1/ Investors are navigating 2023 with our 44-page Year Ahead for DeFi report covering:

🔹Predictions

🔹Themes

🔹Challenges & Opportunities 👀

Here is the 13 tweet report breakdown, simplified with charts & data: 👇🧵

🔹Predictions

🔹Themes

🔹Challenges & Opportunities 👀

Here is the 13 tweet report breakdown, simplified with charts & data: 👇🧵

DeFi was the golden child of 2020, acting as the first true narrative of the last market cycle.

Its initiation into the crypto mainstream has now endearingly gone down in history as “DeFi Summer.”

Its initiation into the crypto mainstream has now endearingly gone down in history as “DeFi Summer.”

While DeFi has come far, obstacles remain:

1. DeFi products with traction are speculation-based

2. Onboarding new users is very difficult

3. Retaining users is even harder

4. Crypto UX is not good

The challenging end goal is self-sovereignty & a transparent, borderless system

1. DeFi products with traction are speculation-based

2. Onboarding new users is very difficult

3. Retaining users is even harder

4. Crypto UX is not good

The challenging end goal is self-sovereignty & a transparent, borderless system

We explore 7 themes in DeFi that make us excited for 2023:

1. Tailwinds for DEXs

2. DeFi Blue Chips

3. Speculation Primitives

4. Undercollateralized Money Markets

5. Passive LP Products

6. UX Aggregators

7. veTokens

Let's dive in to the charts ⬇️

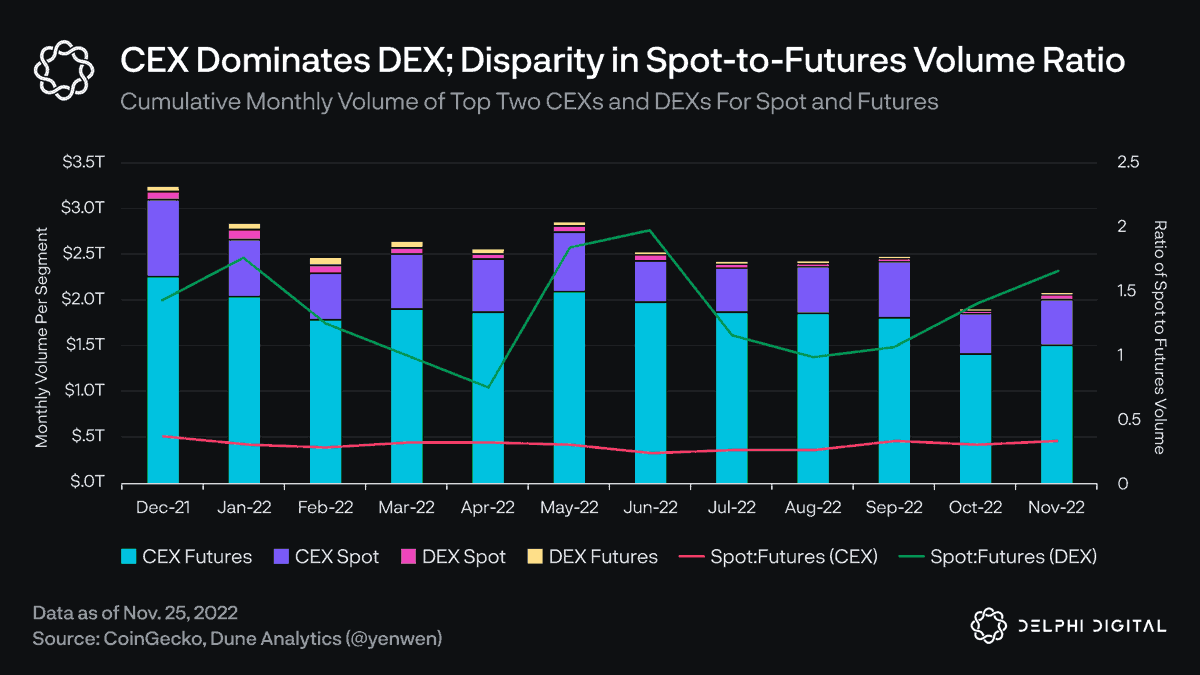

1. Tailwinds for DEXs

2. DeFi Blue Chips

3. Speculation Primitives

4. Undercollateralized Money Markets

5. Passive LP Products

6. UX Aggregators

7. veTokens

Let's dive in to the charts ⬇️

1. Tailwinds for DEXs

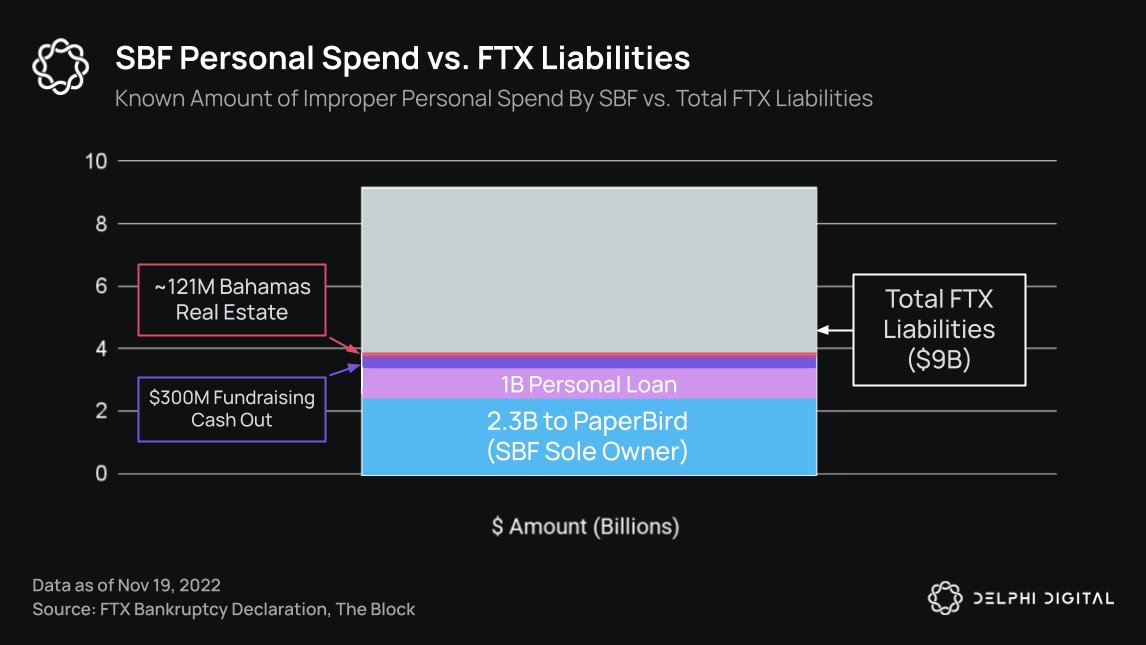

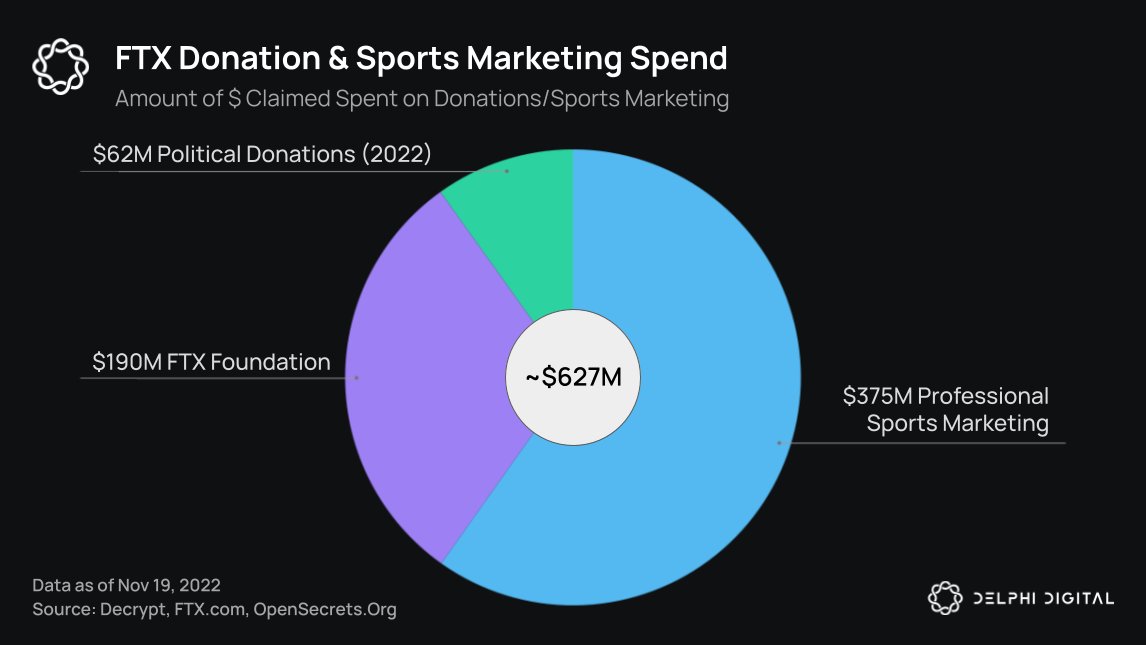

Transparency provided by public ledger blockchains makes DeFi protocols auditable in real-time, curtailing risks that led to the downfall of FTX.

Perhaps market makers will now see how DEXs are the path forward for price discovery and trading in crypto.

Transparency provided by public ledger blockchains makes DeFi protocols auditable in real-time, curtailing risks that led to the downfall of FTX.

Perhaps market makers will now see how DEXs are the path forward for price discovery and trading in crypto.

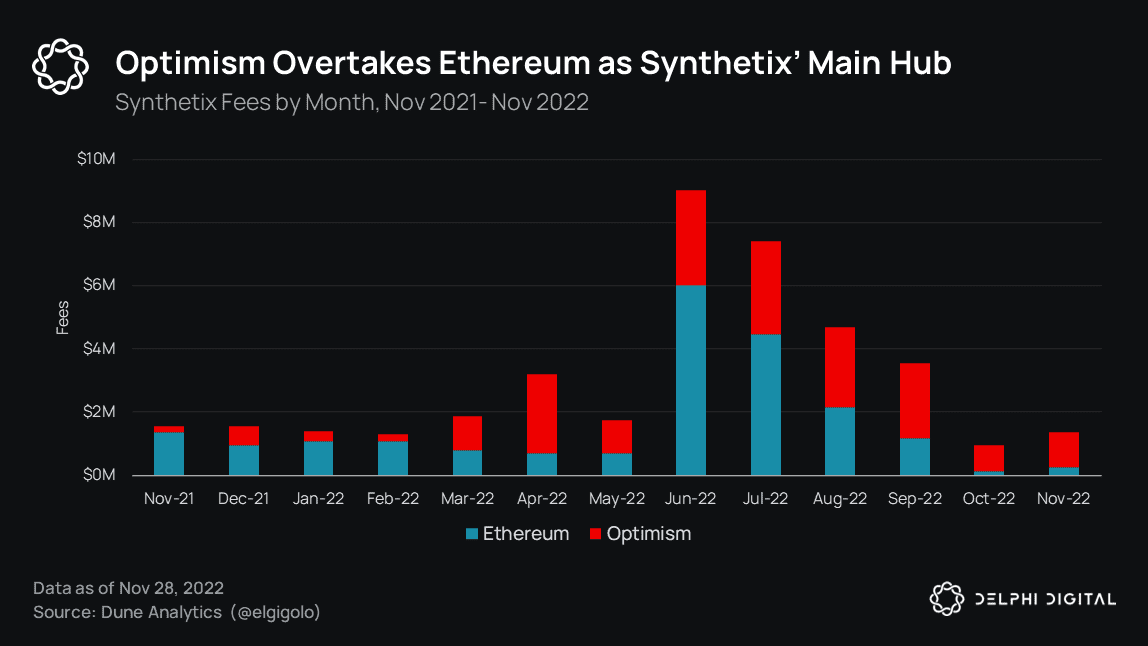

2. DeFi Blue Chips

DeFi blue chips still dominate their respective sectors.

As the sole form of collateral & recipient of platform fees, @synthetix_io holds the most straightforward value accrual and utility of any major DeFi token.

@optimismFND has become its new main hub.

DeFi blue chips still dominate their respective sectors.

As the sole form of collateral & recipient of platform fees, @synthetix_io holds the most straightforward value accrual and utility of any major DeFi token.

@optimismFND has become its new main hub.

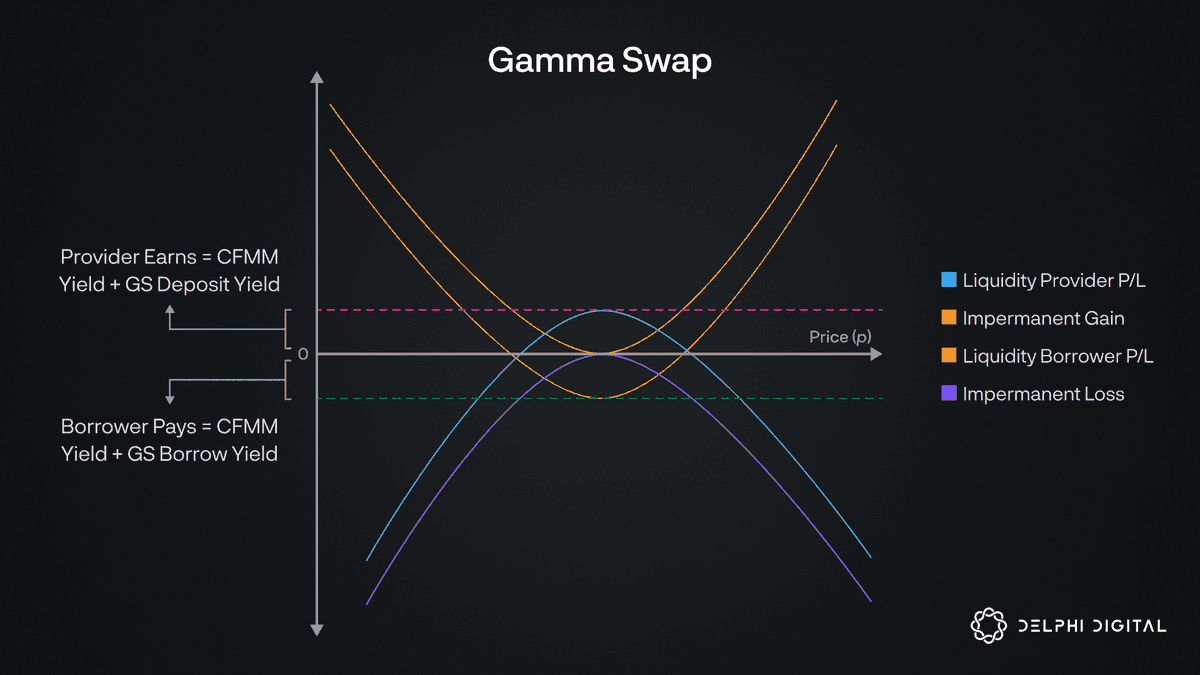

3. Speculation Primitives

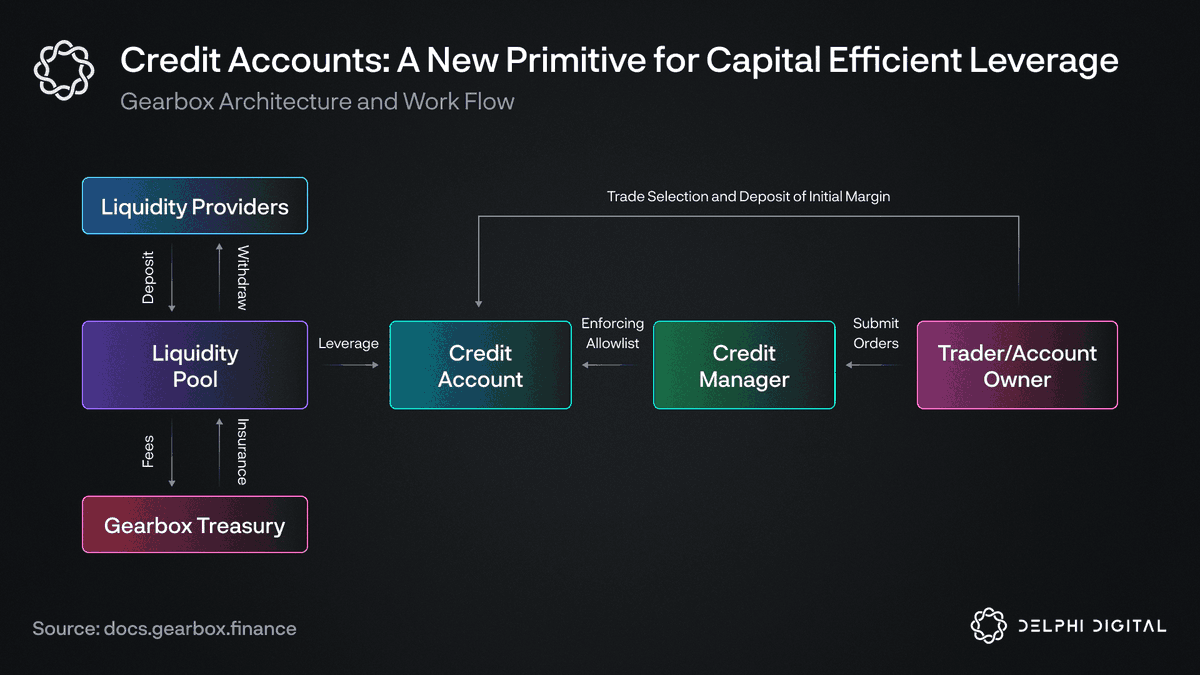

There’s been a lack of convenient, capital-efficient access to leverage in DeFi so far.

@GearboxProtocol allows for composable, capital-efficient leverage through its credit accounts with v2 streamlining liquidations and gas costs.

There’s been a lack of convenient, capital-efficient access to leverage in DeFi so far.

@GearboxProtocol allows for composable, capital-efficient leverage through its credit accounts with v2 streamlining liquidations and gas costs.

4. Undercollateralized Money Markets

Undercollateralized Money Markets serve the speculation use case by funding market makers and hedge funds with efficient leverage.

Default risks along with counterparty and concentration risk are always important to consider.

Undercollateralized Money Markets serve the speculation use case by funding market makers and hedge funds with efficient leverage.

Default risks along with counterparty and concentration risk are always important to consider.

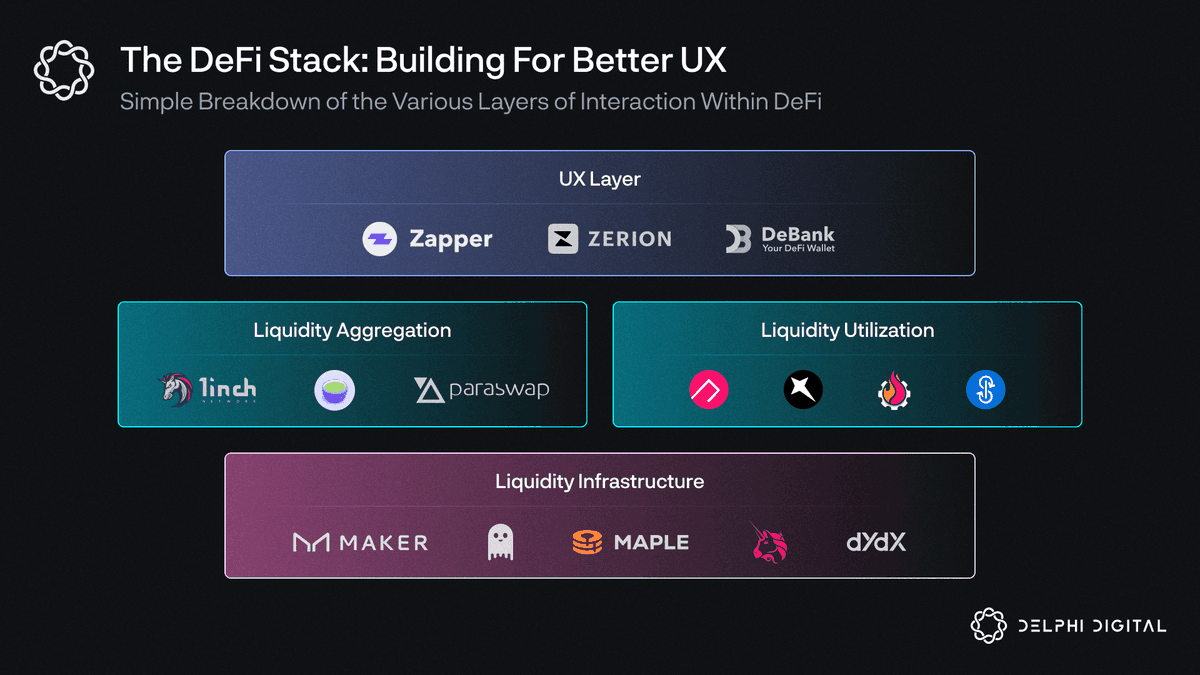

6. UX Aggregators

We can create UX aggregators that act as a unified front end for all of DeFi.

With different aggregation layers, dApps become "liquidity infrastructure" with their main goal being to house liquidity and enable efficient execution for user activity.

We can create UX aggregators that act as a unified front end for all of DeFi.

With different aggregation layers, dApps become "liquidity infrastructure" with their main goal being to house liquidity and enable efficient execution for user activity.

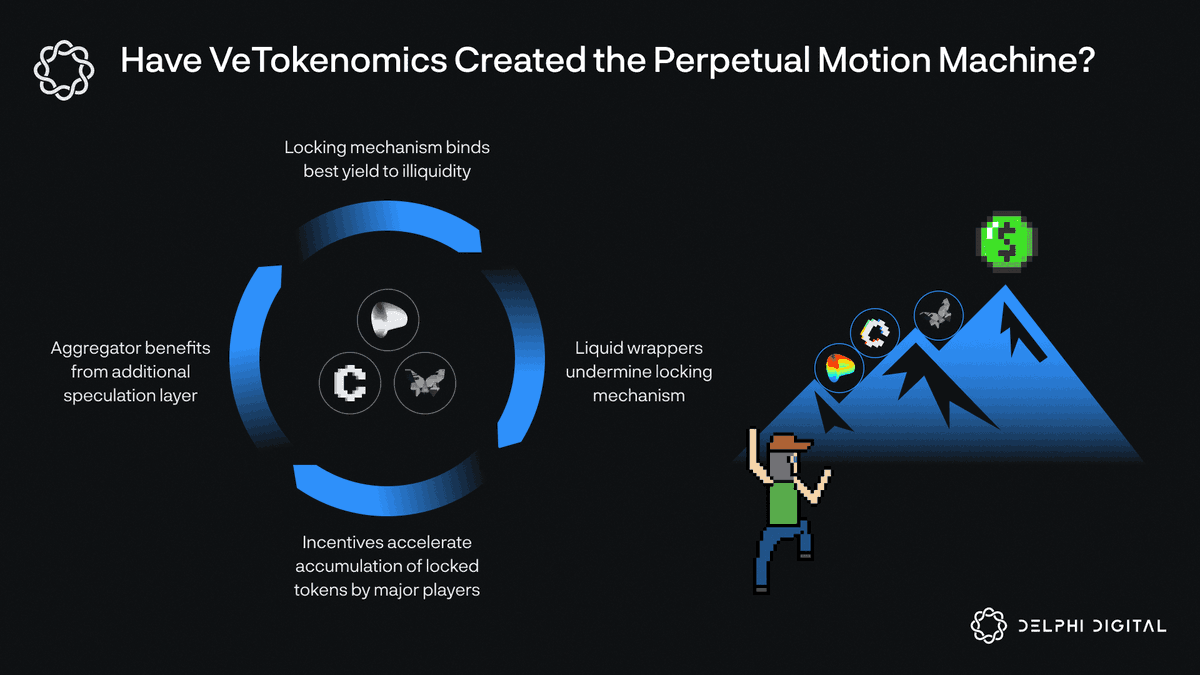

7. veTokens

Projects are implementing veTokenomics as a levered liquidity-mining program without concrete objectives.

All roads lead to a laissez-faire approach with value to be extracted while inching towards equilibrium.

Projects are implementing veTokenomics as a levered liquidity-mining program without concrete objectives.

All roads lead to a laissez-faire approach with value to be extracted while inching towards equilibrium.

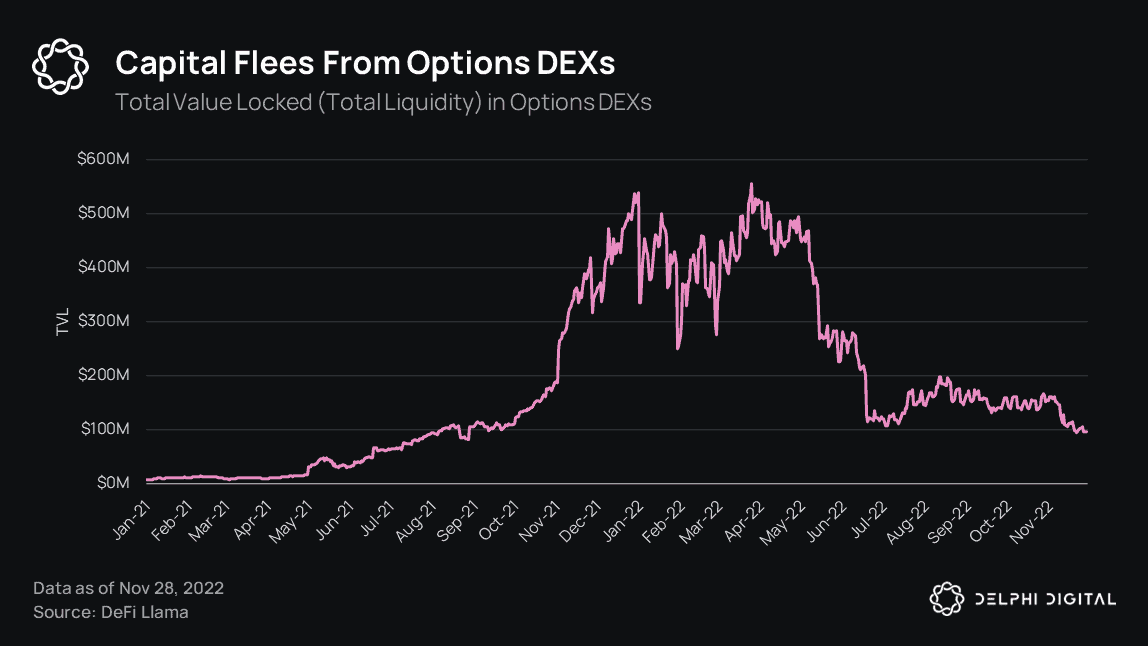

Along with themes for the future, there were multiple surprises in 2022 including:

🔹Saturation of structured products

🔹Lack of on-chain derivatives adoption (besides @dYdX 💪)

🔹Lack of DeFi options traction ⬇️

🔹Saturation of structured products

🔹Lack of on-chain derivatives adoption (besides @dYdX 💪)

🔹Lack of DeFi options traction ⬇️

Overall, there’s a lot to be excited about.

DeFi stands on the precipice of some of the greatest opportunities (and challenges) the financial industry has seen.

The Year Ahead for DeFi, free for all to read ⬇️

members.delphidigital.io/reports/the-ye…

DeFi stands on the precipice of some of the greatest opportunities (and challenges) the financial industry has seen.

The Year Ahead for DeFi, free for all to read ⬇️

members.delphidigital.io/reports/the-ye…

• • •

Missing some Tweet in this thread? You can try to

force a refresh