🚨BREAKING🚨

I have just released the full trading report on politicians in 2022.

Despite 2022 being the worst market since 2008, both Democrats & Republicans beat the market.

Many politicians individually beat the market.

And many made unusual trades resulting in huge gains.

I have just released the full trading report on politicians in 2022.

Despite 2022 being the worst market since 2008, both Democrats & Republicans beat the market.

Many politicians individually beat the market.

And many made unusual trades resulting in huge gains.

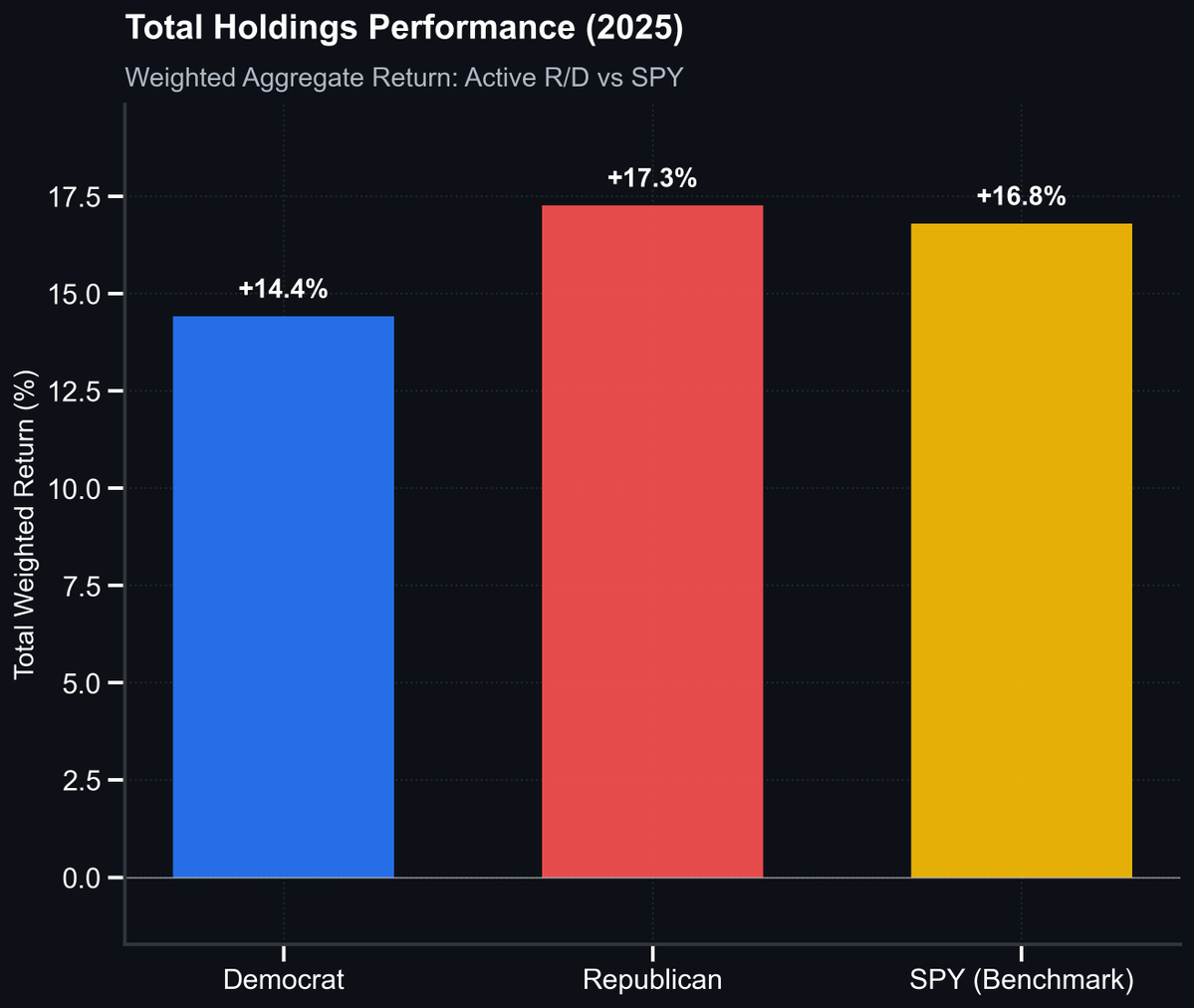

On average, Democrats were down -1.76% in 2022, whereas Republican members were up +0.4%.

Meanwhile, the S&P500 itself was down 18% in 2022.

Like in 2021, politicians beat the market.

Read the full report here: unusualwhales.com/politics/artic…

Meanwhile, the S&P500 itself was down 18% in 2022.

Like in 2021, politicians beat the market.

Read the full report here: unusualwhales.com/politics/artic…

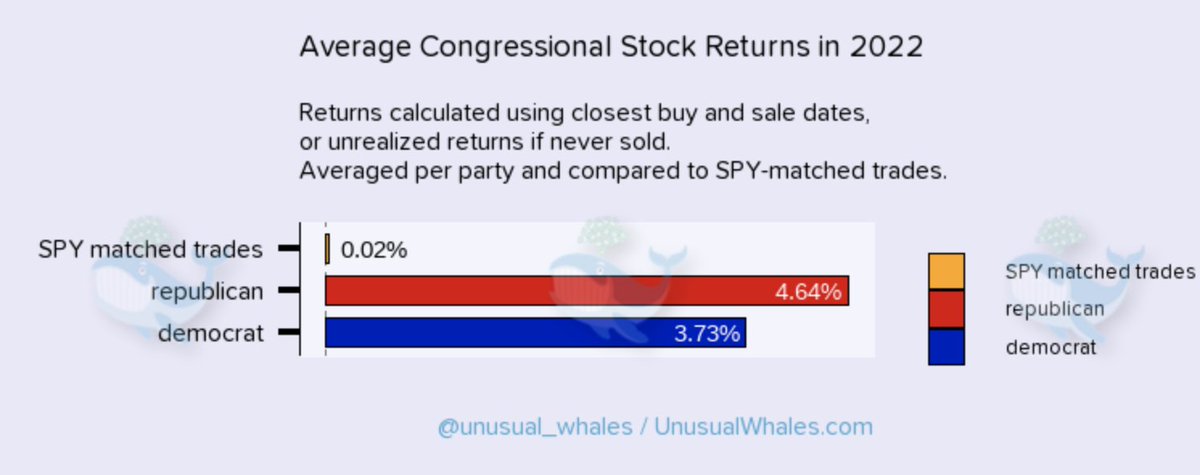

A SPY-matched trades approach shows a similar result.

This allows us to compare a politician’s individual trades with $SPY, the S&P500, over the same period.

You can see that in both Democrats and Republicans beat the market.

See the full report here: unusualwhales.com/politics/artic…

This allows us to compare a politician’s individual trades with $SPY, the S&P500, over the same period.

You can see that in both Democrats and Republicans beat the market.

See the full report here: unusualwhales.com/politics/artic…

It is truly inexcusable.

In all ways we tested, Congress beat the market.

This is the worst market since 2008, and yet, politicians returned better than many.

How unusual.

Read the full report: unusualwhales.com/politics/artic…

In all ways we tested, Congress beat the market.

This is the worst market since 2008, and yet, politicians returned better than many.

How unusual.

Read the full report: unusualwhales.com/politics/artic…

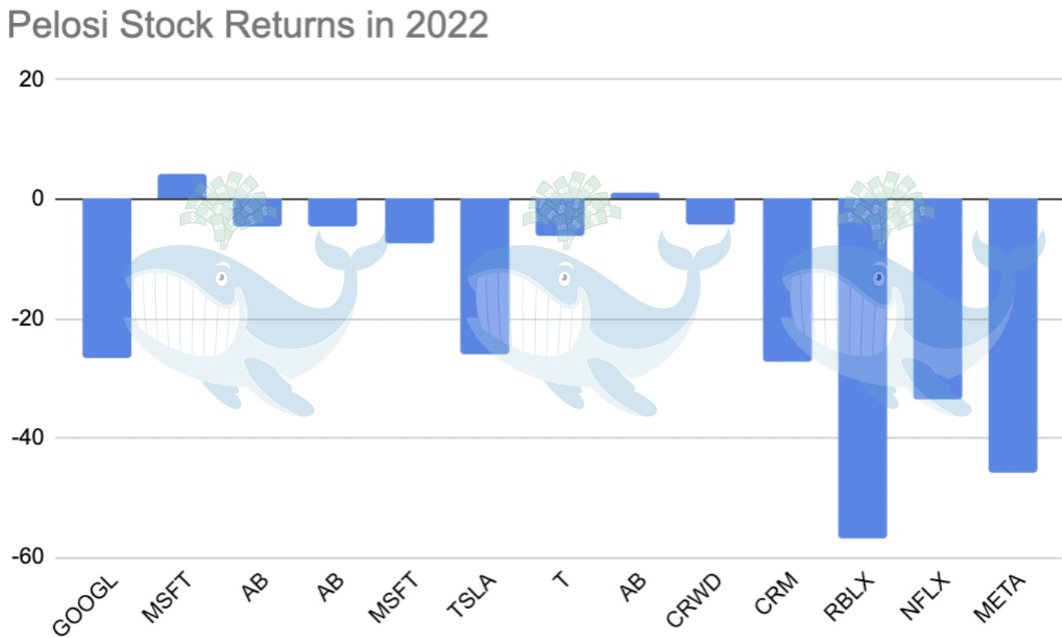

Many have asked: What about the Pelosis in 2022?

In 2022, they were down nearly 20%. Many of their deep in-the-money option plays expired at a loss.

Meanwhile, the top trader, Pat Fallon, a Republican, was up 51% on his 2022 trades.

Read full report: unusualwhales.com/politics/artic…

In 2022, they were down nearly 20%. Many of their deep in-the-money option plays expired at a loss.

Meanwhile, the top trader, Pat Fallon, a Republican, was up 51% on his 2022 trades.

Read full report: unusualwhales.com/politics/artic…

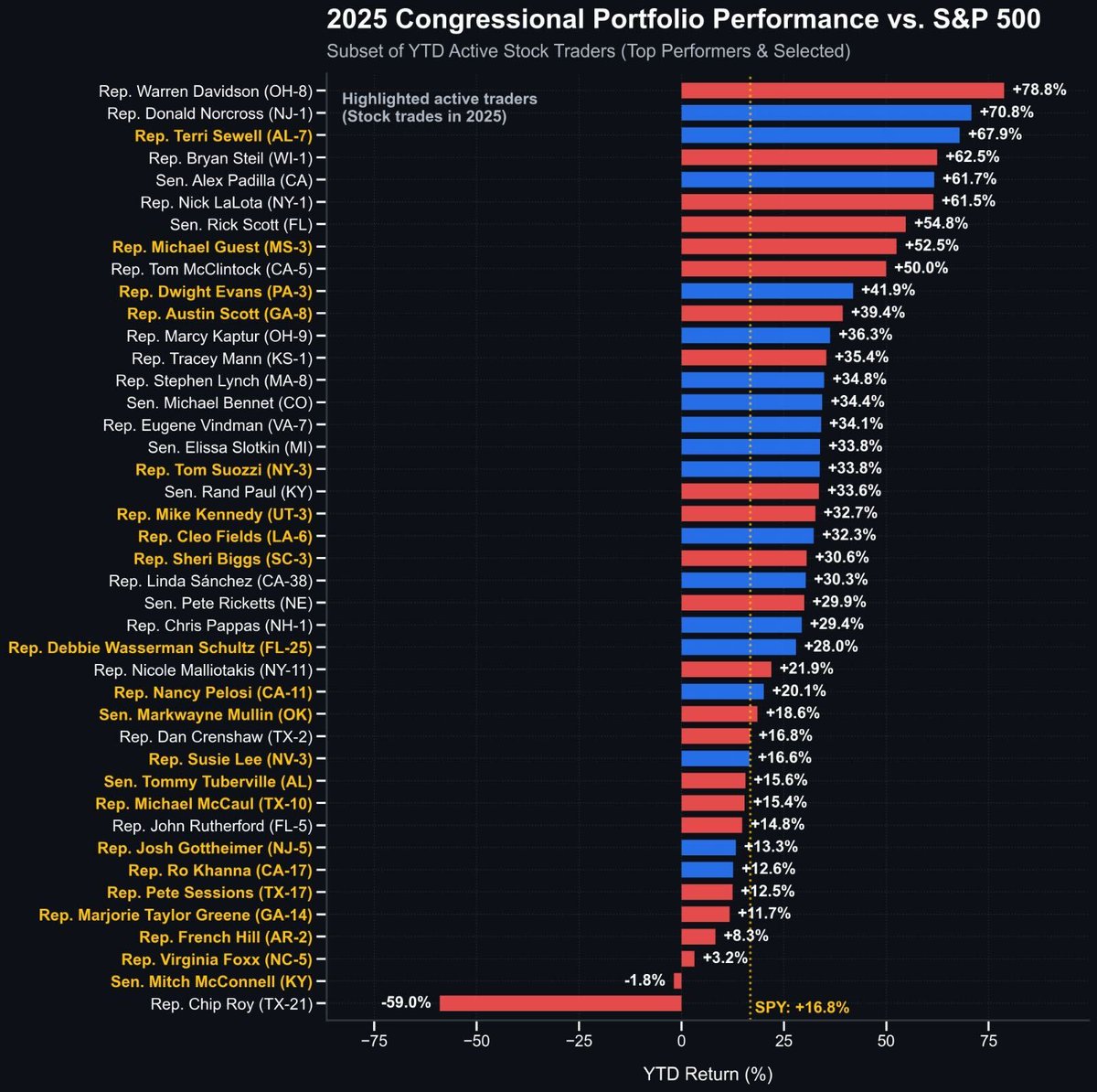

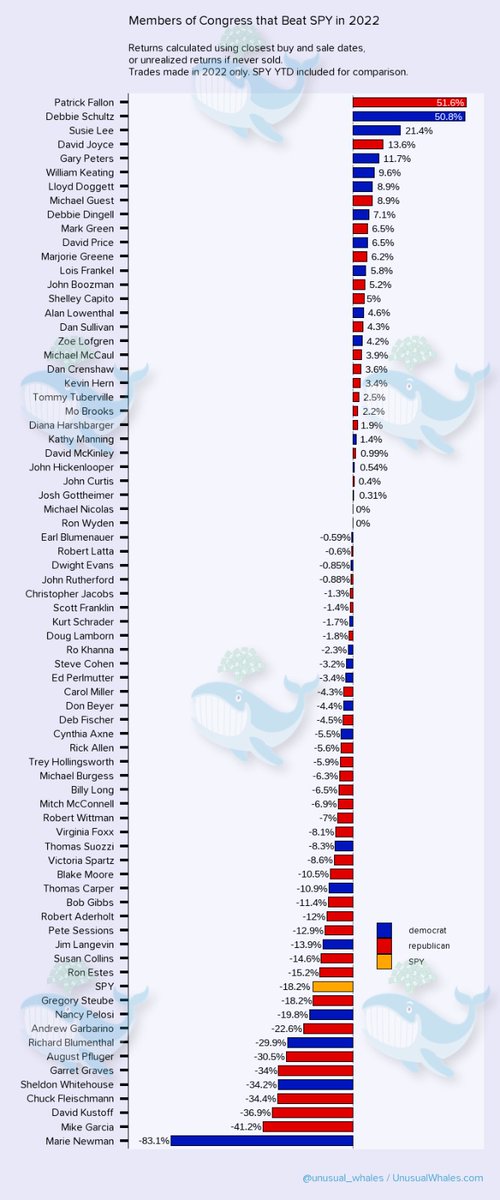

Here is a longer list, with returns estimated to mid Dec 2022.

Many members had wins and losses alike.

Notably, however, the majority beat SPY year to date, in the worst market since 2008.

Interesting!

Read the full report: unusualwhales.com/politics/artic…

Many members had wins and losses alike.

Notably, however, the majority beat SPY year to date, in the worst market since 2008.

Interesting!

Read the full report: unusualwhales.com/politics/artic…

It is truly unusual.

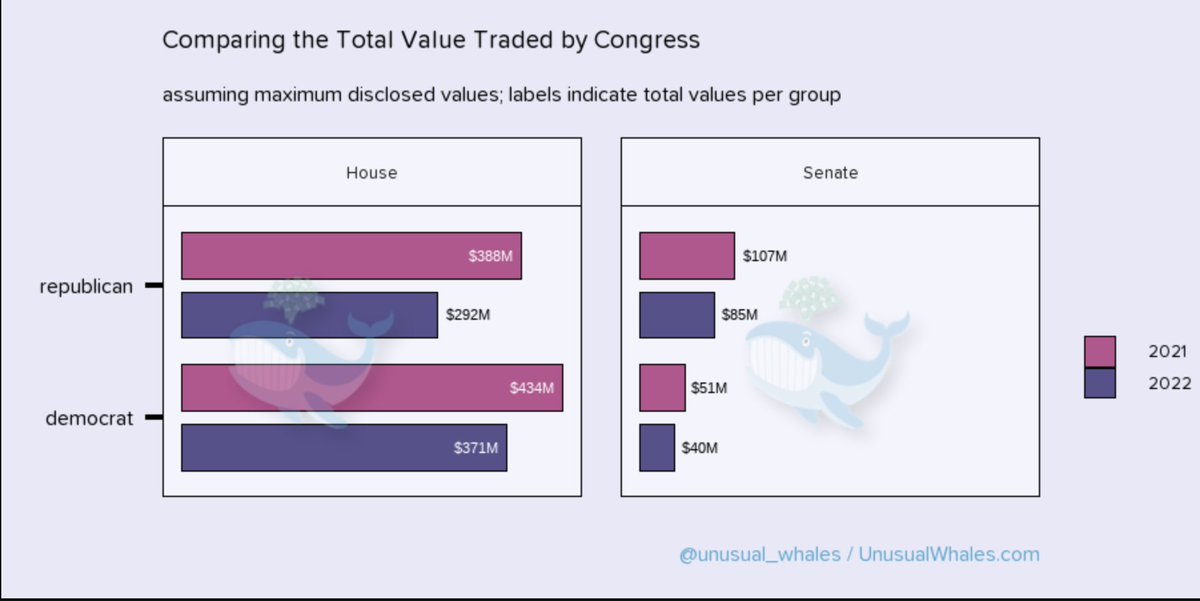

Politicians beat the market in 2021, and now 2022.

While the total value of stocks traded dropped, some politicians like Ro Khanna made 5,700+ trades in 2022.

Read the full report for details: unusualwhales.com/politics/artic…

Politicians beat the market in 2021, and now 2022.

While the total value of stocks traded dropped, some politicians like Ro Khanna made 5,700+ trades in 2022.

Read the full report for details: unusualwhales.com/politics/artic…

It is important to note that this is not a new trend.

In 2021, politicians beat the market too.

Here is our 2021 report.

Unusual.

In 2021, politicians beat the market too.

Here is our 2021 report.

Unusual.

https://twitter.com/unusual_whales/status/1480656947577860096

Some members have sent their trades for UW to verify.

One of them was Fallon.

With updated history, he is:

- -18% on full portfolio

- In 2022, +24% $TWTR from costs of derivative position (not known before), -8% $VZ

- No longer trades stocks

Read thread

One of them was Fallon.

With updated history, he is:

- -18% on full portfolio

- In 2022, +24% $TWTR from costs of derivative position (not known before), -8% $VZ

- No longer trades stocks

Read thread

https://twitter.com/unusual_whales/status/1613972325329932290?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh