Extremistan, Non-Linearity, Unfair Advantage.

If you find value in what we present, "Retweet" this thread 🧵to help us educate maximum investors.🙏

smartsyncservices.com/extremistan-no…

If you find value in what we present, "Retweet" this thread 🧵to help us educate maximum investors.🙏

smartsyncservices.com/extremistan-no…

Calvin’s dad is right.

The world is unfair.

The business and the investing world are unfair too.

If you think otherwise, bear with us for a couple of minutes, we will change your mind.

1/

The world is unfair.

The business and the investing world are unfair too.

If you think otherwise, bear with us for a couple of minutes, we will change your mind.

1/

Even though we are fans of Calvin, we think he is wrong here.

Calvin says:

“Why isn’t it ever unfair in my favour?”

The world is always unfair in favour of someone or the other.

It is we who fail to notice.

2/

Calvin says:

“Why isn’t it ever unfair in my favour?”

The world is always unfair in favour of someone or the other.

It is we who fail to notice.

2/

Similarly, the world of investing is always unfair in favour of some businesses.

~Y2K mania in the late 1990s

~RE/Infra/Construction boom in the mid 2000s

~FMCG/Steady compounders in the late 2010s

~Pharma at the stroke of Covid

~New age IPOs in 2021

~Defense/PSUs in 2022.

3/

~Y2K mania in the late 1990s

~RE/Infra/Construction boom in the mid 2000s

~FMCG/Steady compounders in the late 2010s

~Pharma at the stroke of Covid

~New age IPOs in 2021

~Defense/PSUs in 2022.

3/

Don’t you think they all had an unfair advantage over other businesses in terms of the collective market appreciation for them in those times?

4/

4/

Likewise, different types of investors have an unfair advantage over others at different times in the market.

Sometimes market favours value investing, sometimes growth investing, sometimes momentum investing, and so on and so forth.

5/

Sometimes market favours value investing, sometimes growth investing, sometimes momentum investing, and so on and so forth.

5/

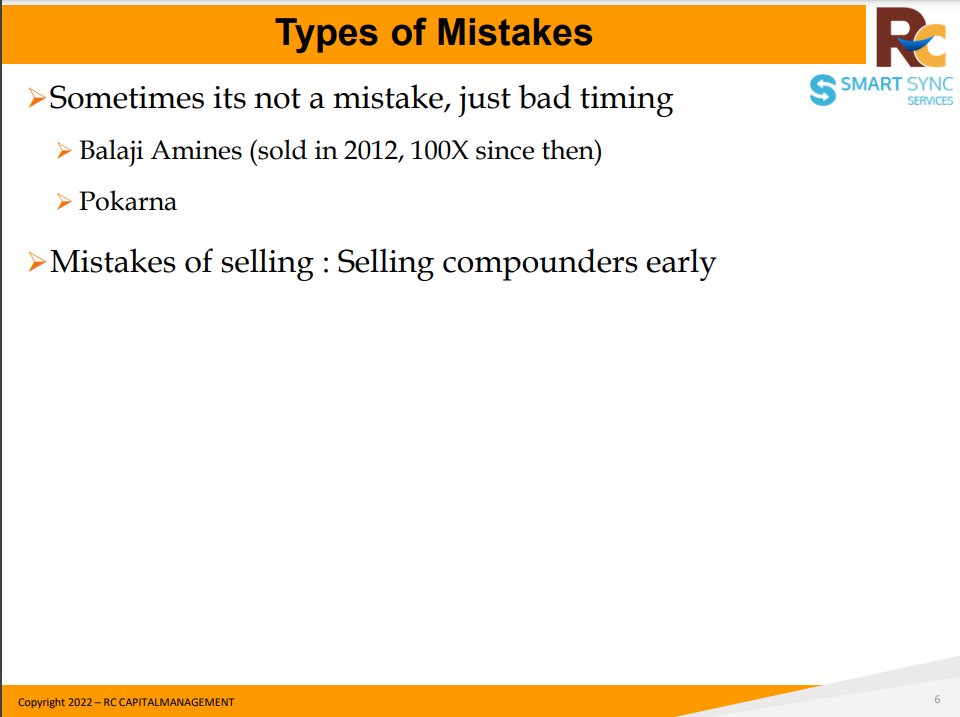

But these are all about someone getting an unfair advantage over others for sometime.

Do you know there are some special types of unfair advantages that last for a very long time?

Let’s understand this.

6/

Do you know there are some special types of unfair advantages that last for a very long time?

Let’s understand this.

6/

@nntaleb writes about Extremistan & Mediocristan in his book, The Black Swan.

He describes the world of Extremistan & Mediocristan as follows:

7/

Image courtesy; @SeekingAlpha

He describes the world of Extremistan & Mediocristan as follows:

7/

Image courtesy; @SeekingAlpha

Taleb also says that if one randomly chooses a 1000 authors, & adds up the number of books they have sold. Then add one of the bestselling authors in the world, say J.K. Rowling, the author of the Harry Potter series.

Rowling book sales > Other 1000 authors

#extremistan

9/

Rowling book sales > Other 1000 authors

#extremistan

9/

In today’s world, a more relatable analogy would be digital content.

Take YouTube for example.

We have a youtube channel for @SmartSyncServ.

Our most popular content has about 5k views as on date.

youtube.com/channel/UCVWOI…

10/

Take YouTube for example.

We have a youtube channel for @SmartSyncServ.

Our most popular content has about 5k views as on date.

youtube.com/channel/UCVWOI…

10/

There would be a thousand finance content youtube channels like ours with a similar number of views for their best content.

But when you look at someone like CA @rachana_ranade, her popular videos have views in millions.

That’s what Extremistan is all about.

11/

But when you look at someone like CA @rachana_ranade, her popular videos have views in millions.

That’s what Extremistan is all about.

11/

From digital content let’s move to digital businesses listed on the Indian stock exchange.

Let’s understand what unfair advantages some of these digital/platform businesses have compared to their non-digital counterparts.

Let’s begin.

12/

Let’s understand what unfair advantages some of these digital/platform businesses have compared to their non-digital counterparts.

Let’s begin.

12/

BKT is an off-highway tire manufacturer based out of India and has a global market share in the mid-single digits. It has grown its sales, profits, & CFs at a healthy double-digit in the last 10 years. And the market has also rewarded it handsomely.

13/

13/

If you are short on time, check out this blog to know more about BKT:

14/

smartsyncservices.com/bkt-widening-i…

14/

smartsyncservices.com/bkt-widening-i…

To Deep Dive👇

15/

15/

To grow it has to increase the volume of tires sold. And to do that, it has to increase capacity.

It is evident in the investments in FAs p.a.

It is a business with linear growth.

For getting more output, the business has to work equally on more inputs.

17/

It is evident in the investments in FAs p.a.

It is a business with linear growth.

For getting more output, the business has to work equally on more inputs.

17/

Let’s take a different business. CCL Products

CCL is in the instant coffee business.

In the last few years, they have started transitioning from B2B to B2C.

If you wish to know more about CCL Products, you may check this.

18/

CCL is in the instant coffee business.

In the last few years, they have started transitioning from B2B to B2C.

If you wish to know more about CCL Products, you may check this.

18/

Now check this.

The same thing.

Linear business model.

To grow more they have to produce more.

To produce more they need to invest more in new capacities.

19/

The same thing.

Linear business model.

To grow more they have to produce more.

To produce more they need to invest more in new capacities.

19/

Both are decent businesses.

However, they belong to Taleb’s Mediocristan.

One new input is almost always similar to the average of all the inputs in the past.

But there are other businesses that are non-linear. They belong to Taleb’s Extremistan.

20/

However, they belong to Taleb’s Mediocristan.

One new input is almost always similar to the average of all the inputs in the past.

But there are other businesses that are non-linear. They belong to Taleb’s Extremistan.

20/

The businesses in the world of Extremistan are highly scaleable & benefit from network effects.

Think Amazon, Google, Fab, Uber, Netflix, etc.

But for our example, let’s look at Indian Energy Exchange (IEX).

Find out more about IEX here👇

21/

Think Amazon, Google, Fab, Uber, Netflix, etc.

But for our example, let’s look at Indian Energy Exchange (IEX).

Find out more about IEX here👇

21/

https://twitter.com/SmartSyncServ/status/1618965072025640961

Btw, we are doing a deep dive on IEX on 31st January 2023 (Tuesday).

You may register for the same below:

bit.ly/3DniyUu

22/

You may register for the same below:

bit.ly/3DniyUu

22/

As against BKT & CCL, look at how little IEX has to spend on acquiring assets to grow.

That’s what an Extremistan type of business looks like. The one that benefits from non-linearity. And the one that has a lot of unfair advantages over the others.

23/

That’s what an Extremistan type of business looks like. The one that benefits from non-linearity. And the one that has a lot of unfair advantages over the others.

23/

That’s why they are valued differently.

And remember, these numbers are after a 55% fall in the share price of IEX in recent times.

Source: @screener_in

24/

And remember, these numbers are after a 55% fall in the share price of IEX in recent times.

Source: @screener_in

24/

Don’t get us wrong. We're not proposing to avoid businesses like BKT & CCL and only focus on companies like IEX. No.

We only want to show how different these Extremistan businesses are & how differently they will be valued by the market.

Do you still want to ignore them?

25/

We only want to show how different these Extremistan businesses are & how differently they will be valued by the market.

Do you still want to ignore them?

25/

Vikas Kasturi, our fried, a prolific value investor and thinker, is a much better authority on this subject.

He writes its here in his blog.

interestuponinterest.wordpress.com/2022/03/16/whe…

26/

He writes its here in his blog.

interestuponinterest.wordpress.com/2022/03/16/whe…

26/

Calvin should know this.

The world is sometimes unfair in our favour. We fail to notice.

The business world is unfair in favour of some businesses. We fail to notice.

Those businesses belong to Extremistan. They are non-linear. You can’t ignore them.

27/

The world is sometimes unfair in our favour. We fail to notice.

The business world is unfair in favour of some businesses. We fail to notice.

Those businesses belong to Extremistan. They are non-linear. You can’t ignore them.

27/

For a curious investor, the investing world is also sometimes unfair in his favour. He just fails to notice.

Thanks for reading.

Happy investing.

Wish to read the whole piece at one place?

28/

smartsyncservices.com/extremistan-no…

Thanks for reading.

Happy investing.

Wish to read the whole piece at one place?

28/

smartsyncservices.com/extremistan-no…

Thanks for reading🙏

End

n/n

End

n/n

If you liked our research, do consider "Retweeting" the first tweet to help us reach out to maximum investors.

Also, check out our MissioN SMILE app to get access to high quality free and premium content on investing.👇

Also, check out our MissioN SMILE app to get access to high quality free and premium content on investing.👇

https://twitter.com/SmartSyncServ/status/1609554229043269632

• • •

Missing some Tweet in this thread? You can try to

force a refresh