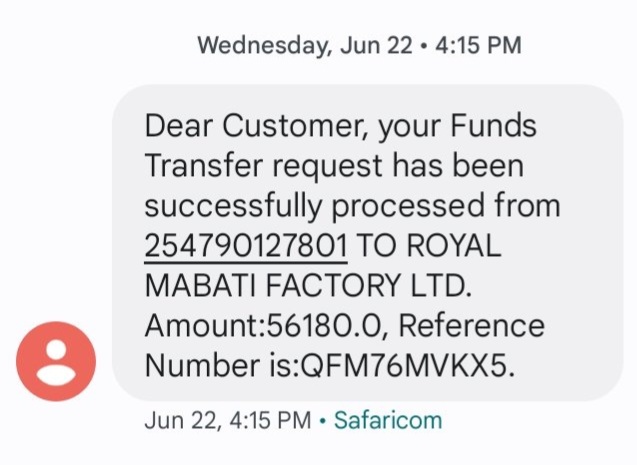

On June 2022, Jackline Makena bought Mabatis worth Ksh. 56,180 from Royal Mabati Factory.

She paid via Mpesa.

MPESA transaction attached below.

#RoyalMabatiFraud.

1/

She paid via Mpesa.

MPESA transaction attached below.

#RoyalMabatiFraud.

1/

The payment was confirmed.

However, Royal Mabati NEVER delivered nor processed her order.

After push and pull, Jacky was frustrated but never gave up.

In August, 3 months later, she requested for a refund since the company wasn't communicating to her.

#RoyalMabatiFraud

2/

However, Royal Mabati NEVER delivered nor processed her order.

After push and pull, Jacky was frustrated but never gave up.

In August, 3 months later, she requested for a refund since the company wasn't communicating to her.

#RoyalMabatiFraud

2/

Jackline was Advised by the company to fill a Refund Request Form and her money was to be refunded within 2 week.

She filled the form.

#RoyalMabatiFraud.

She filled the form.

#RoyalMabatiFraud.

Sadly, Royal Mabati ceased picking her calls.

It is now six months since she filled that Refund Request Form.

Royal Mabati swindled her hard earned money.

Ksh. 56,000 is alot of money.

#RoyalMabatiFraud

It is now six months since she filled that Refund Request Form.

Royal Mabati swindled her hard earned money.

Ksh. 56,000 is alot of money.

#RoyalMabatiFraud

I tried to personally contact Royal Mabati over this issue, I got no word from them.

Is this how Royal Mabati operates?

#RoyalMabatiFraud.

Is this how Royal Mabati operates?

#RoyalMabatiFraud.

• • •

Missing some Tweet in this thread? You can try to

force a refresh