A beginner-level intro to #nostr: an open protocol for censorship-resistant communication networks created by @fiatjaf.

thread.

thread.

Before we get into what it is, it’s probably equally as helpful to understand what it’s not.

https://twitter.com/lopp/status/1611377277954293763

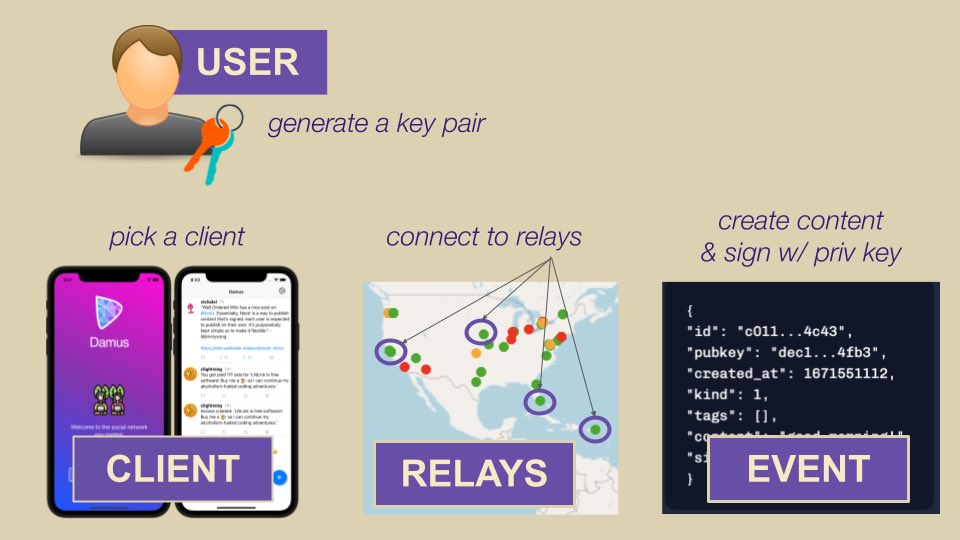

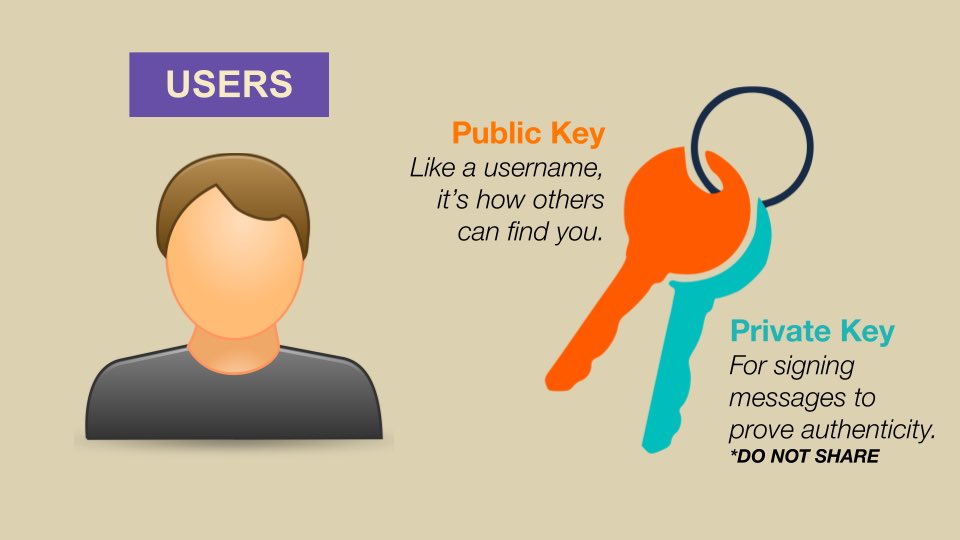

Like the bitcoin protocol, nostr is permissionless. All you need to use the protocol is to generate a key pair.

A public key (as a unique identifier) and a private key (to sign content you post).

1 person ≠ 1 account. You don’t even have to be human.

A public key (as a unique identifier) and a private key (to sign content you post).

1 person ≠ 1 account. You don’t even have to be human.

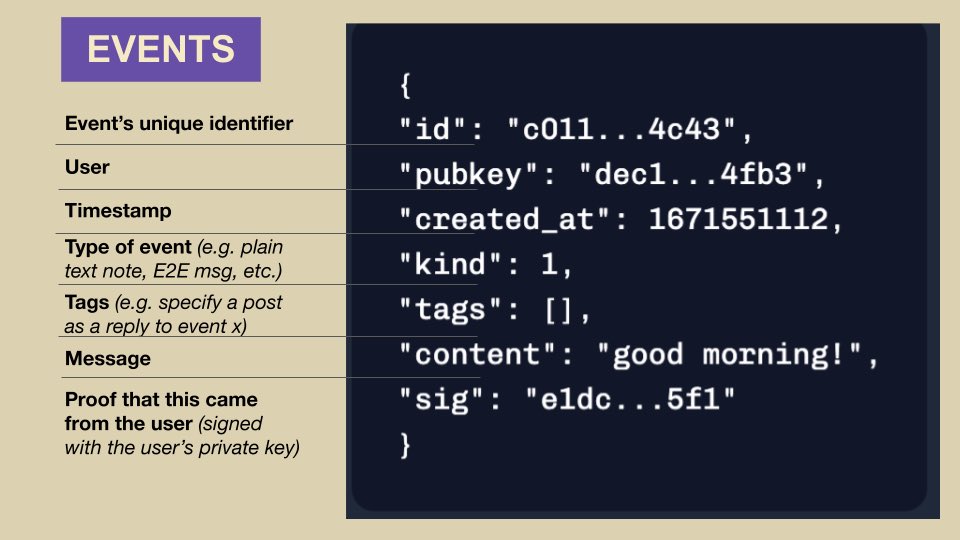

At the core of nostr is a protocol for packaging content (a.k.a ‘events’) which are sent to relays.

These events are simple text-based objects.

These events are simple text-based objects.

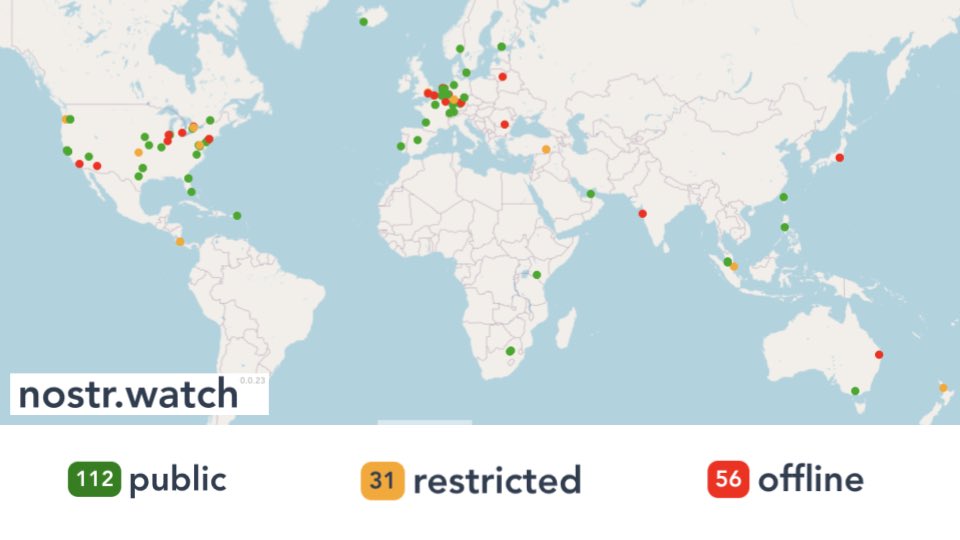

Unlike bitcoin nodes (which connect to one another to broadcast, receive, or validate data), relays operate as independent repositories of ‘events’.

When you send content to someone, you are not sending it directly to the recipient (P2P), but to a relay that you and the recipient are both connected.

When you broadcast a message, anyone who is following you can see it by also connecting to any common relay.

When you broadcast a message, anyone who is following you can see it by also connecting to any common relay.

How could this possibly scale?

The nostr protocol is extremely light in terms of disk space per event. Additionally, a relay doesn’t need to store every single event.

The nostr protocol is extremely light in terms of disk space per event. Additionally, a relay doesn’t need to store every single event.

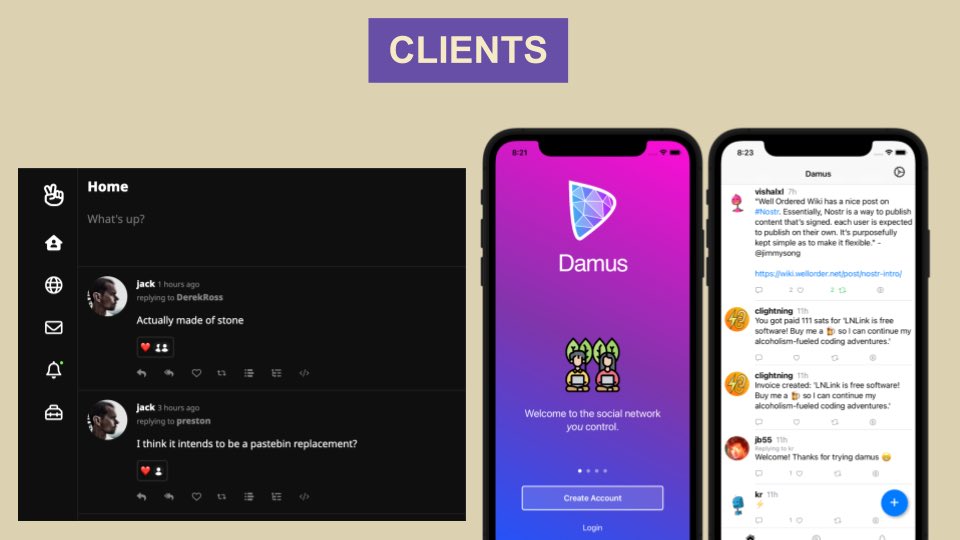

Users interact with the nostr protocol through clients (native or web-based).

You can see a list of some here: nostr.net

You can see a list of some here: nostr.net

You can use ANY client you wish or even build your own.

Imagine signing in to any one of a dozen options (web or mobile) and still being able to see all of your events and the events of those you follow.

You’re no longer beholden to a single service.

Imagine signing in to any one of a dozen options (web or mobile) and still being able to see all of your events and the events of those you follow.

You’re no longer beholden to a single service.

https://twitter.com/neb_b/status/1611199943426949122

When open-source protocols are the basis for communication, innovation can explode at the fringes as anyone can tinker and build applications, no permission required.

https://twitter.com/mrhodl/status/1610779334347726850

And as a truly open protocol, interoperability with other open protocols (e.g. Lightning⚡️) can be possible.

https://twitter.com/therealtahinis/status/1611074271547215873

Nostr is not limited to twitter clones. The potential types of data (‘kind’ field) in an event is always broadening.

Some examples of what people have already built/replicated as censorship-resistant versions.

Some examples of what people have already built/replicated as censorship-resistant versions.

Lots of fantastic educational resources and guides popping up every single day.

Here’s a good starting point by @dergigi

nostr-resources.com

Here’s a good starting point by @dergigi

nostr-resources.com

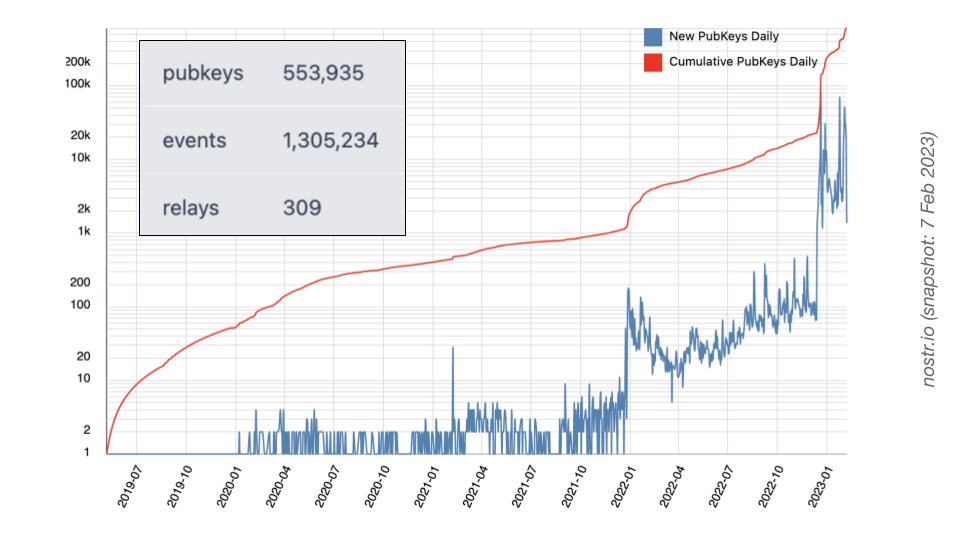

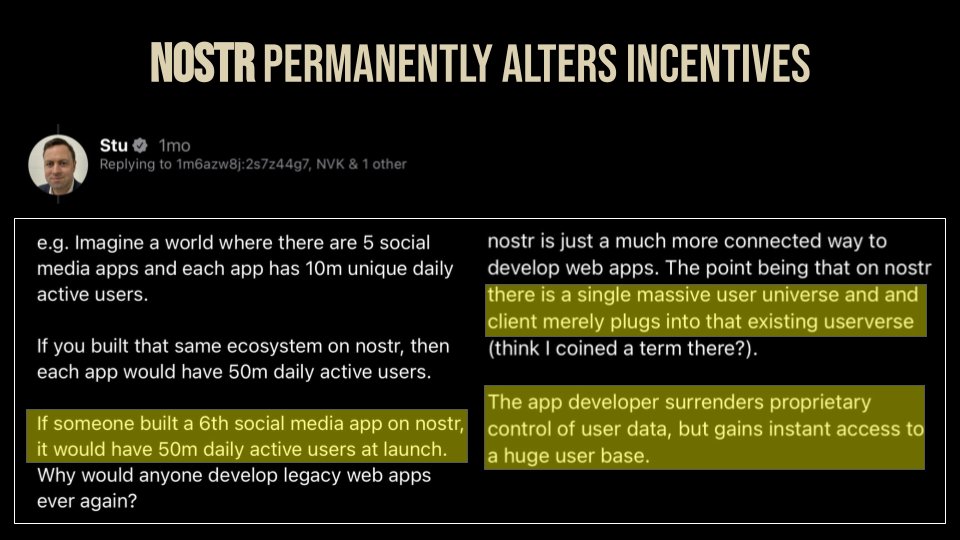

This fact massively alters the incentives for developers.

As any app built utilizing the nostr protocol instantly begins life with potential access to this 'userverse'.

As any app built utilizing the nostr protocol instantly begins life with potential access to this 'userverse'.

🔮Find me on #nostr:

npub14hn6p34vegy4ckeklz8jq93mendym9asw8z2ej87x2wuwf8werasc6a32x

npub14hn6p34vegy4ckeklz8jq93mendym9asw8z2ej87x2wuwf8werasc6a32x

• • •

Missing some Tweet in this thread? You can try to

force a refresh