquidity

- Credit unions are stepping up with better terms

- But CUs also have SHIT technology and LIMITED liquidity

And that, my friends, is the GOLDEN opportunity for FinTech:

- People ALWAYS need cars.

- Dealers NEED lenders that will LEND.

- Lenders are suffering and AREN'T lending like before.

So... Who will step up and conquer this trillion-dollar opportunity?

- People ALWAYS need cars.

- Dealers NEED lenders that will LEND.

- Lenders are suffering and AREN'T lending like before.

So... Who will step up and conquer this trillion-dollar opportunity?

That's a wrap. If you enjoyed this thread:

1. Follow me @GuyDealership for more of these

2. RT the tweet below to share this thread with your audience

1. Follow me @GuyDealership for more of these

2. RT the tweet below to share this thread with your audience

https://twitter.com/GuyDealership/status/1610261499397775361

More content like this in my newsletter – free to join: dealershipguy.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh