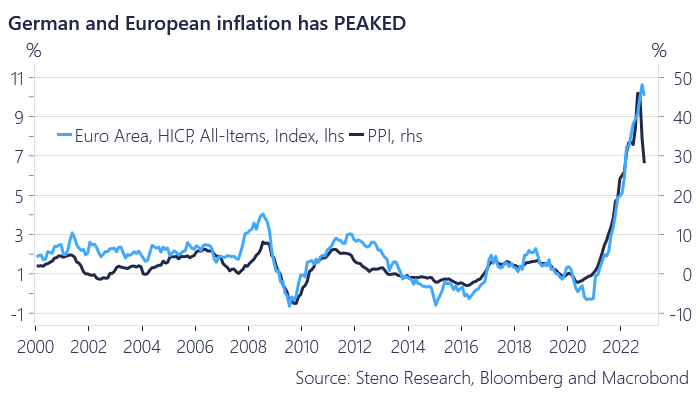

7 charts showing why inflation is likely to DROP further!

1/n

1/n

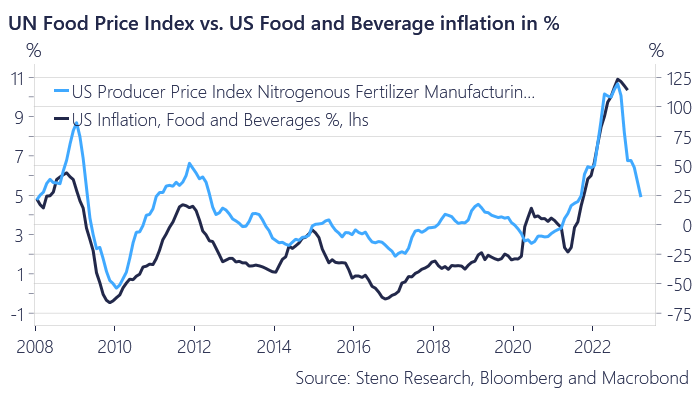

Food prices will drop as a lagged consequence of a severe slowdown in fertilizer prices. The drop is likely to kick in NOW

2/n

2/n

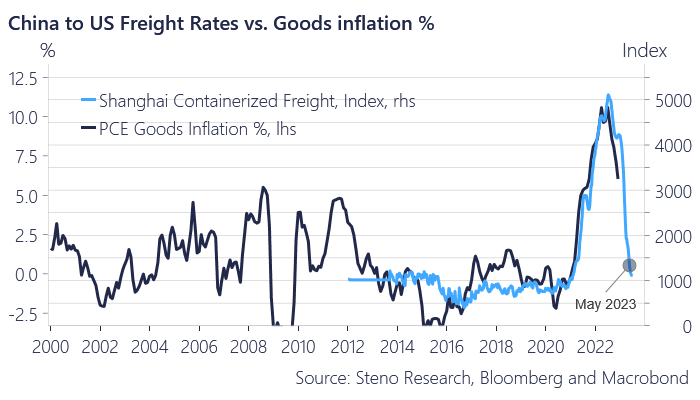

Freight rates have fallen off a cliff due to 1) weaker demand and 2) easing supply chains in China

Goods inflation will follow since transportation costs matter for almost all goods

Goods inflation at 0% in May?

3/n

Goods inflation will follow since transportation costs matter for almost all goods

Goods inflation at 0% in May?

3/n

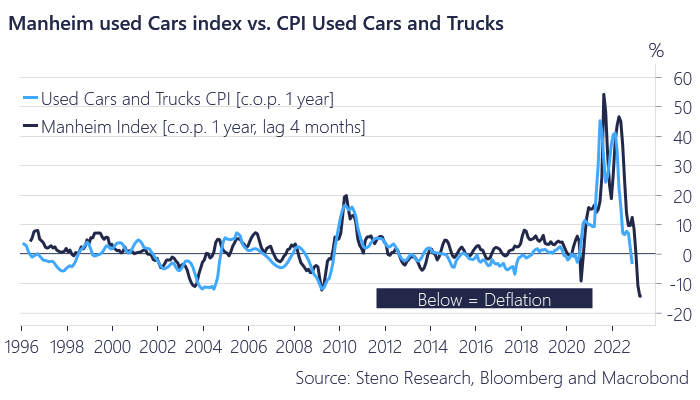

We already have outright deflation in car prices and they are likely going to drop further

This is a category that could surprise clearly on the low side this week

4/n

This is a category that could surprise clearly on the low side this week

4/n

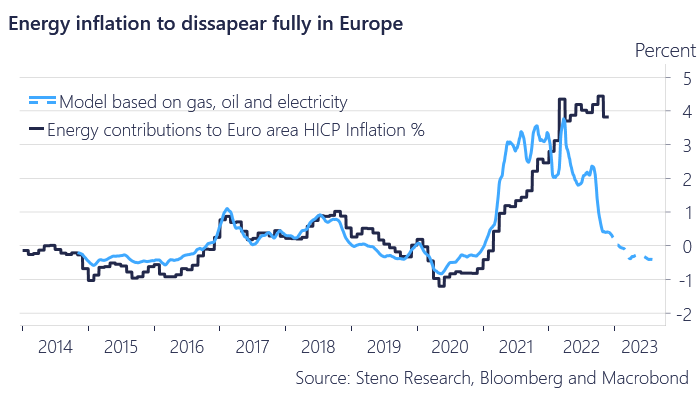

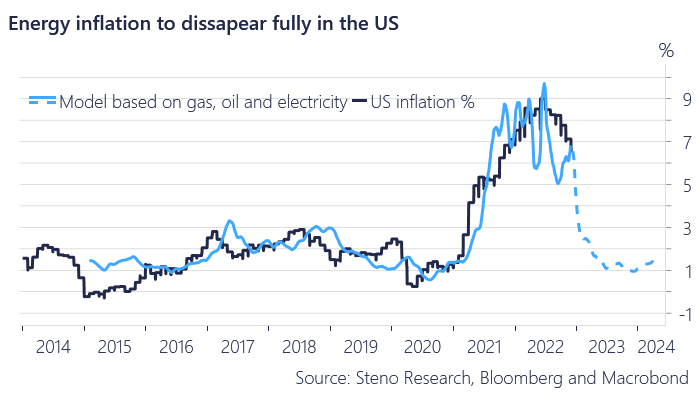

Energy prices will help drag the inflation index lower and given the spike in energy prices in 2021/2022, we should expect an easing price pressure to spill over to weaker core inflation as well

5/n

5/n

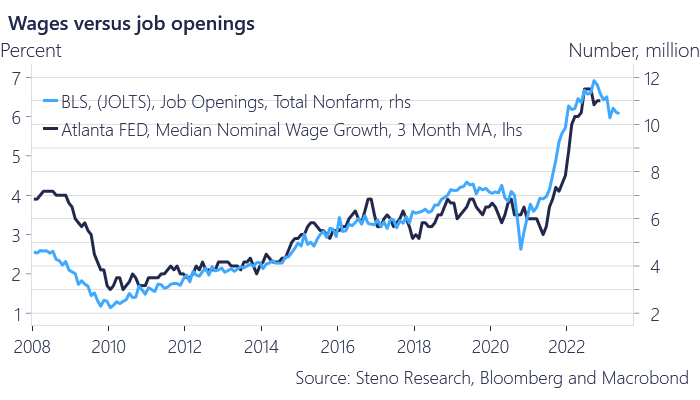

Speaking of core inflation, which is linked to wage growth..

Job openings have softened and they usually lead wage growth .. Wage growth has peaked as well..

6/n

Job openings have softened and they usually lead wage growth .. Wage growth has peaked as well..

6/n

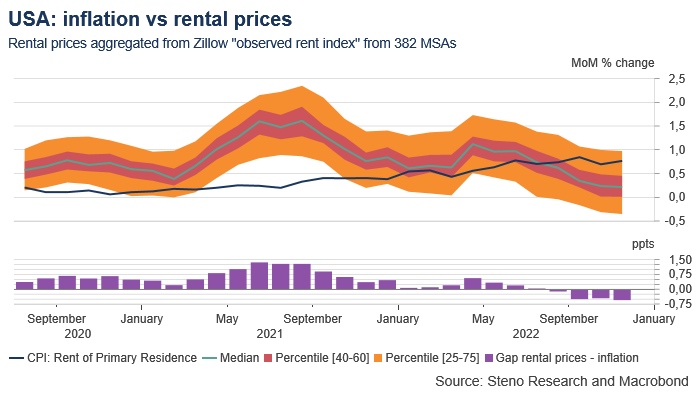

Housing inflation is now running MUCH above what is actually realized on the market.. We are closing in on peakish territory in the ULTRA-late shelter cost category as well

7/n

7/n

All in all, we expect both headline and core inflation to surprise to the DOWNSIDE again this week.

This was an extract of the institutionally backed macro strategy that we deliver on stenoresearch.com at affordable prices.

Go have a look. It doesn't hurt you :)

8/n

This was an extract of the institutionally backed macro strategy that we deliver on stenoresearch.com at affordable prices.

Go have a look. It doesn't hurt you :)

8/n

• • •

Missing some Tweet in this thread? You can try to

force a refresh