Most crypto assets suck. From the thousands that are listed on @coingecko there’s max 50 that I would invest in.

Close to none generate reliable cashflows & the few that do are highly correlated to the crypto market's overall success.

We need to connect crypto to the real world

Close to none generate reliable cashflows & the few that do are highly correlated to the crypto market's overall success.

We need to connect crypto to the real world

What the last few years of on-chain gambling have shown is that blockchains are incredibly powerful machines to track and exchange assets at global scale.

It’s hard to quantify these things but probably an order of magnitude more efficient than the patchwork of siloed databases

It’s hard to quantify these things but probably an order of magnitude more efficient than the patchwork of siloed databases

.. & excel sheets that make the international financial system turn today.

You can see these massive efficiency gains at play with stablecoins, the first tokenized real world asset gaining adoption on-chain.

You can see these massive efficiency gains at play with stablecoins, the first tokenized real world asset gaining adoption on-chain.

Today, the stablecoin marketcap is around $140 billion.

The total value settled by stablecoin transfers was $7tn in 2022 implying a remarkably high money velocity.

Tether alone settled more value than Mastercard in 2022.

The total value settled by stablecoin transfers was $7tn in 2022 implying a remarkably high money velocity.

Tether alone settled more value than Mastercard in 2022.

It’s easy to see why. They are far superior for international B2B payments & retail cross border remittances.

They can be sent around the globe 24/7, to any person or entity, only requiring the sender and recipient to have a free open-source crypto wallet.

No middlemen involved

They can be sent around the globe 24/7, to any person or entity, only requiring the sender and recipient to have a free open-source crypto wallet.

No middlemen involved

I started getting paid my salary in stablecoins instead of fiat recently.

I reside in Australia and my employer is located in the United States

Cost with Bank (Fiat): 2%

Cost with Fintech: 0.7%

Cost with stables: 0.1% (off-ramp) + $1 blockchain tx fees

I reside in Australia and my employer is located in the United States

Cost with Bank (Fiat): 2%

Cost with Fintech: 0.7%

Cost with stables: 0.1% (off-ramp) + $1 blockchain tx fees

https://twitter.com/litocoen/status/1603612426208944129?s=20&t=M8coja4MwWNNR4ONiTW3uA

So how do we tokenize the next wave of financial assets and replicate the success of stablecoins to make stocks, bonds, commodities etc. as easily accessible to the 8 billion people around the globe as stablecoins are today ?

The answer is standardization 👇

The answer is standardization 👇

While there have been projects like RealT tokenizing real estate or Goldfinch financing SME’s in emerging markets, none of these attempts have managed to pull in assets *at scale* let alone compose with the rest of DeFi.

Here TradFi offers some promising answers through “Securitization”.

Securitization is process in which certain types of loans are pooled so that they can be repackaged into interest-bearing securities.

Securitization is process in which certain types of loans are pooled so that they can be repackaged into interest-bearing securities.

Why is this done?

- Diversification

- Some degree of “composability” (yes even in TradFi)

- Introduction of risk tranches

- Cheaper cost of capital

- Better liquidity

- Diversification

- Some degree of “composability” (yes even in TradFi)

- Introduction of risk tranches

- Cheaper cost of capital

- Better liquidity

Let’s unpack this.

One of the most complex pieces in lending is pricing the borrower's risk.

Over thousands of years humans have come up with risk models taking into account variables like the financial health of the borrower, loan duration and whether the loan is secured.

One of the most complex pieces in lending is pricing the borrower's risk.

Over thousands of years humans have come up with risk models taking into account variables like the financial health of the borrower, loan duration and whether the loan is secured.

But some parts are just impossible to foresee. Maybe the borrower dies. Or there is an earthquake in their town.

This is called idiosyncratic risk. Lenders respond to this by pricing a higher cost of capital than necessary.

This is called idiosyncratic risk. Lenders respond to this by pricing a higher cost of capital than necessary.

Smart people had the idea to pool hundreds of loans together smooth out the effect of these black swan events.

Instead of writing one $1000 loan to a borrower that would wipe you out completely in case of default, you buy $1000 worth of claims in a diversified loan bundle.

Instead of writing one $1000 loan to a borrower that would wipe you out completely in case of default, you buy $1000 worth of claims in a diversified loan bundle.

There is another benefit.

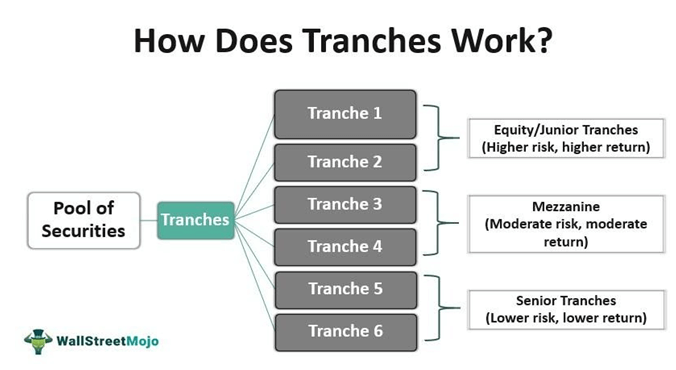

It’s called tranching.

By cutting up this loan bundle into two ore more tranches, whereby higher-yielding junior tranches incur losses before lower-yielding senior tranches, you can chunk it up into the distinct profiles that investors want.

It’s called tranching.

By cutting up this loan bundle into two ore more tranches, whereby higher-yielding junior tranches incur losses before lower-yielding senior tranches, you can chunk it up into the distinct profiles that investors want.

Higher risk, higher return or lower risk, lower return.

The cashflow generated from loan repayments are directed in chronological order to each tranche.

Any shortfalls and the junior tranche takes the first hit. That’s the risk.

The cashflow generated from loan repayments are directed in chronological order to each tranche.

Any shortfalls and the junior tranche takes the first hit. That’s the risk.

Tranching allows asset originators to finance loans at a cheaper rate

e.g if they originate $1b in loans yielding 10% they can securitize it, sell 30% of the loans as a Junior Tranche to Hedge Funds at 15%, 70% as a Senior to Banks at 4% and pay a weighted cost of capital of 7%

e.g if they originate $1b in loans yielding 10% they can securitize it, sell 30% of the loans as a Junior Tranche to Hedge Funds at 15%, 70% as a Senior to Banks at 4% and pay a weighted cost of capital of 7%

Buyers are happy as they hold a diversified portfolio of loan securities at a rate of return that matches their risk tolerance.

And the investment bank (or asset originator) is happy because they can pocket the spread (10% - 7%)

Ok but what does this have to do with crypto?

And the investment bank (or asset originator) is happy because they can pocket the spread (10% - 7%)

Ok but what does this have to do with crypto?

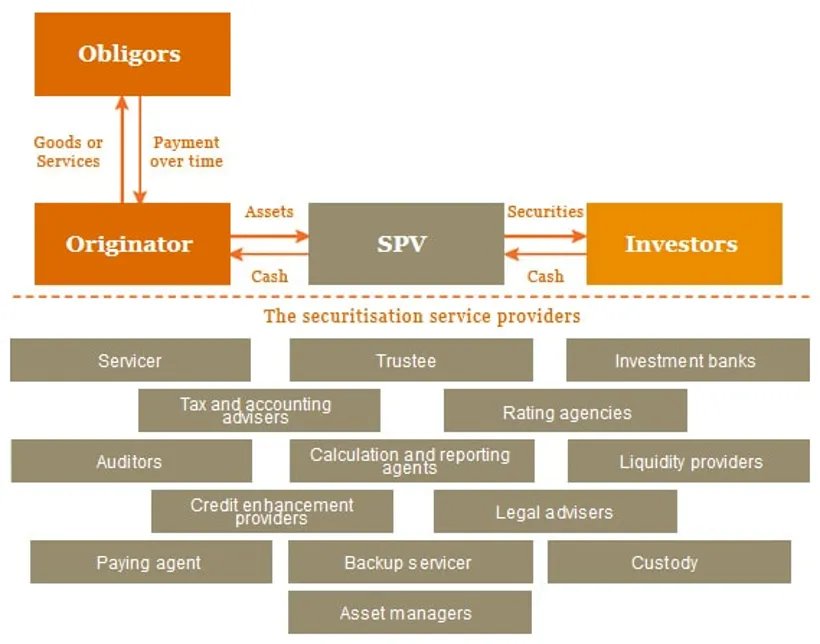

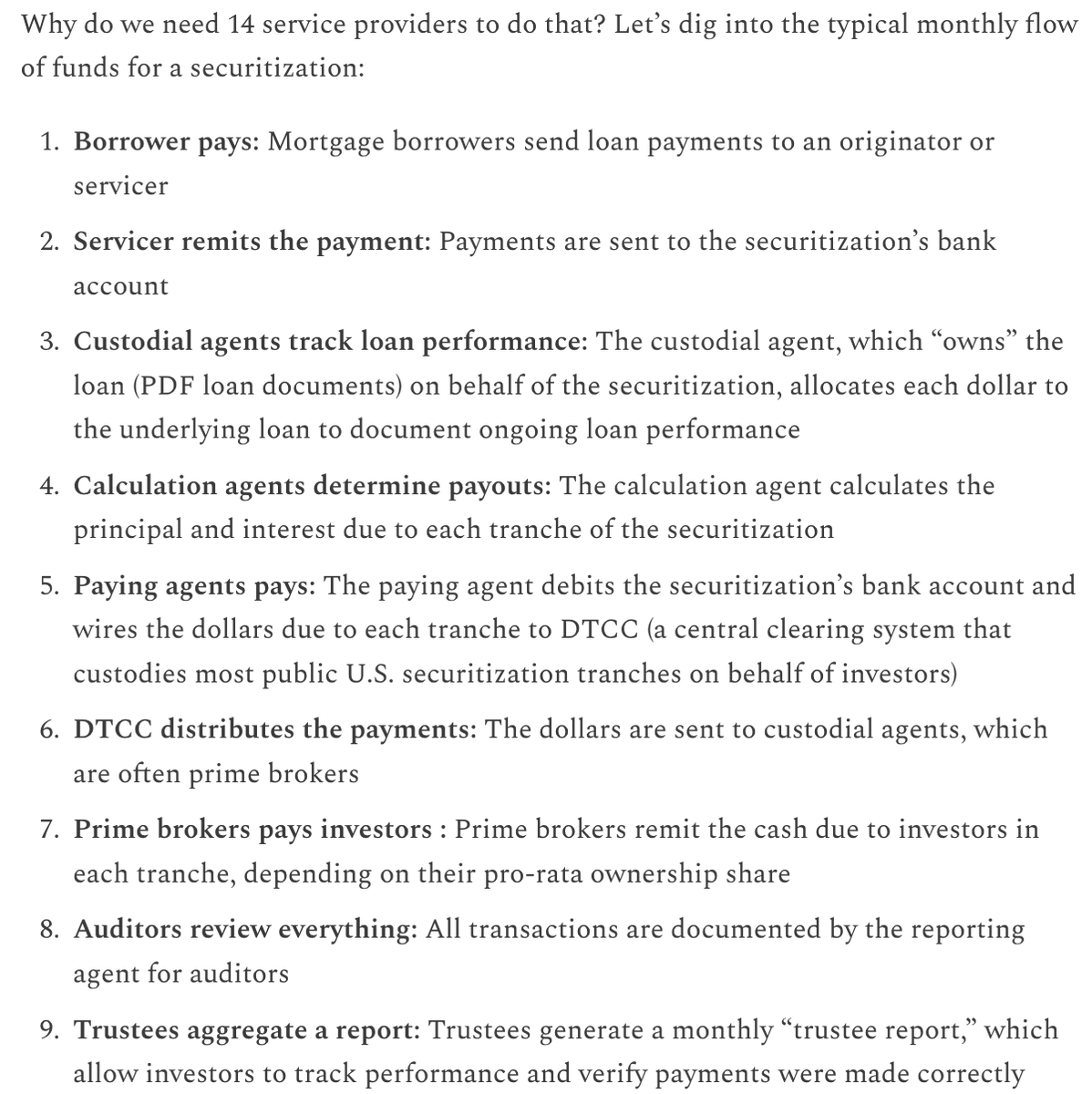

Turns out the 3% difference is far from being pure profit because this multi-trillion industry requires many parties involved in every securitization even if the task is seemingly trivial:

aggregate cashflows from the bundle of loans and divide it pro-rata between investors.

aggregate cashflows from the bundle of loans and divide it pro-rata between investors.

This whole intermediary riddled process is estimated to add up to around 1% in a typical securitization.

Imagine how much efficiency gains could be achieved here by even reducing costs by a few bps in a trillion dollar industry.

Imagine how much efficiency gains could be achieved here by even reducing costs by a few bps in a trillion dollar industry.

Cost savings which could be passed on to borrowers..

I’ll let you guess which technology improves coordination among multiple parties, tracks ownership transparently, automates custom payments etc. 🫡

Enter cryptoo

I’ll let you guess which technology improves coordination among multiple parties, tracks ownership transparently, automates custom payments etc. 🫡

Enter cryptoo

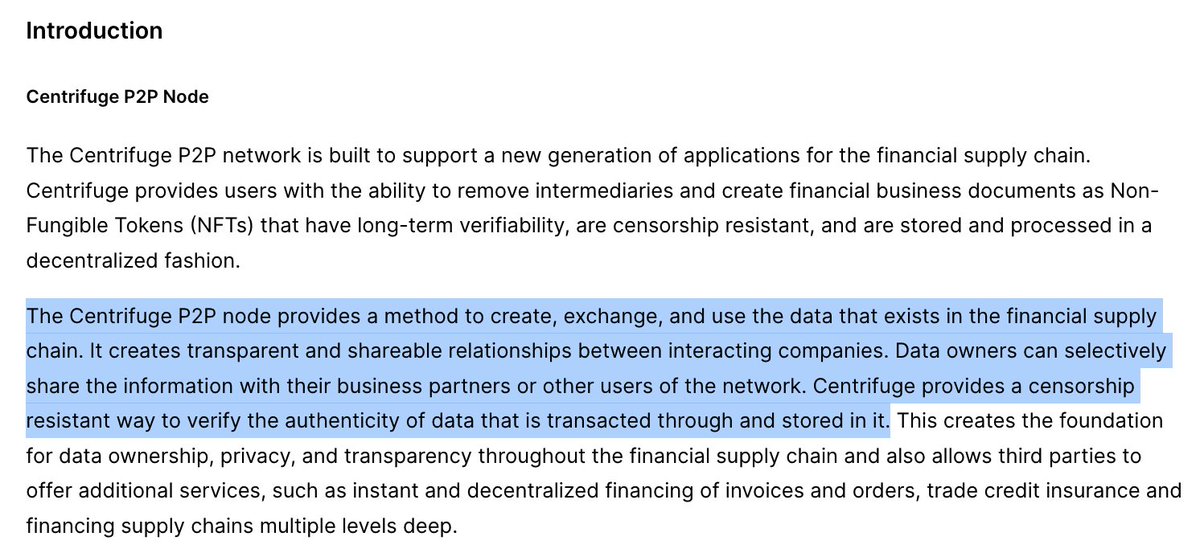

1 project in particular which has done great progress bringing this entire capital structure & process on-chain is @centrifuge.

Centrifuge was founded by a bunch of crypto OG's & folks who had exited a startup offering working capital financing for SME's to SAP for close to $1b.

Centrifuge was founded by a bunch of crypto OG's & folks who had exited a startup offering working capital financing for SME's to SAP for close to $1b.

A good mix of talent.

They set out to build a similar but more powerful platform on crypto rails.

Today, they have financed over $258m in real world assets and directed millions of $ in yield originating from these assets to investors - all on-chain.

Let's look at how 👇

They set out to build a similar but more powerful platform on crypto rails.

Today, they have financed over $258m in real world assets and directed millions of $ in yield originating from these assets to investors - all on-chain.

Let's look at how 👇

In short, Centrifuge includes all the features needed to finance real world assets on a blockchain, from tokenization up to liquidity integrations with Maker.

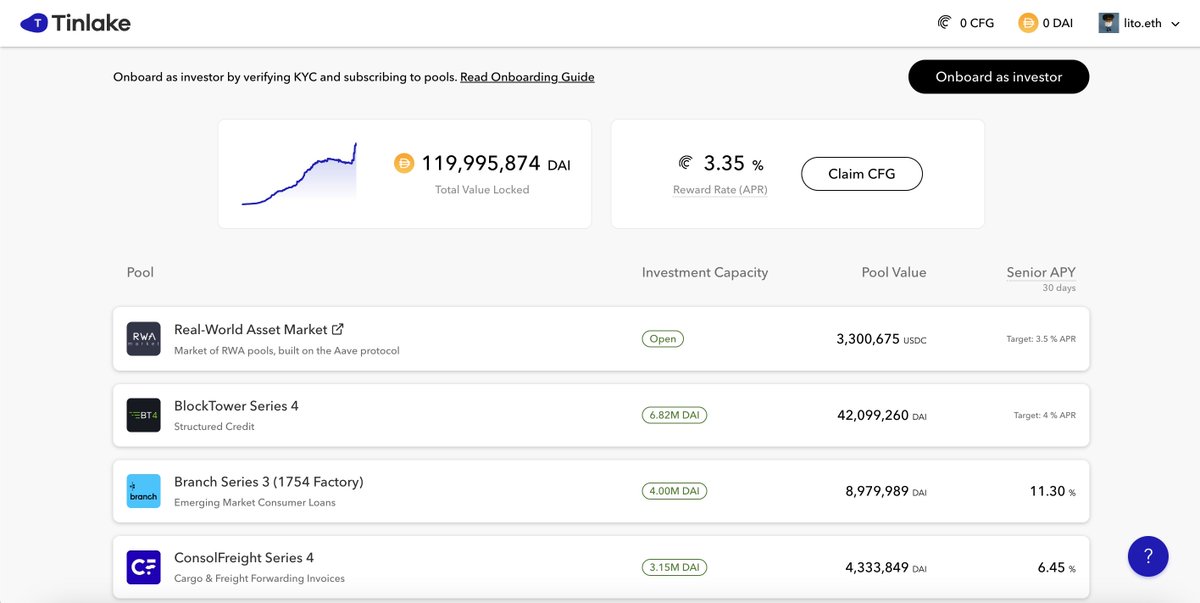

Tinlake is the name of the dapp on Ethereum where most of the action on Centrifuge happens.

Tinlake is the name of the dapp on Ethereum where most of the action on Centrifuge happens.

Tinlake is where “asset originators” and investors are brought together.

Asset originators are the parties that source the real-world assets and arrange the sale into the Tinlake pools.

Asset originators are the parties that source the real-world assets and arrange the sale into the Tinlake pools.

Technically they are the ones lending money to borrowers but they immediately turn around to re-finance them by selling them to Tinlake investors.

Asset originators are effectively brokers.

Asset originators are effectively brokers.

Investors can be protocols like Maker or KYC’ed retail investors.

Assets can be thinks like mortgages, car loans or invoice receivables etc.

Assets can be thinks like mortgages, car loans or invoice receivables etc.

Note, this is secured lending backed by *real assets*.

Different from @maplefinance etc. where loans are unsecured and significantly more risky (but also important).

Secured lending in crypto has been limited to crypto assets until now.

This has the potential to 100x it.

Different from @maplefinance etc. where loans are unsecured and significantly more risky (but also important).

Secured lending in crypto has been limited to crypto assets until now.

This has the potential to 100x it.

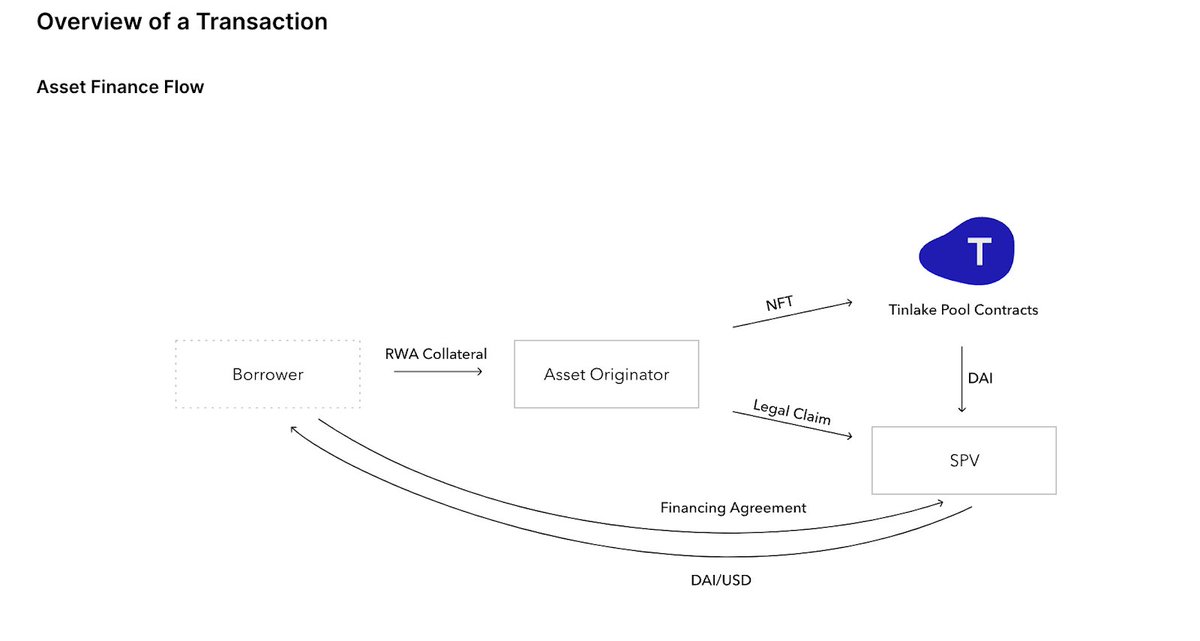

How are these real world assets brought on-chain?

Each Tinlake pool has a legal entity (SPV) tied to it that exists solely to manage the pool and hold the legal claims on behalf of the investors in the pool.

Each Tinlake pool has a legal entity (SPV) tied to it that exists solely to manage the pool and hold the legal claims on behalf of the investors in the pool.

The assets owned by the SPV in the real world are represented as NFT’s on-chain.

Investors in the Tinlake pools are effectively purchasing tokenized asset-backed securities issued by the SPV which give them a claim against the SPV and the RWA’s owned by it.

Investors in the Tinlake pools are effectively purchasing tokenized asset-backed securities issued by the SPV which give them a claim against the SPV and the RWA’s owned by it.

Asset originators can mint these NFT’s and transfer them into Tinlake pools to receive financing in return.

The SPV also manages the stablecoin-to-fiat conversion to pay the asset originator and the fiat-to-stablecoin conversions to disburse the interest payments.

The SPV also manages the stablecoin-to-fiat conversion to pay the asset originator and the fiat-to-stablecoin conversions to disburse the interest payments.

There’s a data layer where asset originators, issuers and investors can share loan documents, payment data etc. with granular controls over who gets to see what, allowing TradFi players to get the degree of privacy they’re comfortable with.

And remember Senior and Junior tranches?

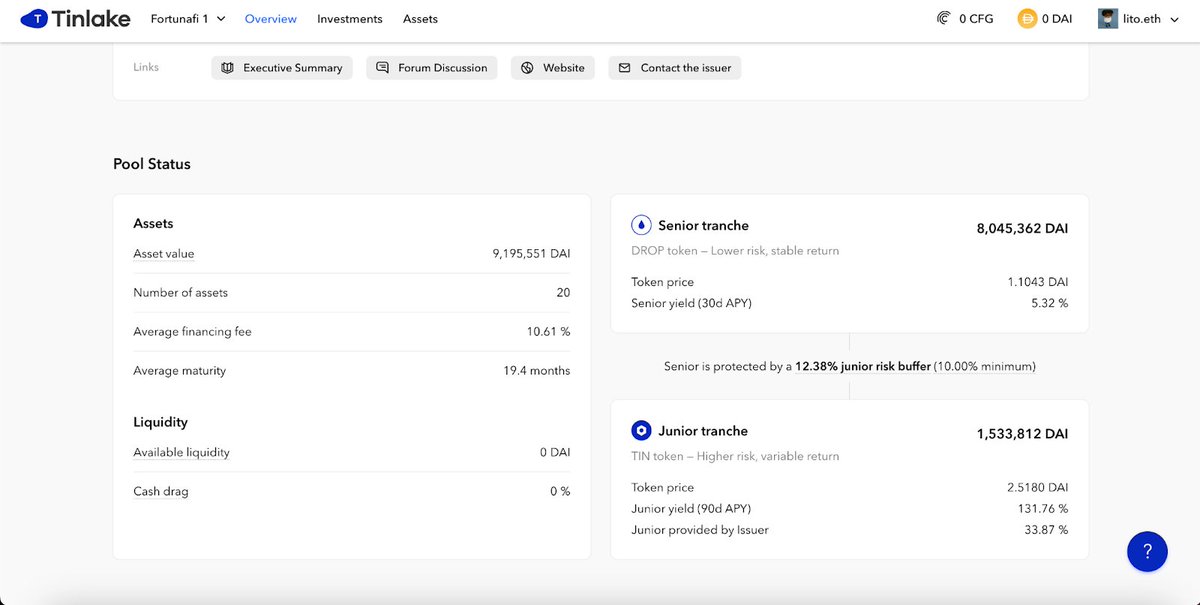

In @centrifuge, depositors can choose to invest in TIN (Junior) or DROP (Senior) tokens which have different risk and return profiles and represent tranches in the pool.

In @centrifuge, depositors can choose to invest in TIN (Junior) or DROP (Senior) tokens which have different risk and return profiles and represent tranches in the pool.

To signal confidence in the assets they sourced, asset originators such as @blocktower frequently purchase TIN tokens themselves

to have skin in the game & take the first hit in case of defaults.

Needless to say, all re-payments to TIN and DROP holders happen on-chain.

to have skin in the game & take the first hit in case of defaults.

Needless to say, all re-payments to TIN and DROP holders happen on-chain.

Today Centrifuge is mostly interesting for crypto investors who want access to quality yield.

This is why Maker is financing many of these pools. Like a bank it can underwrite risk & finance loans by issuing $DAI.

Just from Centrifuge yield it will generate $8m in revenue.

This is why Maker is financing many of these pools. Like a bank it can underwrite risk & finance loans by issuing $DAI.

Just from Centrifuge yield it will generate $8m in revenue.

But I am convinced that this can become much bigger as the infrastructure matures & more actors from traditional finance realize its advantages.

Ultimately, an open and transparent marketplace like Centrifuge has potential to lower the cost of capital for borrowers worldwide.

Ultimately, an open and transparent marketplace like Centrifuge has potential to lower the cost of capital for borrowers worldwide.

FWIW I am a big fan of what parties like @makerDAO and @blocktower are doing in this space and will continue following.

At the same time I also acknowledge that this erodes the censorship resistance values that $DAI once had.

At the same time I also acknowledge that this erodes the censorship resistance values that $DAI once had.

There’s many aspects to decentralization; Maker is decentralized in that it is run by a DAO but $DAI is not censorship resistant anymore as its share of collateral linked to the off-chain world grows.

And that’s fine imo.

And that’s fine imo.

The stablecoin market is huge and I expect others will step into that void (or already are like $RAI and $LUSD).

And to be clear i am not arguing that centralization in crypto is fine.

I think it's fine if disclosed and properly insulated from the decentralized part of crypto.

And to be clear i am not arguing that centralization in crypto is fine.

I think it's fine if disclosed and properly insulated from the decentralized part of crypto.

What I dislike more than anything are DeFi protocols pretending to be decentralized but have single points of failure all over the place.

And I also dont think having a permissioned layer will mean those rules automatically spill over into the permissionless DeFi space.

And I also dont think having a permissioned layer will mean those rules automatically spill over into the permissionless DeFi space.

Both can co-exist.

Just like in the real world where different rules apply to different businesses.

You go into a casino you need to identify yourself but if you go into a supermarket you don't.

Just like in the real world where different rules apply to different businesses.

You go into a casino you need to identify yourself but if you go into a supermarket you don't.

• • •

Missing some Tweet in this thread? You can try to

force a refresh