Visualizing the #KinesisMoney $KAU "Emissions account".

Kinesis says the "Emissions account" is supposed to be both the mint and the redeem address.

The on chain data looks different.

Kinesis says the "Emissions account" is supposed to be both the mint and the redeem address.

The on chain data looks different.

It's the "Root account" that seems to be the real mint along with the "Inflation account' and the "Other inflation account". These are the three accounts that transfer out tokens they never received in the first place. This is what would be traditionally thought of as "minting".

The Root account has no inflows, it only has outflows. The outflows go to the "Emissions account" (3,060,512 $KAU) and to the "Inflation account" (110 $KAU).

It looks like this 👇

It looks like this 👇

Here is the "Other inflation account". It has 26.91 $KAU of inflows and 475,648.52 $KAU of outflows.

It looks like this 👇

It looks like this 👇

In conclusion, the blockchain data appears to show less than 4 million $KAU that have been repeatedly cycled through the "Emissions account" to arrive at the figures of 48,976,675.9959 KAU minted and 47,568,311.2704 redeemed.

Most of this activity took place between audits of the gold and silver backing the system. This activity stopped abruptly with a very large 174,000 $KAU ($10.8 million) transaction just hours before the last audit (June 2022) began. 👇

Is the picture becoming clearer yet?

Is the picture becoming clearer yet?

This is that large transaction 👇

https://twitter.com/cryptoinformer0/status/1618567066566656001?s=20

To provide further perspective 👇

347,800 in $KAU fees were generated between November 2020 and June 2022 (92% of total $KAU fees).

53,400 in $KAG fees were generated during the same time period (75% of total $KAG fees).

347,800 in $KAU fees were generated between November 2020 and June 2022 (92% of total $KAU fees).

53,400 in $KAG fees were generated during the same time period (75% of total $KAG fees).

Most of this volume which in turn generated the majority of all #KinesisMoney fees and revenue to date, was likely "mint cycling" 👇

https://twitter.com/cryptoinformer0/status/1614571592163495936?s=20

👆Can we hereby christen this the #KinesisMoney "Mint Cycle Scheme"?

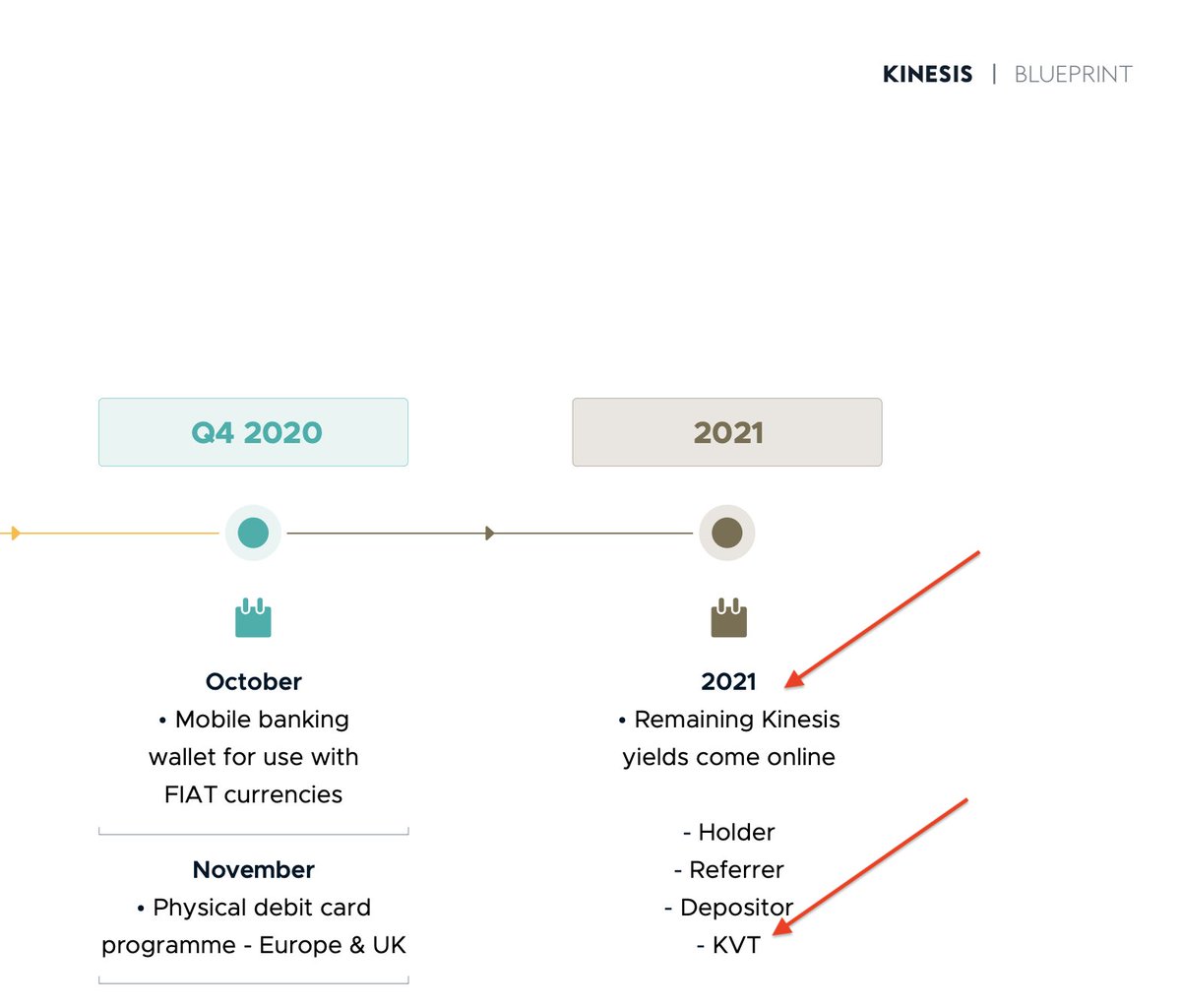

Similar, but definitely not the same as the "Flywheel Scheme," although they do have their own $KVT security token which does come into play.

h/t @MikeBurgersburg 👇

dirtybubblemedia.substack.com/p/mashinskys-f…

Similar, but definitely not the same as the "Flywheel Scheme," although they do have their own $KVT security token which does come into play.

h/t @MikeBurgersburg 👇

dirtybubblemedia.substack.com/p/mashinskys-f…

👀 Have a look, there's a black box $USDT CEX at the heart of this 👆

@cryptohippo65 @otteroooo @Cryptadamist @BennettTomlin @CasPiancey @ParrotCapital @ThegreatLambiny @davidgerard @DataFinnovation @RasooliSheida @Bitfinexed

@cryptohippo65 @otteroooo @Cryptadamist @BennettTomlin @CasPiancey @ParrotCapital @ThegreatLambiny @davidgerard @DataFinnovation @RasooliSheida @Bitfinexed

• • •

Missing some Tweet in this thread? You can try to

force a refresh