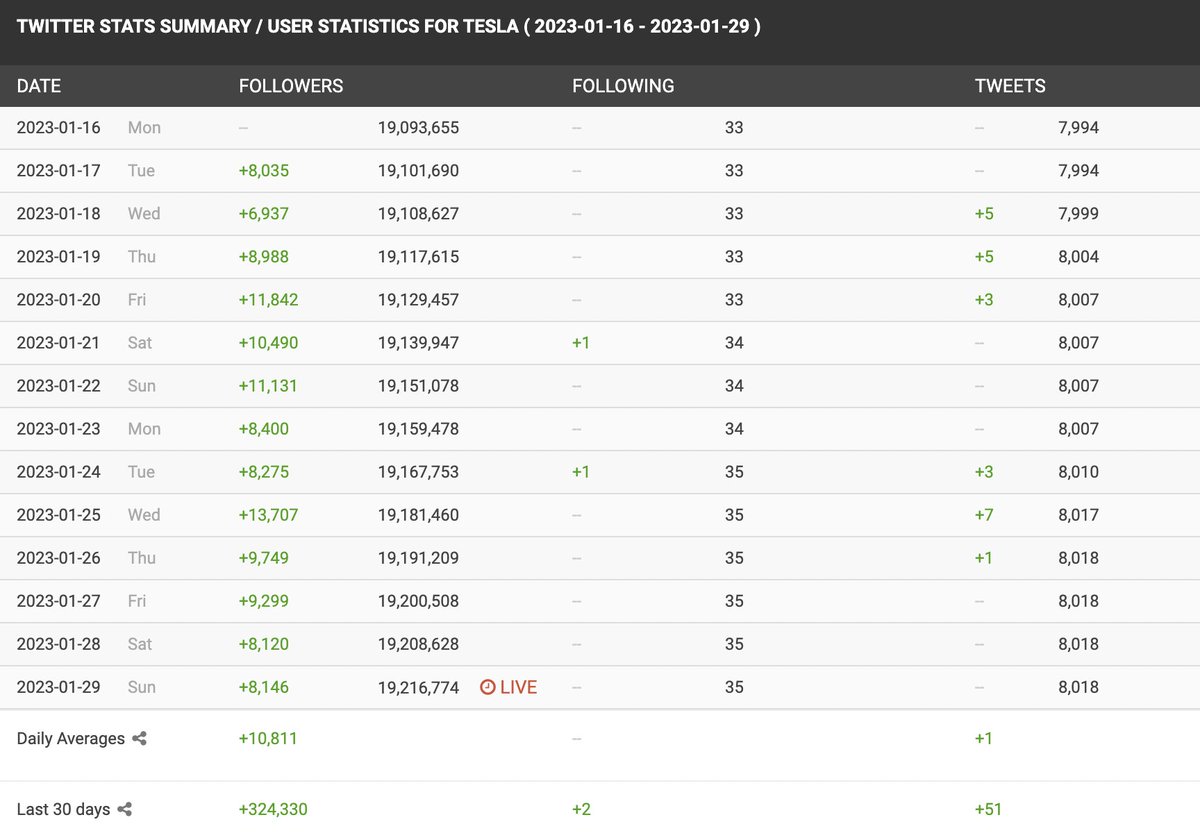

Here are 12 free resources that will help you be a better investor

A thread:

A thread:

1/ SEC Full-Text Search — Search through 20 years of SEC filings for specific terms, people, or entities. I use this tool to see every instance where a person’s name was mentioned in an SEC filing

sec.gov/edgar/search

sec.gov/edgar/search

2/ PCAOB Auditor Search — Find the auditor and specific audit partner for any company, as well as their track record. Use the search bar in the top right and click auditor search

4/ Wisconsin Department of Financial Institutions FDD database – Find nearly any Franchise Disclosure Document (FDD) for franchisors that do business in Wisconsin

5/ OpenCorporates — Quickly find the executives, board members, or state registration for private businesses

6/ Wayback Machine — A non-profit that regularly archives millions of the most visited sites. Use it to see how a site or specific webpage changed over time

Here’s Transdigm’s site from 2015

Here’s Transdigm’s site from 2015

7/ @roic_ai — Up to 30 years of financial statements on any public company available for free

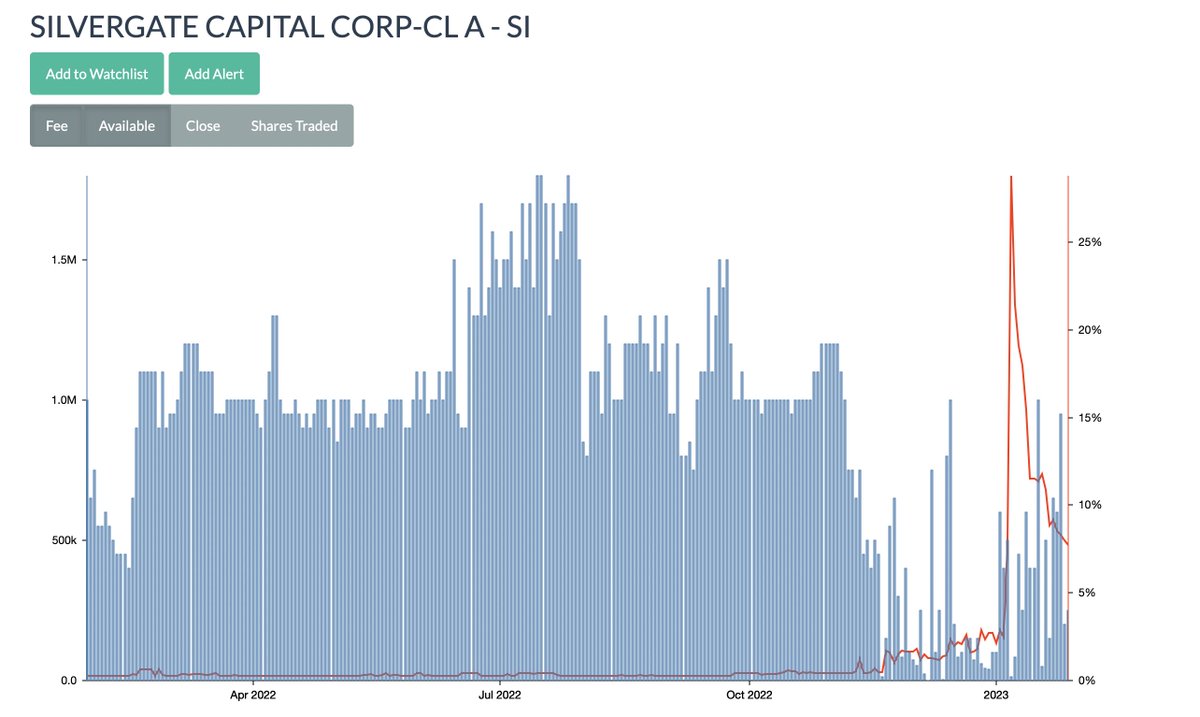

8/ iBorrowDesk — Website with borrow rates and short availability on any stock

For example, here’s the borrow availability and cost for $SI

For example, here’s the borrow availability and cost for $SI

9/ ShortSqueeze — Data on short interest

11/ r/SecurityAnalysis — Wide collection of recent hedge fund investor letters

reddit.com/r/SecurityAnal…

reddit.com/r/SecurityAnal…

12/ 10x EBITDA — A compilation of every hedge fund activist presentation

10xebitda.com/hedge-fund-pre…

10xebitda.com/hedge-fund-pre…

And if you want more awesome resources check out the full list of 80+ cool research tools I made for @BearCaveEmail

thebearcave.substack.com/p/the-best-sto…

thebearcave.substack.com/p/the-best-sto…

• • •

Missing some Tweet in this thread? You can try to

force a refresh