1/IMPORTANT - If you are a doctor we need YOUR Help please! (Free tool)

PLEASE take a few mintues to to respond to the DHSC consultation on pensions taxation

More info here - especially on the crucial government ommision to fix inflation issues with #FixNegativePIAs

See👇 & RT

PLEASE take a few mintues to to respond to the DHSC consultation on pensions taxation

More info here - especially on the crucial government ommision to fix inflation issues with #FixNegativePIAs

See👇 & RT

https://twitter.com/goldstone_tony/status/1602025512334925824

2/ Its really important to take the time to respond to the consultation.

There are different templates for GPs & consultants/hospital doctors, & also those close to retirement, & those (completely ignored by government) who are <55yrs

There are different templates for GPs & consultants/hospital doctors, & also those close to retirement, & those (completely ignored by government) who are <55yrs

3/ Use the free tool here

bit.ly/StopPensionThe…

It should only take a few minutes to use.

As always *PLEASE* take a few minutes to customise your response - let them know how this car crash of pension taxation is affecting YOU / your service / practice & your patients

bit.ly/StopPensionThe…

It should only take a few minutes to use.

As always *PLEASE* take a few minutes to customise your response - let them know how this car crash of pension taxation is affecting YOU / your service / practice & your patients

4/ The consultation is quite technical so some of this is necessarily technical

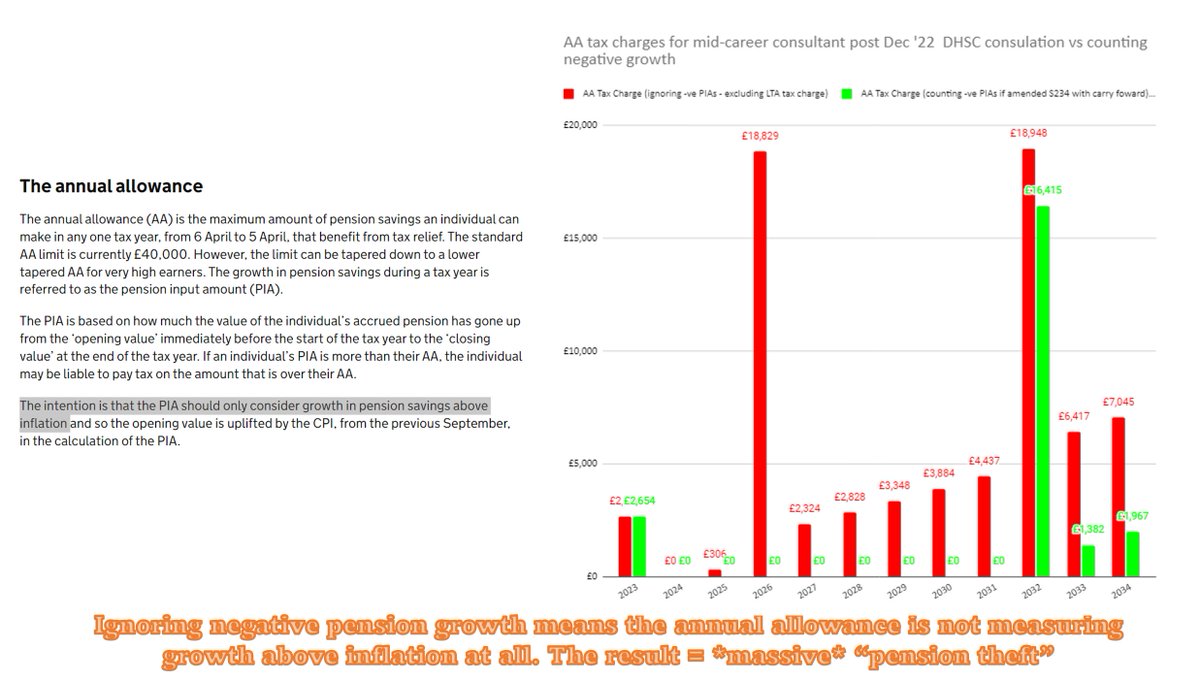

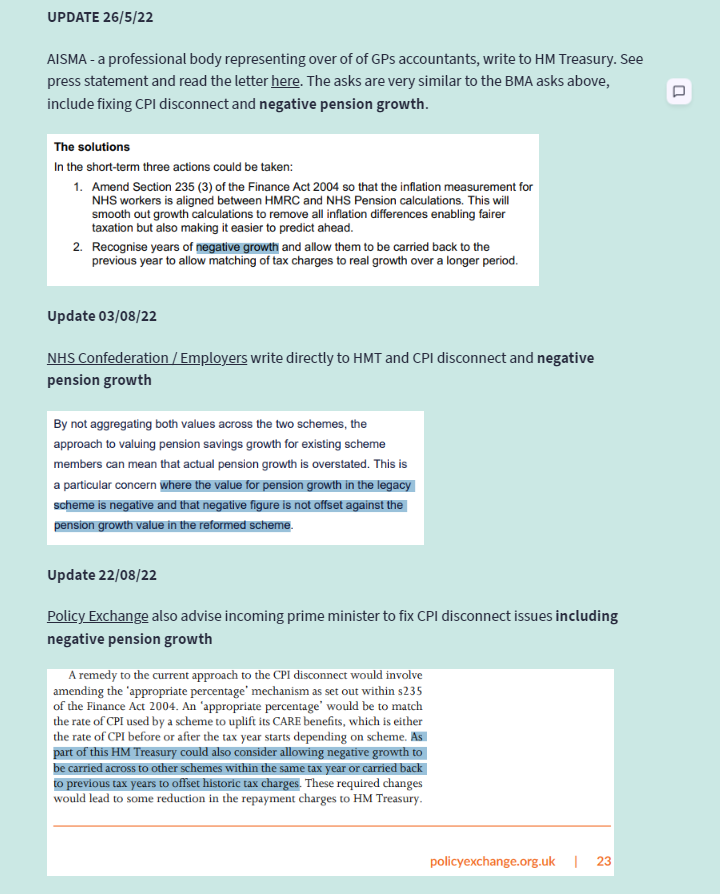

One of the more difficult issues to understand is "negative pension growth".

I cant emphasize enough how important it is to fix this. As things currently stand, many members will continue to pay

One of the more difficult issues to understand is "negative pension growth".

I cant emphasize enough how important it is to fix this. As things currently stand, many members will continue to pay

5/ *HUGE* & unfair AA charges despite the fact their overall pension may go down in 23/24 & 24/25. This is because government is taxing the part of your pension going up, and ingoring the bit going down. This is, basically, tantamount to theft. Read👇

https://twitter.com/goldstone_tony/status/1602025512334925824?s=20&t=gyWP3uKhwrK474asENUUOA

6/ & watch the two videos including this one I recorded with fellow pension expert @gdcuk

https://twitter.com/goldstone_tony/status/1602025544320688130?s=20&t=gyWP3uKhwrK474asENUUOA

7/ Once again please set aside some time to complete the consultation

bit.ly/StopPensionThe…

Better still do it RIGHT NOW (and personalise)! And then please RT / share on FB / Whatsapp etc

#FixNegativePIAs

#FixTheFinanceAct

Thank you in advance

bit.ly/StopPensionThe…

Better still do it RIGHT NOW (and personalise)! And then please RT / share on FB / Whatsapp etc

#FixNegativePIAs

#FixTheFinanceAct

Thank you in advance

• • •

Missing some Tweet in this thread? You can try to

force a refresh