New DEX protocols migrated and launched on @arbitrum every week since #arbitrumseason started but how are the top 4 Dexes doing and who's winning the #dexwars? Is the @arbitrum DEX market really so lucrative? I crunch data with @DuneAnalytics 📊 to help you find out!

👇

0/13

👇

0/13

This thread will cover:

🔹DEX landscape overview

🔹Market share analysis of Volume and Users

🔹Data insights per month

🔹Concluding thoughts

1/13

The market share charts only feature @Balancer , @Uniswap , @SushiSwap and @CurveFinance

🔹DEX landscape overview

🔹Market share analysis of Volume and Users

🔹Data insights per month

🔹Concluding thoughts

1/13

The market share charts only feature @Balancer , @Uniswap , @SushiSwap and @CurveFinance

The @arbitrum DEX landscape has always been dominated by native DEX protocols but it has recently attracted the attention of multiple native entrants such as the v2 fork @SwapFishFi , @CamelotDEX , @ShellProtocol with @SwapFishFi almost hitting 50m in TVL at one point

2/13

2/13

So this begs the question, are non-native DEXes losing market share and are DEXes that lucrative? Taking a looking a look at this volume chart comparing the top 4 non native dexes, we observe a decreasing trend in DEX volume despite the growth of the @arbitrum ecosystem

3/13

3/13

There is a clear downtrend in non-native DEX volume after December with the influx of new entrants, among the 4 non-native dexes, @Uniswap consistently owns an overwhelming 80% market share of volume on @arbitrum ,while there is a clear downtrend in @CurveFinance volume

4/13

4/13

The only competitor that can barely control 7% of volume is @SushiSwap yet the users comparison paints quite a different picture. @SushiSwap consistently attracts more than 30% of users while @Balancer owns 10%. This demonstrates that @Uniswap has higher volume per dex user

5/13

5/13

Taking a look at the dex users table, we observe that @CurveFinance has dipped to almost absolute irrelevance with barely 100 users in december. The number of DEX users on these dexes hasn't actually decreased significantly despite the dip in volume

6/13

6/13

Lets take a look at some insights for the past month, Uniswap has attracted over $1.1B in volume on @arbitrum with nearly 78% dominance while @SushiSwap held on to about 13% (200M in volume)

7/13

7/13

Zooming in on user numbers, @SushiSwap was able to average almost 32% of Daily DEX users over the past month while @Uniswap only averaged 44.9% of users. Surprisingly @Balancer owns almost 20% of DEX user market share

8/13

8/13

The strongest native DEX is @CamelotDEX with their well-knit partnerships and customizability. They have already done $15m in cumulative vol and is on track to take over @Balancer . This is impressive because unlike the native dexes they provide liquidity for low caps.

9/13

9/13

Over the past 6 months the average annualized total DEX volume of the 4 protocols was $23.2B. Using back of paper calculation, at the following swap fees this is the size of @arbitrum DEX revenue market:

1.0% fee = $23m

0.3% fee = $6.9m

0.5% fee = $11.5m

10/13

1.0% fee = $23m

0.3% fee = $6.9m

0.5% fee = $11.5m

10/13

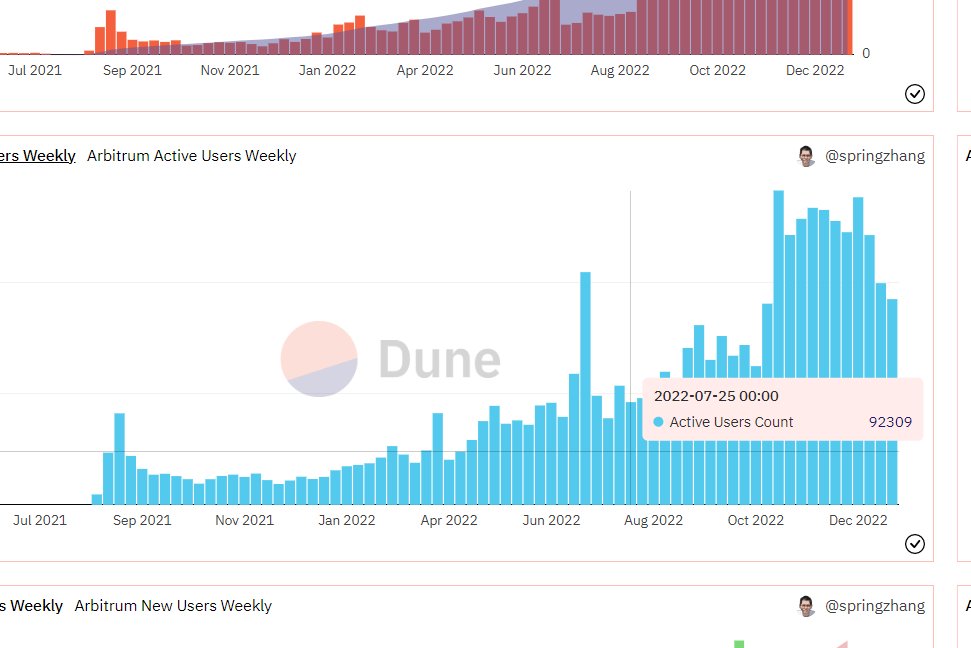

Taking a look at @superamscom 's Arbitrum overview ,there is growing active user count despite the dip in DEX users. A potential reasons for this is airdrop farming.

Average DAU on @arbitrum is almost 200k while average DEX DAU is 14k, DEX penetration is at about 7%

11/13

Average DAU on @arbitrum is almost 200k while average DEX DAU is 14k, DEX penetration is at about 7%

11/13

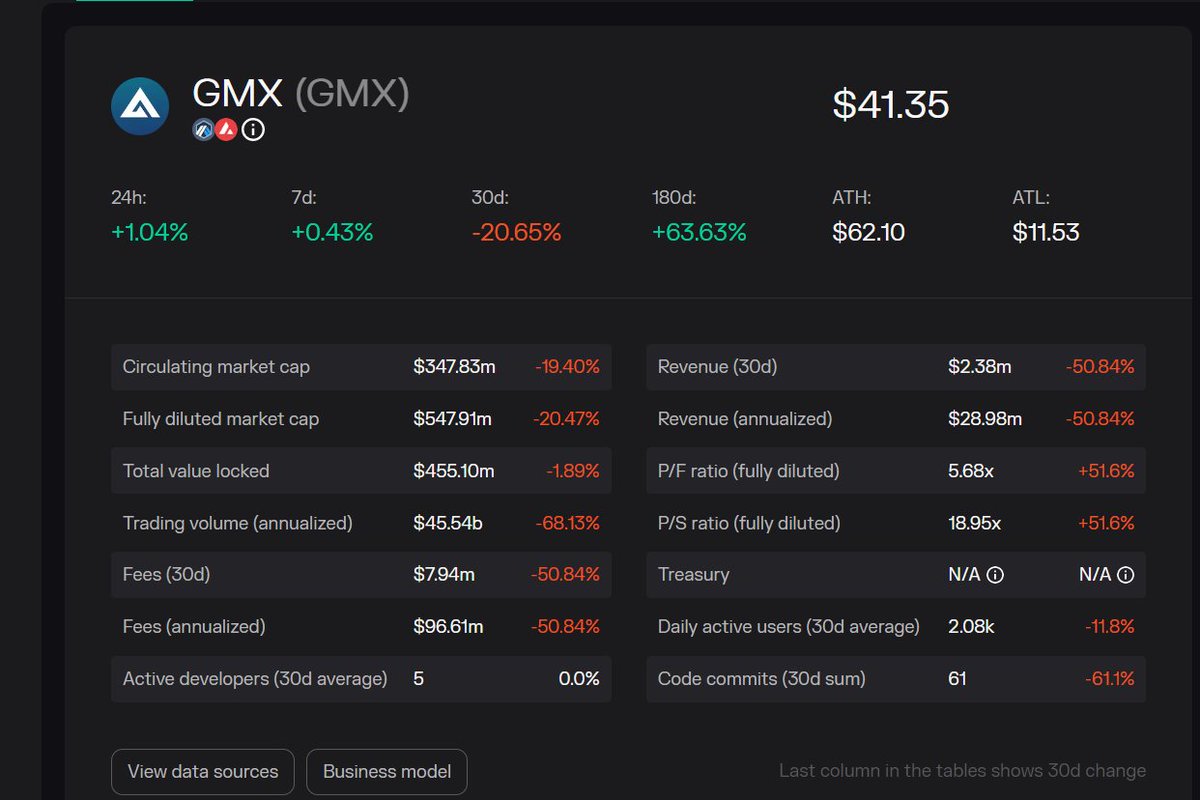

Personally i don't think theres any more room for native dexes to grow, neither do i think DEXes are as profitable as perps like @GMX_IO which did almost $96m in annualized fees.

Source: @tokenterminal

12/13

Source: @tokenterminal

12/13

However, i don't dislike the idea of onboarding new protocols and forming strong partnerships that @orbitaldex and @CamelotDEX is trying to achieve. With innovative protocols such as @GammaSwapLabs solving issues for LPs, we could see growth in the dex market on @arbitrum

13/13

13/13

Thanks for making it this far, this is the finished dashboard for your reference:

dune.com/defimochi/arbi…

dune.com/defimochi/arbi…

Trust worthy Threadoors and friends of @defi_mochi:

@rektdiomedes

@defiprincess_

@TheDeFinvestor

@LouisCooper_

@Chinchillah_

@jake_pahor

@DeFiMinty

@midoji7

@BackTheBunny

@0xTindorr

@crypto_linn

@CryptoDragonite

@0xCrypto_doctor

@eli5_defi

@xpnp404

@WinterSoldierxz

@Slappjakke

@rektdiomedes

@defiprincess_

@TheDeFinvestor

@LouisCooper_

@Chinchillah_

@jake_pahor

@DeFiMinty

@midoji7

@BackTheBunny

@0xTindorr

@crypto_linn

@CryptoDragonite

@0xCrypto_doctor

@eli5_defi

@xpnp404

@WinterSoldierxz

@Slappjakke

Special thanks to my donatooors for making these speed dashboard runs possible:

@0xGeeGee

@mazeydefi

@B2Option

@CryptoTaxCat

@gryndamere

@0xFlips

@0xGeeGee

@mazeydefi

@B2Option

@CryptoTaxCat

@gryndamere

@0xFlips

Sorry guys I got mixed up abt the decimals, the correct figure is 230m, 115m and 69m respectively, it's still rather low considering that is the entire Dex market while gmx made 96m in fees for the year

Sorry guys I got mixed up abt the decimals, the correct figure for the revenue numbers is 230m, 115m and 69m respectively, it's still rather low considering that is the entire Dex market while gmx made 96m in fees for the year

• • •

Missing some Tweet in this thread? You can try to

force a refresh