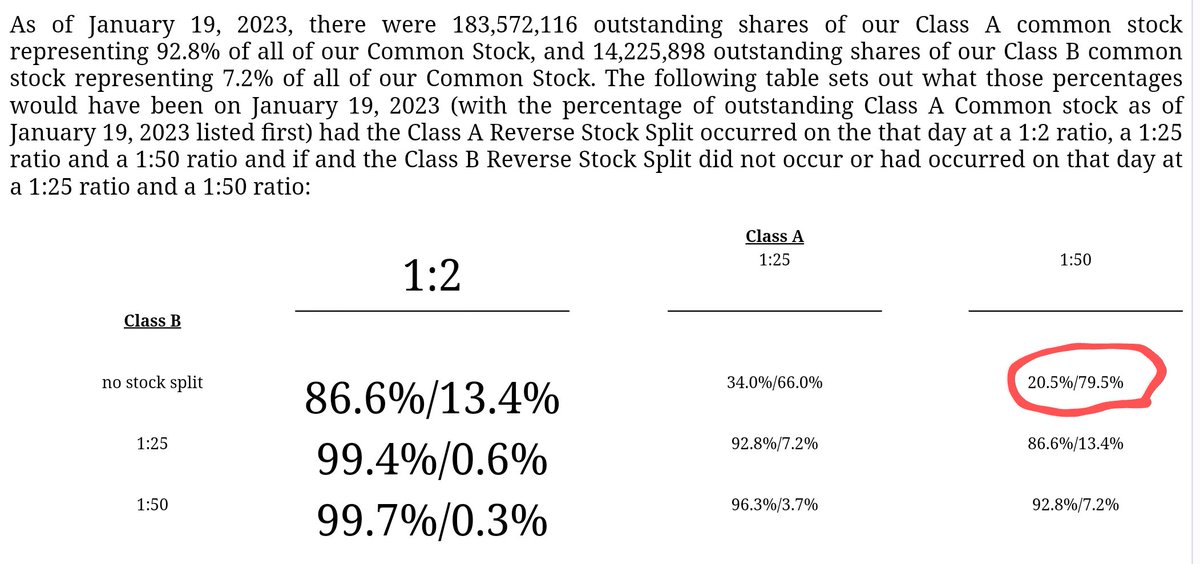

$HLBZ the scammiest element of this vote went over my head at first, and I don't see anyone else talking about it. HLBZ has two series of shares - Class A, and Class B. CEO Palella is the sole Class B shareholder, with 14.2M shares. (1/)

Those shares have supervoting rights, so Palella has 47% of the vote - every proposal is nearly a slam dunk to pass. But the biggest red flag is they're proposing to leave themselves the discretion of whether or not to split the Class B shares by the same ratio as Class A. (2/)

By default, all classes would be adjusted in parallel in a split. With all shares adjusted by the same ratio, no one's proportional ownership of the company would be affected. In this case, they've gone out of their way to be able to opt out of that. (3/)

What does this mean? If Palella's shares are split by a smaller ratio than the other shares, his proportional ownership of the company increases, at the expense of everyone else's proportional ownership. (4/)

Palella currently has 7.2% ownership, everyone else has 92.8%. Worst case scenario (1:50 R/S for Class A, no split for Class B,) his stake would catapult to 79.5% - leaving 20.5% stake for everyone else. #NakedShortWar? This would drop a goddamn nuke on retail! (5/)

There is a caveat - this scheme would need approval from independent directors, and a fairness opinion from a consultant. So it's not guaranteed. But either way, we're looking at an insane attempted power/money grab from the CEO. Time will tell if he can pull it off. (6/6)

PS: this probably would help with MVLS compliance. If Palella reduces retail's stake by 80%, but doesn't sell his shares, the stock probably won't drop by 80% (ignoring other forms of expected dilution.) It's not like anyone's holding this based on discounted cash flows 😂

• • •

Missing some Tweet in this thread? You can try to

force a refresh