NEW FROM US:

Adani Group – How The World’s 3rd Richest Man Is Pulling The Largest Con In Corporate History

hindenburgresearch.com/adani/

(1/x)

Adani Group – How The World’s 3rd Richest Man Is Pulling The Largest Con In Corporate History

hindenburgresearch.com/adani/

(1/x)

Today we reveal the findings of our 2-year investigation, presenting evidence that the INR 17.8 trillion (U.S. $218 billion) Indian conglomerate Adani Group has engaged in a brazen stock manipulation and accounting fraud scheme over the course of decades. (2/x)

Gautam Adani, Founder & Chairman of Adani Group, has amassed a net worth of roughly $120 billion, adding over $100 billion the past 3 years largely through stock price appreciation in the group’s 7 key listed companies, which have spiked an average of 819% over the period. (3/x)

Our research involved speaking with dozens of individuals, including former executives of Adani, reviewing thousands of documents, and conducting diligence site visits in almost half a dozen countries. (4/x)

Even if you ignore the findings of our investigation and take the financials of Adani Group at face value, its 7 key listed companies have 85% downside purely on a fundamental basis, owing to sky-high valuations. (5/x)

Key listed Adani co's have also taken on substantial debt, including pledging shares of inflated stock for loans, putting the group on precarious financial footing. 5 of 7 key listed companies have reported current ratios below 1, indicating near-term liquidity pressure. (6/x)

The group’s very top ranks and 8 of 22 key leaders are Adani family members, a dynamic that places control of the group’s financials and key decisions in the hands of a few.

A former executive described the Adani Group as “a family business.” (7/x)

A former executive described the Adani Group as “a family business.” (7/x)

The Adani Group has previously been the focus of 4 major government fraud investigations which have alleged money laundering, theft of taxpayer funds and corruption, totaling an estimated U.S. $17 billion. (8/x)

Adani family members allegedly cooperated to create offshore shell entities in tax-haven jurisdictions like Mauritius, UAE & the Caribbean to generate forged import/export documentation, generate fake or illegitimate turnover and siphon money from the listed companies. (9/x)

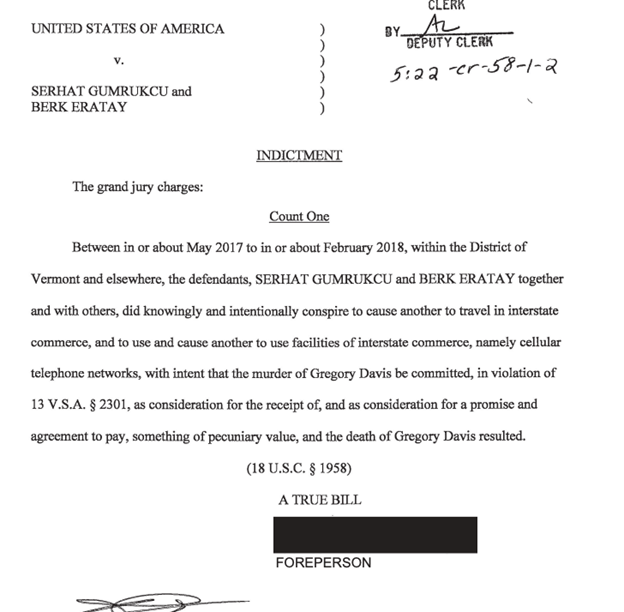

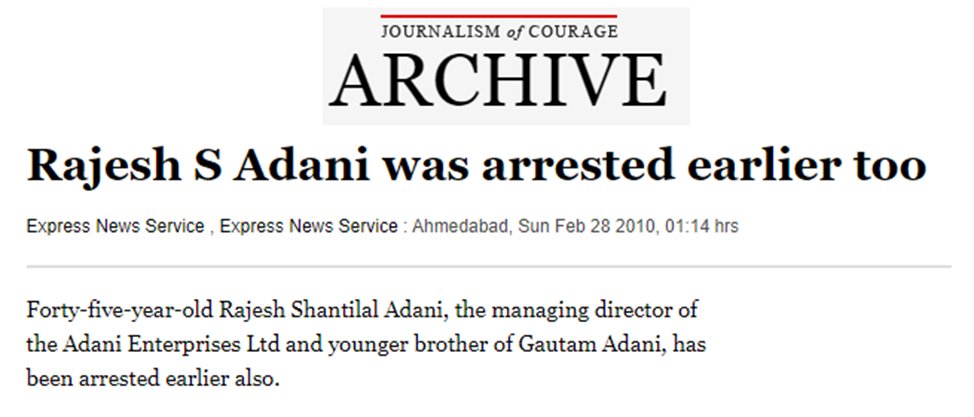

Gautam Adani’s younger brother, Rajesh Adani, was accused by the Directorate of Revenue Intelligence (DRI) of playing a central role in a diamond trading import/export scheme around 2004-2005. (10/x)

The alleged scheme involved the use of offshore shell entities to generate artificial turnover. Rajesh was arrested at least twice over separate allegations of forgery and tax fraud.

He was subsequently promoted to serve as Managing Director of Adani Group. (11/x)

He was subsequently promoted to serve as Managing Director of Adani Group. (11/x)

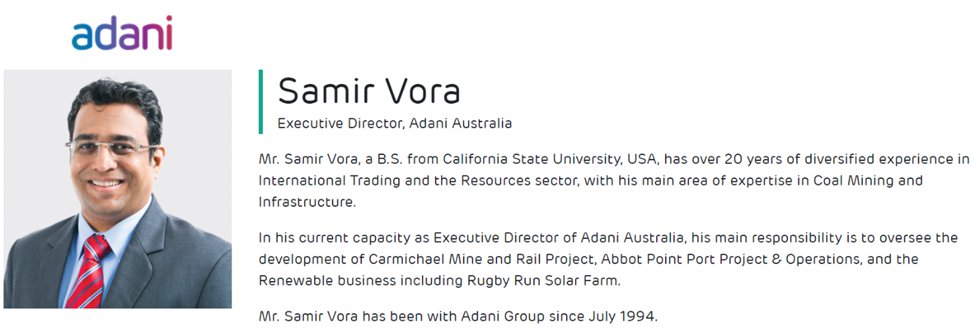

Gautam Adani’s brother-in-law, Samir Vora, was accused by the DRI of being a ringleader of the same diamond trading scam and of repeatedly making false statements to regulators.

He was subsequently promoted to Executive Director of the critical Adani Australia division. (12/x)

He was subsequently promoted to Executive Director of the critical Adani Australia division. (12/x)

Gautam Adani’s elder brother, Vinod Adani, has been described by media as “an elusive figure”. He has regularly been found at the center of the government’s investigations into Adani for his alleged role in managing a network of offshore entities used to facilitate fraud. (13/x)

Our research, which included downloading and cataloguing the entire Mauritius corporate registry, has uncovered that Vinod Adani, through several close associates, manages a vast labyrinth of offshore shells. (14/x)

We have identified 38 Mauritius shell entities controlled by Vinod Adani and close associates.

We have also identified entities that are surreptitiously controlled by Vinod Adani in Cyprus, the UAE, Singapore, and several Caribbean Islands. (15/x)

We have also identified entities that are surreptitiously controlled by Vinod Adani in Cyprus, the UAE, Singapore, and several Caribbean Islands. (15/x)

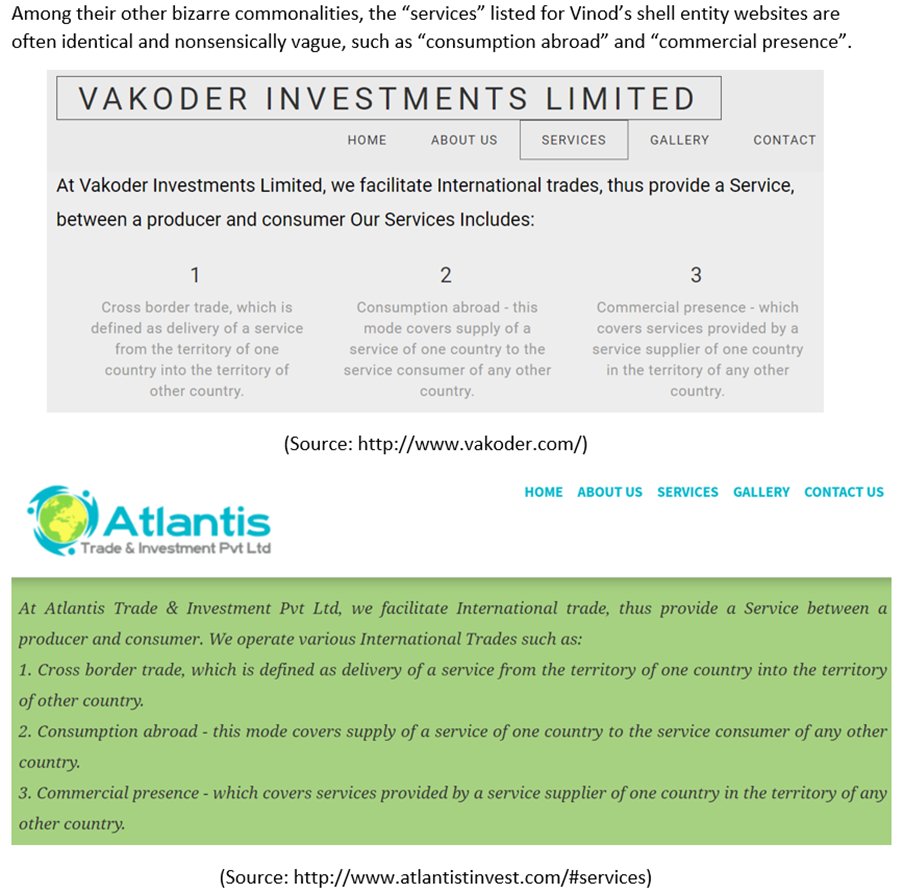

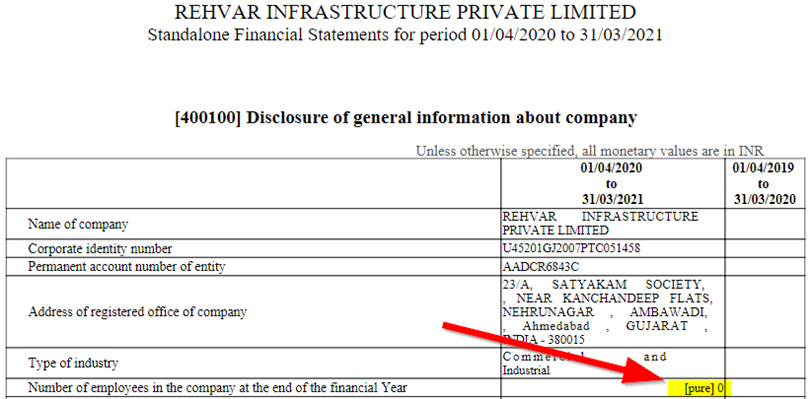

Many Vinod Adani-associated entities have no obvious signs of operations, no reported employees, no independent addresses or phone numbers and no meaningful online presence.

Despite this, they have collectively moved billions of dollars through Adani entities. (16/x)

Despite this, they have collectively moved billions of dollars through Adani entities. (16/x)

We also uncovered efforts that seem designed to mask the shell entities. 13 websites were created for Vinod-associated entities; many were suspiciously formed on the same days, featuring only stock photos, naming no employees & listing the same set of nonsensical services. (17/x)

The Vinod-Adani shells seem to serve several functions, including (1) stock parking / manipulation (2) and laundering money through Adani’s private companies onto the listed companies’ balance sheets in order to maintain the appearance of financial health and solvency. (18/x)

India Pubcos are subject to rules requiring promoter holdings to be disclosed. Listed co's must have >25% of float held by non-promoters to mitigate manipulation/insider trading.

4 of Adani’s listed co's are near the delisting threshold for high promoter ownership. (19/x)

4 of Adani’s listed co's are near the delisting threshold for high promoter ownership. (19/x)

Our research indicates that offshore shells & funds tied to the Adani Group comprise many of the largest “public” (i.e. non-promoter) holders of Adani stock, an issue that would subject the Adani companies to delisting, were Indian securities regulator SEBI rules enforced. (20/x)

Many of the “public” funds exhibit flagrant irregularities such as being (1) Mauritius/offshore-based entities, often shells (2) w/beneficial ownership concealed via nominee directors (3) little to no diversification, holding almost exclusively shares in Adani listed co's. (21/x)

Right to Information (RTI) requests we filed with SEBI confirm that the offshore funds are subject of an ongoing investigation, more than a year-and-a-half after concerns were initially raised by media and members of parliament. (22/x)

A former employee of Elara, one such fund w/ almost $3B in concentrated holdings of Adani, told us it is obvious that Adani controls the shares.

He explained the funds are intentionally structured to conceal the source of capital. (23/x)

He explained the funds are intentionally structured to conceal the source of capital. (23/x)

Leaked emails show the CEO of Elara worked on deals w/ Dharmesh Doshi, a fugitive accountant who worked on stock manipulation deals with Ketan Parekh, an infamous Indian market manipulator.

The CEO of Elara worked with Doshi after he evaded arrest & was a known fugitive. (24/x)

The CEO of Elara worked with Doshi after he evaded arrest & was a known fugitive. (24/x)

Another firm called Monterosa Investment Holdings controls 5 supposedly independent funds that collectively hold over INR 360 billion (U.S. $4.5 billion) in shares of listed Adani companies, according to Legal Entity Identifier (LEI) data and Indian exchange data. (25/x)

Monterosa’s Chairman and CEO served as director in 3 companies alongside a fugitive diamond merchant who allegedly stole $1 billion before fleeing India.

Vinod Adani’s daughter married the fugitive diamond merchant’s son. (26/x)

Vinod Adani’s daughter married the fugitive diamond merchant’s son. (26/x)

A once-related party entity of Adani invested heavily in one of the Monterosa funds that allocated to Adani Enterprises and Adani Power, according to corporate records, drawing a clear line between the Adani Group and the suspect offshore funds. (27/x)

Another Cyprus-based entity called New Leaina Investments owned U.S. $420 million in Adani Green Energy shares until mid-2021, comprising ~95% of its portfolio.

Parliamentary records show it was (and may still be) a shareholder of other Adani entities. (28/x)

Parliamentary records show it was (and may still be) a shareholder of other Adani entities. (28/x)

New Leaina is operated by Amicorp, which has aided Adani in developing its offshore entity network.

Amicorp formed at least 7 Adani promoter entities, 17 offshore shells & entities associated with Vinod Adani & 3 Mauritius-based holders of Adani stock. (29/x)

Amicorp formed at least 7 Adani promoter entities, 17 offshore shells & entities associated with Vinod Adani & 3 Mauritius-based holders of Adani stock. (29/x)

Amicorp played a key role in the 1MDB international fraud scandal that resulted in U.S. $4.5B being siphoned from Malaysian taxpayers. (30/x)

Amicorp established ‘investment funds’ for the key 1MDB perpetrators that were “simply a way to wash a client’s money through what looked like a mutual fund”, according to the book Billion Dollar Whale, which reported on the scandal. (31/x)

‘Delivery volume’ is a unique daily data point that reports institutional flows.

Our analysis found offshore suspected stock parking entities accounted for up to 30%-47% of yearly ‘delivery volume’ in several Adani listed companies, a flagrant irregularity. (32/x)

Our analysis found offshore suspected stock parking entities accounted for up to 30%-47% of yearly ‘delivery volume’ in several Adani listed companies, a flagrant irregularity. (32/x)

Evidence of stock manipulation in Adani listed companies shouldn’t come as a surprise.

SEBI has investigated and prosecuted at least 70 entities and individuals over the years, including Adani promoters, for pumping Adani Enterprises’ stock. (33/x)

SEBI has investigated and prosecuted at least 70 entities and individuals over the years, including Adani promoters, for pumping Adani Enterprises’ stock. (33/x)

Ketan Parekh is perhaps India’s most notorious stock market manipulator.

A 2007 SEBI ruling wrote: "the charges leveled against promoters of Adani that they aided and abetted Ketan Parekh entities in manipulating the scrip of Adani stand proved".

(34/x)

A 2007 SEBI ruling wrote: "the charges leveled against promoters of Adani that they aided and abetted Ketan Parekh entities in manipulating the scrip of Adani stand proved".

(34/x)

Adani Group entities originally received bans for their roles, but those were later reduced to fines, a show of government leniency toward the Group that has become a decades-long pattern. (35/x)

Per the 2007 investigation, 14 Adani private entities transferred shares to entities controlled by Parekh, who then engaged in blatant market manipulation. (36/x)

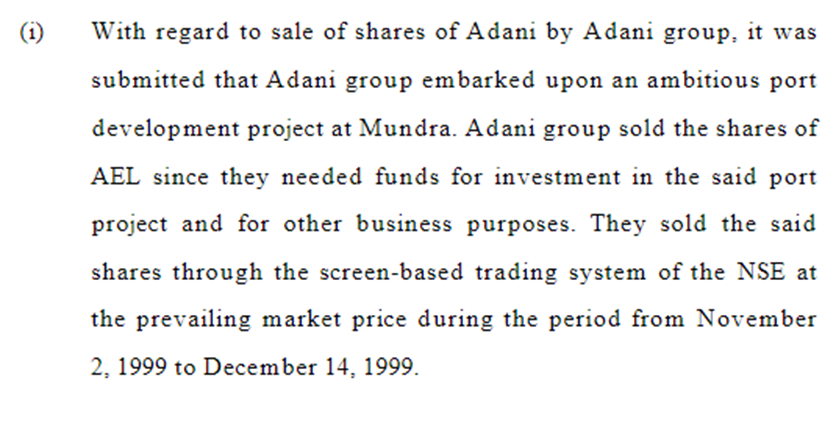

Adani Group responded to SEBI by arguing that it had dealt with Ketan Parekh to finance its operations at Mundra port, seemingly suggesting that share sales via stock manipulation somehow constitutes a legitimate form of financing. (37/x)

We also interviewed an individual banned from trading on Indian markets for stock manipulation via Mauritius funds.

He told us he knew Ketan Parekh & that little has changed, explaining “All the previous clients are still loyal to Ketan & are still working with Ketan”. (38/x)

He told us he knew Ketan Parekh & that little has changed, explaining “All the previous clients are still loyal to Ketan & are still working with Ketan”. (38/x)

In addition to using offshore entities to park stock, offshore shells surreptitiously controlled by Adani have directed capital through onshore private Adani companies and onto listed public Adani companies. (39/x)

The funds then seem to be used to engineer Adani's accounting whether by bolstering reported profit or cash flows, cushioning capital balances to make listed entities appear more creditworthy, or simply moved out to other parts of the Adani empire where capital is needed. (40/x)

We identified numerous undisclosed related party transactions, seemingly in open and repeated violation of Indian disclosure laws. (41/x)

One Vinod Adani-controlled Mauritius entity with no signs of operations lent INR 11.71B (U.S. ~$253M) to a private Adani entity without related party disclosure.

The private entity lent funds to listed entities, including U.S. $138M to Adani Enterprises. (42/x)

The private entity lent funds to listed entities, including U.S. $138M to Adani Enterprises. (42/x)

Another Vinod-controlled Mauritius entity, Emerging Market Investment DMCC, lists no employees on LinkedIn, has no substantive online presence, has announced no clients or deals, and is based out of an apartment in the UAE.

It lent U.S. $1B to an Adani Power subsidiary. (43/x)

It lent U.S. $1B to an Adani Power subsidiary. (43/x)

A “silver bar” merchant w/ no website, zero employees, almost no signs of operations, based out of a residence, run by a current & a former Adani director lent INR 15 billion (U.S. $202 million) to a private Adani entity.

We found no related party disclosure of the deal. (44/x)

We found no related party disclosure of the deal. (44/x)

The offshore shell network also seems to be used for earnings manipulation.

We detail a series of transactions where assets were transferred from a subsidiary of listed Adani Enterprises to a Singapore entity controlled by Vinod Adani, without related party disclosures. (45/x)

We detail a series of transactions where assets were transferred from a subsidiary of listed Adani Enterprises to a Singapore entity controlled by Vinod Adani, without related party disclosures. (45/x)

Once on the books of the private entity, the assets were almost immediately impaired, likely helping the listed entity avoid a material write down and negative impact to net income. (46/x)

Adani's accounting irregularities & sketchy dealings seem to be enabled by virtually non-existent financial controls. Listed Adani co's have seen sustained turnover in the CFO role. Adani Enterprises has had 5 CFOs in 8 years, indicating potential accounting irregularities (47/x)

The independent auditor for Adani Enterprises and Adani Total Gas is a tiny firm called Shah Dhandharia. It seems to have no current website.

Historical archives of its website show that it had only 4 partners and 11 employees. (48/x)

Historical archives of its website show that it had only 4 partners and 11 employees. (48/x)

Records show Shah Dhandharia paid INR 32,000 (U.S. $435 in 2021) in monthly office rent.

The only other listed entity we found that it audits has a market capitalization of about INR 640 million (U.S. $7.8 million). (49/x)

The only other listed entity we found that it audits has a market capitalization of about INR 640 million (U.S. $7.8 million). (49/x)

Shah Dhandharia hardly seems capable of complex audit work. Adani Enterprises alone has 156 subsidiaries and many more joint ventures and affiliates, for example. (50/x)

Shah Dhandharia hardly seems capable of complex audit work.

Adani Enterprises alone has 156 subsidiaries and many more joint ventures and affiliates, for example. (50/x)

Adani Enterprises alone has 156 subsidiaries and many more joint ventures and affiliates, for example. (50/x)

The audit partners at Shah Dhandharia who respectively signed off on Adani Enterprises and Adani Gas’ annual audits were as young as 24 and 23 years old when they began approving the audits. (51/x)

They were essentially fresh out of school, hardly in a position to scrutinize and hold to account the financials of some of the largest companies in the country, run by one of its most powerful individuals. (52/x)

Gautam Adani claimed in an interview to “have a very open mind towards criticism…Every criticism gives me an opportunity to improve myself.”

Despite this claim, Adani has sought to have critical journalists and commentators jailed or silenced through litigation. (53/x)

Despite this claim, Adani has sought to have critical journalists and commentators jailed or silenced through litigation. (53/x)

We believe the Adani Group has been able to operate a massive, flagrant fraud in broad daylight in large part because investors, journalists, citizens and even politicians have been afraid to speak out about the obvious, for fear of reprisal. (54/x)

We have included 88 questions in the conclusion of our report.

If Gautam Adani truly embraces transparency, as he claims, they should be easy questions to answer.

We look forward to Adani’s response.

hindenburgresearch.com/adani/

(55/end)

If Gautam Adani truly embraces transparency, as he claims, they should be easy questions to answer.

We look forward to Adani’s response.

hindenburgresearch.com/adani/

(55/end)

• • •

Missing some Tweet in this thread? You can try to

force a refresh