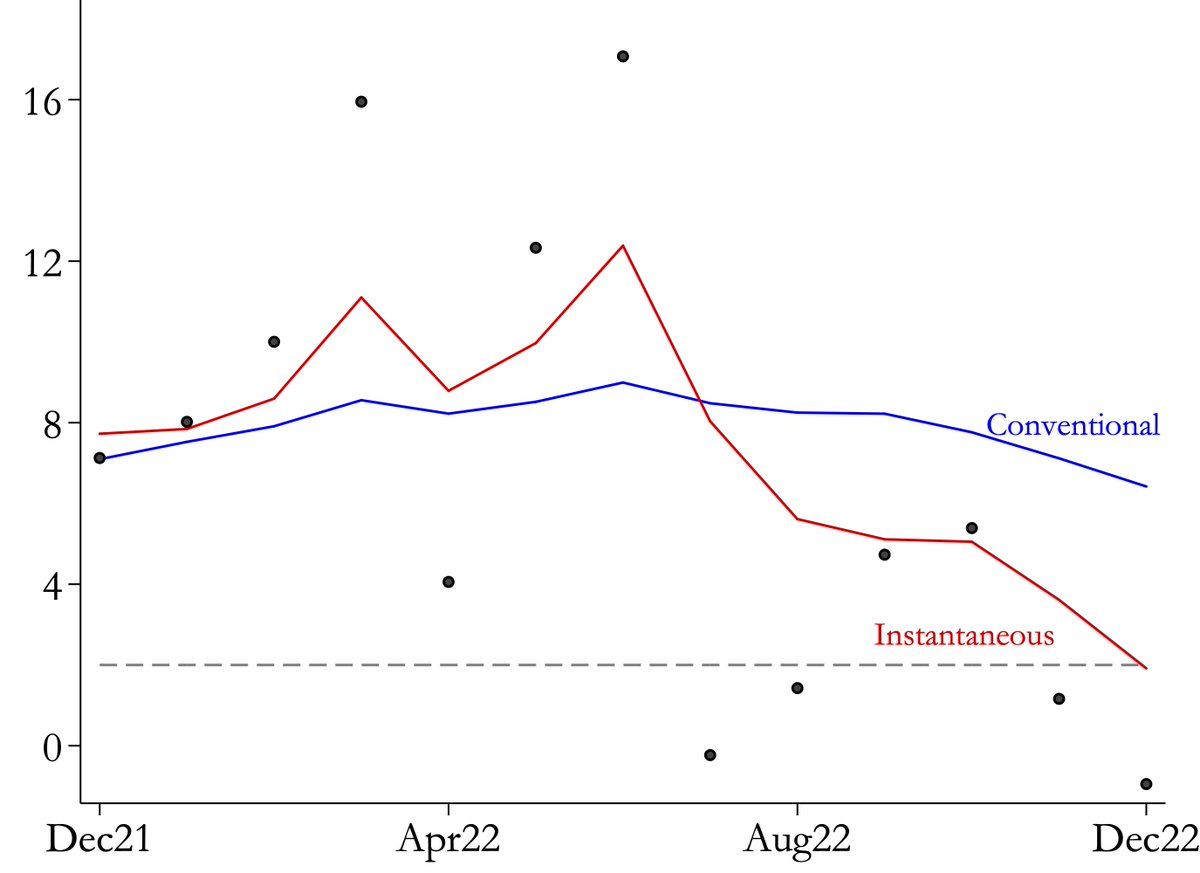

I don’t think people fully appreciate that high inflation in the US and the Euro area is over. We are back at 2%

Part of the high inflation perception today is measurement: instantaneous inflation in December is 2% instead of the conventional measure of 6.5%

1/9

Part of the high inflation perception today is measurement: instantaneous inflation in December is 2% instead of the conventional measure of 6.5%

1/9

Why is conventional inflation so high still?

Prices are recorded monthly, so Inflation numbers come in monthly. There are 2 issues:

1. Magnitude

2. Averaging

2/

Prices are recorded monthly, so Inflation numbers come in monthly. There are 2 issues:

1. Magnitude

2. Averaging

2/

1. Magnitude. The price change month-to-month is a lot smaller than year-to-year. Because we are used to talking about annual rates, we transform monthly rates into annual rates. E.g., a monthly price change of 1% is 12.7% annually (more than times 12 because of compounding)

3/

3/

2. Averaging. The monthly data are noisy (sales, human error, weather,…). Seasonally adjusting helps, but noise remains, so we use multiple observations to minimize the noise. Therefore we use all 12 monthly observations rather than just 1 to calculate the inflation rate

4/

4/

Averaging is fine when inflation is stable with no sharp in/decrease. But that is not the story of the last two years. Yearly averaging puts as much weight on monthly observations from 12 months ago as on last month. So we obtain the average inflation from 6 months ago

5/

5/

So why not use multiple monthly readings of inflation, but put more weight on recent observations and less on the distant past. We use kernel weights that trade off the averaging needed due to noisy data against the need to have instantaneous inflation readings

6/

6/

The differences are big: 6.5% versus 2%

This has profound implications for monetary policy as the Central Bank may be reacting to old news. It also affects expectations, inflation-indexed financial assets, labor contracts, and fiscal policy

7/

janeeckhout.com/wp-content/upl…

This has profound implications for monetary policy as the Central Bank may be reacting to old news. It also affects expectations, inflation-indexed financial assets, labor contracts, and fiscal policy

7/

janeeckhout.com/wp-content/upl…

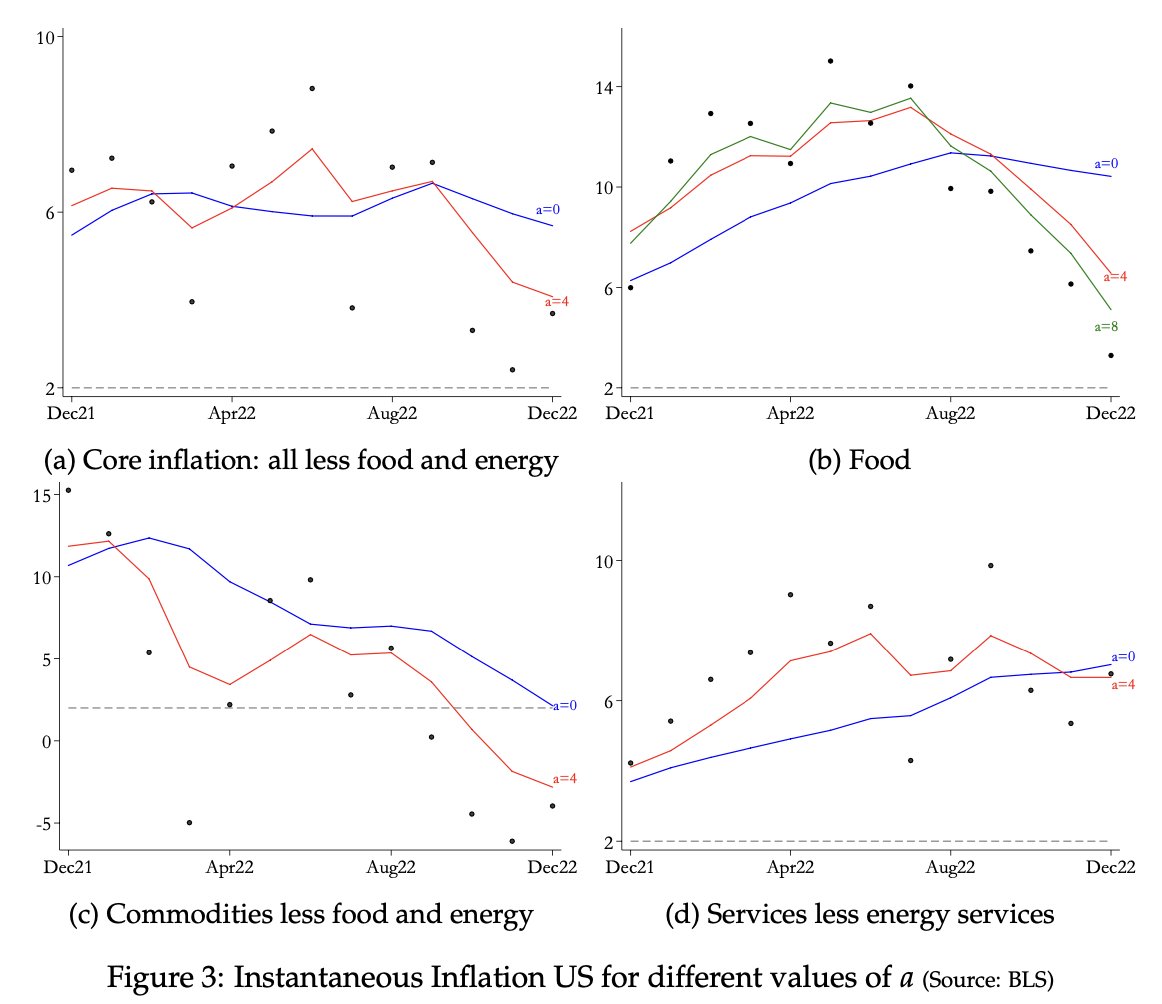

Core inflation, food, and commodities are falling fast (commodities inflation is negative). Services inflation is high and on the rise

8/

8/

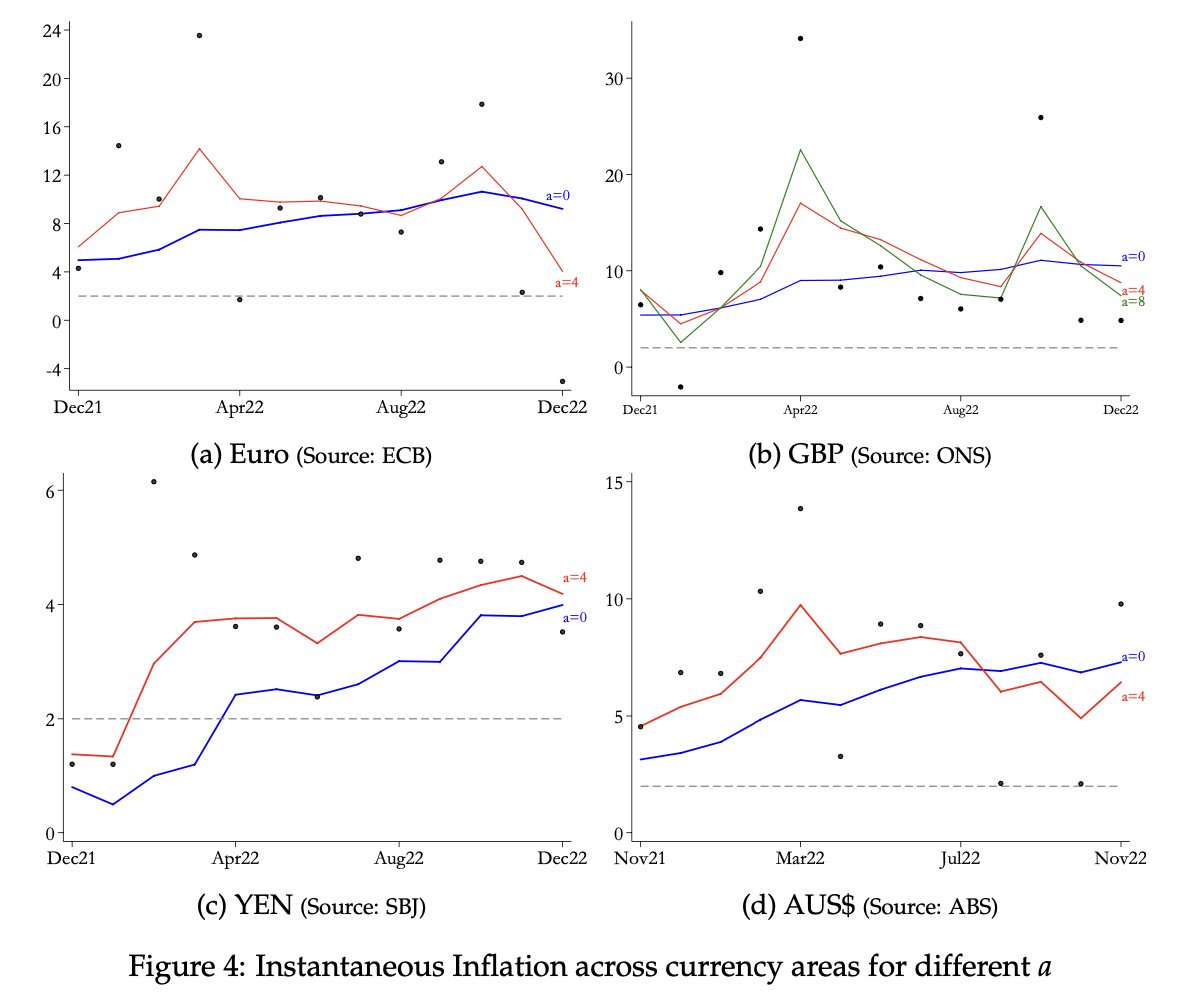

Inflation in the Euro area mirrors what happens in the United States, though Euro inflation is still above the 2% target.

The UK, Japan, and Australia do not show much of a declining trend in inflation

9/9

The UK, Japan, and Australia do not show much of a declining trend in inflation

9/9

• • •

Missing some Tweet in this thread? You can try to

force a refresh