I have received a bunch of questions about how I knew 3 weeks ago to be bullish for February from #volland. Ever since the CPI report in January, the options landscape for dealers has been the same as the big bull run... that is, puts bought and calls sold by customers.

That presents as sold puts and bought calls by dealers. That created $91B in open net positive delta in $SPX, seen in the #volland picture. Why is this bullish? In short, this typical GEX formation creates a lot of negative charm to push markets up...

Charm is seen in the picture with the negative aggregate charm highlighted in green (for bullish). To have such high charm this early in the option month is a big deal, as it will only grow the closer we get to Feb. opex. As price increases, vol typically decreases...

That means positive aggregate vanna will result in buying. Lower IV means lower deltas, which means buying for dealers. (I know fixed-strike vol is needed for vanna change calculations, but lets put that aside for now since the vol crunch has been across all strikes).

This creates a single large feedback loop per day, and resulted in bullish action. I wasn't expecting such a large push so fast, but we get what we get.

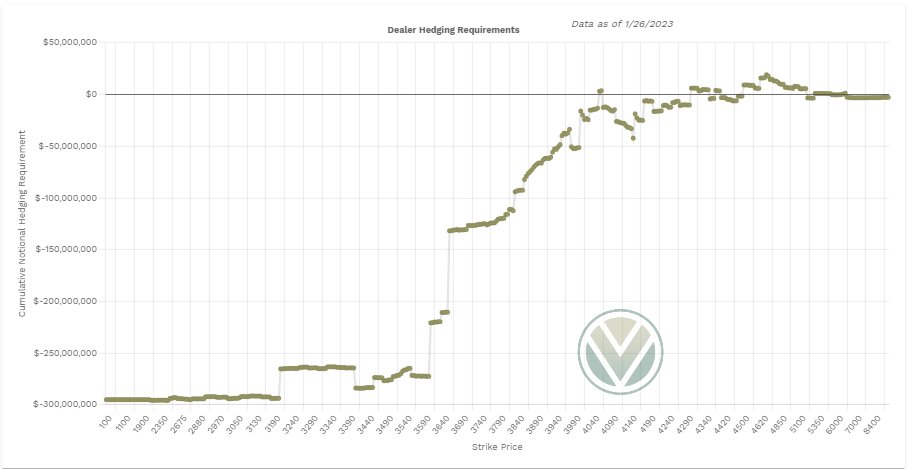

This formation does come with danger in the gamma world, seen in this Delta-Adjusted Gamma (DAG) chart. Positive = buying.

This formation does come with danger in the gamma world, seen in this Delta-Adjusted Gamma (DAG) chart. Positive = buying.

if we run into a stretch where the market gets scared, it can get ugly fast, as you can see by the cliffs. This looks like the typical "GEX" chart since this is the typical GEX assumption, so right now the GEXers and I agree on option outlook, even if they don't give credit...

to vanna and charm for the advance, they have an idea that this formation, if accurate, results in an advance until it doesn't.

Another note, even though we are in earnings season, this formation is the same across many equities. Here's $AAPL DAG with resistance at 150-155.

Another note, even though we are in earnings season, this formation is the same across many equities. Here's $AAPL DAG with resistance at 150-155.

Here's $MSFT who would love to see a push past 255 to keep the good vibes rolling. And so on.

If you believe option dealer positioning has a major impact on market moves (which it absolutely does whether you believe it or not), I wouldn't know how you can trade without #volland

If you believe option dealer positioning has a major impact on market moves (which it absolutely does whether you believe it or not), I wouldn't know how you can trade without #volland

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh