TSMC Q4 2022 Earnings Thread

Record numbers, but all eyes are on utilization rates and capital spending guidance for 2023.

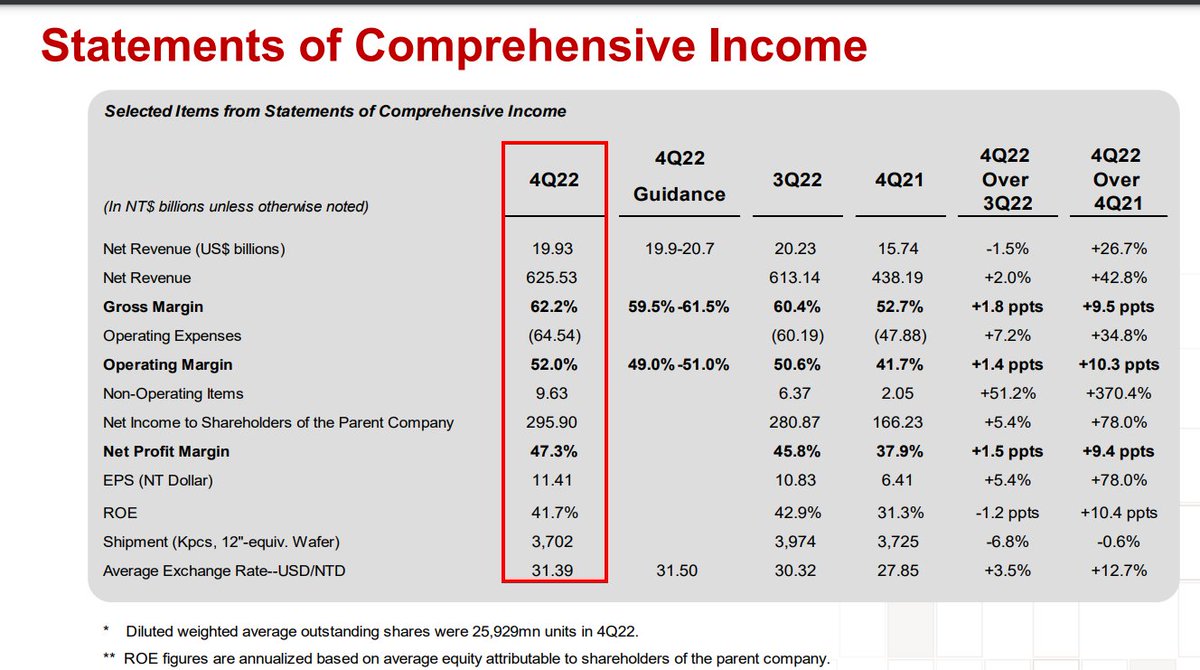

TSM came in on the low end of previous guidance for revenue due to utilization issues from economic weakness. $TSM

Record numbers, but all eyes are on utilization rates and capital spending guidance for 2023.

TSM came in on the low end of previous guidance for revenue due to utilization issues from economic weakness. $TSM

Margins were above guidance, primarily due to foreign exchange changes. TSMC specifically cited utilization rates as a bit of a drag.

N5 and N7 grew in 2022, but there is some weakness now.

Q4 had a slight decrease in wafer shipments year on year, but huge ASP increases from N5

N5 and N7 grew in 2022, but there is some weakness now.

Q4 had a slight decrease in wafer shipments year on year, but huge ASP increases from N5

Q1 2023 guidance is out!

$16.7 to $17.5B revenue which is down significantly down due vs this quarter's $19.3B

Underutilization issues due to semiconductor cyclicality.

Margins are down massively to 53.5% to 55.5% from 62.2%

$16.7 to $17.5B revenue which is down significantly down due vs this quarter's $19.3B

Underutilization issues due to semiconductor cyclicality.

Margins are down massively to 53.5% to 55.5% from 62.2%

Long term gross margin guidance for TSMC is still 53%.

TSMC says R&D spending should be up 20% this year.

TSMC is tightening its capital spending saying they are being disciplined based on long term structural growth.

2023 $32B to $36B capex budget, which is down from this year

TSMC says R&D spending should be up 20% this year.

TSMC is tightening its capital spending saying they are being disciplined based on long term structural growth.

2023 $32B to $36B capex budget, which is down from this year

The $32B to $36B Capex is split 70% to the leading edge, 20% to the trailing edge, and 10% to mask making and advanced packaging.

Leading edge - ~$23.8B

Trailing edge - ~$6.8B

Masks and packaging - ~$3.5B

Leading edge - ~$23.8B

Trailing edge - ~$6.8B

Masks and packaging - ~$3.5B

TSMC expects the semiconductor cycle to bottom in the first half.

They project the industry to have

-4% for the semiconductor industry in 2023, excluding memory.

-3% for foundry.

TSMC expects they will beat that by growing slightly

They project the industry to have

-4% for the semiconductor industry in 2023, excluding memory.

-3% for foundry.

TSMC expects they will beat that by growing slightly

N3 will be mid-single-digit revenue to be 2023.

Higher than N5 was in 2020, but N5 went into production in April 2020 vs N3 being in production all year.

Much slower ramp, especially considering the huge increase in wafer pricing.

semianalysis.com/p/tsmcs-3nm-co…

Higher than N5 was in 2020, but N5 went into production in April 2020 vs N3 being in production all year.

Much slower ramp, especially considering the huge increase in wafer pricing.

semianalysis.com/p/tsmcs-3nm-co…

N7/N6 utilization was lower than expected in Q4.

The capacity commitments are very flexible as expected.

It will be down a lot in H1, and with only a mild pick up in 2H23.

TSM says it is a temporary issue, not a cyclical one and that specialty technologies on N7 will ramp.

The capacity commitments are very flexible as expected.

It will be down a lot in H1, and with only a mild pick up in 2H23.

TSM says it is a temporary issue, not a cyclical one and that specialty technologies on N7 will ramp.

TSMC is considering specialty fab in Europe for automotive-specific customers based on government support.

TSMC asking the EU to show them the money if they want a fab.

TSMC asking the EU to show them the money if they want a fab.

Margins of overseas fabs are lower outside of Taiwan but with government support, TSMC can make up for it.

TSMC confirms they are pricing to value for the geographic diversity benefits that customers get from overseas fabs.

Confirms that US and Japan fabs do have higher pricing.

TSMC confirms they are pricing to value for the geographic diversity benefits that customers get from overseas fabs.

Confirms that US and Japan fabs do have higher pricing.

The first question is about cost differential between US and Taiwan.

They used the press releases from TSMC to say that it costs ~$300k per wafer for N3 in TW vs ~$800k for N3 in US.

He ignores the TW number is for Capex only, US is not.

Explained here.

semianalysis.com/p/tsmcs-3nm-co…

They used the press releases from TSMC to say that it costs ~$300k per wafer for N3 in TW vs ~$800k for N3 in US.

He ignores the TW number is for Capex only, US is not.

Explained here.

semianalysis.com/p/tsmcs-3nm-co…

TSMC tax rate is going from 11% to 15% year on year due to the expiration of tax benefits in Taiwan.

Taiwan is likely going to pass more benefits, but they haven't yet.

Taiwan is likely going to pass more benefits, but they haven't yet.

CC Wei is saying that semiconductors will capture more value in our daily lives. Says TSMC are pricing to value and that structurally brings up gross margin vs few years ago.

TSMC argues the 7nm underutilization issues are temporary and will not be repeated at 5nm and 3nm

That's an interesting thought

Part of the argument as that the tools are very transferrable

Definitely true for N3E and N5, but SAC and higher number of EUV for N3, less transferable

That's an interesting thought

Part of the argument as that the tools are very transferrable

Definitely true for N3E and N5, but SAC and higher number of EUV for N3, less transferable

Their main argument was around the pandemic boom and supply chain disruptions which led to inventory buildups and pull-forward demands.

"Certainly, it's not a U shape for the recovery in the 2nd half"

WOW

😳😳😳

WOW

😳😳😳

TSMC says long term capital intensity is mid to high 20%'s

Question about if there is value in Moore's Law going forward given cost

TSMC argues density is important, but power consumption is even more important, and 3D IC SoIC technologies are also than the density of a process node

Power is where customers will derive value in shrinks

TSMC argues density is important, but power consumption is even more important, and 3D IC SoIC technologies are also than the density of a process node

Power is where customers will derive value in shrinks

In response to leading-edge costs, TSMC says

"We do not see any slowdowns for the adoption of our leading-edge technology"

"Technology adoption did not slow down"

TSMC also talks up hyperscale customers adopting leading edge.

A big part of the doubling in N3 tape-outs.

"We do not see any slowdowns for the adoption of our leading-edge technology"

"Technology adoption did not slow down"

TSMC also talks up hyperscale customers adopting leading edge.

A big part of the doubling in N3 tape-outs.

Question about if hyperscale demand will cannibalize the demand from merchant silicon.

TSMC says they don't think so.

TSMC says they don't think so.

TSMC reiterates 15% to 20% CAGR for revenue after 2023 slightly up year.

TSMC believes in 2023, units will fall for smartphones and PCs in 2023, but the content will go up.

Furthermore, they believe they will gain a share in these areas, which allows them to grow in 2023

TSMC believes in 2023, units will fall for smartphones and PCs in 2023, but the content will go up.

Furthermore, they believe they will gain a share in these areas, which allows them to grow in 2023

Advanced packaging grew at a similar rate in 2022 as total corporate rate.

~7% of revenue

TSMC believes that advanced packaging revenue in 2023 will be flat vs slight growth in total business.

Advanced packaging is under growing wafer revenue growth

~7% of revenue

TSMC believes that advanced packaging revenue in 2023 will be flat vs slight growth in total business.

Advanced packaging is under growing wafer revenue growth

TSMC argues they are a service business, not a contract manufacturer.

They are totally right because the foundry is rarely a 1-way street.

There is a constant back and forth with customers and co-development.

They are totally right because the foundry is rarely a 1-way street.

There is a constant back and forth with customers and co-development.

check out the other threads from #SiliconGang

Sravan:

Dan:

Cyw60:

Sravan:

https://twitter.com/SKundojjala/status/1613409777719312384?s=20

Dan:

https://twitter.com/dnystedt/status/1613410890094899200?s=20

Cyw60:

https://twitter.com/cyw60/status/1613437806386491393?s=20

See the full report of earnings here! More details included!

https://twitter.com/dylan522p/status/1613496314485956608?s=20

Full earnings report detailed and dissected here in a quick, punchy article.

https://twitter.com/dylan522p/status/1613496314485956608?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh