ok, let's do this. I've now read all 153 pages of United States vs Google filed earlier today. As I've said earlier, Google is royally screwed.

The suit is super well-written building on prior work investigating Google’s market power abuse leveraging advertising technologies. /1

The suit is super well-written building on prior work investigating Google’s market power abuse leveraging advertising technologies. /1

Much of the suit is indeed anchored around Google's maintenance of 20% revenue share from its ad exchange. And it smartly describes Google's scale across three dimensions: publishers, ad impressions and importantly, data. /2

On the data point, which anyone who follows me knows I heavily lean into the intersection of data protection and antitrust. The third dimension includes targeting data which no doubt has informed Google's approach to privacy rules - or the lack of them. /3

One more broad point on the suit. They do an outstanding job on clear language of complex topic - including not getting lost in G's rebranding of adtech services or secret projects (Poirot, Bernanke, Jedi, Bell, Poirot 2.0!) leveraging work in Australia, Texas, EU, UK, et al. /4

They also have some good visuals that very clearly demonstrate Google's dominance on all sides of the markets as they begin to walk through what really resembles like insider trading. There might be handcuffs if it was wall street and proven. /5

Google's reactions to "header bidding" that opened up and allowed multiple parties on both sides of auctions is a focus of guts of suit. G appears to ack header bidding happened organically across industry due to G's abuse of control over market. What did they then do... /6

The suit walks through how Google allegedly and systematically worked to "dry out" header bidding in the occasions it couldn't block it altogether. This includes the Jedi Blue claims of its deal with Facebook. And first time I've seen an approach to Amazon which was rejected. /7

Let me now take a moment to break down the alleged anticompetitive conduct as they do very deep in the report. I'll give you eight examples of broad conduct that the United States will work to prove was illegal. /8

(1) Google acquired DoubleClick in order to obtain not only a dominant publisher ad server (50% now 90%+), DFP, but also a nascent ad exchange, AdX (now 50%+), in order to pursue its goal of dominance across the entire ad tech stack /9

(2) Google then restricted all of its Google Ads’ advertiser demand exclusively to AdX. Basically, if you wanted any of the dominant ad$ flowing through Google then you had to use its adtech. /10

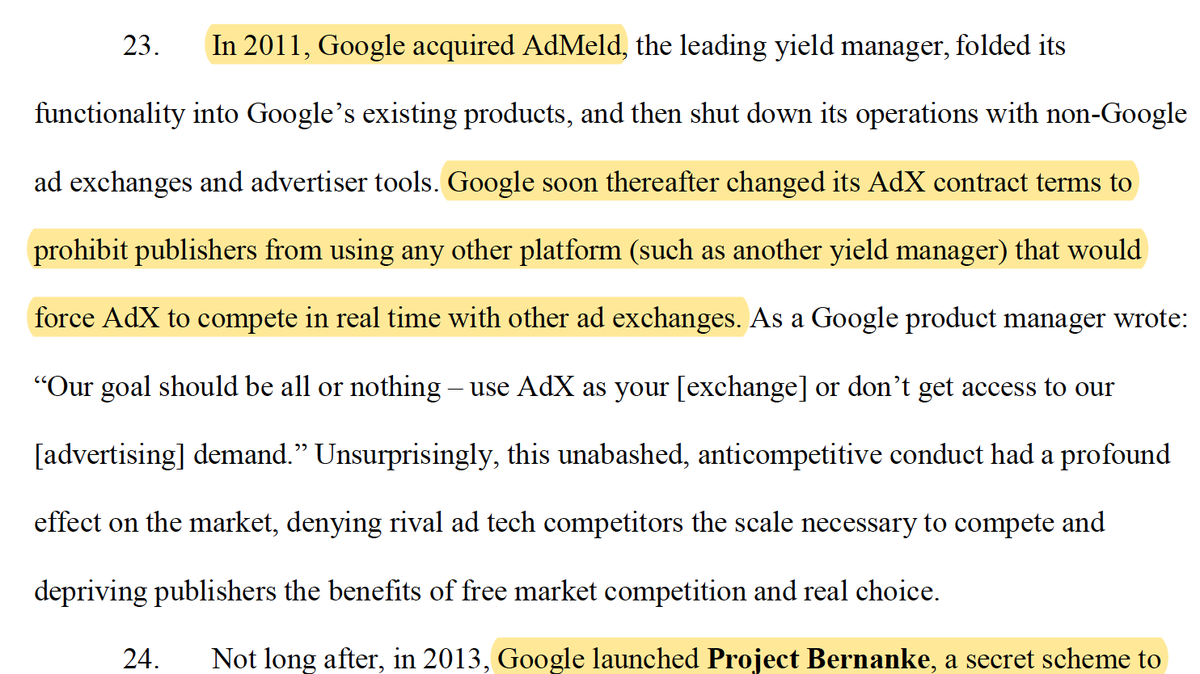

(3) They also allegedly provided AdX a bunch of exclusive features for Google's publisher customers using DFP (dynamic allocation, "last look," effective real-time access). Again, "drying out..." header bidding. /11

(4) Interestingly, despite a # of cited problematic adtech acquisitions, they seem to focus on Google’s acquisition of AdMeld (Hi Ben!) in order to stop AdMeld's "multi-homing across ad exchanges" as being key to Google. /12

(5) They walk through Google’s use of Project Bell, which "lowered, without advertisers’ permission or knowledge, bids to publishers who dared partner with Google’s competitors." Angry face emoji from me. /13

(6) Google’s deployment of sell-side "Dynamic Revenue Share" to manipulate auction bids—without publishers’ knowledge -- and to advantage AdX. Basically cutting share to win bids for Google's systems making up for it on less competitive auctions. /14

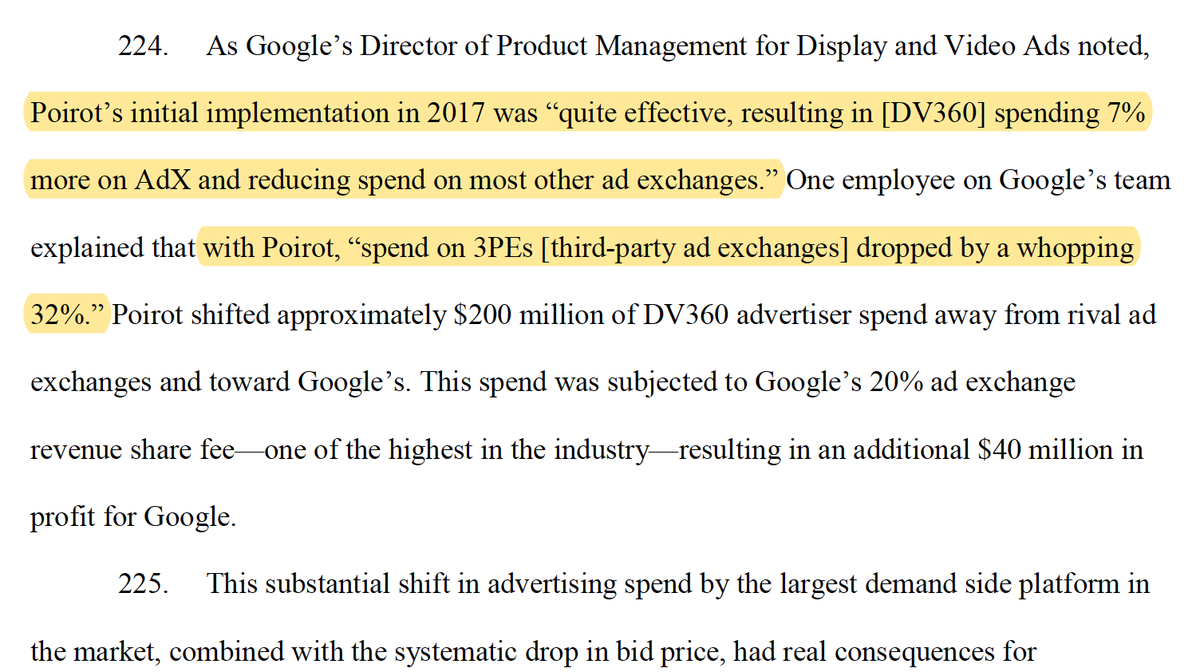

(7) Feels like bid rigging. "Google’s use of Project Poirot to thwart competitive threat of header bidding by secretly and artificially manipulating DV360’s advertiser bids on rival ad exchanges using header bidding in order to ensure transactions were won by Google’s AdX." /15

Still on (7), taking Project Poirot as the example, the lawsuit also includes internal messages at Google which show the "whopping" effects on the competitive advertising exchanges. Haven't seen this data previously. Again, smells like bid rigging to me. /16

the last anticompetitive conduct allegation - Google’s veiled introduction of so-called Unified Pricing Rules that took away publishers’ power to transact with rival ad exchanges at preferred prices. This was to deal with Google's "flooring problem." /17

The lawsuit also names names in terms of impacted competition. If you worked at or owned shares in AppNexus/Xandr, Rubicon, OpenX, Pubmatic among others, you may not be terribly happy with Google. Of course, they all were supposed to be working for publishers' revenues. /18

For the AMP haters. We also see internal messages where an engineer makes clear Google's real AMP motivations were justified by business needs rather than architecture and users. Remember this example when you considering trusting Google on its decisions around 3P cookies. /19

Ultimately, on the publisher side, Google's control over the publisher ad server market allegedly allowed it to do a long list of shady things to maintain an average 20% rake on the intermediation and the data. "Average" is important as it could manipulate to get there. /20

and for the antitrust wonks and Google defenders, the relevant markets in the lawsuit are threefold: the publisher ad servers, advertising exchanges and advertiser networks. Google's market shares are crazy-large as long documented. /21

I'm going to stop there. Bottom-line, I think this is a masterpiece. Any interesting perspectives or reports, please do send my way. And a reminder, the bipartisan state AGs lawsuit is already passed dismissal and moving forward in SDNY. /22

https://twitter.com/jason_kint/status/1339349312694837250?s=20&t=YE1NItZnipZ-fS00JgYl5w

Sorry shame on me, here is a link to the full 153 pages for those who also want to read it. I would welcome anything I missed or different reads on it. Also... /23 storage.courtlistener.com/recap/gov.usco…

And lastly, I should link to the video clips I did from the announcement. As I've been saying since I had the very first meetings with enforcers probably five years ago, they've seriously ramped up at enforcement offices. Popcorn. /24

https://twitter.com/jason_kint/status/1617968332145299456?s=20&t=YE1NItZnipZ-fS00JgYl5w

Dropping this statement at the tail of the thread for those who make it. Well done.

https://twitter.com/jason_kint/status/1618061468133625856

• • •

Missing some Tweet in this thread? You can try to

force a refresh