A new stablecoin launches on Cardano next week!

Let's talk about $DJED!

🪙What is a stablecoin?

🪙What is DJED?

🪙How do I get DJED?

🪙What is SHEN?

🪙What rewards can be earned?

🪙and more...

🧵a thread #COTI

Let's talk about $DJED!

🪙What is a stablecoin?

🪙What is DJED?

🪙How do I get DJED?

🪙What is SHEN?

🪙What rewards can be earned?

🪙and more...

🧵a thread #COTI

🪙What is a stablecoin?

A stablecoin is a type of cryptocurrency that is designed to maintain a stable value, usually by being pegged to the value of other assets such as fiat currencies, precious metals, stocks, or other cryptocurrencies

A stablecoin is a type of cryptocurrency that is designed to maintain a stable value, usually by being pegged to the value of other assets such as fiat currencies, precious metals, stocks, or other cryptocurrencies

Stablecoins are divided into three different types:

🔵Overcollateralized

🔵Algorithmic

🔵Fiat Backed

🔵Overcollateralized

🔵Algorithmic

🔵Fiat Backed

Overcollateralized stablecoins are backed by a greater value of crypto assets than the stablecoins issued, ensuring a reserve.

Examples include DAI from @MakerDAO

Examples include DAI from @MakerDAO

Algorithmic stablecoins use algorithms to maintain value & are partially collateralized, unlike overcollateralized stablecoins.

Examples include UST from Terra

Examples include UST from Terra

Fiat backed stablecoins are backed 1:1 with a reserve of fiat currency. These reserves are held by a custodian.

Examples include USDT from @Tether_to

Examples include USDT from @Tether_to

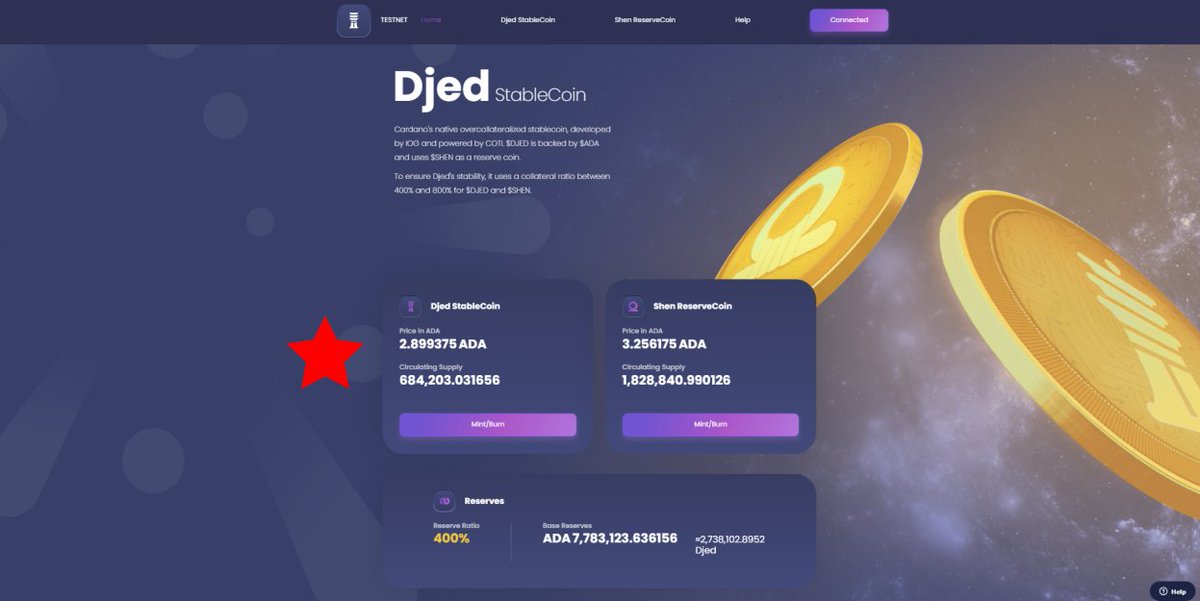

🪙What is DJED?

DJED is an Overcollateralized stablecoin. It is backed by the cryptocurrency ADA. Users can mint DJED by sending ADA to a smart contract, with the amount of ADA required to mint one DJED determined by the current value of ADA.

DJED is an Overcollateralized stablecoin. It is backed by the cryptocurrency ADA. Users can mint DJED by sending ADA to a smart contract, with the amount of ADA required to mint one DJED determined by the current value of ADA.

If a user wants to sell DJED, they can send it back to the contract, which burns DJED and sends back the equivalent value in ADA.

Fluctuations in the price of ADA can at times mean that there is not enough ADA to cover redemptions

😱

Don't worry, this is where SHEN comes in!

Fluctuations in the price of ADA can at times mean that there is not enough ADA to cover redemptions

😱

Don't worry, this is where SHEN comes in!

SHEN is the reserve coin that is not pegged to any specific asset and is used to provide extra reserves.

By minting SHEN, holders provide a service of stability to DJED users and smart contracts manage the reserve ratio to ensure stability and incentivize SHEN holders.

By minting SHEN, holders provide a service of stability to DJED users and smart contracts manage the reserve ratio to ensure stability and incentivize SHEN holders.

🪙What rewards can be earned?

SHEN holders are rewarded with a share of the fees collected from DJED and SHEN transactions

When DJED is MINTED/BURNED a 2% fee (1.5% mint/burn fee + .5% operating fee) is taken

1.5% goes to an ADA pool along with ADA that was exchanged for DJED

SHEN holders are rewarded with a share of the fees collected from DJED and SHEN transactions

When DJED is MINTED/BURNED a 2% fee (1.5% mint/burn fee + .5% operating fee) is taken

1.5% goes to an ADA pool along with ADA that was exchanged for DJED

When SHEN is MINTED a .2% fee is taken.

When SHEN is burned a .5% fee is taken.

These fees go to the ADA pool.

❌No operating fees are taken for SHEN burning and minting

When SHEN is burned a .5% fee is taken.

These fees go to the ADA pool.

❌No operating fees are taken for SHEN burning and minting

SHEN holders will also earn ADA PoS Rewards

ADA that is deposited to the DJED smart contract will generate extra rewards for SHEN holders, a snapshot mechanism and UI that will be added to, where SHEN holders will be able to track these extra rewards on the website

ADA that is deposited to the DJED smart contract will generate extra rewards for SHEN holders, a snapshot mechanism and UI that will be added to, where SHEN holders will be able to track these extra rewards on the website

The .5% Operational fee goes to a pool that will be used to buy COTI at market price at an unspecified time to prevent price manipulation.

This COTI goes back to the COTI treasury.

This COTI goes back to the COTI treasury.

🪙What about DJED rewards?

DJED & SHEN Liquidity pools will be available on three major DEXs next week!

Users will be able to supply liquidity and:

1⃣ Earn on trading fees

2⃣Earn LP Farming rewards

Lending and borrowing on platforms like @AadaFinance should be available also

DJED & SHEN Liquidity pools will be available on three major DEXs next week!

Users will be able to supply liquidity and:

1⃣ Earn on trading fees

2⃣Earn LP Farming rewards

Lending and borrowing on platforms like @AadaFinance should be available also

In another thread we will cover the risks of $DJED stablecoin ⚠️⚠️⚠️⚠️⚠️

Be sure to follow @SubcriticalTV to stay up to date 🤝

If you enjoyed this thread consider leaving a comment!

👇

Be sure to follow @SubcriticalTV to stay up to date 🤝

If you enjoyed this thread consider leaving a comment!

👇

• • •

Missing some Tweet in this thread? You can try to

force a refresh