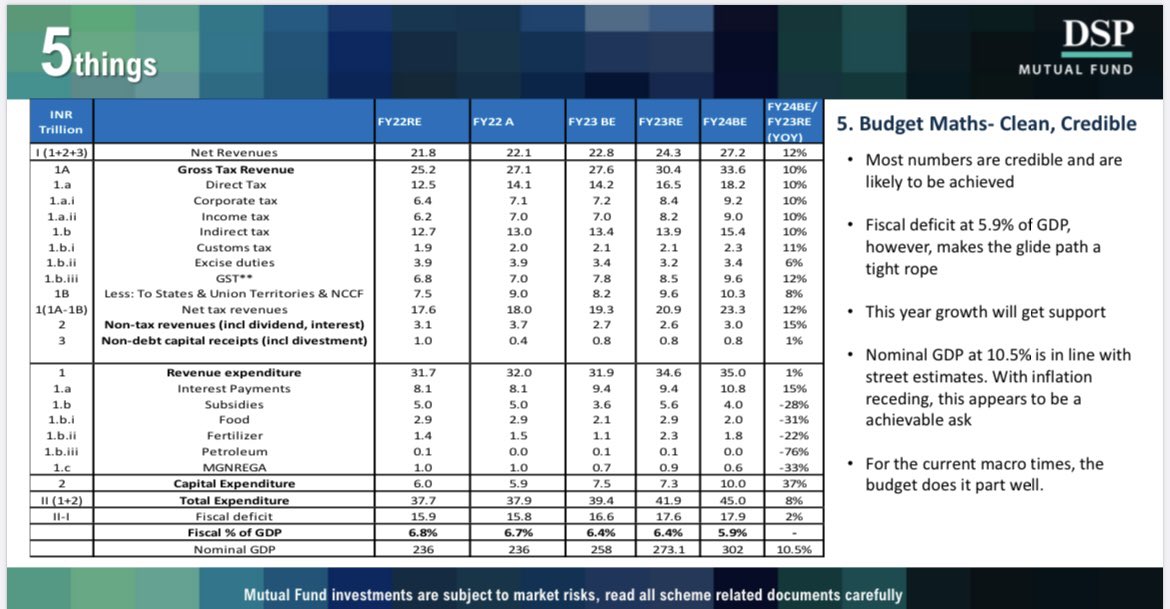

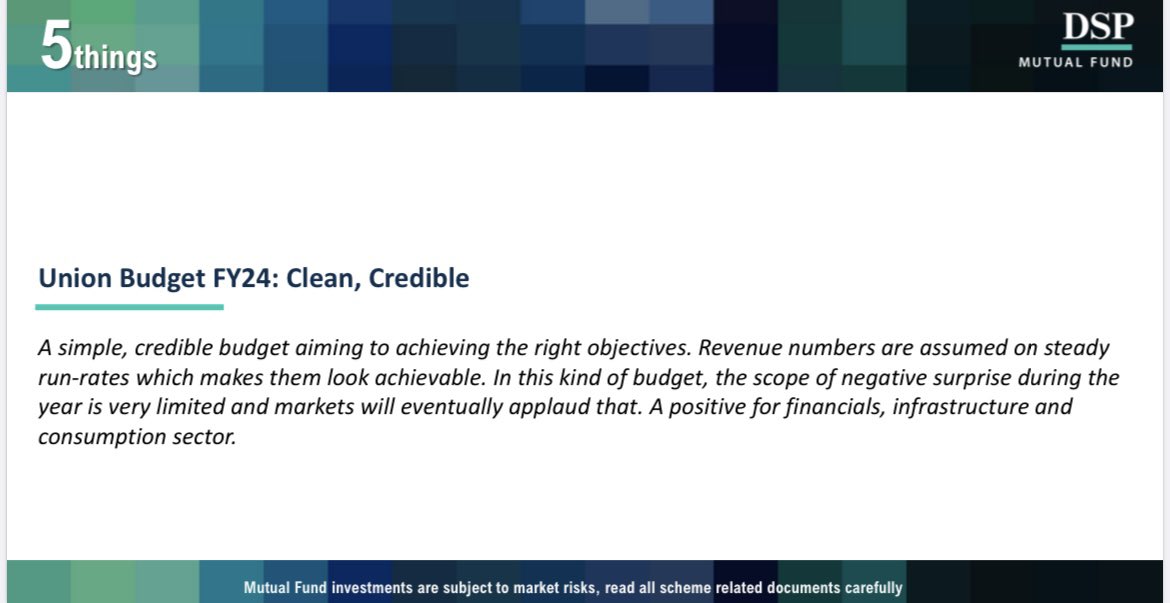

Budget day is noisy, chaotic! Here’s us trying to sum all that matters in 5 slides via #DSP5things

@SahilKapoor @dspmf

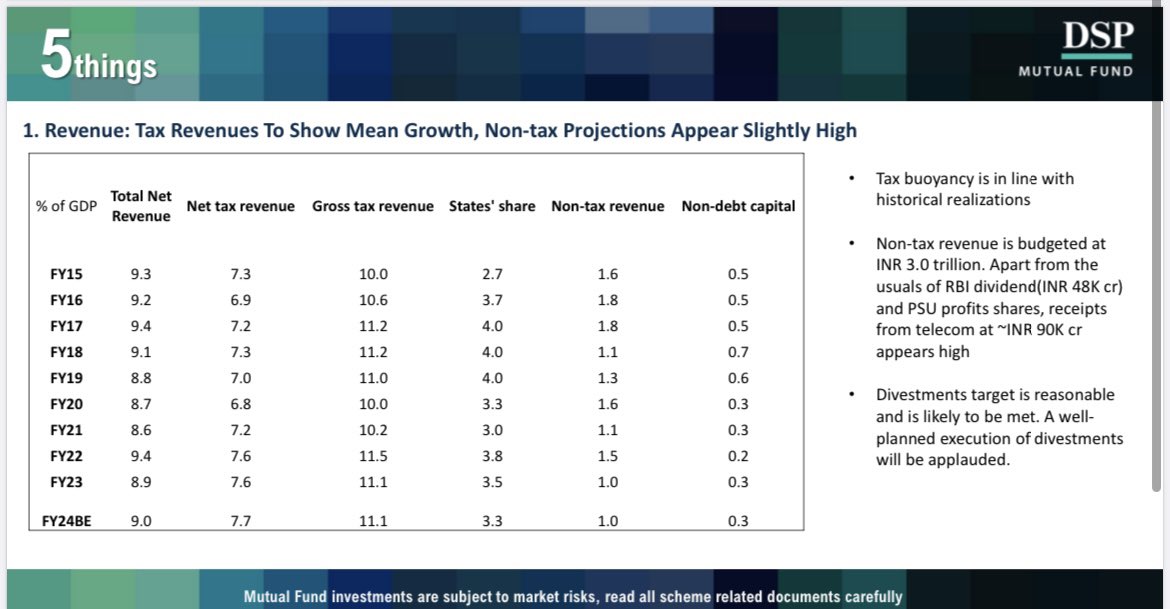

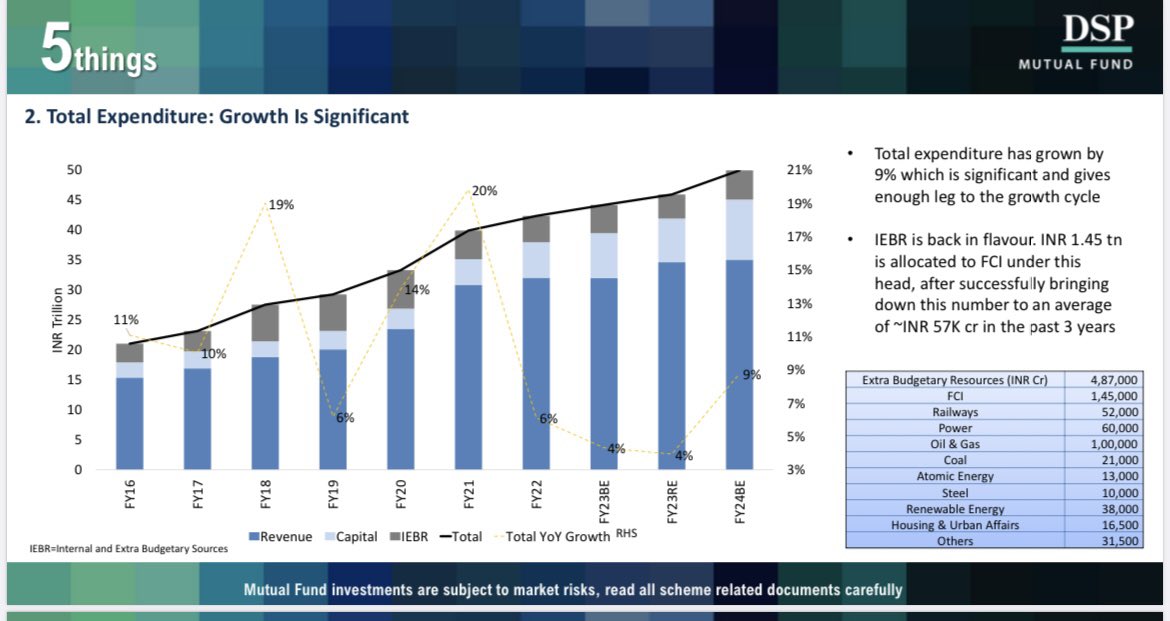

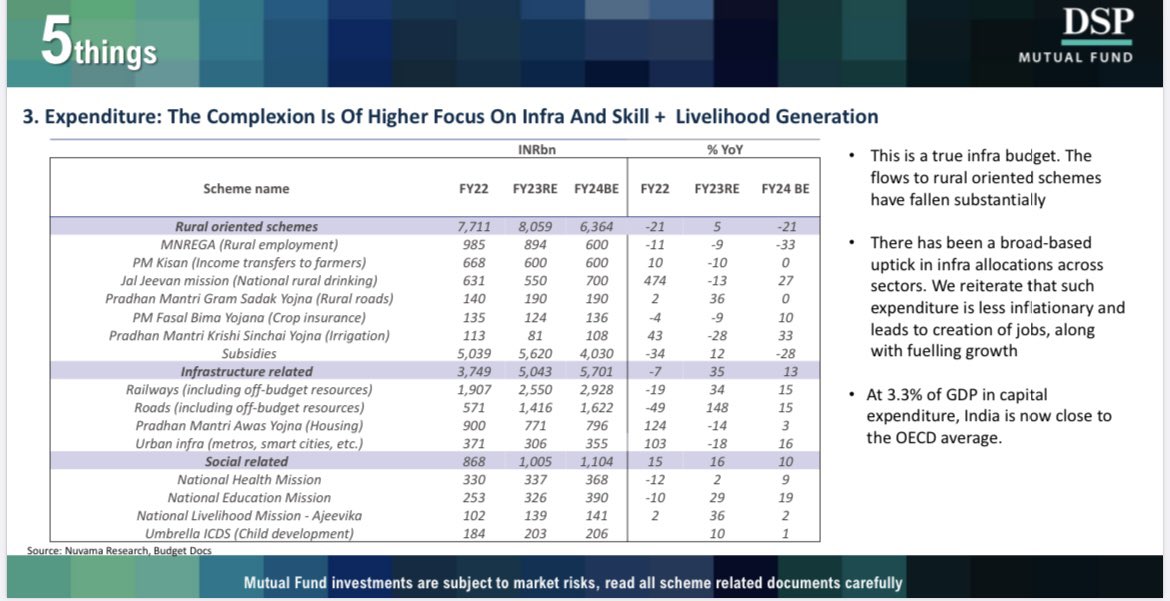

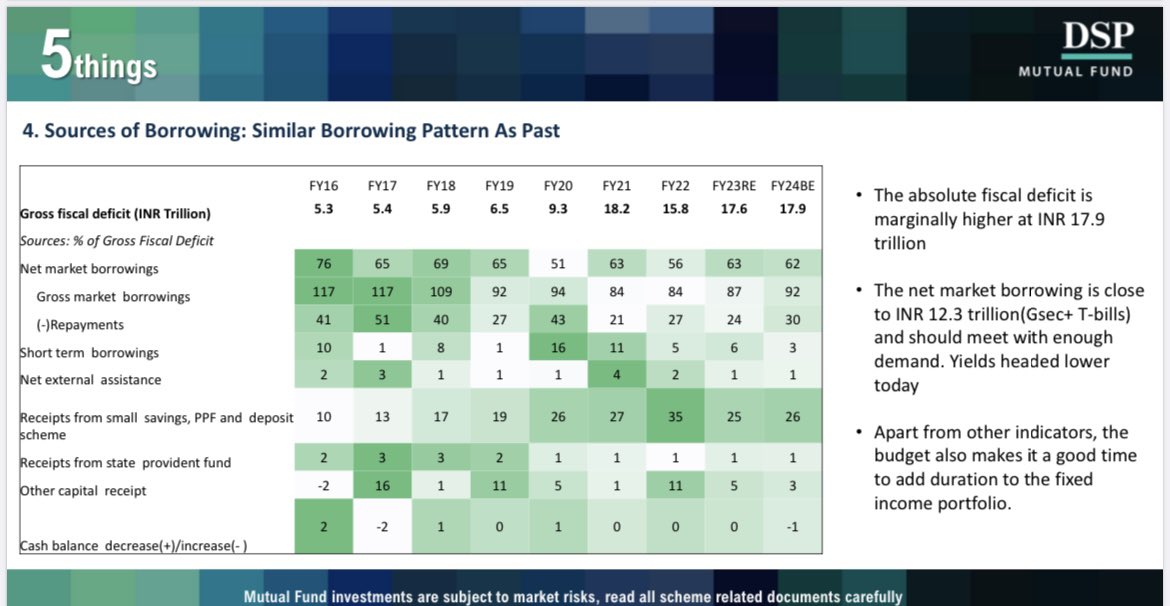

In summary 👇

@SahilKapoor @dspmf

In summary 👇

• • •

Missing some Tweet in this thread? You can try to

force a refresh